Which Of The Following Would Increase Assets And Increase Liabilities

Breaking: A transaction simultaneously increasing assets and liabilities has major implications for financial health and stability.

Understanding these transactions is crucial for investors, businesses, and anyone managing financial statements. This article dissects scenarios where both sides of the balance sheet inflate, exploring the 'who, what, where, when, why, and how' behind these critical accounting events.

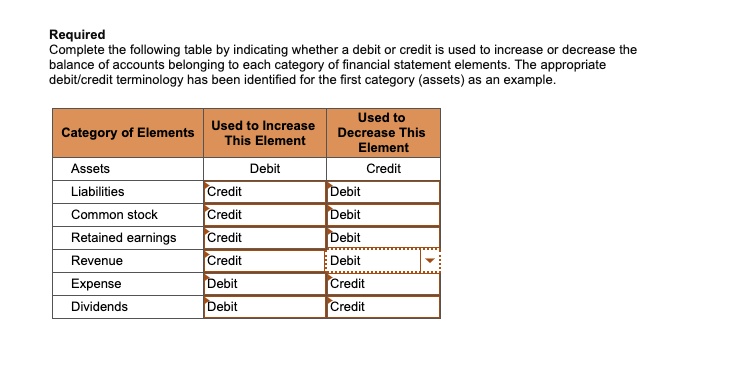

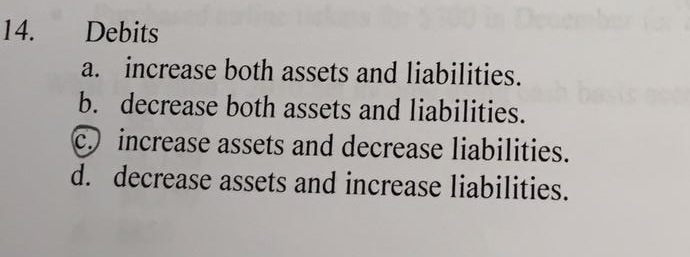

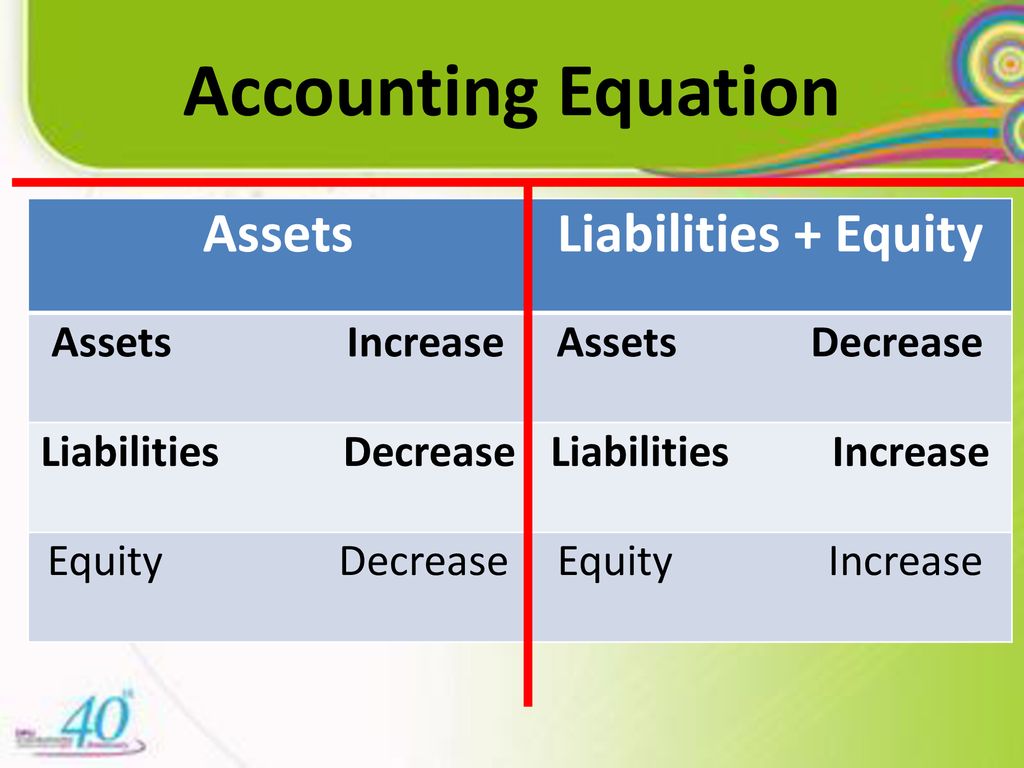

Understanding Asset and Liability Increases

The key lies in recognizing transactions that create new assets while simultaneously creating obligations. Classic examples include borrowing money and purchasing assets on credit.

Ignoring these can skew financial analysis, leading to misinterpretations of a company's true financial standing.

Common Scenarios: Examining the Mechanics

Scenario 1: Taking Out a Loan

A business secures a loan from a bank. The cash received immediately increases the company's assets.

Simultaneously, the loan itself becomes a liability, representing the company's obligation to repay the borrowed funds.

