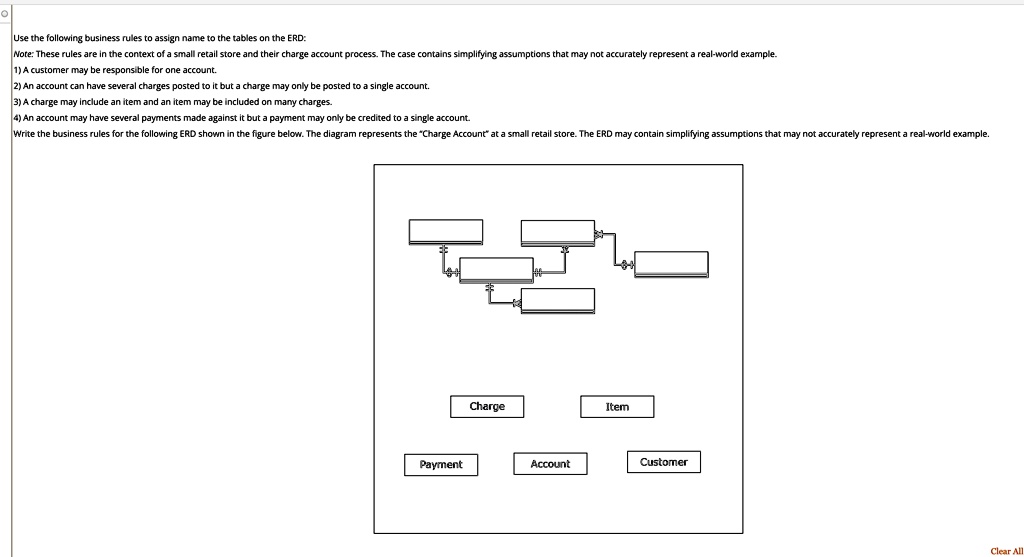

Which Of The Following Represents An Obligation Of The Company

In the intricate world of corporate finance and legal frameworks, understanding a company's obligations is paramount, not just for internal stakeholders but also for investors, creditors, and the public. Misinterpreting these obligations can lead to severe financial repercussions, legal battles, and a loss of stakeholder trust.

Navigating this complex landscape requires a clear comprehension of what constitutes an obligation, a term encompassing a broad spectrum of liabilities. This article aims to dissect the key elements that define a company's obligations, providing a comprehensive overview based on financial reporting standards and legal principles, and illuminating the importance of accurate identification and management of these responsibilities.

A company's obligations, in their simplest form, represent debts or duties the company is bound to fulfill, arising from past transactions or events. These obligations demand the outflow of resources, such as cash, assets, or services, to another entity at a specific or determinable future date. Accurately categorizing and managing these obligations is crucial for maintaining financial stability and fostering stakeholder confidence.

