Which Of The Following Macroeconomic Factors Is Typically Considered

Economic alarm bells are ringing as inflation remains stubbornly high. Experts are urgently debating which macroeconomic indicators truly signal the path ahead.

The question of which factors are most crucial is not merely academic; it dictates policy responses that will impact every citizen's financial well-being.

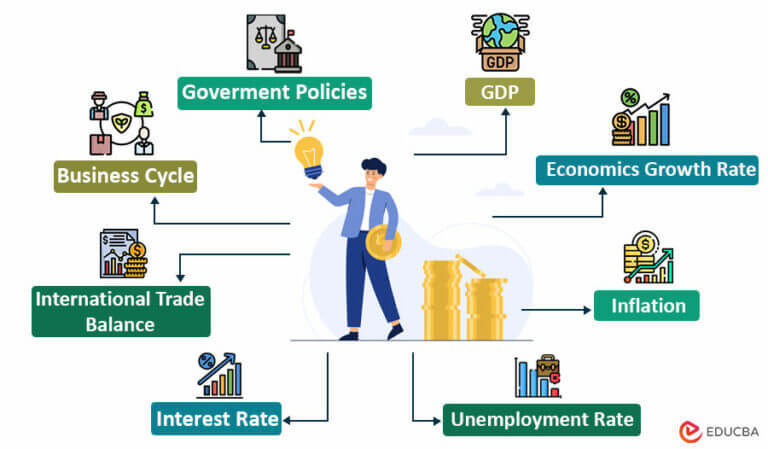

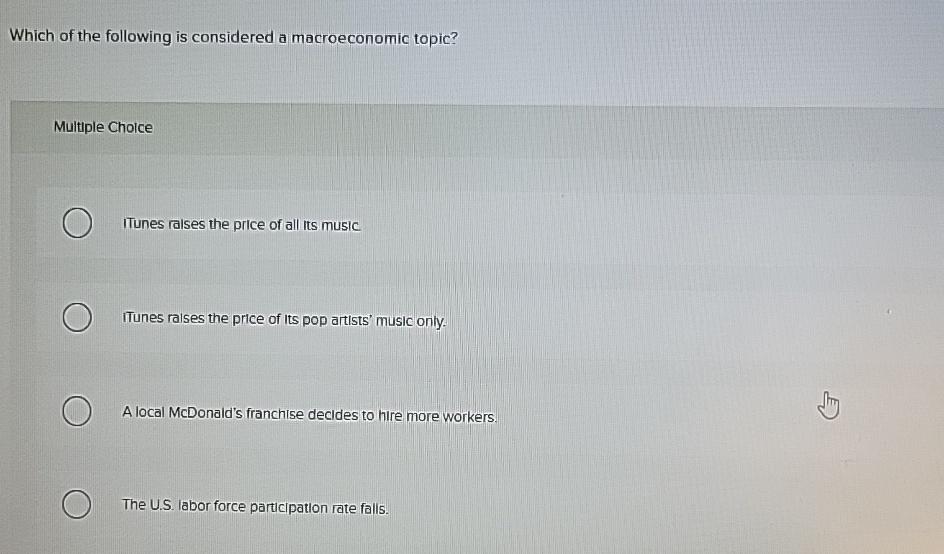

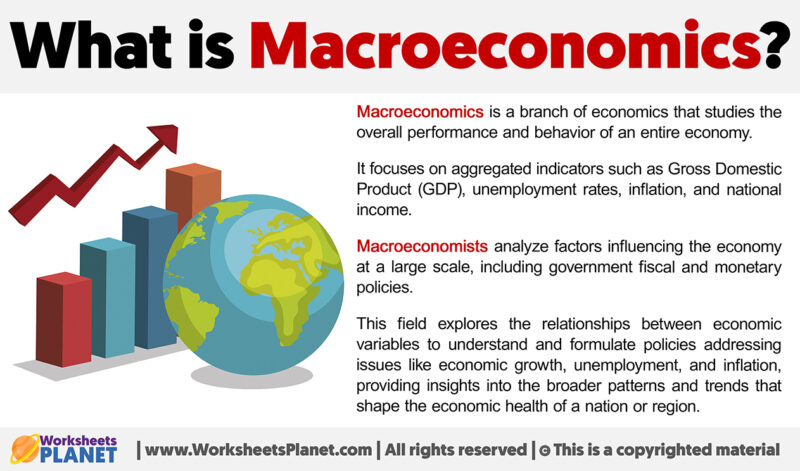

The Core Debate: GDP vs. Inflation vs. Employment

The central question revolves around the relative importance of Gross Domestic Product (GDP), inflation rates, and employment figures.

