Which Of These Is Not A Valid Fico Credit Score

BREAKING: Confusion and potential financial risk are spreading as consumers discover inconsistencies in credit score reporting.

The core issue revolves around identifying invalid FICO score versions, which can lead to inaccurate loan assessments and financial decisions.

Understanding FICO Scores: What's at Stake?

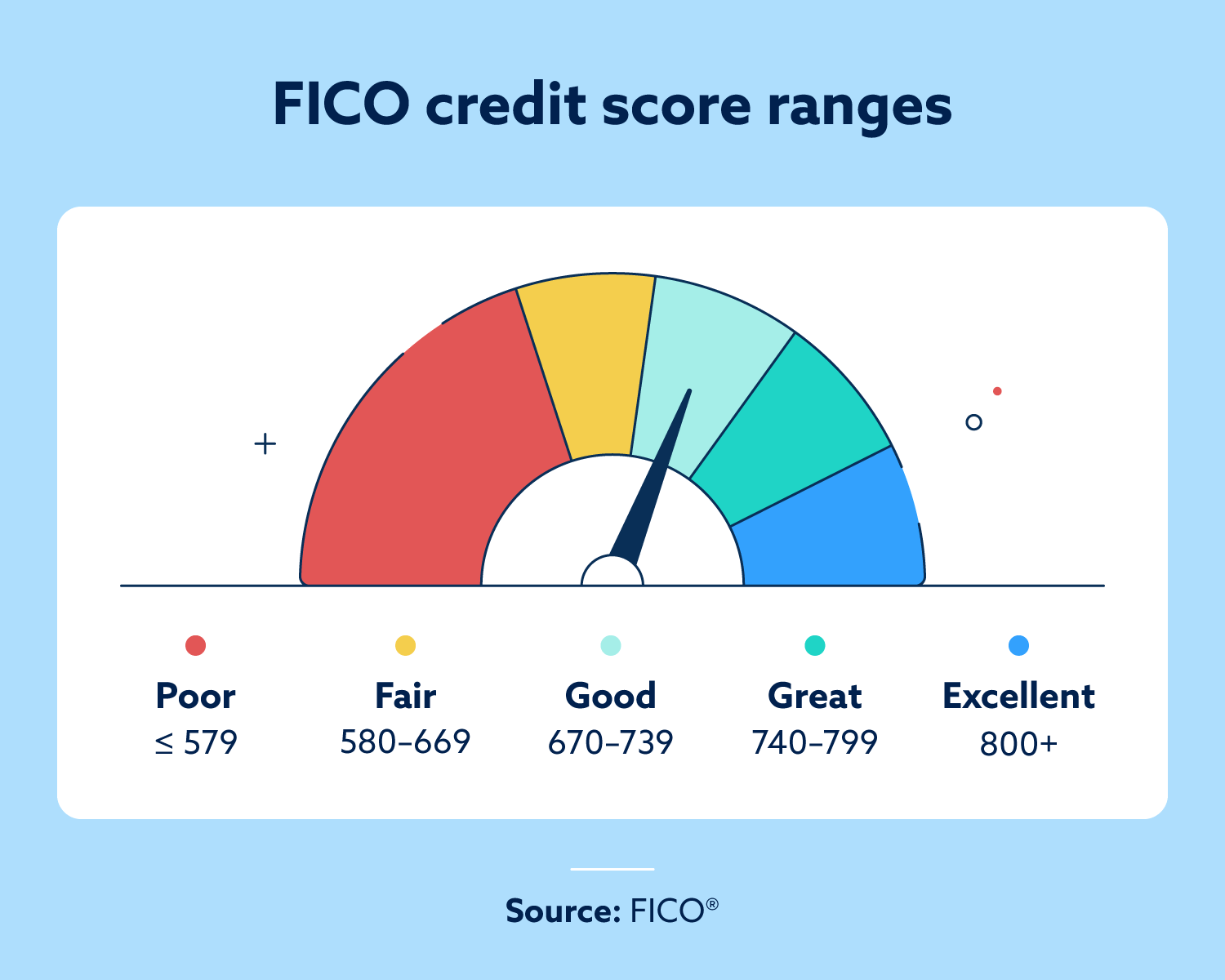

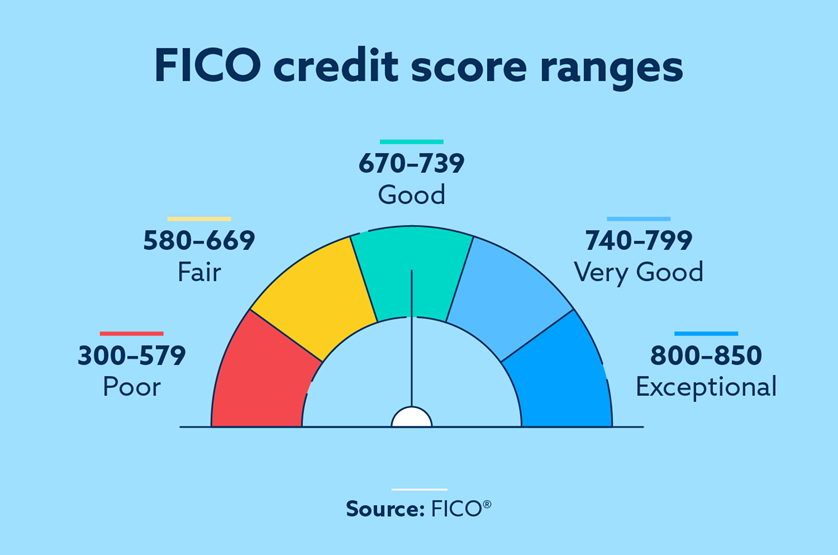

FICO scores are a cornerstone of the lending industry, impacting everything from mortgage rates to credit card approvals.

