Which Of The Following Is True About Accounting

The accounting profession is often shrouded in misconceptions. Determining the true nature of accounting can be challenging, particularly for those unfamiliar with its intricacies.

This article aims to clarify some common misunderstandings surrounding accounting, exploring core principles and debunking myths. Understanding the reality of accounting is crucial for students, business owners, and anyone seeking financial literacy.

Demystifying Accounting: Facts vs. Fiction

Accounting is far more than just number crunching. It is a complex and dynamic discipline that forms the backbone of financial decision-making.

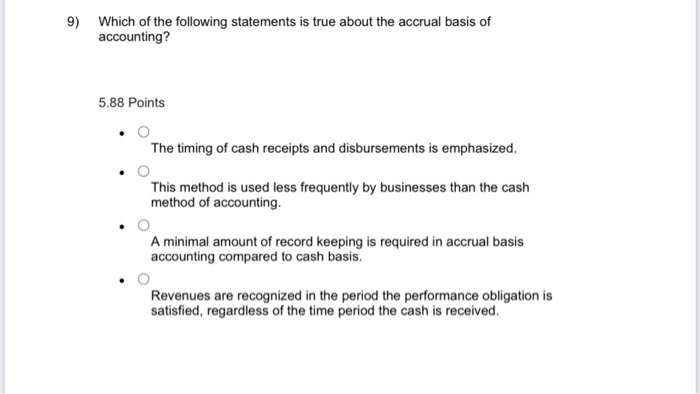

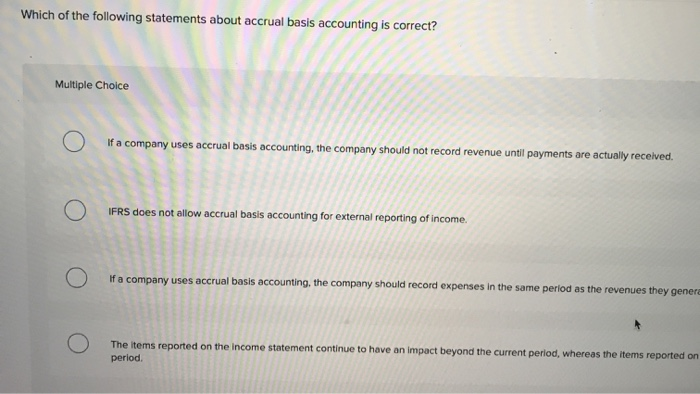

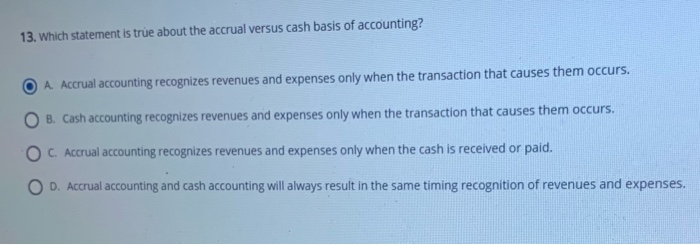

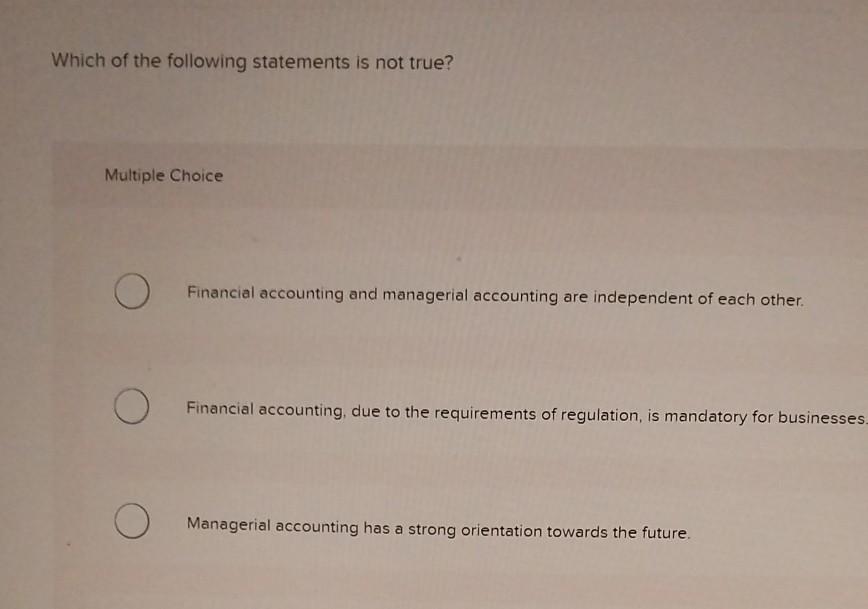

One common misconception is that accounting is solely about recording past transactions. While record-keeping is a crucial function, accounting also involves analyzing data, forecasting future performance, and providing strategic insights.

