Which One Of The Following Is A Capital Budgeting Decision

Imagine yourself as the captain of a ship, the Enterprise Inc., charting a course through the vast ocean of business opportunities. The wind whispers of expansion, promising new horizons, but the waves of uncertainty crash against the bow. Do you invest in a new, state-of-the-art vessel? Or perhaps modernize the existing one? These aren’t everyday operational choices; they are weighty decisions that will determine the long-term fate of your company, akin to navigating treacherous waters with only the most crucial maps and instruments.

At the heart of it all lies the crucial business question: Which one of the following is a capital budgeting decision? This article aims to navigate the complexities of capital budgeting, illuminating what defines such a decision and why it's so vital for the future of any organization.

To understand capital budgeting, we first need to define what it is. Capital budgeting involves the process a company uses for decision making on capital projects – those projects with a life of a year or more. These are typically large, significant investments, like purchasing new equipment, launching a new product, or expanding into a new market.

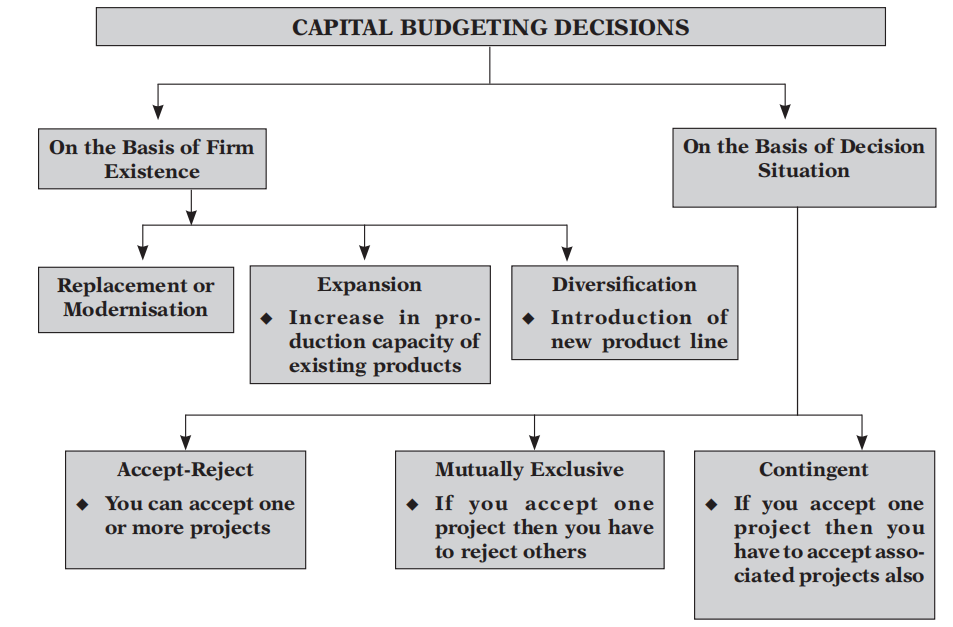

What Constitutes a Capital Budgeting Decision?

A capital budgeting decision is fundamentally about allocating resources to long-term assets or projects. These decisions are strategic and can significantly impact a company's profitability, growth, and overall value. To clarify, we'll examine the key characteristics that distinguish a capital budgeting decision from other financial choices.

Long-Term Impact

Capital budgeting decisions have a lasting effect. They are not simply about day-to-day operations or short-term gains. Rather, they shape the direction and capabilities of the organization for years to come. Think of them as planting a tree – the benefits are not immediate but grow over time.

Investing in a new manufacturing plant, for example, is a capital budgeting decision because the plant will be used for many years, influencing the company's production capacity and efficiency. This is unlike paying monthly rent, which is an operational expense.

Significant Investment

Capital projects typically involve substantial sums of money. The sheer scale of the investment requires careful analysis and planning. A wrong decision can lead to significant financial losses, while a correct one can generate substantial returns.

Consider a tech company deciding whether to invest in a new research and development (R&D) program. The program may require millions of dollars in funding and span several years. A decision of this magnitude clearly falls under capital budgeting.

Irreversible or Difficult to Reverse

Many capital budgeting decisions are difficult, if not impossible, to undo without incurring significant costs. Once a new factory is built or a major piece of equipment is purchased, it can be challenging to recover the invested capital if the project doesn't perform as expected. This characteristic underscores the need for rigorous evaluation and planning before committing to a capital project.