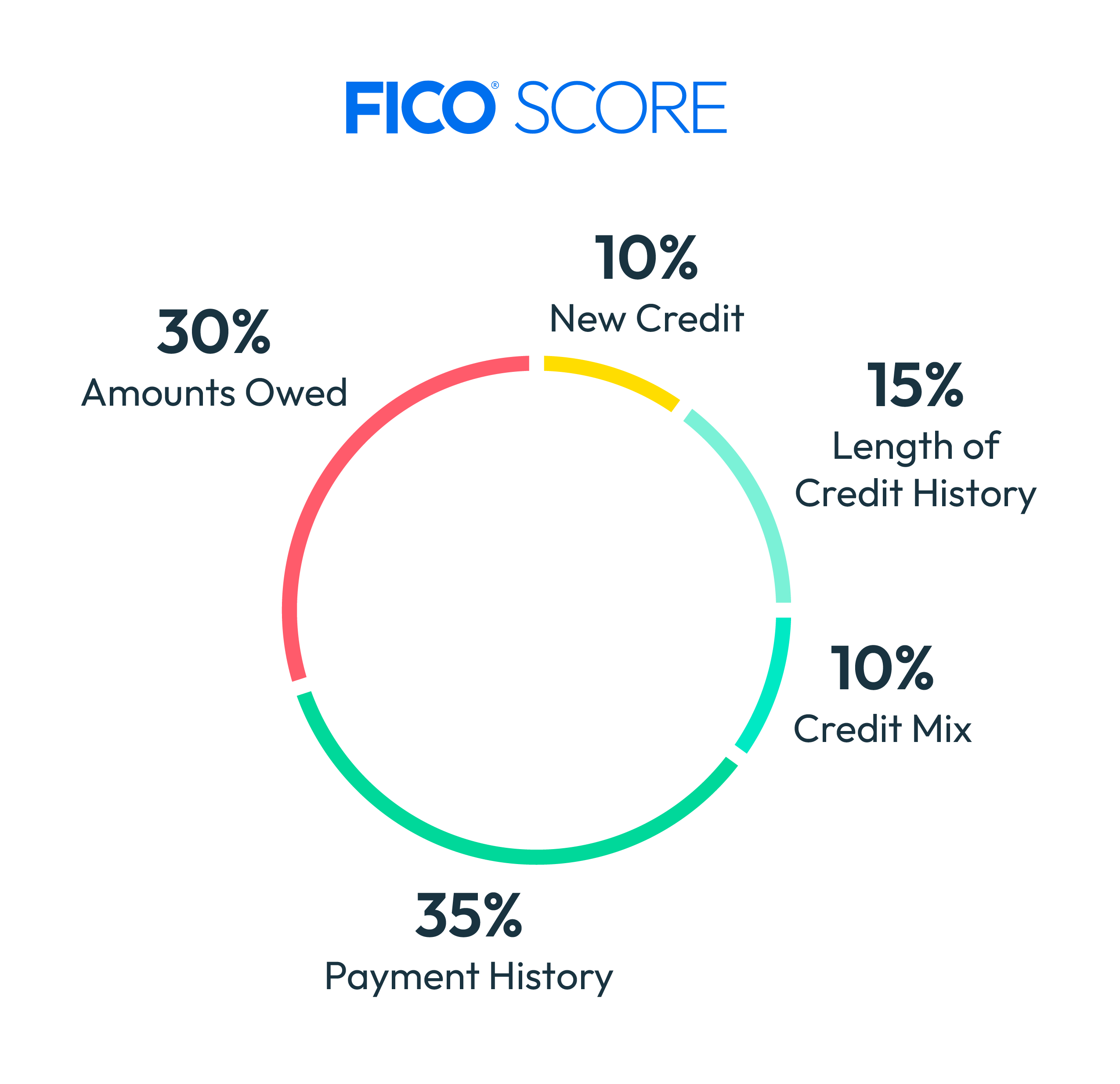

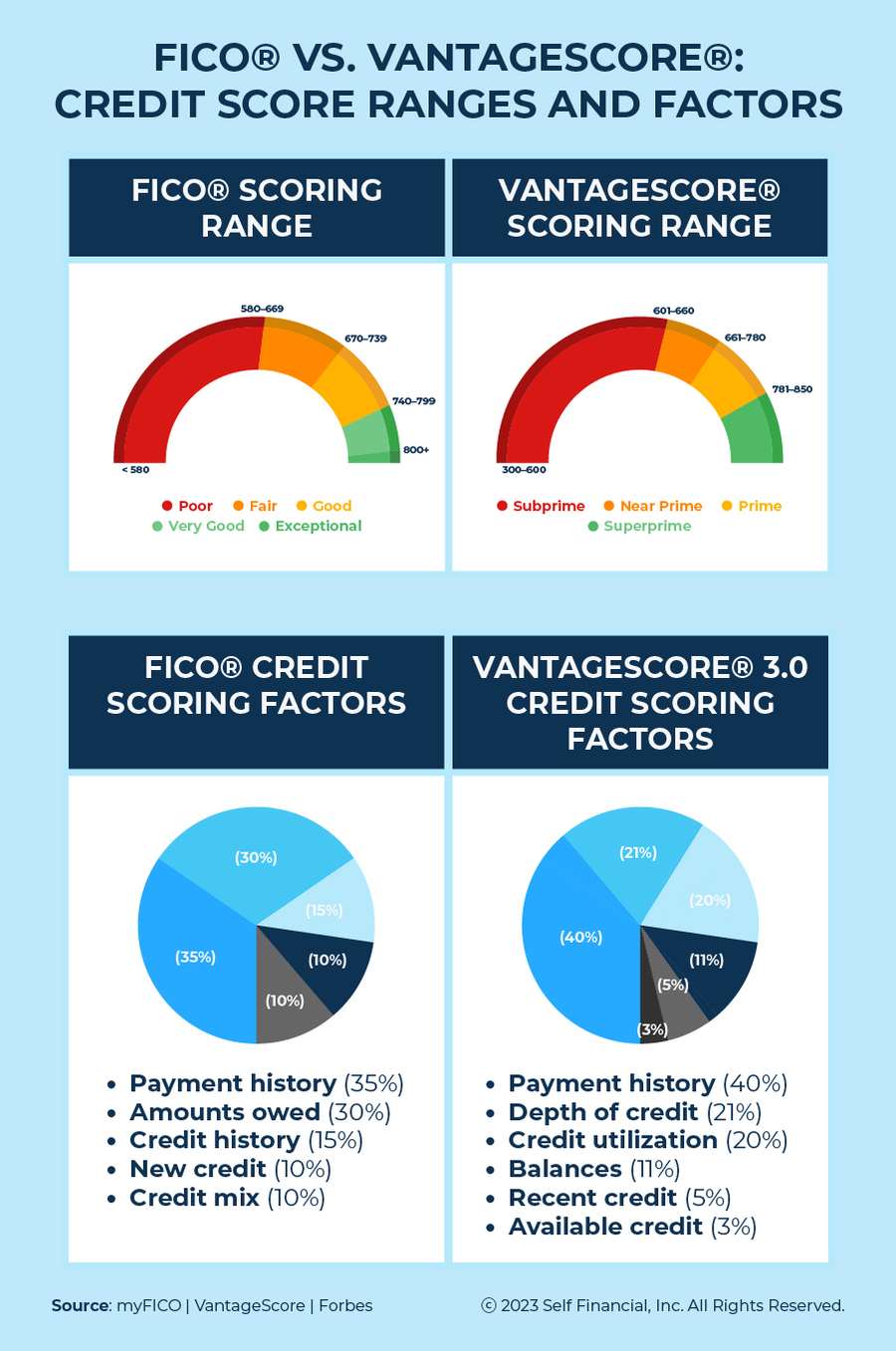

Different versions of FICO scores exist, each with its own algorithm and data weighting.

However, not all versions are actively used or considered valid by lenders, creating a potential for misinterpretation and financial harm.

The Critical Question: Which Scores Matter?

