Which Of The Following Transactions Increases Total Assets

In the realm of accounting and finance, understanding how different transactions impact a company's balance sheet is crucial. Specifically, identifying which transactions lead to an increase in total assets is a fundamental concept for investors, business owners, and anyone seeking to interpret financial statements accurately.

This article aims to clarify which types of financial activities directly contribute to the growth of a company's asset base. It's essential to distinguish between transactions that simply reallocate existing assets and those that actively bring new assets into the organization.

Defining Assets

Assets, in accounting terms, are resources owned or controlled by a company that are expected to provide future economic benefits. These can be tangible items like cash, accounts receivable, inventory, property, plant, and equipment (PP&E), or intangible assets like patents, trademarks, and goodwill.

Understanding the composition of assets is critical before analyzing how specific transactions impact the total asset value.

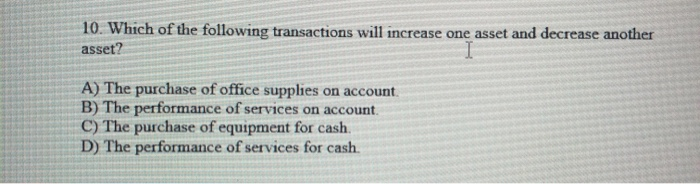

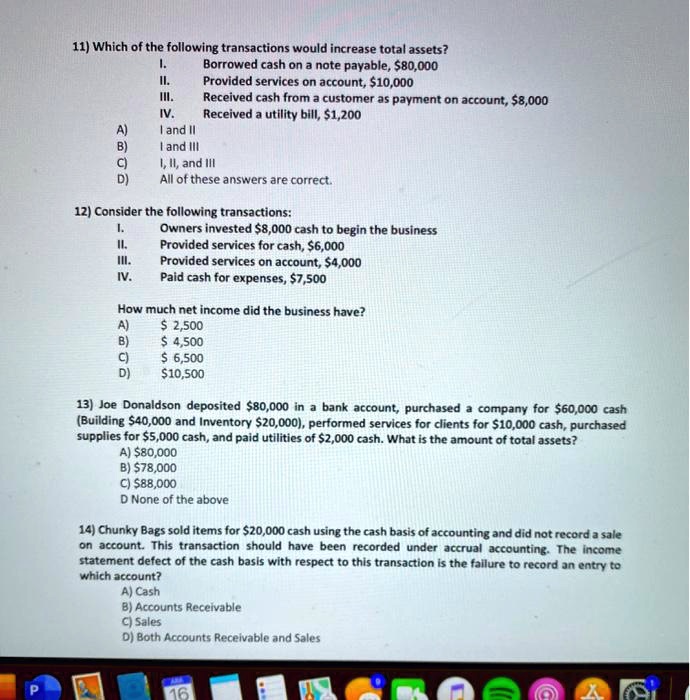

Transactions That Increase Total Assets

Several types of transactions can lead to an increase in a company's total assets. The most common include the acquisition of assets through cash purchases, credit purchases, and investments made by owners or shareholders.

Cash Purchases

A straightforward way to increase total assets is by purchasing assets with cash. For instance, if a company uses cash to buy a new piece of equipment, cash decreases, but the equipment (an asset) increases by the same amount.

The net effect is an increase in total assets, as the company now owns more assets overall.

Credit Purchases

Purchasing assets on credit, also known as accounts payable, also increases total assets. While the company doesn't immediately pay cash, it acquires the asset, and a corresponding liability (accounts payable) is created.

The balance sheet reflects both the increased asset and the increased liability.

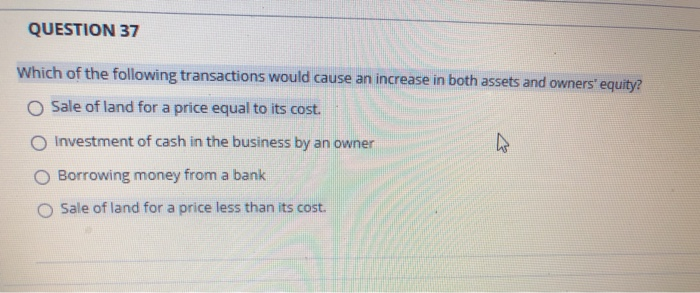

Owner/Shareholder Investment

When owners or shareholders invest cash into the company, this increases the company's cash balance (an asset) and also increases equity. This is a direct injection of assets into the organization.

This increase in cash directly contributes to a higher total asset value.

Transactions That Do Not Increase Total Assets

It is equally important to identify transactions that do not increase total assets. For example, paying off a liability with cash does not increase total assets. While cash decreases, a liability decreases by the same amount, resulting in no net change to the total assets.

Another example is collecting cash from accounts receivable. In this scenario, one asset (accounts receivable) decreases, and another asset (cash) increases. The total assets remain unchanged.

Internal transfers between asset accounts don't lead to overall asset growth. They represent a reallocation of existing resources.

Significance and Impact

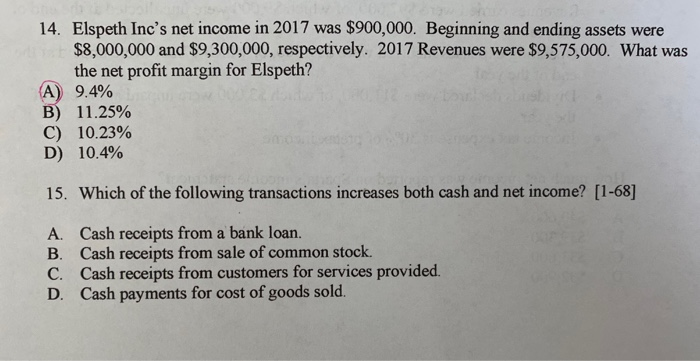

Understanding these principles is critical for several reasons. For investors, it provides a clearer picture of how a company is growing and managing its resources.

For business owners, it aids in making informed decisions about investments and financing.

Accurately tracking asset growth is vital for financial reporting and compliance.

Examples

Consider a small business purchasing a delivery van for $30,000 using a bank loan. The van becomes an asset, increasing the company’s assets by $30,000. Concurrently, a liability (the loan) of $30,000 is created. Total assets increase because of the acquisition of the van.

Alternatively, if the company pays off a $5,000 account payable with cash, the cash asset decreases by $5,000, and the accounts payable liability decreases by $5,000. This transaction has no impact on total assets.

Conclusion

Transactions that directly increase a company's total assets involve the acquisition of new resources, whether through cash, credit, or owner investment. Differentiating between these activities and internal asset reallocations is essential for understanding a company's financial health and growth trajectory.

By focusing on how transactions impact the balance sheet, stakeholders can gain valuable insights into a company's asset management strategies and overall financial performance.