Which Are Attributes Of A Conventional Corporation

A conventional corporation, the backbone of much of the global economy, operates with specific defining characteristics. These attributes dictate its structure, legal standing, and operational procedures, impacting everything from taxation to liability.

Understanding these core features is crucial for anyone involved in business, investment, or regulatory oversight. This article breaks down the essential attributes that define a conventional corporation.

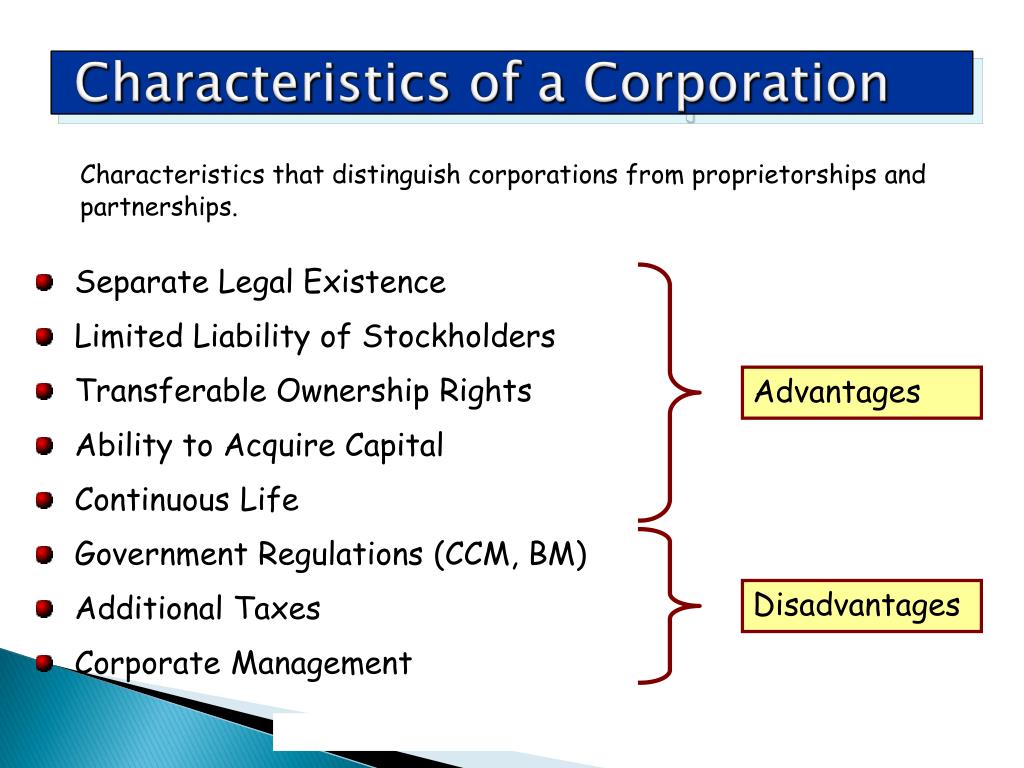

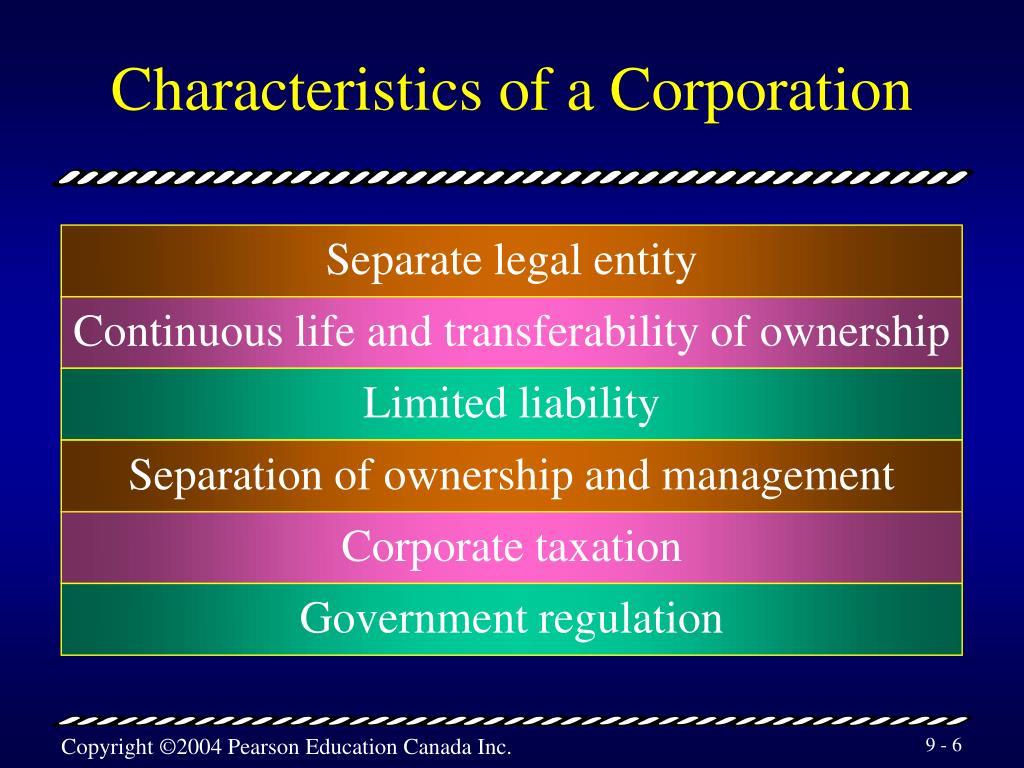

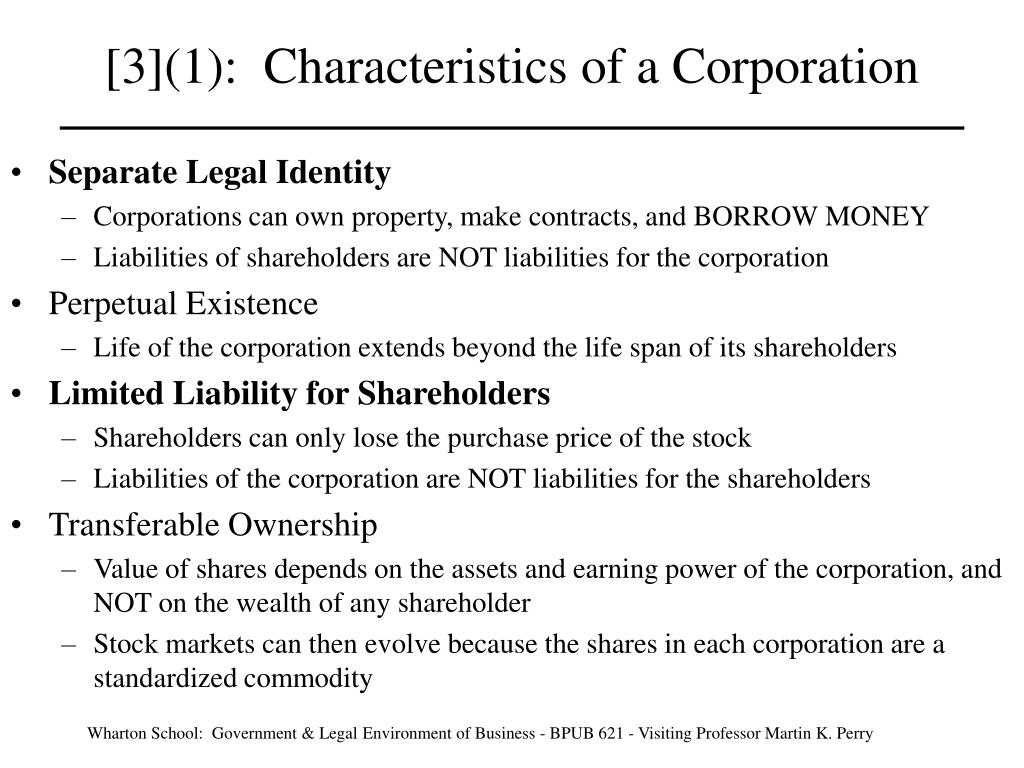

Separate Legal Entity

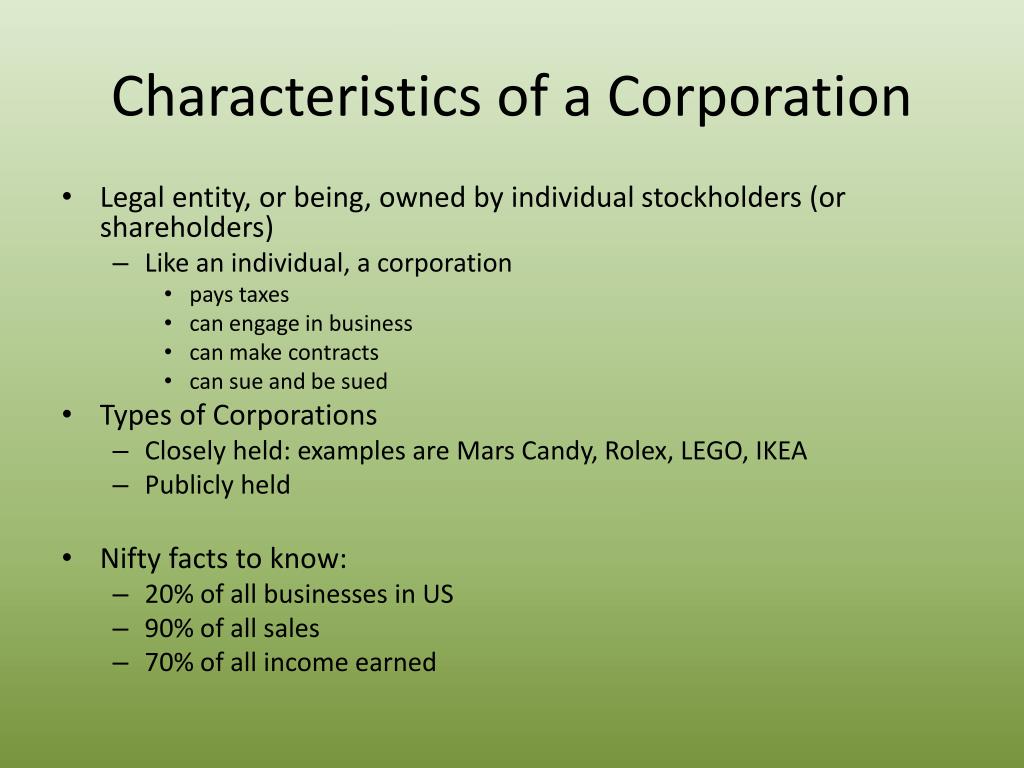

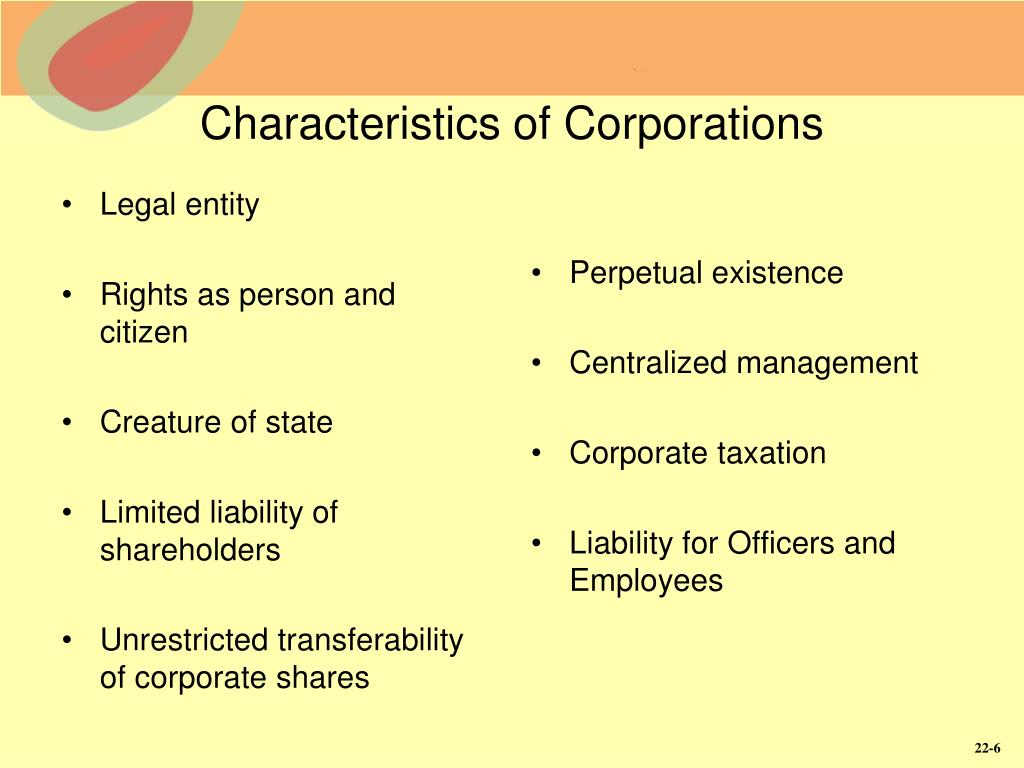

The defining feature of a conventional corporation, often called a C-corp, is its status as a separate legal entity. This means the corporation is legally distinct from its owners, the shareholders.

It can own property, enter into contracts, sue, and be sued in its own name, independent of the shareholders' personal assets. This separation shields shareholders from personal liability for the corporation's debts and obligations.

Limited Liability