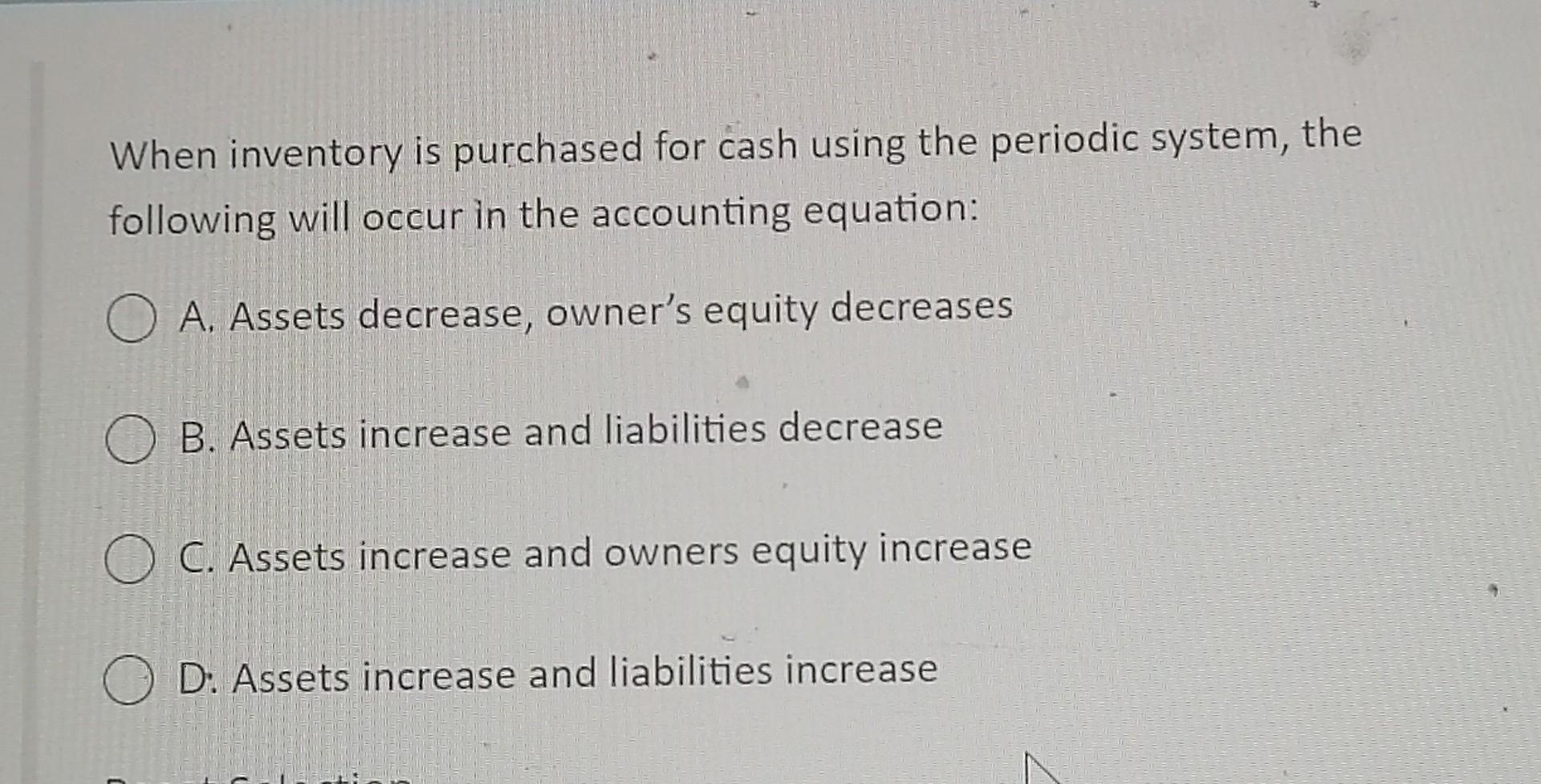

Scenario 2: Purchasing Inventory on Credit

A retailer acquires a large shipment of inventory from a supplier but pays later. The inventory, a current asset, goes up immediately.

However, the outstanding invoice from the supplier creates an accounts payable, increasing current liabilities.

Scenario 3: Acquiring Fixed Assets with Financing

A manufacturer buys a new piece of equipment, financing the purchase through a long-term loan. The equipment is a fixed asset added to the balance sheet.

The loan repayment obligation is a long-term liability, extending potentially years into the future.

Delving Deeper: Impact on Financial Ratios

These transactions significantly impact key financial ratios. The debt-to-equity ratio, for example, climbs as liabilities increase.

The current ratio, calculated as current assets divided by current liabilities, may also decrease, indicating potentially reduced liquidity.

Investors and analysts closely monitor these shifts to gauge risk.

Real-World Implications: Case Studies

Consider a small business expanding its operations. To fund this, it takes out a loan to purchase new equipment.

This instantly boosts the asset base but saddles the company with increased debt.

The business must carefully manage cash flow to service this debt and avoid financial strain.

Another example involves a real estate developer acquiring land using a mortgage. The land becomes an asset.

The mortgage creates a substantial long-term liability.

The developer’s profitability hinges on successful property sales and repayment of the debt.

Who is Affected: Stakeholders to Watch

This directly impacts stakeholders across the financial spectrum. Investors require transparency regarding these transactions to assess risk.

Lenders must evaluate a company's ability to repay increased debt obligations.

