Which Of The Following Is The Least Liquid

Market volatility intensifies as investors grapple with liquidity risks. Analysts urgently warn: illiquid assets could trigger cascading losses.

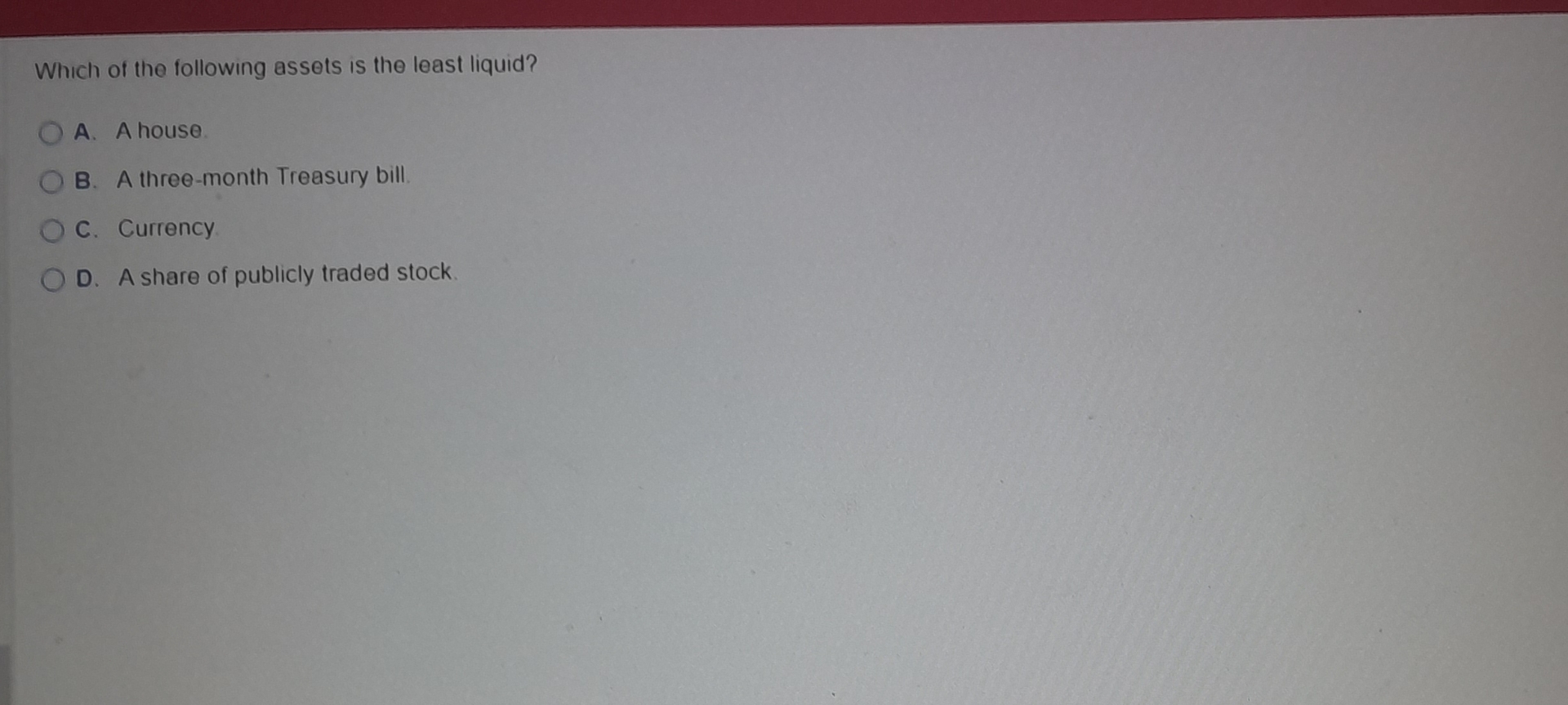

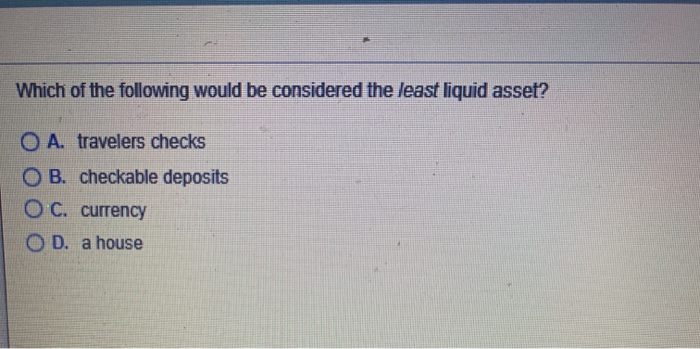

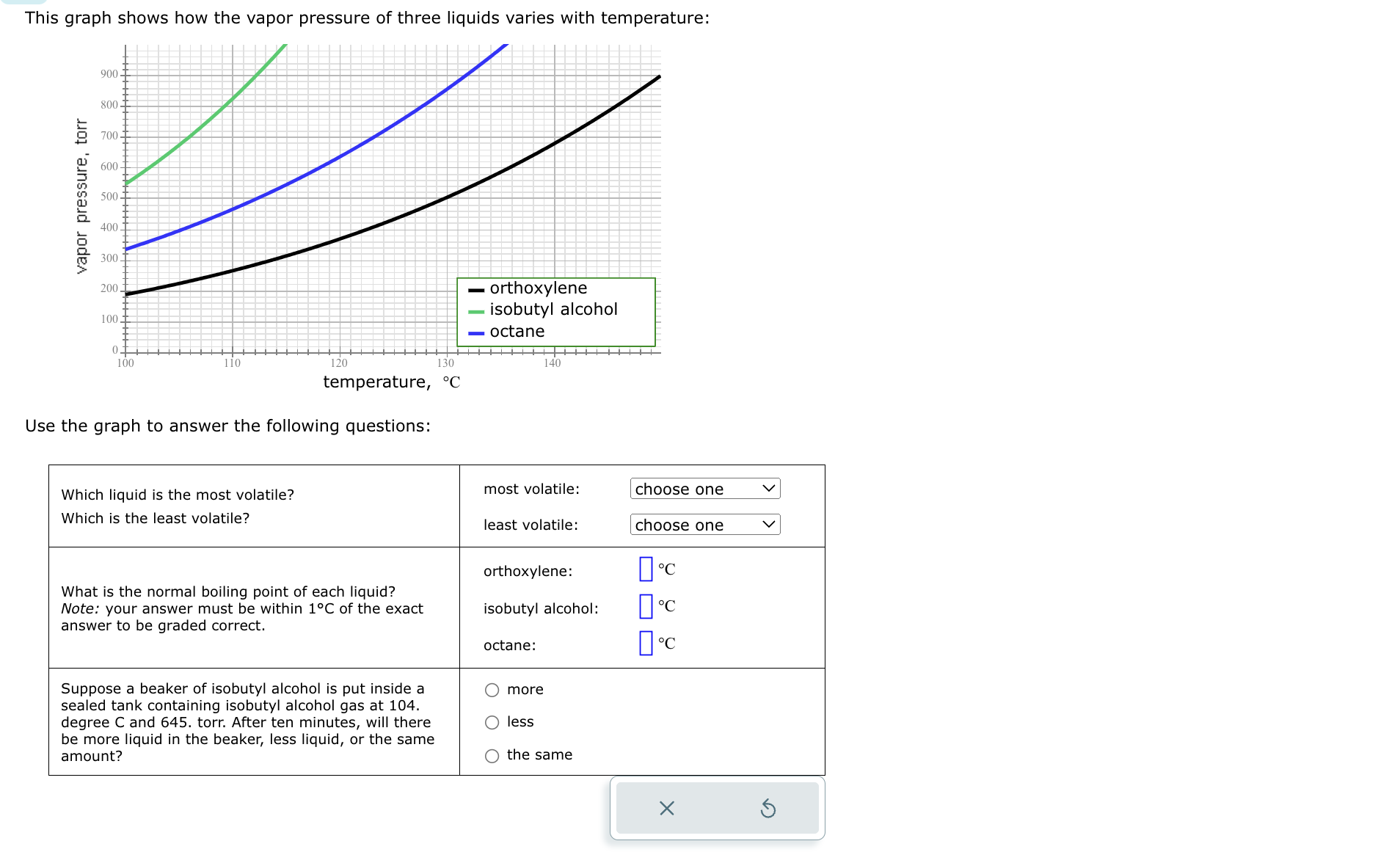

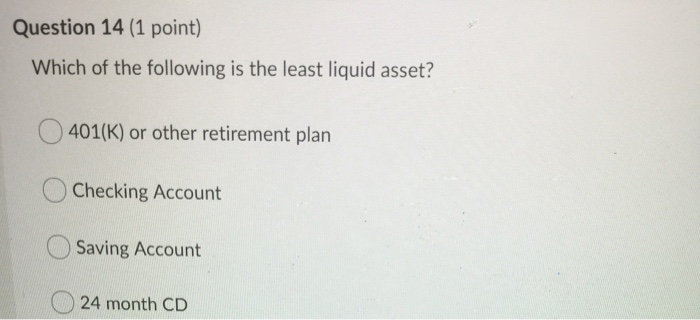

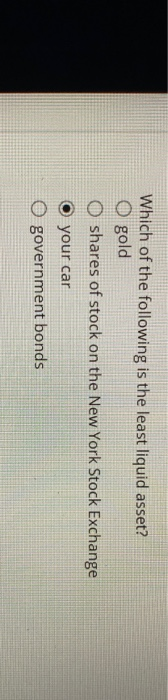

The question dominating financial circles is clear: which asset is the least liquid? Understanding liquidity – the ease with which an asset can be converted into cash without significant loss of value – is now paramount to mitigating risk.

The Liquidity Landscape: Assets Under Scrutiny

Several asset classes are under intense scrutiny. Real estate, private equity, collectibles, and certain specialized fixed-income securities are all being evaluated. The relative illiquidity of these assets poses a challenge to investors seeking to rapidly adjust portfolios.