The Broader Scope of Accounting

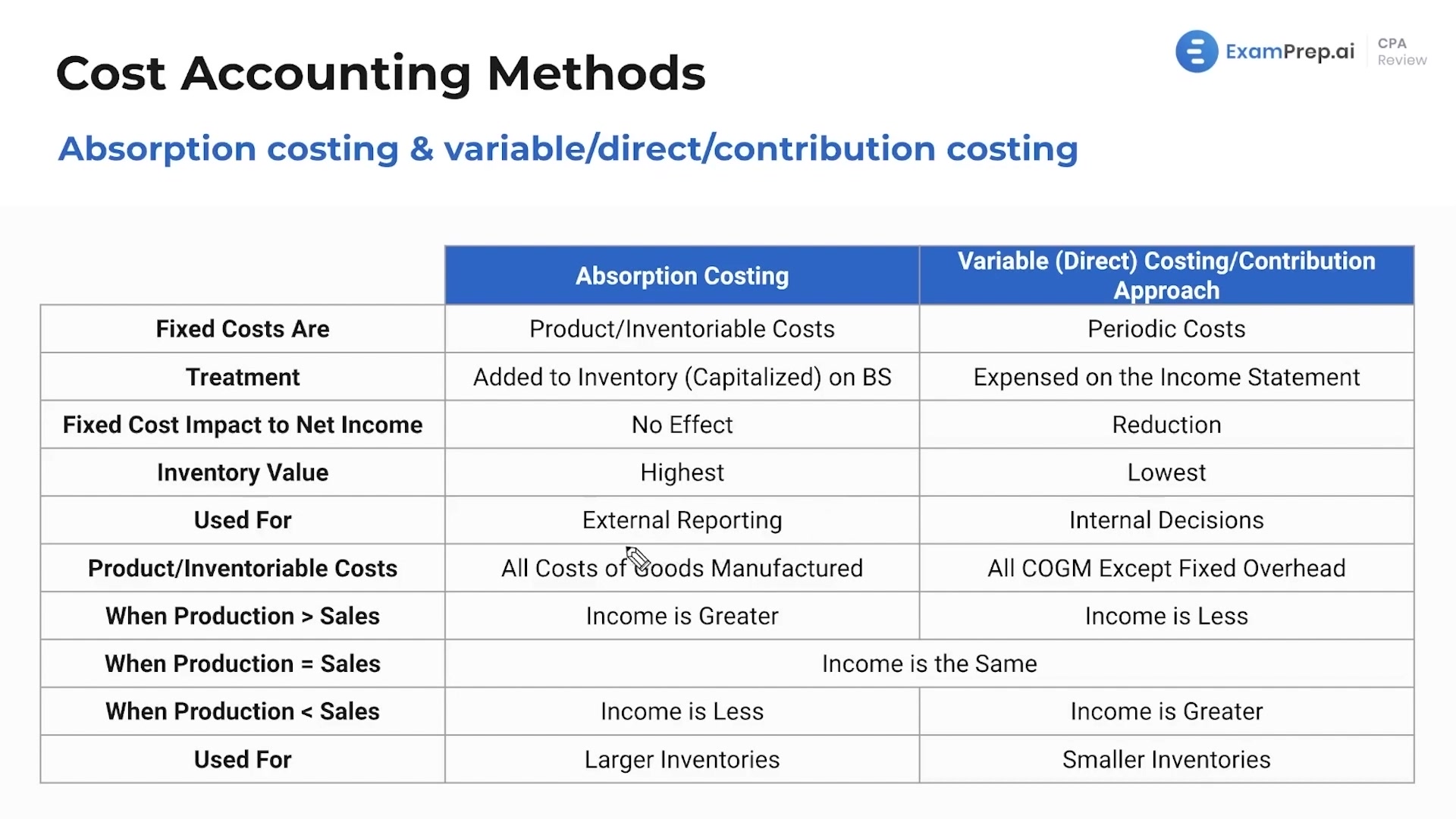

Accounting encompasses a wide range of activities beyond basic bookkeeping. It involves developing financial statements, conducting audits, managing taxes, and providing consulting services.