Management must make judicious decisions about financing to maintain financial health.

Where and When: Context Matters

These scenarios unfold across all sectors, from retail to manufacturing to tech. They are most common during periods of growth or expansion.

Companies often use debt financing to acquire assets that will generate future revenue.

However, the timing is critical; leveraging during economic downturns can prove precarious.

How to Interpret: Essential Analysis

Analyzing financial statements requires scrutiny of asset and liability movements. Understanding the nature of the transaction is vital.

Analysts must evaluate the quality of the assets acquired and the terms of the liabilities created.

A holistic view, combining balance sheet analysis with cash flow statements, offers a more complete picture.

Expert Perspectives: Insights from Professionals

Leading financial analysts emphasize the importance of understanding leverage. 'Debt is a powerful tool but also a double-edged sword,' says renowned economist, Dr. Anya Sharma.

'Increased assets and liabilities require careful management to avoid overextension.'

Accounting professionals stress the need for proper disclosure. 'Transparency is key,' notes CPA John Lee. 'Investors need a clear understanding of the company's financial obligations.'

Moving Forward: Monitoring and Adaptation

Continuous monitoring of these financial metrics is paramount. Companies must adapt their strategies to manage debt effectively.

Investors must stay informed about financing decisions and their implications.

The current economic climate demands vigilance and prudent financial management.

![Which Of The Following Would Increase Assets And Increase Liabilities [GET ANSWER] 5. Working through a change in the reserve requirement](https://cdn.numerade.com/ask_images/ff395b9cc3d14ca19a2e087be3ff1b12.jpg)