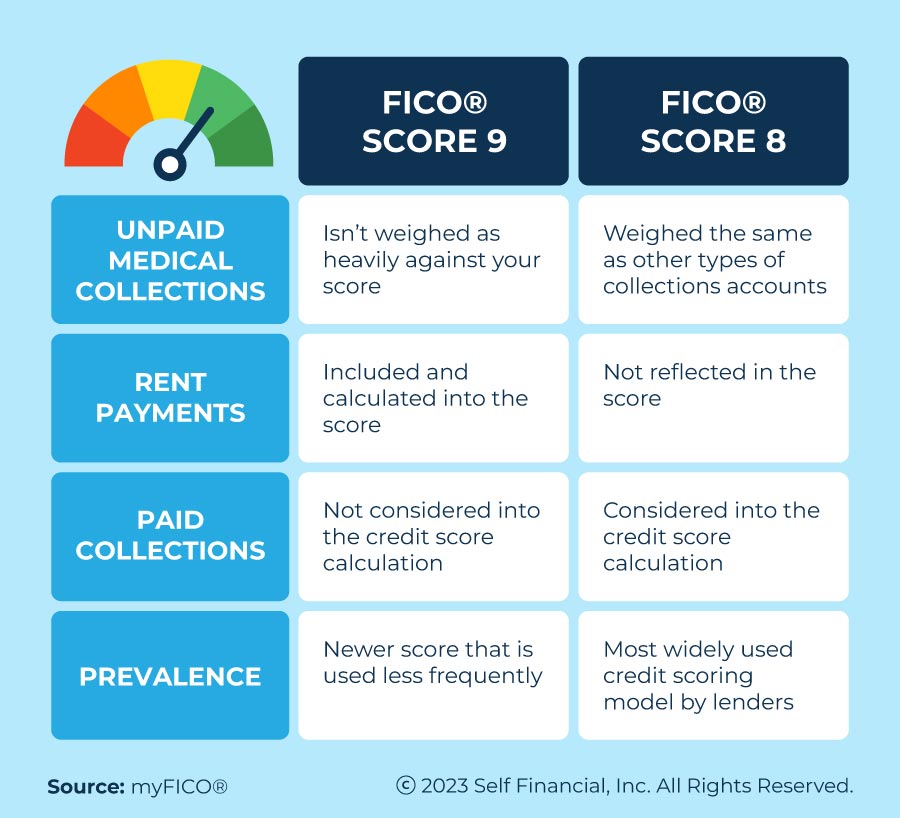

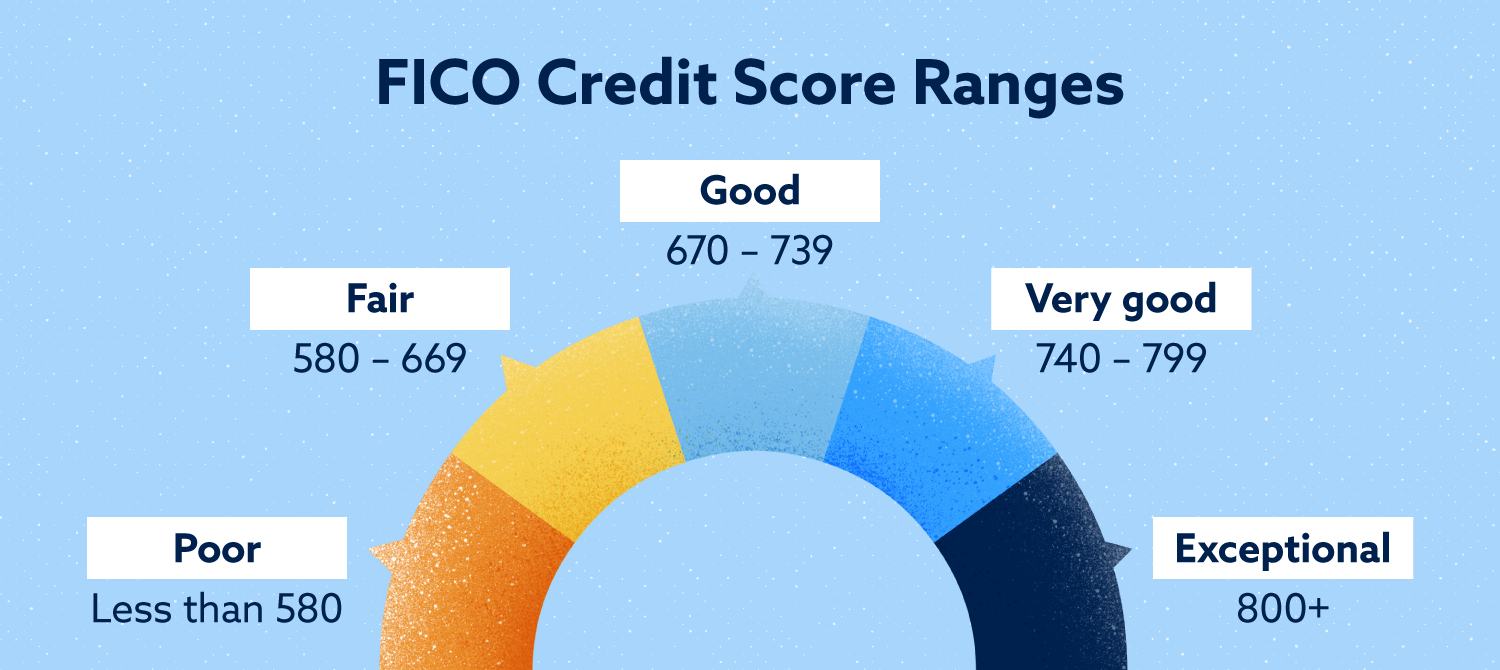

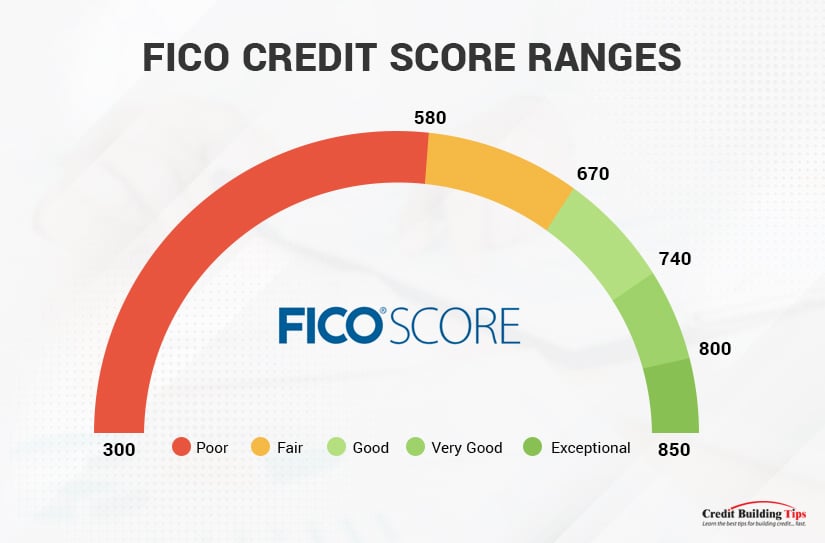

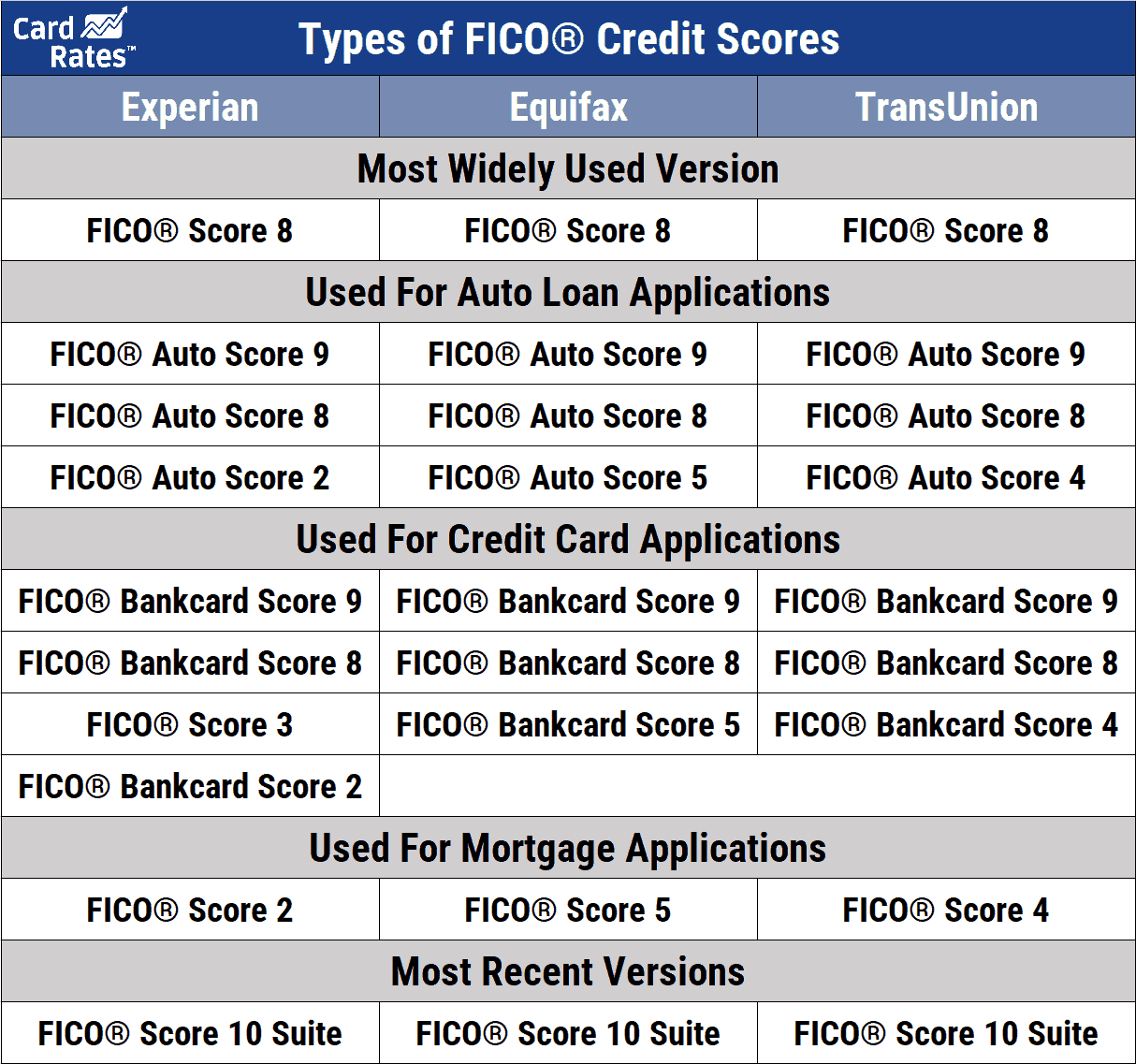

The most commonly used FICO scores are the FICO Score 8, FICO Score 9, and various industry-specific scores (e.g., FICO Auto Score, FICO Bankcard Score).

Older versions, like FICO Score 2, 4, and 5, are generally considered outdated and less relevant by many lenders.

Consumers accessing these outdated scores might be getting an inaccurate picture of their creditworthiness.

The Danger of Relying on Invalid FICO Scores

Using an invalid FICO score can lead to several problems.

First, it can result in a misjudgment of your borrowing power.

Second, it might prompt unnecessary applications for credit lines you're unlikely to secure, potentially damaging your credit report further.

Identifying Valid vs. Invalid FICO Score Versions

The key is to understand which FICO score your lender or credit monitoring service uses.

