Which Of The Following Is True Of Level Term Insurance

Navigating the complexities of insurance can feel overwhelming, especially when trying to determine the most suitable option for your individual needs. Level term insurance, a popular choice for many seeking straightforward protection, often raises questions about its features and benefits.

This article aims to clarify the characteristics of level term insurance, providing a comprehensive overview based on industry standards and expert insights to help consumers make informed decisions. Understanding the core elements of this type of policy is crucial for those planning for their family's financial security.

What is Level Term Insurance?

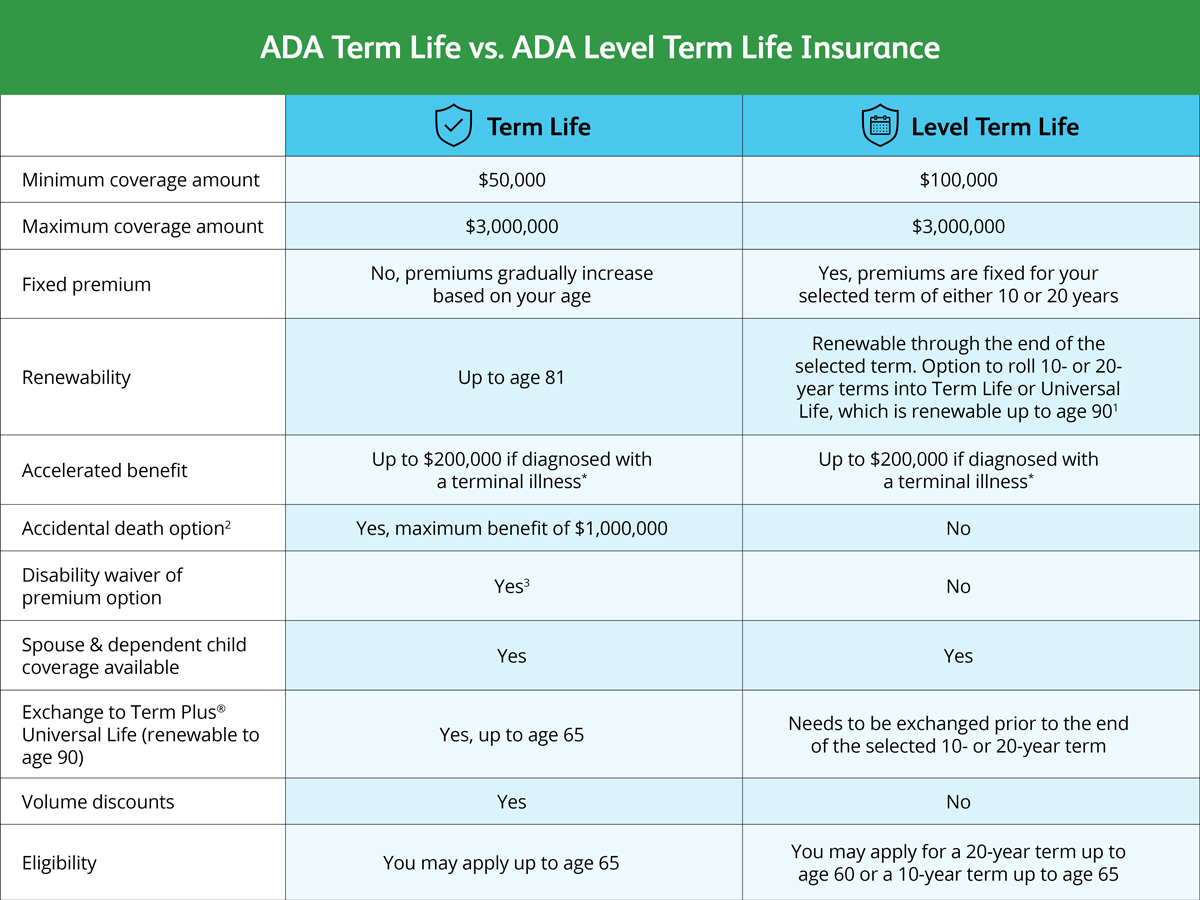

Level term insurance is a type of term life insurance where the premium remains the same throughout the policy's term, and the death benefit also remains constant.

The term can range from 10 to 30 years, or even longer in some cases, depending on the insurer and the policyholder's preferences.

