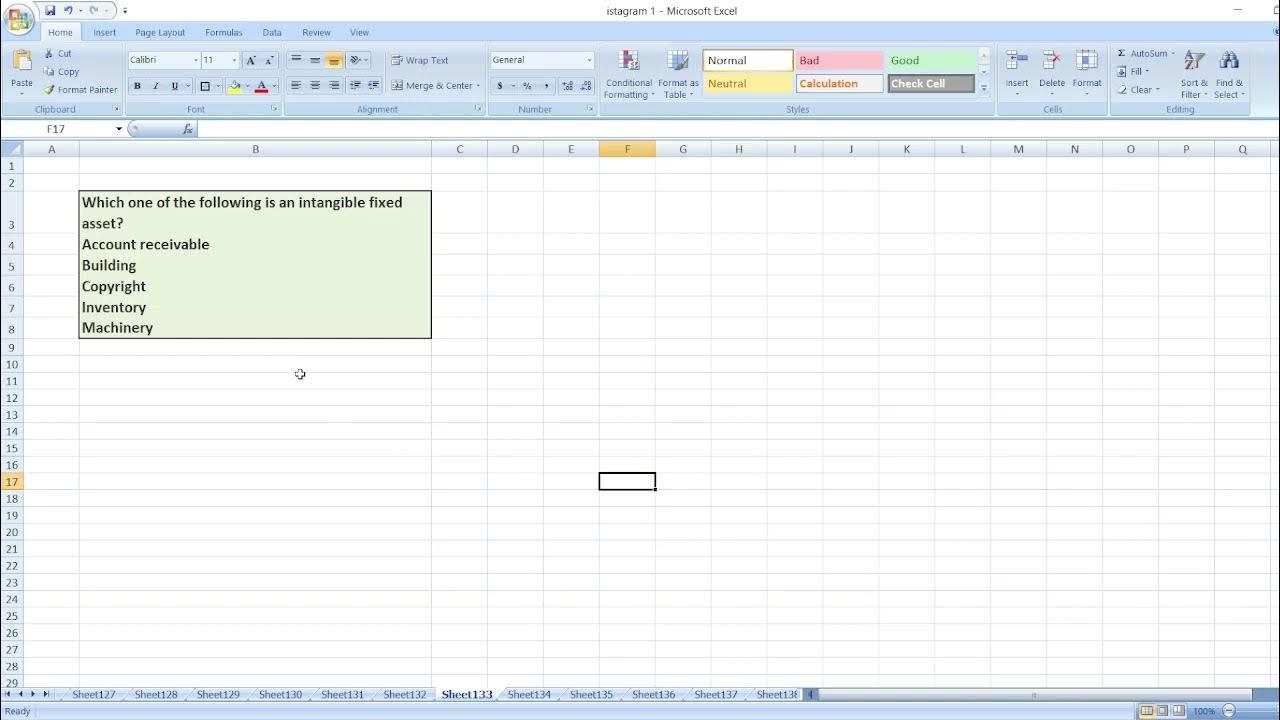

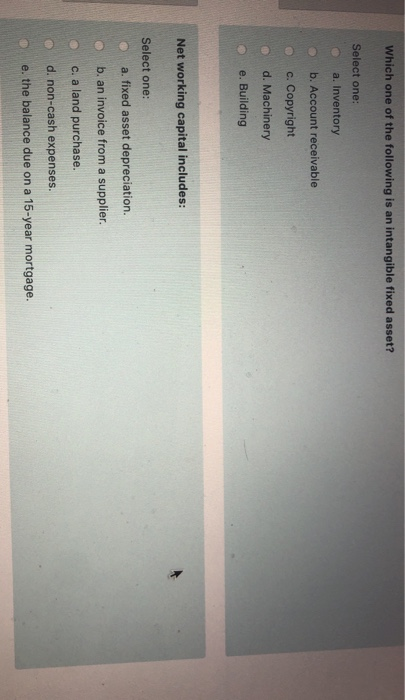

Which One Of The Following Is An Intangible Fixed Asset

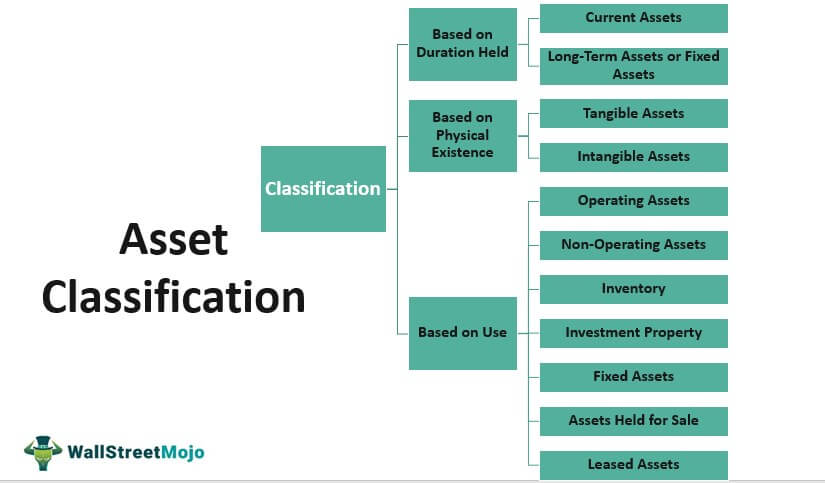

Urgent clarification is needed for businesses grappling with asset classification. Distinguishing between tangible and intangible fixed assets is crucial for accurate financial reporting and strategic decision-making.

This article swiftly identifies intangible fixed assets, providing businesses with essential knowledge for proper accounting and valuation. Understanding this distinction impacts balance sheets, investment strategies, and overall financial health.