Linked directly to its separate legal entity status is the principle of limited liability. Shareholders are generally only liable up to the amount of their investment in the corporation's stock.

Personal assets are protected from corporate creditors. However, it is important to note that there may be exceptions to this protection, such as piercing the corporate veil in cases of fraud or gross negligence.

Centralized Management

Corporate management is typically centralized in a hierarchical structure. Shareholders elect a board of directors who are responsible for overseeing the corporation's overall strategy and direction.

The board then appoints officers, such as the CEO, CFO, and COO, to manage the day-to-day operations. This centralized structure allows for efficient decision-making and accountability.

Free Transferability of Shares

Shares of stock in a conventional corporation are generally freely transferable. Shareholders can sell or transfer their shares to others without requiring the consent of the corporation or other shareholders.

This allows for liquidity in the ownership structure and facilitates investment in the corporation. However, restrictions on transferability can be included in shareholder agreements, particularly in smaller, closely held corporations.

Perpetual Existence

A corporation has the potential for perpetual existence. Unlike sole proprietorships or partnerships, a corporation's existence is not tied to the lives or actions of its shareholders or officers.

The corporation continues to exist even if shareholders sell their shares or officers retire or resign. This longevity provides stability and allows the corporation to pursue long-term goals and investments.

Double Taxation

A significant disadvantage of a conventional corporation is its exposure to double taxation. The corporation's profits are taxed at the corporate level, and then any dividends distributed to shareholders are taxed again at the individual level.

This double taxation can significantly reduce the after-tax returns for shareholders. Strategies exist to mitigate double taxation, such as retaining earnings within the corporation or compensating officers through salaries rather than dividends.

Ease of Raising Capital

Corporations find it easier to raise capital compared to other business structures. They can issue and sell stock to the public or private investors, allowing them to raise substantial sums of money.

They can also issue bonds and other debt instruments to finance operations and expansion. This access to capital is a key advantage that enables corporations to grow and compete effectively.

Formalities and Compliance

Operating as a corporation involves significant formalities and compliance requirements. Corporations must adhere to strict corporate laws and regulations at both the state and federal levels.

This includes maintaining corporate records, holding annual meetings, filing annual reports, and complying with securities laws if publicly traded. Compliance can be costly and time-consuming but is essential to maintaining the corporation's legal standing.

Board of Directors Responsibilities

The Board of Directors plays a pivotal role in corporate governance. They have a fiduciary duty to act in the best interests of the corporation and its shareholders.

This duty includes overseeing the corporation's strategy, monitoring management performance, and ensuring compliance with laws and regulations. Breaches of fiduciary duty can lead to legal action against directors.

Ongoing Developments

The legal and regulatory landscape for corporations is constantly evolving. Recent developments include increased scrutiny of corporate governance practices, environmental, social, and governance (ESG) considerations, and the impact of technology on corporate operations.