Which One Of The Following Is A Source Of Cash

Businesses face a critical question daily: Where will the cash come from? Identifying reliable sources of cash is paramount for survival and growth, especially in today's volatile economic climate.

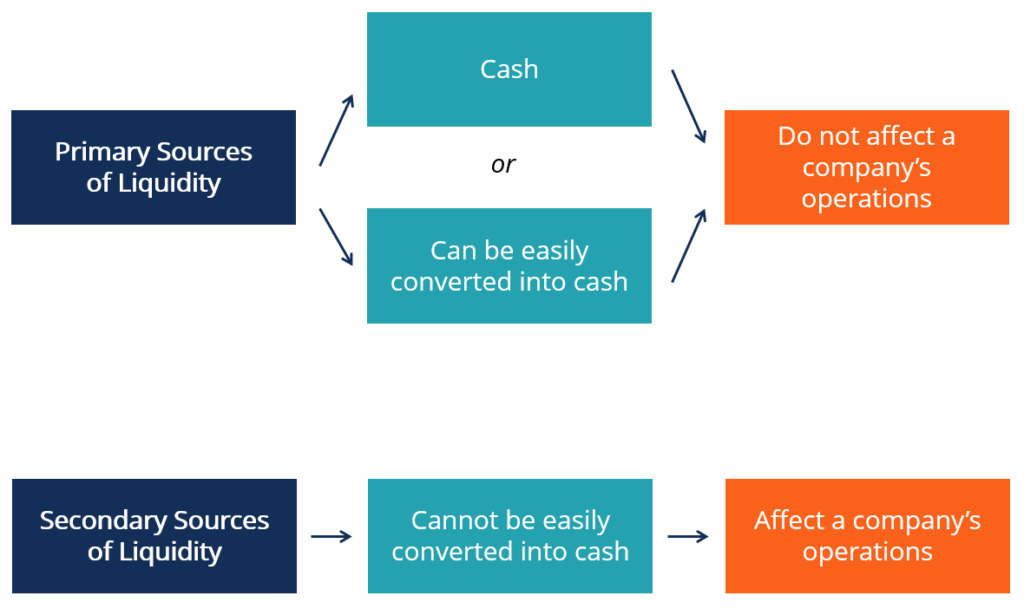

The immediate need to understand cash flow stems from the basic operational imperative. A healthy business needs cash to meet short-term obligations and to invest in long-term opportunities.