Identifying Intangible Fixed Assets

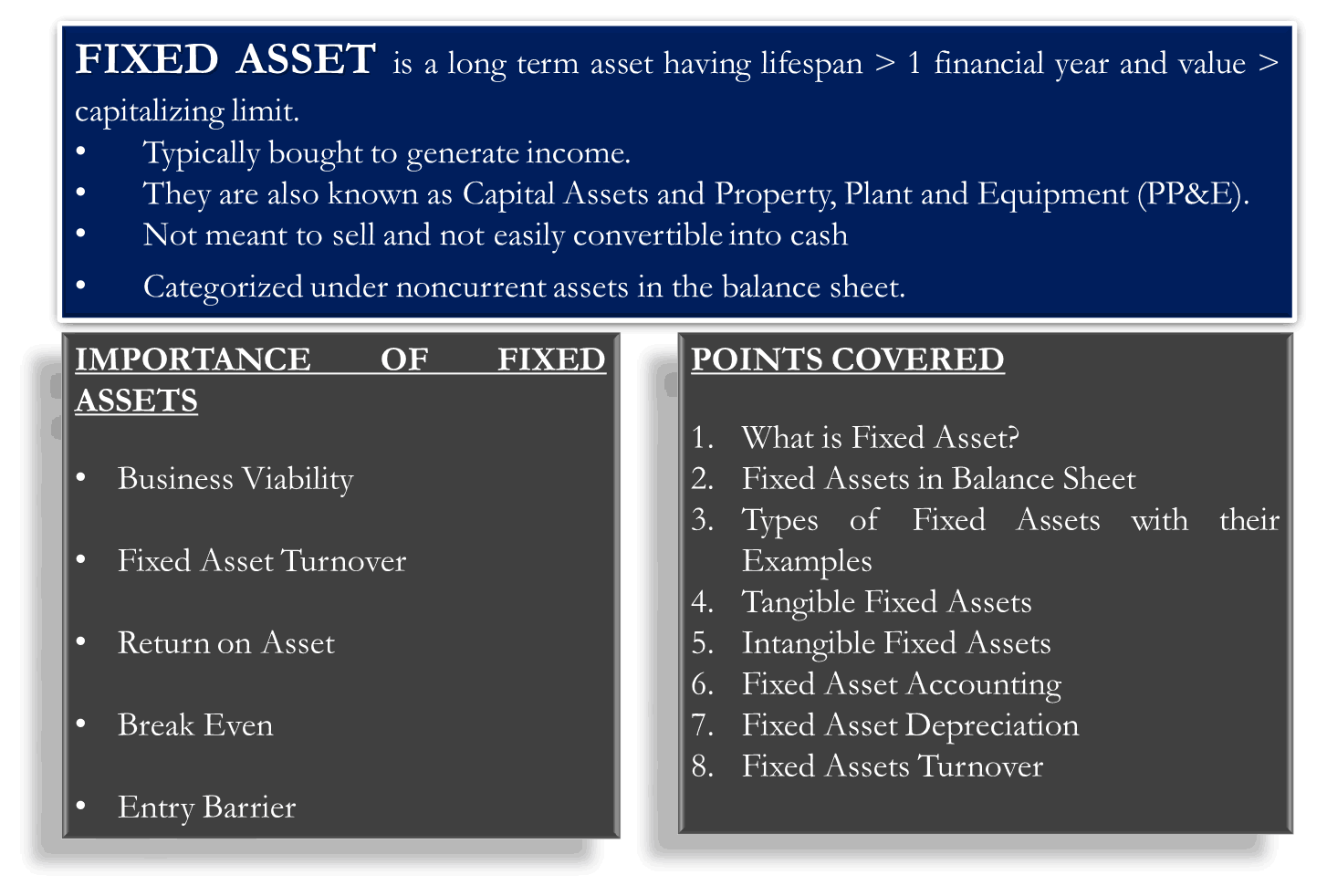

An intangible fixed asset is an asset that lacks physical substance but provides long-term economic benefits to a business. Unlike tangible assets like buildings or equipment, you can't touch or see an intangible asset.

Crucially, these assets are not held for sale in the ordinary course of business. They