Contact your lender directly to confirm the specific FICO score version they utilize for credit decisions.

Reputable credit monitoring services should clearly state the FICO score version they provide.

Where Are Consumers Getting These Scores?

Some free credit score services and older platforms may still provide outdated FICO scores.

These services might not explicitly state that the scores are obsolete, misleading consumers.

It's crucial to verify the source and validity of any credit score you receive.

The Role of Credit Bureaus

Credit bureaus (Equifax, Experian, TransUnion) are responsible for maintaining your credit data.

They license FICO scores to lenders and other businesses.

Consumers should check their credit reports regularly for accuracy, regardless of the FICO score version being used.

Expert Opinions: Weighing in on the Issue

Financial analysts are urging consumers to prioritize obtaining FICO scores from reliable sources.

"Consumers need to be proactive in understanding which FICO score their lenders are using," says Jane Doe, a leading credit expert. "Relying on outdated versions can have serious financial consequences."

The Consumer Financial Protection Bureau (CFPB) also emphasizes the importance of informed credit decision-making.

What Action Should Consumers Take?

First, determine the FICO score version used by your lenders.

Second, compare scores from multiple sources, noting the version provided.

Third, if you suspect you're relying on an invalid score, seek a credit report from AnnualCreditReport.com and dispute any inaccuracies.

The Ongoing Development

The financial industry is constantly evolving, with newer FICO score versions being developed and adopted.

Stay informed about the latest changes and updates to FICO scoring models.

We will continue to monitor this situation and provide updates as they become available.

+Score.jpg)