Which Of The Following Is True Of A Stock Dividend

Imagine a sunny afternoon, lounging in your favorite armchair with a cup of tea, and the comforting feeling of checking your investment portfolio. There's a little boost – not from the market soaring, but from a stock dividend quietly deposited into your account. It's like a small thank you from the company you've invested in, a share of the profits distributed directly to shareholders.

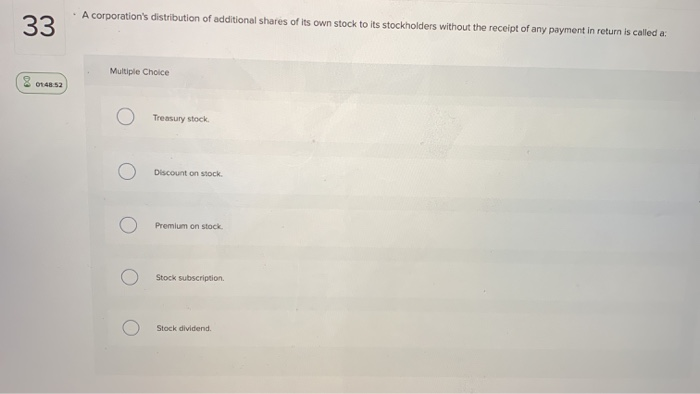

At its core, a stock dividend is a payment made to shareholders in the form of additional shares of the company's stock, rather than cash. This article aims to clarify exactly what's true about a stock dividend, demystifying its mechanics and exploring its implications for investors. Understanding stock dividends is crucial for anyone looking to build a well-rounded and informed investment strategy.

Understanding Stock Dividends: Beyond the Basics

Let's delve into the specifics. A stock dividend, unlike a cash dividend, doesn't represent an outflow of cash from the company.

Instead, it's an accounting maneuver that shifts value from retained earnings to common stock and paid-in capital.

The pie itself doesn't get bigger, it's just sliced into more pieces.

Key Insight: The total value of your investment immediately following a stock dividend remains theoretically unchanged.

You own more shares, but each share is worth slightly less, as the company's value is now spread across a greater number of shares.

Think of it like cutting a cake into more slices; you have more slices, but each slice is smaller.

Why Companies Issue Stock Dividends

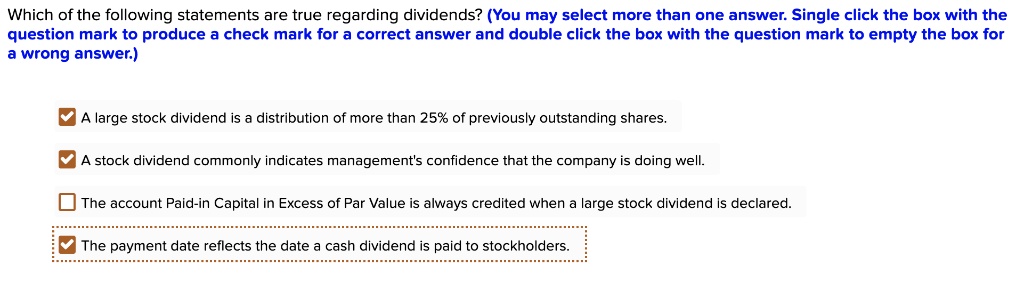

Companies issue stock dividends for a variety of reasons. Often, it's a sign that the company is doing well and wants to reward shareholders without depleting its cash reserves.

This can be particularly appealing to companies that are rapidly growing or investing heavily in research and development.

It signals confidence in future performance.

Another reason is to increase the number of outstanding shares, potentially making the stock more accessible to a wider range of investors. This increased liquidity can be beneficial.

A lower per-share price might attract smaller investors who might have been priced out before.

It's about broadening appeal and making the stock more tradeable.

Furthermore, stock dividends can be used to signal to the market that the company believes its stock is undervalued. By issuing more shares, the company expresses confidence in its future prospects.

This can be a powerful signal, influencing investor sentiment and potentially driving up the stock price over time.

It's a statement of belief in the company's inherent value.

What is True About Stock Dividends: Key Characteristics

Let's pinpoint what's undeniably true about stock dividends.

