How Does Interest Capitalization Affect A Loan

For borrowers navigating the complex world of loans, understanding the intricacies of interest capitalization can be crucial to managing debt effectively. This financial mechanism, often lurking in the fine print of loan agreements, can significantly impact the total cost of borrowing and the repayment timeline.

This article will explore what interest capitalization is, how it works, and its potential effects on different types of loans, particularly student loans, mortgages, and personal loans.

What is Interest Capitalization?

Interest capitalization is the process of adding unpaid accrued interest to the principal balance of a loan. In essence, it's interest earning interest, turning deferred debt into part of the loan's initial amount.

This means the borrower will now be paying interest on a larger sum than they originally borrowed, potentially increasing the overall cost of the loan.

How Does it Work?

Interest capitalization typically occurs during periods of deferment or forbearance, where borrowers are temporarily allowed to postpone loan payments. During these periods, interest usually continues to accrue, even though no payments are being made.

Once the deferment or forbearance period ends, the accumulated interest is added to the principal balance. From that point forward, the borrower will be paying interest on the original principal plus the capitalized interest.

Example Scenario

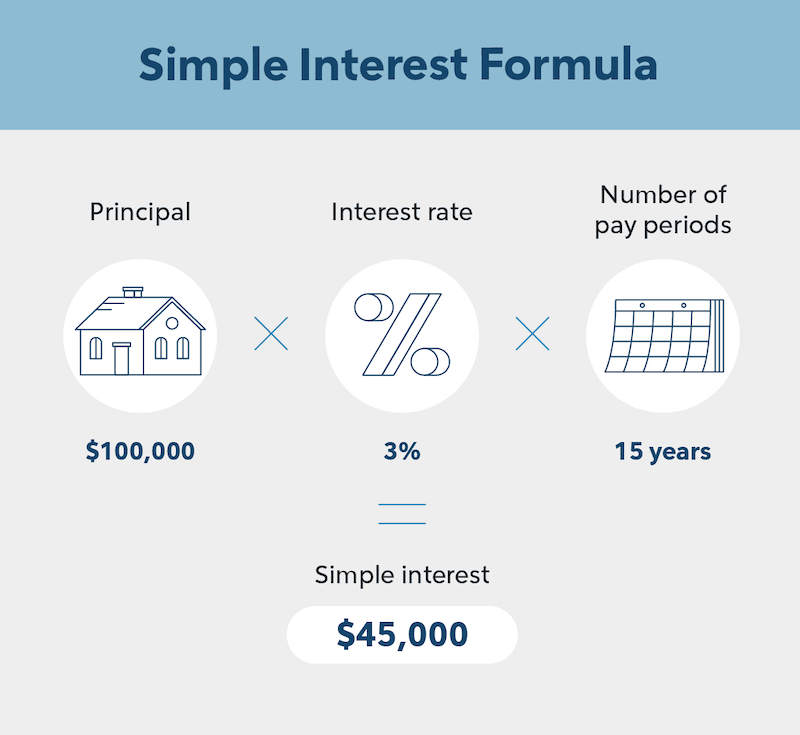

Imagine a borrower with a $10,000 loan at a 6% interest rate who enters a period of deferment. After a year of deferment, $600 in interest has accrued.

When the deferment ends, that $600 is capitalized, increasing the principal balance to $10,600. The borrower will now pay interest on $10,600 instead of $10,000.

Impact on Different Loan Types

The impact of interest capitalization can vary depending on the type of loan and its specific terms.

Student Loans

Student loans are a common area where interest capitalization can have a significant impact. Many student loan borrowers utilize deferment or forbearance during periods of unemployment, economic hardship, or while pursuing further education.

According to the U.S. Department of Education, capitalized interest can substantially increase the total amount borrowers owe on their student loans. This can lead to higher monthly payments and a longer repayment period.

Mortgages

While less common than with student loans, interest capitalization can occur in mortgages under specific circumstances, such as loan modifications or during periods of negative amortization.

Negative amortization happens when monthly payments are not sufficient to cover the accrued interest, resulting in the unpaid interest being added to the principal balance.

Personal Loans

Interest capitalization is less prevalent with personal loans, but it can occur if a borrower negotiates a deferment or forbearance with the lender. The specific terms of the loan agreement will dictate whether interest accrues and is capitalized during these periods.

Potential Consequences

The consequences of interest capitalization can be far-reaching for borrowers. The most immediate impact is an increase in the outstanding loan balance.

This leads to higher monthly payments, potentially straining the borrower's budget. Over the life of the loan, the borrower will end up paying significantly more in total interest charges.

The extended repayment period also means the borrower will be in debt for a longer time.

Avoiding or Minimizing Capitalization

While it's not always possible to completely avoid interest capitalization, there are strategies borrowers can employ to minimize its impact. The first step is to understand the loan terms and be aware of the conditions under which interest capitalization can occur.

If possible, borrowers should try to make at least interest-only payments during periods of deferment or forbearance to prevent the accrual of interest. If that is not viable, consider income-driven repayment plans offered by the Department of Education for eligible federal student loans, which may offer lower payments and even eventual loan forgiveness.

Careful financial planning and proactive communication with lenders can help borrowers navigate these complex situations and mitigate the negative effects of interest capitalization.

Conclusion

Interest capitalization is a critical aspect of loan management that borrowers need to understand. By understanding how this process works, borrowers can make informed decisions about managing their debt and potentially save a considerable amount of money over the life of their loans.

Staying informed about loan terms and proactively managing debt is crucial for ensuring long-term financial well-being.