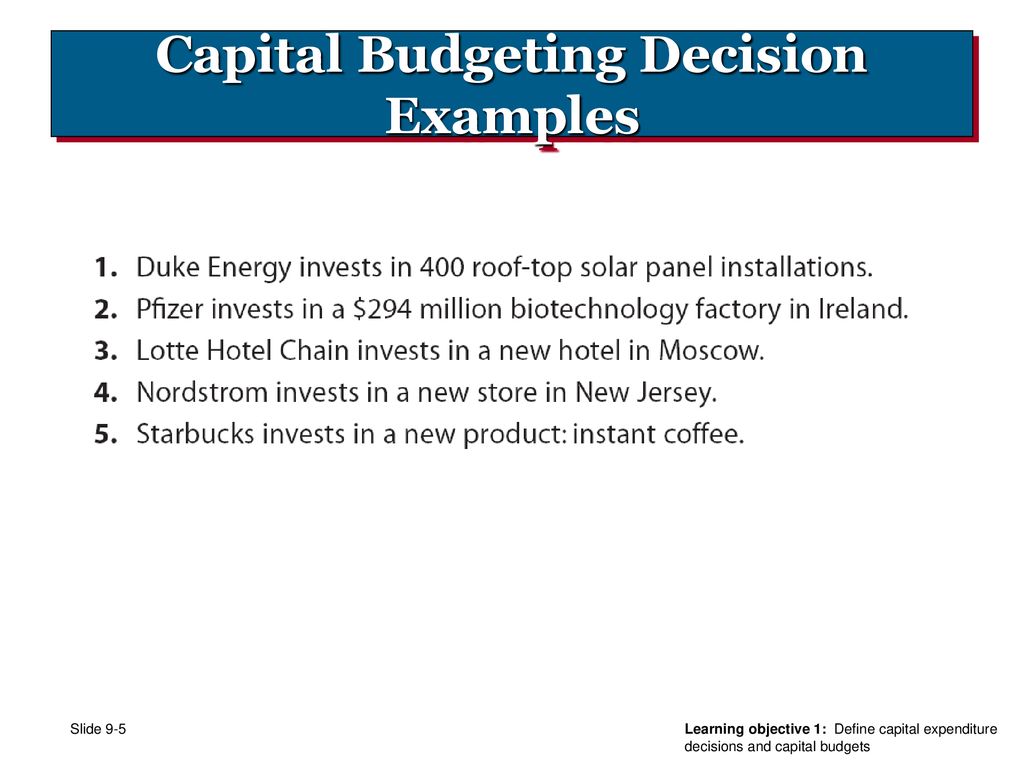

Examples of Capital Budgeting Decisions

To further illustrate what constitutes a capital budgeting decision, here are some specific examples:

- Acquiring a new business: Purchasing another company involves a large capital outlay and is expected to generate returns over many years.

- Developing a new product line: Investing in the research, development, and launch of a new product is a long-term project that requires significant resources.

- Expanding into a new geographical market: Opening operations in a new country or region involves substantial investment in infrastructure, marketing, and personnel.

- Replacing old equipment: Upgrading outdated machinery with more efficient models can improve productivity and reduce costs over time.

- Investing in a major IT upgrade: Implementing a new enterprise resource planning (ERP) system or cloud infrastructure requires a significant upfront investment.

Distinguishing Capital Budgeting from Operational Decisions

It’s crucial to distinguish capital budgeting from routine operational decisions. Operational decisions are typically short-term, involve smaller amounts of money, and are easily reversible. Here's a comparison:

Capital Budgeting Decisions: Long-term impact, significant investment, difficult to reverse, strategic in nature. Operational Decisions: Short-term impact, smaller investment, easily reversible, tactical in nature.

Examples of operational decisions include purchasing office supplies, paying salaries, and running marketing campaigns. While these decisions are important for the day-to-day functioning of a business, they do not fall under the purview of capital budgeting.

Why is Capital Budgeting Important?