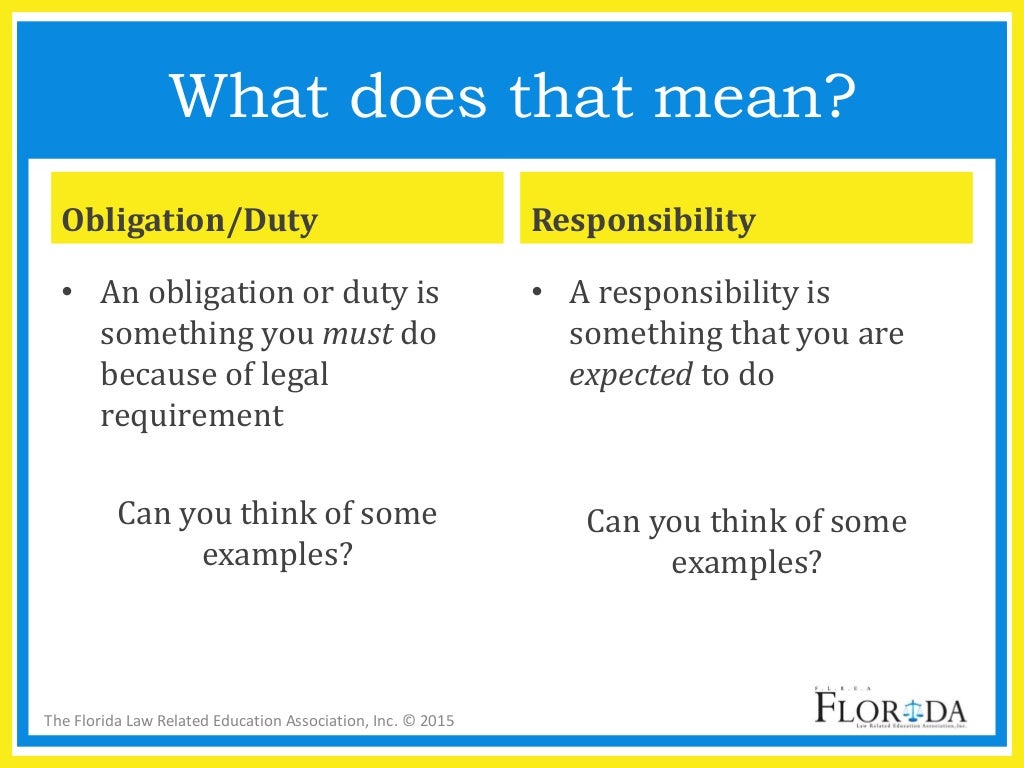

Defining Company Obligations: A Comprehensive Overview

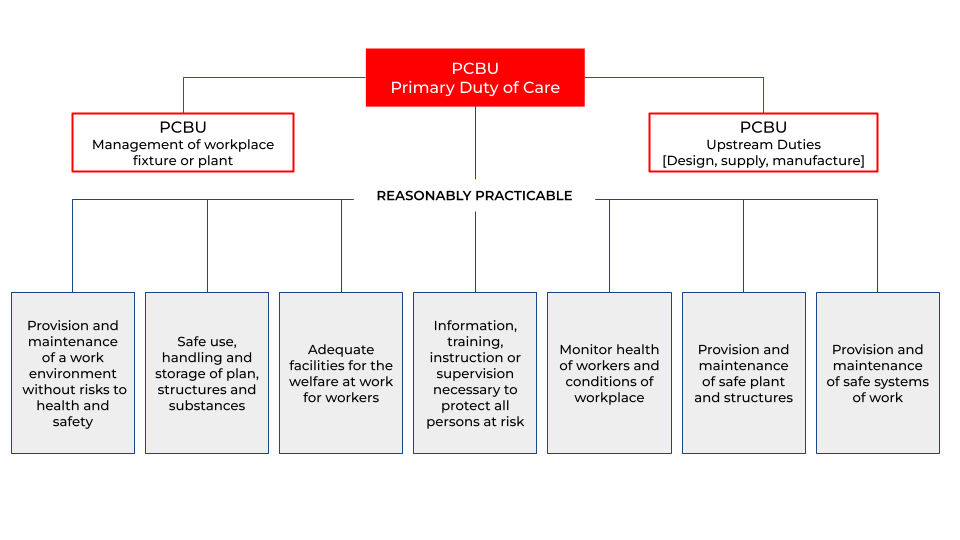

The term "obligation" in a business context is multifaceted. It includes financial liabilities, contractual responsibilities, and even implied duties based on established business practices.

Recognizing these different types of obligations is vital for correct financial reporting and risk management.

Financial Liabilities

Financial liabilities are perhaps the most straightforward type of obligation. These liabilities represent amounts owed to creditors, suppliers, or other entities, typically arising from borrowing money, purchasing goods or services on credit, or issuing debt instruments.

Common examples include accounts payable, loans payable, bonds payable, and accrued expenses. These obligations are typically measured at their present value, reflecting the time value of money.

Contractual Obligations

Contractual obligations arise from legally binding agreements between the company and another party. These agreements stipulate specific actions or payments the company must perform.

Lease agreements, service contracts, and purchase orders are prime examples. Failure to meet these obligations can result in legal action and financial penalties.

For instance, a lease agreement requires the company to make regular payments for the use of an asset. This represents a contractual obligation, impacting the company’s financial statements.

Implied Obligations

Implied obligations are less explicit than financial or contractual liabilities, but equally important. These obligations arise from the company's actions, policies, or accepted business practices, creating a reasonable expectation that the company will fulfill certain responsibilities.

Warranty obligations are a common example. When a company sells a product with a warranty, it implicitly promises to repair or replace the product if it malfunctions within a specified period.

This promise creates an obligation to future customers, even if no formal contract exists beyond the sale of the product. Another instance might involve offering refunds under a publicly advertised return policy.

Key Considerations in Identifying Obligations

Identifying a company's obligations requires careful assessment and adherence to accounting standards. The International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) provide frameworks for recognizing and measuring liabilities.

These frameworks emphasize the importance of substance over form, meaning that the legal structure of a transaction may not always reflect the underlying economic reality. Companies must consider the potential outflow of resources when determining whether an obligation exists.

The Importance of Accrual Accounting

Accrual accounting plays a critical role in recognizing obligations. This accounting method requires companies to record revenues when earned and expenses when incurred, regardless of when cash changes hands.

This means obligations are recognized when the company has a present duty, even if the payment or fulfillment will occur in the future. For instance, a company may receive goods in December but not pay for them until January. Under accrual accounting, the accounts payable (an obligation) is recognized in December, reflecting the economic reality of the transaction.

Off-Balance Sheet Obligations

Companies sometimes attempt to structure transactions to avoid recognizing obligations on their balance sheets. These so-called "off-balance sheet" obligations can create a misleading picture of the company's financial health.