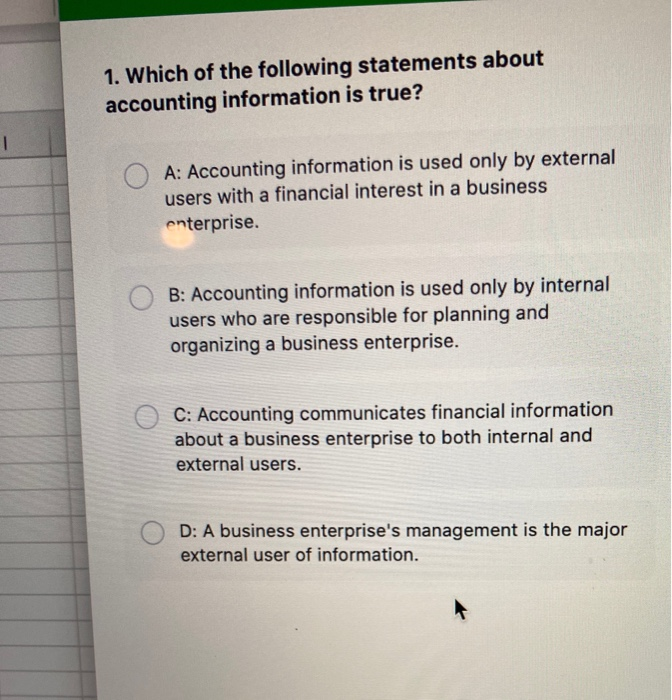

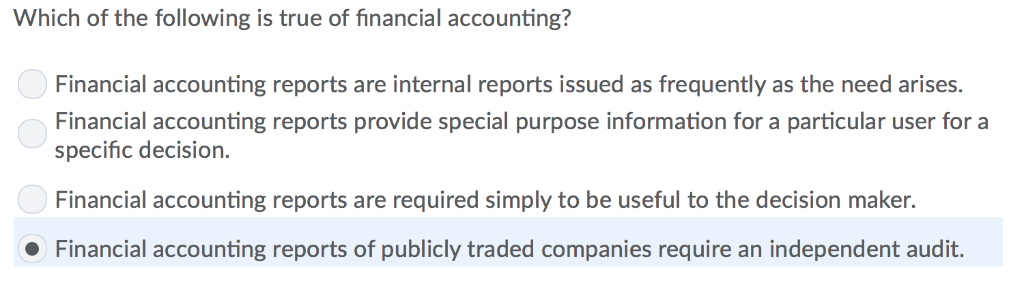

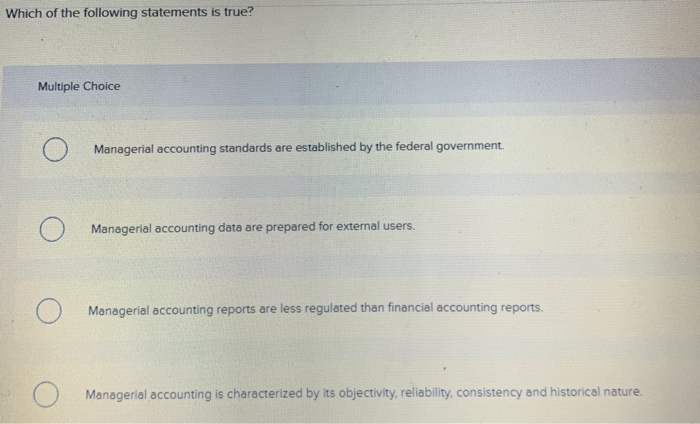

Financial accounting focuses on providing information to external stakeholders like investors and creditors. Managerial accounting, on the other hand, provides information to internal stakeholders like managers for decision-making.

According to the American Institute of Certified Public Accountants (AICPA), accounting professionals play a vital role in ensuring the integrity and transparency of financial markets.