are held to generate revenue over multiple accounting periods.

Examples of Intangible Fixed Assets

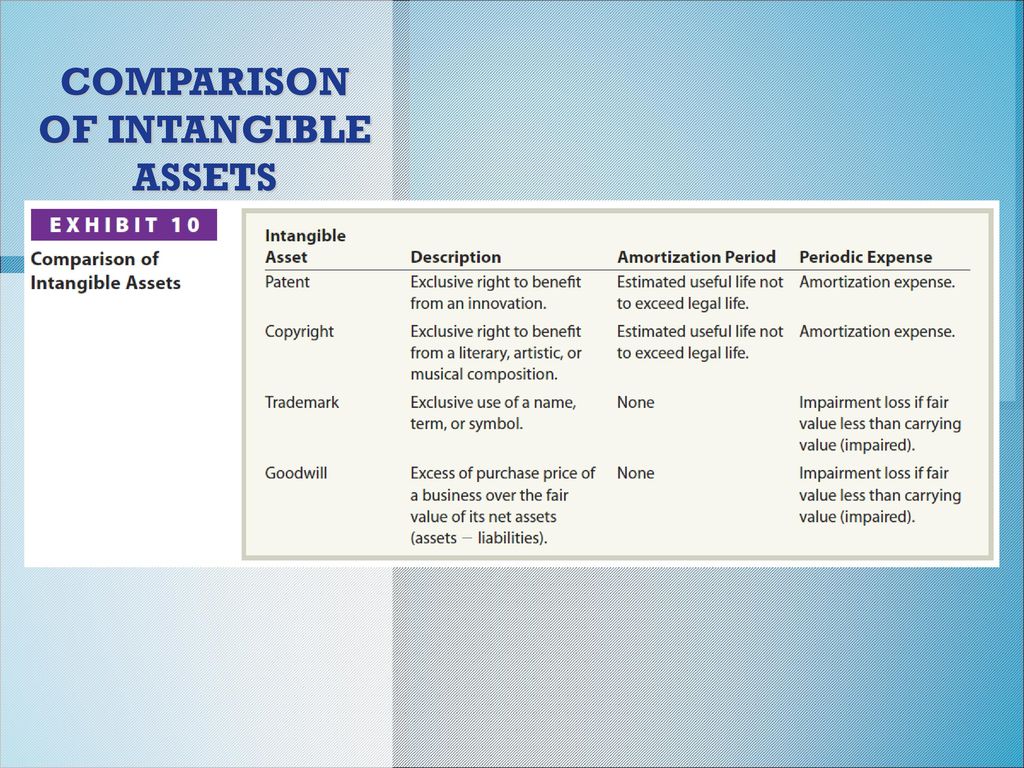

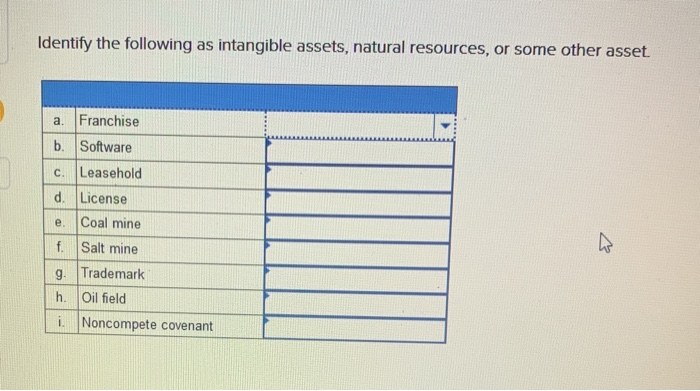

Several categories fall under the umbrella of intangible fixed assets. These include patents, trademarks, copyrights, and goodwill. Each plays a distinct role in a company's long-term value.