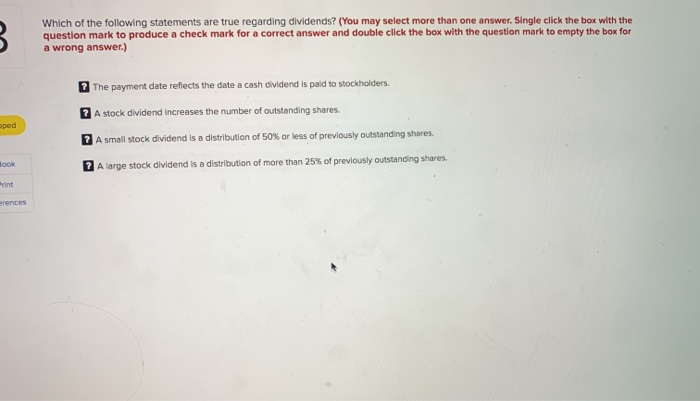

Firstly, a stock dividend increases the number of shares you own.

If you owned 100 shares before a 10% stock dividend, you would own 110 shares afterward.

Secondly, a stock dividend doesn't create taxable income for shareholders at the time of distribution. This is a significant difference compared to cash dividends, which are typically taxed in the year they are received.

Tax implications arise only when you eventually sell the shares received as a stock dividend. This is a key advantage for investors seeking tax-efficient investment strategies.

The tax burden is deferred until the sale.

Thirdly, the market price per share usually decreases proportionally after the stock dividend.

If a stock was trading at $100 before a 10% stock dividend, it would likely trade around $90.91 after the dividend (calculated as $100 / 1.10).

This adjustment ensures that the overall value of your holdings remains roughly constant.

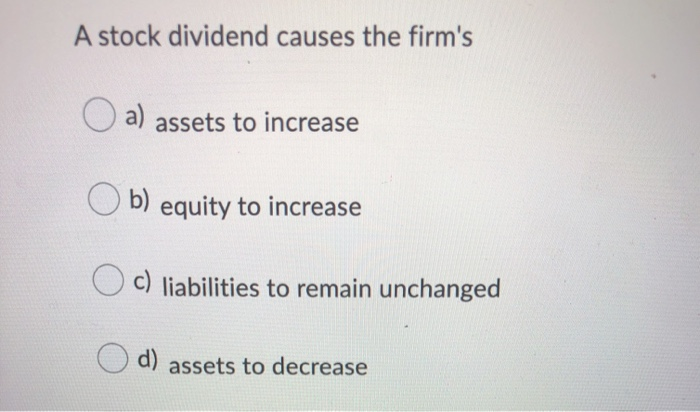

Fourthly, a stock dividend does not change the company's assets or liabilities.

It's purely an accounting adjustment within the equity section of the balance sheet. No real assets change hands.

The financial health of the company is not directly affected.