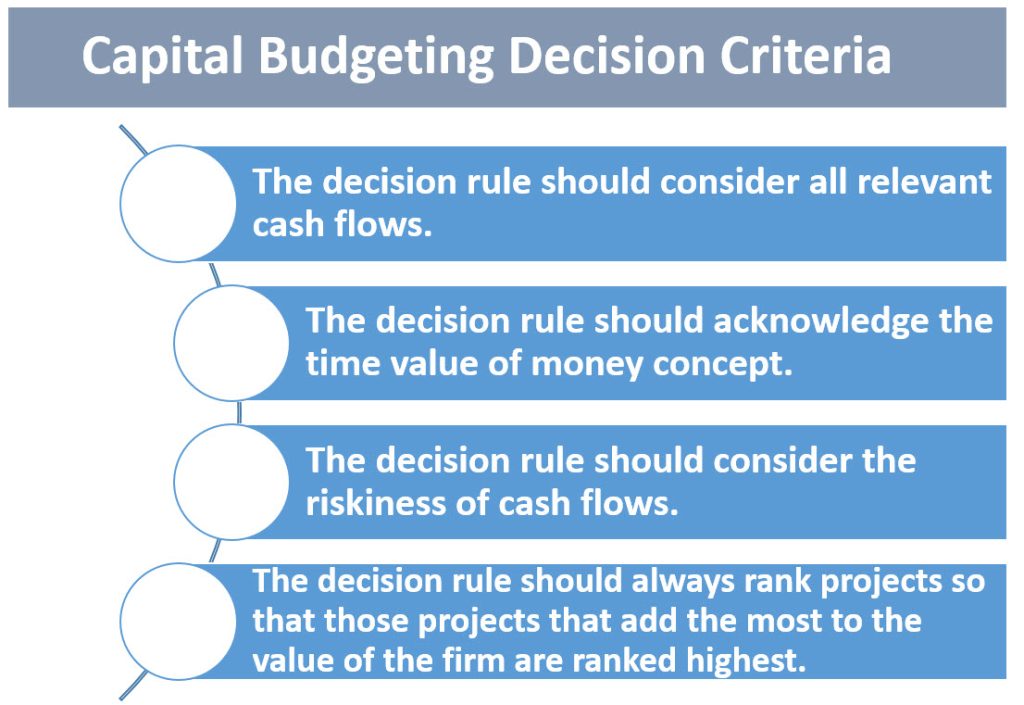

Capital budgeting is vital for several reasons. It helps companies allocate resources efficiently, choose the most profitable projects, and create long-term value. Sound capital budgeting practices are essential for the long-term health and success of any organization.

Effective capital budgeting enhances a company's competitiveness. By carefully evaluating and selecting projects, companies can invest in technologies, products, and markets that will give them a competitive edge.

Capital budgeting is crucial for managing risk. A thorough analysis of potential projects helps companies identify and mitigate risks. By considering various scenarios and conducting sensitivity analyses, companies can make more informed decisions and avoid costly mistakes.

Methods Used in Capital Budgeting

Several methods are used to evaluate capital budgeting projects. Each method has its strengths and weaknesses. The most common techniques include:

- Net Present Value (NPV): Calculates the present value of expected cash flows, minus the initial investment. A positive NPV indicates that the project is expected to be profitable.

- Internal Rate of Return (IRR): Determines the discount rate at which the NPV of a project equals zero. A project is generally accepted if its IRR exceeds the company's required rate of return.

- Payback Period: Measures the time it takes for a project to recover its initial investment. While simple to calculate, it doesn't consider the time value of money.

- Discounted Payback Period: A variation of the payback period that takes into account the time value of money.

Choosing the right method or combination of methods depends on the specific project and the company's objectives. A comprehensive approach that considers multiple factors is often the most effective.

The Human Element in Capital Budgeting

While financial analysis and quantitative data are crucial in capital budgeting, the human element should not be overlooked. The experience and judgment of managers, engineers, and other experts play a vital role in identifying and evaluating potential projects. Human insight can enhance the objectivity of models and add nuance to decision making.

“Capital isn’t so important in business. Experience isn’t so important. You can get both these things. What is vital is ideas.” - Tom Peters

A collaborative environment where diverse perspectives are valued can lead to better decisions. Encouraging open communication and constructive debate can help identify potential pitfalls and uncover innovative solutions.

The Ever-Evolving Landscape of Capital Budgeting

Capital budgeting is not a static process. It is constantly evolving to adapt to changes in technology, markets, and the overall business environment. Staying abreast of new developments and best practices is essential for making sound investment decisions.

With the rise of sustainability and social responsibility, companies are increasingly considering environmental, social, and governance (ESG) factors in their capital budgeting decisions. Projects that promote sustainability and contribute to society are gaining prominence.

Conclusion

So, going back to our initial question: Which one of the following is a capital budgeting decision? It's the one that charts a long-term course, demanding a significant investment and potentially reshaping the destiny of the Enterprise Inc. It’s the one that requires careful consideration, meticulous analysis, and a bold vision for the future. A well-thought-out capital budgeting decision empowers businesses to navigate the unpredictable waters of the market, reach new heights, and ensure that their legacy endures.