Which Of The Following Statements Is Correct Regarding Revenues

The deceptively simple question – "Which of the following statements is correct regarding revenues?" – can unravel into a complex web of accounting standards, economic realities, and potential misinterpretations. Its implications reach far beyond textbook definitions, influencing investment decisions, corporate strategies, and even macroeconomic policy.

At its core, understanding revenue recognition is crucial for assessing a company's financial health. This article delves into the nuances of revenue accounting, examining various perspectives and clarifying common misconceptions. We will explore the principles governing revenue reporting, dissect the impact of different accounting standards, and analyze how revenue figures can be interpreted in the broader economic context.

The Foundation: Defining and Recognizing Revenue

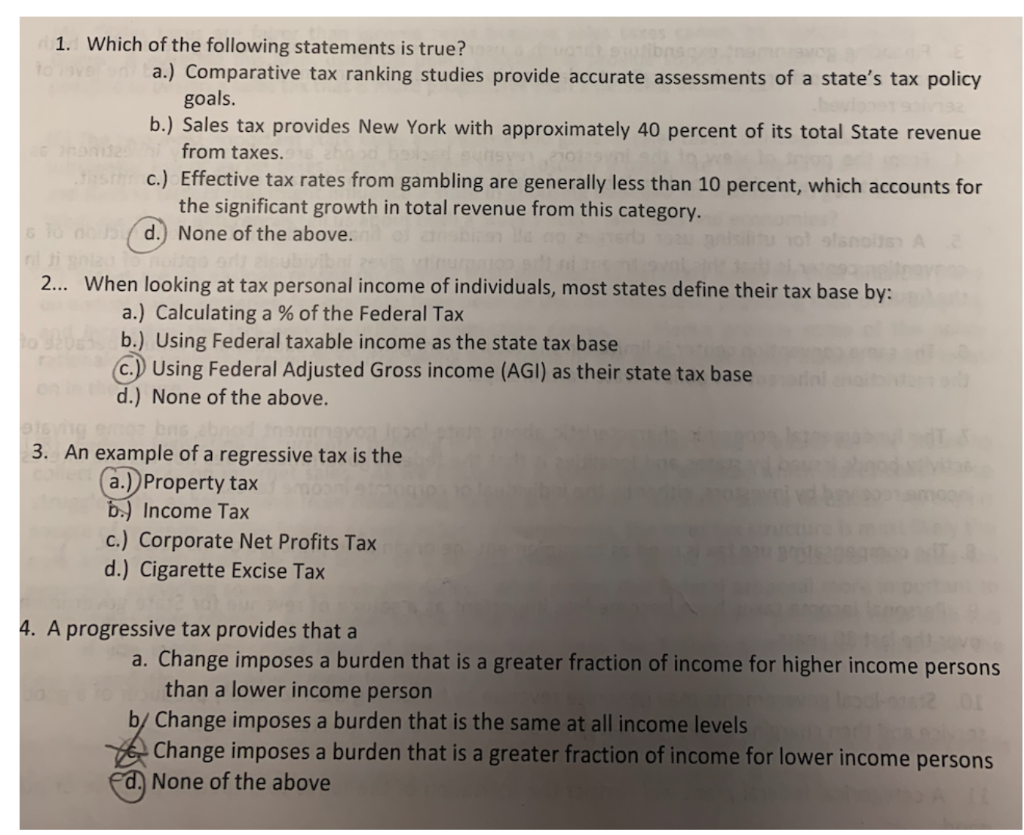

Revenue, in its most basic form, represents the inflow of economic benefits arising from a company's ordinary activities. The generally accepted accounting principles (GAAP) and the International Financial Reporting Standards (IFRS) provide frameworks for recognizing revenue, aiming to ensure transparency and comparability across financial statements.

Both standards emphasize a principles-based approach, requiring companies to recognize revenue when they have transferred control of goods or services to a customer. This seemingly straightforward principle necessitates careful judgment and interpretation in practice.