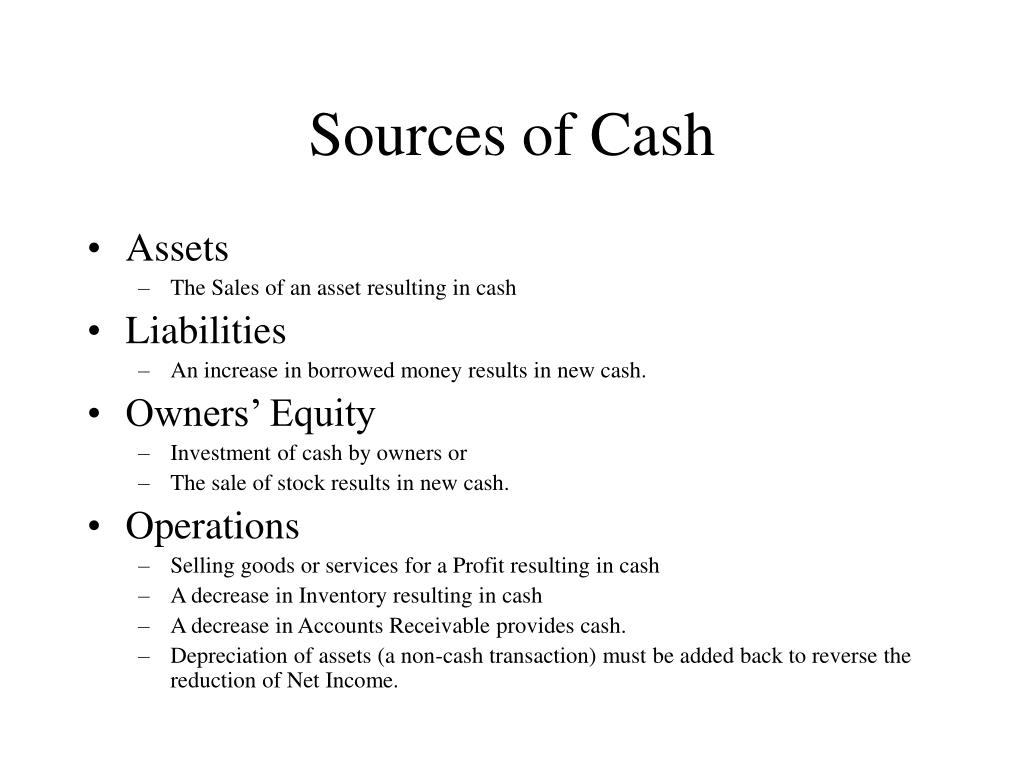

Understanding Sources of Cash

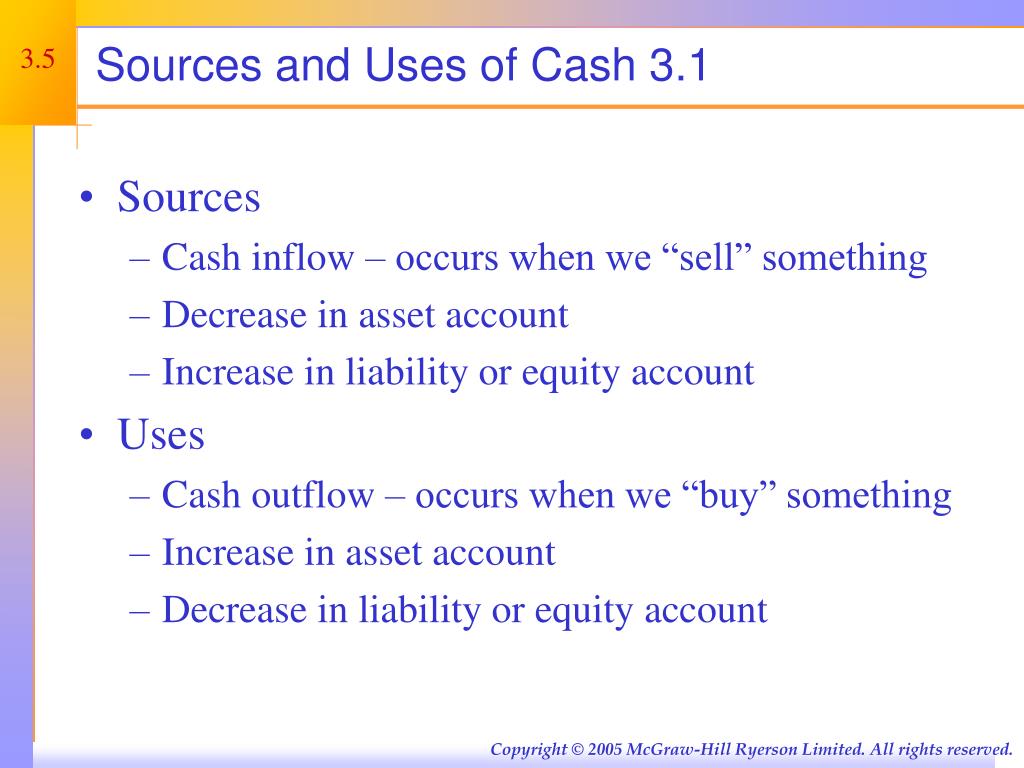

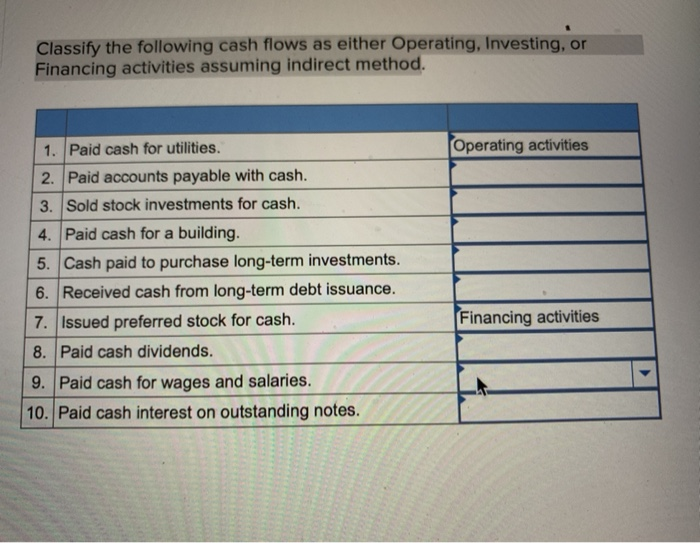

The primary sources of cash for most businesses fall into a few distinct categories. These include operational activities, investment activities, and financing activities.

Operational Activities: The Heart of Cash Flow

Cash generated from the normal day-to-day running of a business is crucial. This is the most sustainable source of cash and reflects a company’s core profitability.

Sales revenue is the most common and fundamental source of cash. It reflects the direct exchange of goods or services for payment.

Collecting receivables efficiently is crucial. Managing accounts receivable to minimize the time between sale and cash collection significantly boosts available funds.