This predictability makes it a favored option for individuals seeking stable and budget-friendly coverage.

Key Characteristics

One of the defining features of level term insurance is its fixed premium.

This means that regardless of changes in the policyholder's health or age during the term, the premium will not increase, providing peace of mind and financial stability.

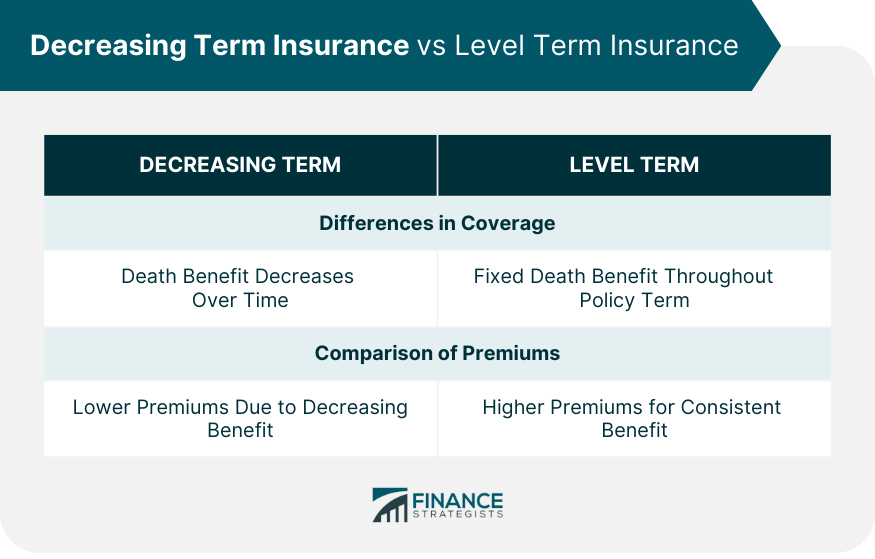

This contrasts with other types of insurance, such as annually renewable term, where premiums increase each year as the policyholder ages.

The death benefit also remains constant throughout the policy term. If the insured individual passes away during the term, the beneficiary will receive the full death benefit amount specified in the policy.

This fixed payout ensures that beneficiaries receive the expected financial support, without any surprises or reductions due to market fluctuations or other factors.

No cash value accumulation is another critical aspect of level term insurance. Unlike whole life insurance, term life insurance does not build cash value over time.

The premiums paid solely cover the cost of insurance, providing death benefit protection without any investment or savings component.

This makes it a more affordable option compared to permanent life insurance policies that offer cash value accumulation.

When Does Level Term Insurance Make Sense?

Level term insurance is often a good fit for individuals who need significant life insurance coverage for a specific period, such as while raising children or paying off a mortgage.

It is useful for covering specific financial obligations with a defined timeline.

For example, if a couple has a 20-year mortgage, a 20-year level term policy could provide sufficient coverage to pay off the mortgage should one of them pass away during that period.

Young families are a common demographic for level term policies.

Parents often want to ensure their children's financial well-being in the event of their premature death, including providing for education, childcare, and other essential needs.

Level term insurance can provide this protection at a relatively affordable cost.

Potential Drawbacks

One potential drawback of level term insurance is that the policy expires at the end of the term.

If the insured individual needs coverage beyond the initial term, they may need to purchase a new policy, potentially at a higher premium due to their older age and possible changes in health.

However, some policies offer a renewal option, although the premium will likely increase at the time of renewal.

Another factor to consider is the lack of cash value accumulation.

While this makes level term insurance more affordable, it does not offer the savings or investment benefits of whole life or universal life insurance.

Individuals seeking to build wealth through their life insurance policy may prefer permanent life insurance options.

Getting the Right Policy

When considering level term insurance, it is important to assess your financial needs and determine the appropriate coverage amount and term length.

Consider consulting with a qualified insurance advisor who can help you evaluate your specific circumstances and recommend the best policy for your needs.

Shopping around and comparing quotes from multiple insurers is also essential to ensure you are getting the most competitive rates.

Impact and Conclusion

The significance of level term insurance lies in its ability to provide affordable and predictable financial protection.

By understanding the key characteristics of this type of policy, individuals can make informed decisions about their life insurance needs and safeguard their families' financial future.

With careful planning and consultation, level term insurance can be a valuable tool for managing risk and providing peace of mind.