Key Principles in Revenue Recognition

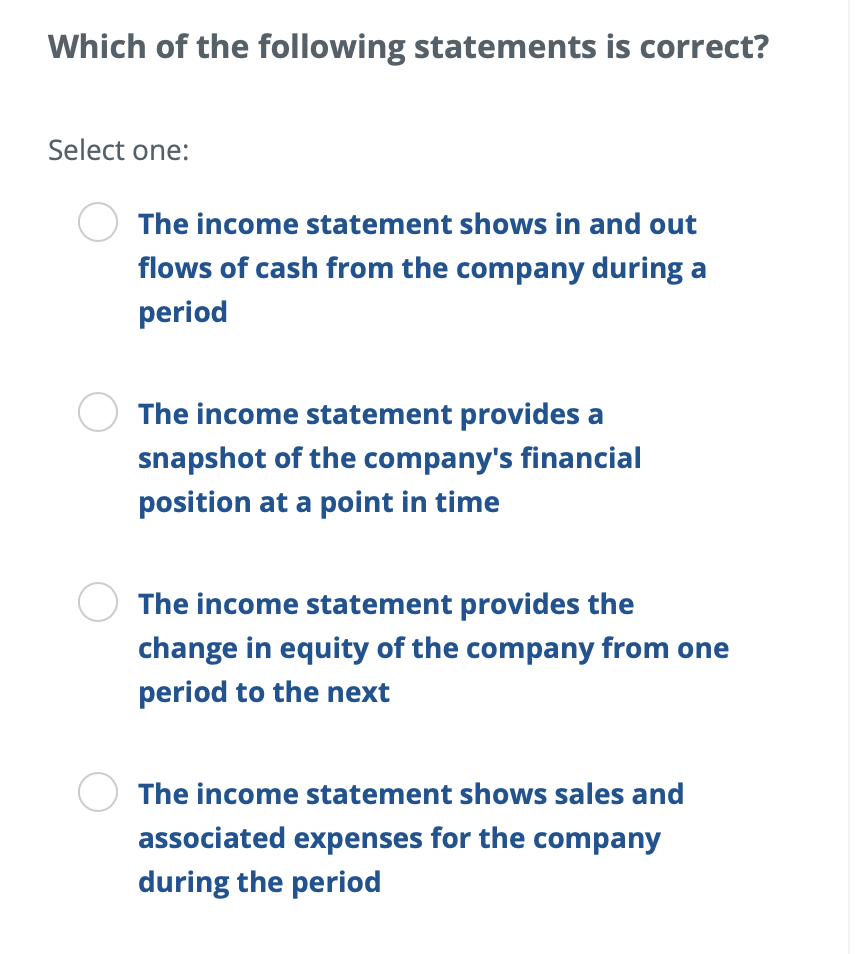

Under both GAAP and IFRS, the core principle hinges on the transfer of control to the customer. This signifies the customer's ability to direct the use of, and obtain substantially all of the remaining benefits from, the asset or service.

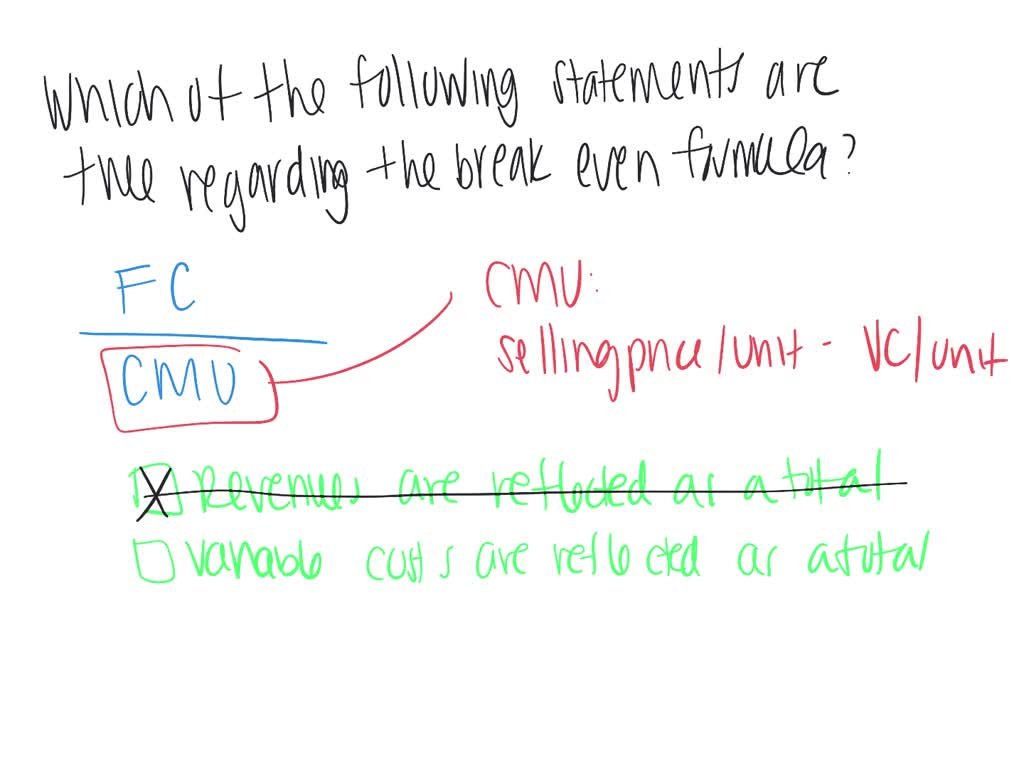

The timing of revenue recognition is vital. It dictates when a company can record the revenue on its income statement. Premature or delayed recognition can significantly distort a company's financial performance.