Reducing inventory levels can also free up cash tied up in stock. Optimized inventory management allows companies to avoid holding excessive goods, freeing up capital.

Investment Activities: Managing Assets

Investment activities can both consume and generate cash. Selling assets is a direct way to inject cash into the business.

This could involve selling equipment, property, or even subsidiaries. Such sales convert long-term assets into immediate cash resources.

Divesting non-core assets is a strategic decision to streamline operations and raise capital. Focus on core business areas is paramount.

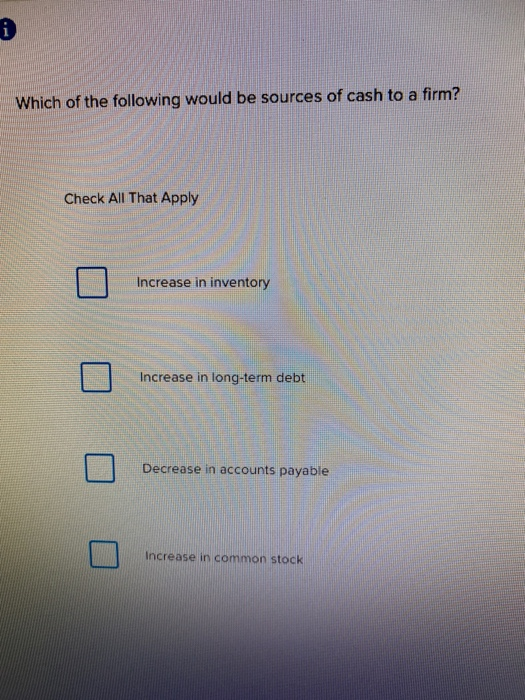

Financing Activities: External Funding

Financing activities involve raising cash from external sources. This includes borrowing money and issuing equity.

Taking out loans is a common method to secure funds, but it comes with repayment obligations. Interest payments impact future cash flow.

Issuing stock or equity can provide a significant cash infusion without debt obligations. However, this dilutes ownership.

Another cash source includes government grants. Many governments offer financial incentives to encourage certain business activities.

Which One is Always a Source of Cash?

Based on the categories discussed, the most consistently reliable source of cash is sales revenue. It is the lifeblood of any operating business.

While other sources like asset sales and financing can provide significant cash injections, they are not consistently available or desirable.

Businesses must strive to maximize sales revenue and manage operational cash flow efficiently. Without consistent sales, long-term survival is threatened.

Real-World Examples

Tech giant Apple consistently generates massive cash flow from its iPhone and service sales. This allows for research and development and strategic acquisitions.

Retail giant Walmart focuses on high sales volumes and efficient inventory management to maintain strong cash flow. They pass savings on to customers.

Small businesses can learn from these examples by focusing on generating sales and managing receivables effectively. Efficient operations are vital.

The Dangers of Cash Flow Problems

Insufficient cash flow can quickly lead to business failure. Inability to meet payroll and supplier obligations leads to shutdowns.

Companies facing cash shortages might need to delay payments, cut costs, or even declare bankruptcy. Early identification of cash flow issues is critical.

Proactive cash flow management is essential for long-term sustainability and growth. Businesses must understand their inflows and outflows.

Next Steps: Monitoring and Managing Cash Flow

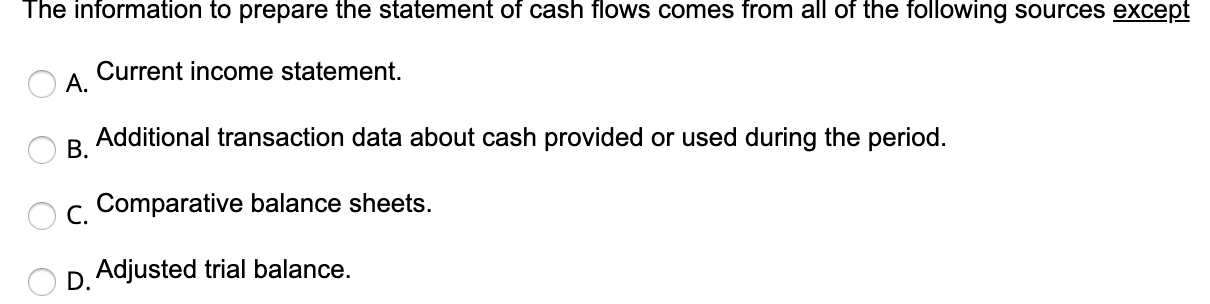

Businesses should implement robust cash flow forecasting and monitoring systems. Regularly review financial statements and adjust strategies accordingly.

Explore options for improving cash flow, such as negotiating better payment terms with suppliers. This could greatly help your business.

Seek professional advice from accountants or financial advisors to optimize cash management strategies. Sound financial counsel is invaluable.