Real Estate: A Known Illiquidity Factor

Real estate is a traditionally illiquid asset. Selling property can take weeks or months, and market fluctuations can significantly impact the final sale price. Recent data shows housing market slowdowns in major metropolitan areas, exacerbating this illiquidity.

According to the National Association of Realtors (NAR), the median time on market for homes in July 2024 was 30 days, a figure significantly higher than pre-pandemic levels. This increased time to sell underscores the inherent liquidity challenges.

Private Equity: Trapped Capital

Private equity investments present a unique liquidity challenge. These investments are typically locked up for several years, limiting investors' ability to access their capital quickly. Early exit options are often limited and come with substantial penalties.

Preqin, a leading alternative assets data provider, reports that the average holding period for private equity investments is between 5 and 7 years. This long-term commitment necessitates careful consideration of an investor's overall liquidity needs.

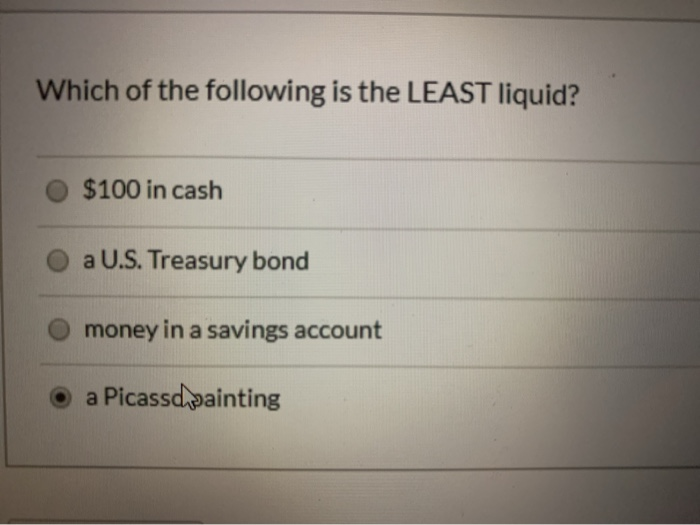

Collectibles: Passion vs. Practicality

Collectibles, such as fine art, rare wines, and vintage cars, are notoriously illiquid. Valuation is subjective, and finding a buyer willing to pay the desired price can be time-consuming and uncertain. Authentication and provenance also add layers of complexity.

The art market, for example, often relies on auctions, which can take weeks or months to organize and execute. The specialized nature of these markets further limits the pool of potential buyers, affecting the speed of converting assets into cash.

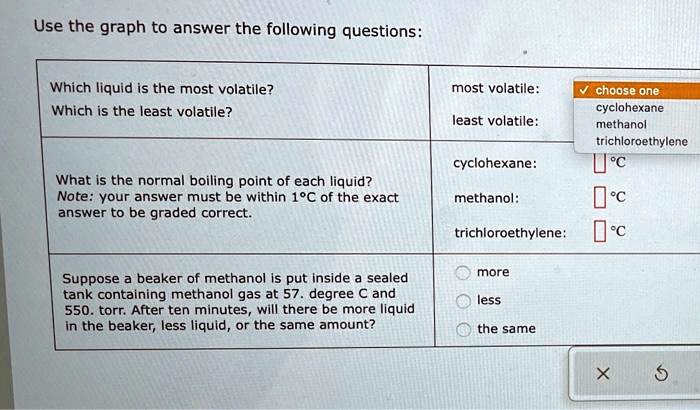

Specialized Fixed Income Securities: Niche Risks

Certain specialized fixed-income securities, particularly those issued by smaller or less well-known entities, can exhibit low liquidity. Trading volumes may be thin, making it difficult to buy or sell large positions without impacting prices. The risk of default further compounds the liquidity issue.

Bloomberg data reveals that bid-ask spreads on certain high-yield corporate bonds have widened considerably in recent weeks. This widening spread is a direct indicator of diminished liquidity, making it harder to transact quickly and efficiently.

The Verdict: Private Equity Reigns Supreme

Based on current market conditions and expert analysis, private equity emerges as the least liquid asset among the options considered. The long lock-up periods, limited exit opportunities, and inherent valuation complexities contribute to its illiquidity.

While real estate, collectibles, and specialized fixed-income securities also pose liquidity challenges, they generally offer more avenues for potential conversion to cash, albeit with varying degrees of speed and certainty.

Looking Ahead: Vigilance and Diversification

Investors are urged to carefully assess their liquidity needs and diversify their portfolios accordingly. Increased market volatility demands a proactive approach to risk management, with a focus on maintaining sufficient cash reserves.

Financial advisors are closely monitoring market conditions and providing guidance to clients on navigating the liquidity landscape. Regular portfolio reviews and adjustments are crucial in the current environment.

The Securities and Exchange Commission (SEC) is also reportedly examining liquidity risk management practices within the financial industry. Potential regulatory changes could further impact the market landscape in the coming months.