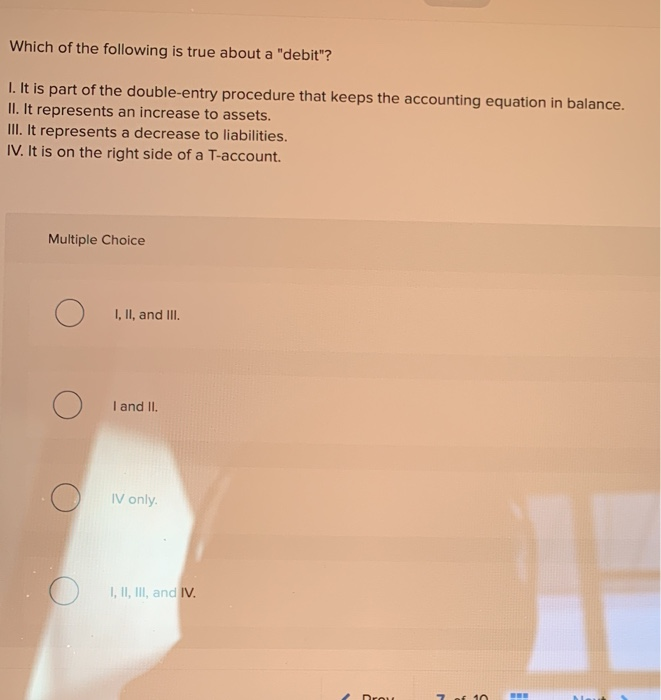

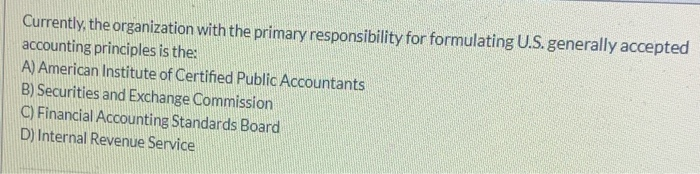

Accounting Standards and Regulations

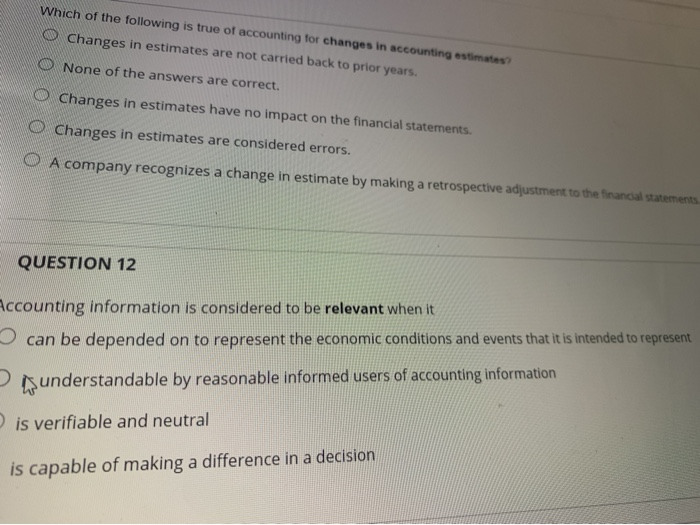

Accounting is governed by a set of standards and regulations to ensure consistency and comparability. These standards vary depending on the jurisdiction.

In the United States, the Financial Accounting Standards Board (FASB) sets accounting standards, known as Generally Accepted Accounting Principles (GAAP). International Financial Reporting Standards (IFRS) are used in many other countries.

Compliance with these standards is essential for maintaining investor confidence and promoting economic stability.

Ethical Considerations in Accounting

Ethics are paramount in the accounting profession. Accountants are expected to maintain objectivity, integrity, and confidentiality.

The Sarbanes-Oxley Act of 2002, enacted in response to major accounting scandals, strengthened corporate governance and accountability requirements.

Ethical lapses can have severe consequences, including legal penalties and reputational damage.

Debunking Common Myths

Several misconceptions persist about the nature and scope of accounting. Addressing these myths can provide a clearer understanding of the profession.

Myth 1: Accounting is only for mathematicians. While mathematical skills are helpful, a strong understanding of business principles and critical thinking are equally important.

Myth 2: Accounting is a boring and repetitive job. In reality, accounting offers a variety of challenges and opportunities for growth, particularly in specialized areas like forensic accounting or tax planning.

Myth 3: Accounting is being replaced by automation. While technology is transforming the accounting profession, it is also creating new opportunities for accountants to focus on higher-level tasks such as analysis and consulting.

The Impact of Technology on Accounting

Technology is revolutionizing accounting processes and practices. Automation, artificial intelligence (AI), and cloud computing are transforming the way accountants work.

According to a report by Deloitte, AI is expected to automate many routine accounting tasks, freeing up accountants to focus on more strategic activities.

Accountants need to adapt to these technological changes by developing new skills in data analytics and technology management.

The Future of Accounting

The accounting profession is constantly evolving to meet the changing needs of businesses and society. Accountants will need to be adaptable, innovative, and technologically savvy.

The demand for accountants with strong analytical and communication skills is expected to grow in the coming years. Specializations such as data analytics and cybersecurity are becoming increasingly important.

The U.S. Bureau of Labor Statistics projects that employment of accountants and auditors will grow by 4% from 2022 to 2032.

Furthermore, a human-interest angle can be seen in the work of accountants who use their skills to help small businesses thrive, assisting families with financial planning, and contributing to the integrity of financial markets.

Ultimately, accounting is a dynamic and essential profession that plays a critical role in the global economy. Understanding its true nature is crucial for anyone seeking financial literacy or considering a career in the field.