Operating leases, for instance, have historically been used to keep lease obligations off the balance sheet. However, accounting standards have evolved to require companies to recognize most leases as liabilities, providing greater transparency.

Companies should be transparent about all obligations, whether they are on or off the balance sheet, to give stakeholders a complete understanding of their financial position.

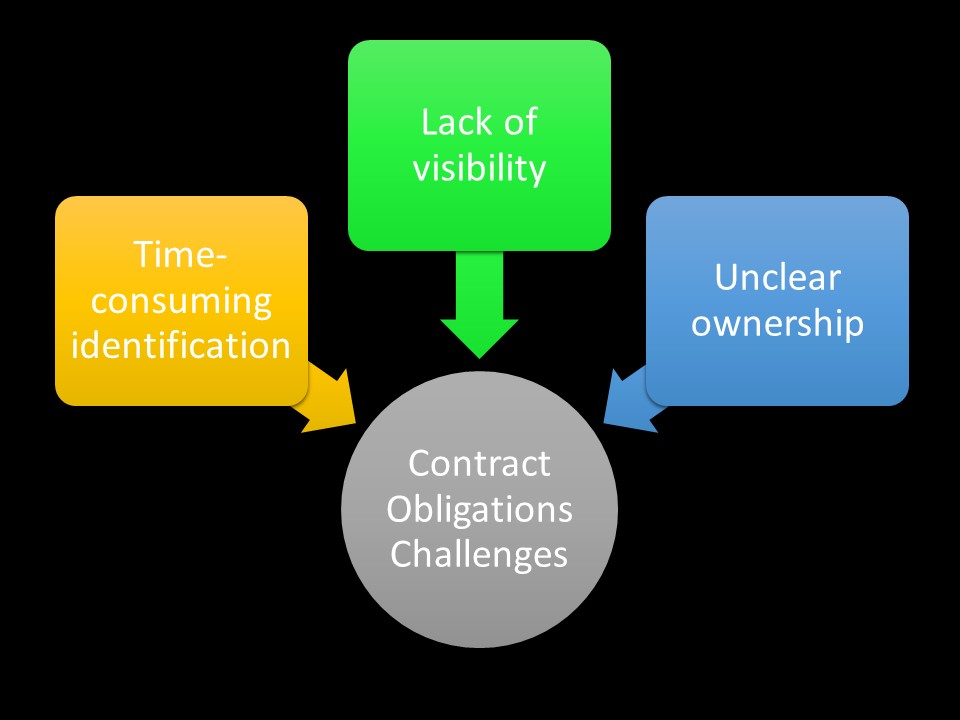

Consequences of Misidentifying or Mismanaging Obligations

Failure to accurately identify and manage obligations can have significant consequences. It can lead to inaccurate financial statements, misleading investors and creditors, and even legal repercussions.

Inaccurate financial reporting can damage a company's reputation and erode investor confidence. Legal consequences may arise from failing to meet contractual obligations or violating accounting standards.

"The proper identification and management of obligations are critical for maintaining financial integrity and ensuring sustainable business operations," said Professor Anya Sharma, a leading expert in corporate finance.

For example, if a company underestimates its warranty obligations, it may not set aside sufficient reserves to cover future claims. This can result in unexpected losses and potentially threaten the company's solvency.

Looking Ahead: Trends in Obligation Management

The landscape of obligation management is constantly evolving. Increased regulatory scrutiny, technological advancements, and evolving business models are shaping how companies identify and manage their responsibilities.

Companies are increasingly adopting sophisticated software solutions to track and manage their obligations. These systems help automate the identification, measurement, and reporting of liabilities, reducing the risk of errors and improving efficiency.

Furthermore, the growing emphasis on environmental, social, and governance (ESG) factors is creating new types of obligations. Companies are now expected to address their impact on the environment, society, and governance, which can translate into concrete financial obligations, such as investments in sustainability initiatives or remediation efforts. These evolving expectations are placing even greater importance on robust obligation management practices.

In conclusion, a clear understanding of what constitutes a company’s obligation is essential for all stakeholders. Accurate identification, careful management, and transparent reporting are crucial for maintaining financial stability, fostering stakeholder trust, and ensuring long-term sustainability. By prioritizing these principles, companies can navigate the complexities of the modern business environment and build a foundation for lasting success.

![Which Of The Following Represents An Obligation Of The Company [FREE] The trial balance of Kroeger Incorporated included the following](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2023/10/65254423396ab_1696941089236.jpg)

![Which Of The Following Represents An Obligation Of The Company [Solved] A company has a noncontributory, defined | SolutionInn](https://s3.amazonaws.com/si.experts.images/answers/2024/05/66551ea5052f8_43666551ea4ecf4e.jpg)

![Which Of The Following Represents An Obligation Of The Company [Solved] Calculate the housing expense ratio and t | SolutionInn](https://dsd5zvtm8ll6.cloudfront.net/questions/2023/11/654f09b63b2ad_646654f09b6374d5.jpg)