Traditionally, policymakers have closely monitored GDP as a primary indicator of economic health.

A rising GDP generally signals expansion, while a contracting GDP suggests recession.

However, the current situation is complicated by persistent inflation, which distorts the GDP picture.

According to the Bureau of Economic Analysis (BEA), Q1 2024 GDP grew at an annualized rate of 1.6%, significantly lower than anticipated.

Simultaneously, the Consumer Price Index (CPI) released by the Bureau of Labor Statistics (BLS) showed a 3.5% increase in March 2024, exceeding expectations.

This suggests that even with apparent growth, purchasing power is eroding, raising concerns about stagflation.

The Inflation Factor

Inflation, measured through indices like the CPI and the Producer Price Index (PPI), is arguably the most intensely scrutinized factor.

The Federal Reserve's dual mandate focuses on price stability and maximum employment.

Currently, the Fed is under immense pressure to bring inflation down to its target of 2%.

High inflation erodes consumer confidence and purchasing power, impacting spending and investment.

Moreover, it disproportionately affects low-income households who spend a larger percentage of their income on essential goods.

The PPI, which tracks wholesale price changes, provides an early warning signal of potential consumer inflation.

Employment: A Lagging Indicator?

While employment figures remain strong, with unemployment hovering around 3.8% according to the BLS, some argue that employment is a lagging indicator.

This means that the labor market may not reflect the true extent of economic weakness until some time after a downturn has begun.

Furthermore, the quality of employment is also a factor.

The number of part-time jobs versus full-time positions, and the prevalence of multiple job holders, can provide insights beyond the headline unemployment rate.

Interest Rates and Monetary Policy

The Federal Reserve's primary tool for managing inflation is adjusting the federal funds rate.

Higher interest rates increase the cost of borrowing, theoretically curbing spending and investment, thereby cooling down the economy and reducing inflationary pressures.

However, aggressive interest rate hikes can also stifle economic growth and potentially trigger a recession.

The current federal funds rate stands at 5.25%-5.50%, and the Fed is closely monitoring economic data to determine the appropriate course of action.

"The Fed faces a delicate balancing act. They need to curb inflation without sending the economy into a tailspin," said Dr. Anya Sharma, a leading economist at the Brookings Institution.

The Global Context

The macroeconomic factors within the United States are inextricably linked to the global economic landscape.

Geopolitical tensions, supply chain disruptions, and fluctuations in global commodity prices can all have significant impacts on the U.S. economy.

For example, the ongoing conflict in Ukraine has contributed to higher energy prices and disruptions to agricultural markets, exacerbating inflationary pressures.

Similarly, disruptions to global supply chains, particularly in semiconductors and other essential goods, have led to shortages and price increases.

The strength of the U.S. dollar also plays a crucial role.

A strong dollar makes U.S. exports more expensive and imports cheaper, potentially impacting the trade balance and economic growth.

International Monetary Fund (IMF) forecasts suggest a global slowdown in economic growth, further complicating the picture for the U.S. economy.

Moving Forward: The Critical Indicators to Watch

While all macroeconomic factors are important, inflation, particularly the CPI and PPI, is currently receiving the most intense scrutiny.

The Federal Reserve's policy decisions will largely depend on how these inflation indicators evolve in the coming months.

Economists and policymakers are also closely watching GDP growth, employment figures, and global economic developments to assess the overall health of the economy and to anticipate potential risks.

The next Federal Open Market Committee (FOMC) meeting is scheduled for June 2024, where policymakers will likely provide updated guidance on the future path of monetary policy.