For example, consider a software company that sells a multi-year subscription. It can not recognize all the revenue upfront. The revenue needs to be allocated over the subscription period.

Contrasting Perspectives: GAAP vs. IFRS

While the overarching principles are similar, subtle differences exist between GAAP and IFRS concerning revenue recognition. These differences often arise from variations in specific industry guidance and interpretation.

One notable difference lies in the level of detail provided within each standard. Historically, GAAP provided more prescriptive guidance, while IFRS adopted a more principles-based approach. However, with the introduction of ASC 606 (Revenue from Contracts with Customers) under GAAP, the gap has narrowed considerably.

ASC 606 brought GAAP more in line with IFRS 15, the corresponding IFRS standard. Both aim to reduce industry-specific guidance and promote a more consistent approach across different sectors.

Common Misconceptions and Challenges

Despite the well-defined principles, several common misconceptions surround revenue recognition. One frequent mistake is confusing revenue with cash receipts. Revenue represents the economic benefit earned, regardless of when cash is received.

Another challenge arises in situations involving complex contracts with multiple performance obligations. Companies must carefully identify each distinct obligation and allocate the transaction price accordingly. This allocation process often requires significant judgment and can significantly impact the timing of revenue recognition.

For instance, a company selling equipment with installation and maintenance services must allocate the contract price to each component. This will recognize revenue for each component when it is transferred to customer.

Impact on Financial Statement Analysis

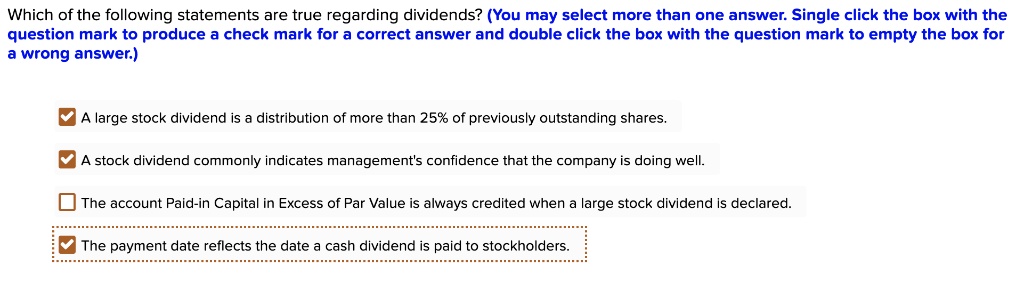

Accurate revenue recognition is paramount for reliable financial statement analysis. Investors and analysts rely on revenue figures to assess a company's growth, profitability, and overall financial health.

Misstated or manipulated revenue figures can lead to distorted performance metrics and ultimately undermine investor confidence. Therefore, scrutiny of a company's revenue recognition policies is essential for due diligence.

When analyzing revenue, it's crucial to consider the company's industry, business model, and specific accounting policies. A thorough understanding of these factors allows for a more informed assessment of the company's financial performance.

The Role of Audits and Regulations

Independent audits play a crucial role in ensuring the accuracy and reliability of revenue reporting. Auditors examine a company's revenue recognition policies and procedures, testing the validity of revenue transactions and assessing compliance with accounting standards.

Regulatory bodies, such as the Securities and Exchange Commission (SEC), also play a vital role in overseeing revenue reporting practices. The SEC actively monitors companies' financial statements and investigates potential instances of fraud or misrepresentation.

Strict enforcement of accounting standards and rigorous oversight by regulatory bodies are essential for maintaining the integrity of financial reporting and protecting investors.

Looking Ahead: The Future of Revenue Recognition

The landscape of revenue recognition is constantly evolving, driven by changes in business models, technological advancements, and regulatory developments. As companies adopt new technologies and engage in more complex transactions, the challenges of revenue recognition will only intensify.

Continuous education and training for accounting professionals are crucial for keeping pace with these changes. Furthermore, ongoing dialogue between accounting standard setters, industry experts, and regulatory bodies is essential for refining and improving revenue recognition practices.

Ultimately, a thorough understanding of revenue recognition principles is essential for anyone involved in financial reporting, investment analysis, or corporate decision-making. By fostering greater transparency and accuracy in revenue reporting, we can promote a more stable and trustworthy financial environment. A correct statement regarding revenue will always prioritize the transfer of control to the customer, regardless of when cash changes hands.