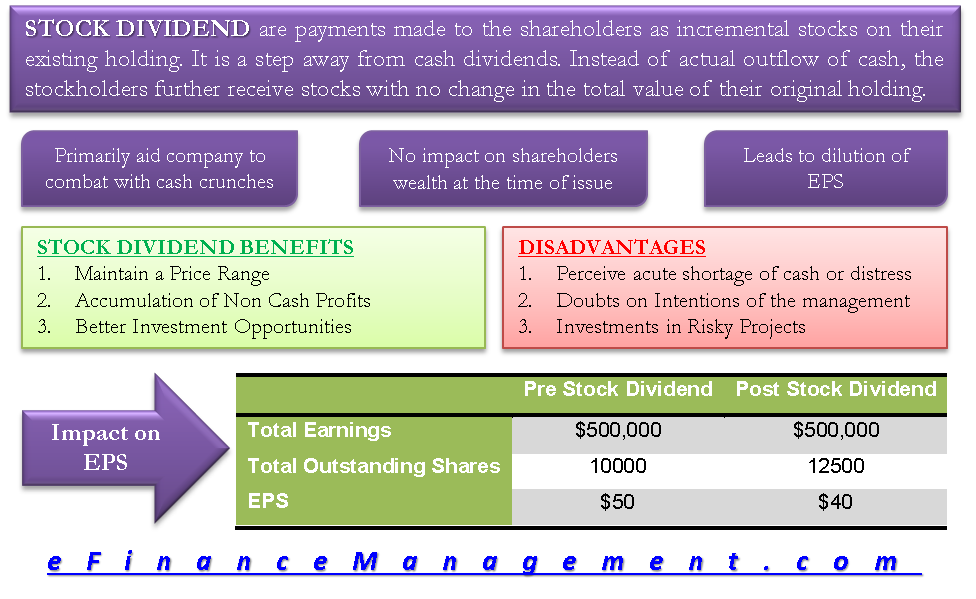

The Impact on Earnings Per Share (EPS)

Another crucial aspect to consider is the impact of stock dividends on earnings per share (EPS).

EPS is a key metric used to evaluate a company's profitability. Because a stock dividend increases the number of outstanding shares, it will dilute the EPS figure.

This means that each share represents a smaller claim on the company's earnings.

However, this dilution isn't necessarily negative. If the company continues to grow its earnings at a faster rate than the increase in shares, the EPS can still increase.

It's all about the company's overall financial performance and its ability to generate profits.

Growth can offset dilution.

"A stock dividend represents a transfer from retained earnings to contributed capital and does not impact the underlying value of the company." - Investopedia

Disentangling Misconceptions About Stock Dividends

There are common misconceptions surrounding stock dividends that need to be addressed. One prevalent myth is that stock dividends are "free money."

While receiving more shares can feel like a windfall, it's important to remember that the overall value of your investment remains essentially the same.

It's not a gift, it's a redistribution.

Another misconception is that stock dividends are always a positive sign. While they can indicate confidence from the company's management, they can also be used to mask underlying financial issues. It's essential to look at the company's overall financial health before drawing conclusions.

Don't rely solely on the dividend as a signal.

Consider the broader context.

Furthermore, some investors mistakenly believe that stock dividends automatically lead to higher stock prices. While a stock dividend can sometimes create positive sentiment, it's not a guaranteed recipe for price appreciation. Market forces and the company's performance are the primary drivers of stock prices.

Positive sentiment may follow.

But performance matters more.

Stock Splits vs. Stock Dividends: A Clarification

It's crucial to differentiate between stock dividends and stock splits.

While both increase the number of outstanding shares, they have slightly different accounting treatments and are often used in different situations.

They are not interchangeable terms.

A stock split typically involves a larger increase in the number of shares (e.g., a 2-for-1 split), whereas a stock dividend usually involves a smaller increase (e.g., a 10% stock dividend).

The accounting treatment also differs slightly, with stock splits generally requiring less complex accounting entries.

Magnitude and accounting differ.

Companies often use stock splits to make their stock more affordable after a period of significant price appreciation. This is a common strategy to improve liquidity and broaden the investor base.

Accessibility and liquidity drive splits.

Affordability matters.

The Investor's Perspective: Is a Stock Dividend Right for You?

Whether a stock dividend is "good" or "bad" ultimately depends on your individual investment goals and risk tolerance. For long-term investors who are focused on growth and are not concerned about immediate income, a stock dividend can be a welcome addition to their portfolio.

It allows them to accumulate more shares over time, potentially benefiting from future price appreciation.

Long-term growth benefits.

However, for investors who are seeking immediate income or who are concerned about dilution, a stock dividend may not be as appealing. Cash dividends provide immediate income and don't dilute the EPS.

Consider your personal investment strategy.

Income now versus growth later.

In conclusion, understanding stock dividends requires a nuanced perspective. While they might not be "free money," they can be a valuable tool for companies to reward shareholders, signal confidence, and potentially increase liquidity.

By demystifying the mechanics and dispelling common misconceptions, investors can make more informed decisions about whether to invest in companies that issue stock dividends.

Informed decisions are key.

Ultimately, the best investment strategy is one that aligns with your personal goals, risk tolerance, and time horizon. Stock dividends can play a role in that strategy, but they should be evaluated within the broader context of the company's financial health and the overall market environment.

Understanding the nuances will help you make better financial decisions. Consider all factors.

A well-informed investor is an empowered investor.