Patents grant exclusive rights to an invention for a specific period. This allows the patent holder to control its use and profit from its exploitation.

Trademarks are symbols, designs, or phrases legally registered to represent a company or product. They protect brand identity and prevent others from using similar marks.

Copyrights protect original works of authorship, such as books, music, and software. These rights grant the copyright holder exclusive control over the reproduction, distribution, and adaptation of the work.

Goodwill arises when a company acquires another business for a price exceeding the fair value of its identifiable net assets. It represents the intangible value associated with the acquired company's reputation, customer relationships, and other factors.

Distinguishing Intangible from Tangible Assets

The primary difference lies in physical existence. Tangible assets have a physical form that can be seen and touched, such as land, buildings, machinery, and equipment.

Intangible assets, conversely, lack physical substance. Their value derives from the rights and privileges they confer.

Consider land versus a patent. You can physically occupy and use land, making it tangible. A patent, while documented, only grants the right to exclude others from using an invention, a right you can't physically interact with.

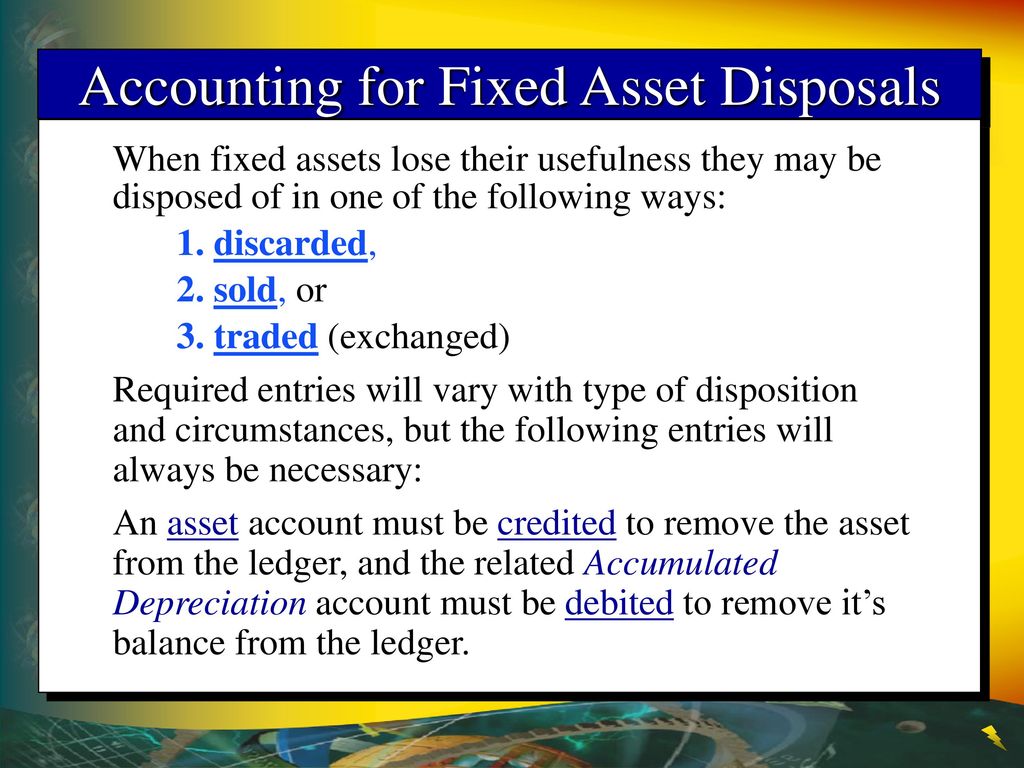

The Role of Amortization

Intangible assets with a definite useful life are subject to amortization. This is the systematic allocation of the asset's cost over its estimated useful life.

Amortization is similar to depreciation, which is used for tangible assets. Goodwill, however, is not amortized but is subject to impairment testing.

Impairment occurs when the carrying value of an asset exceeds its recoverable amount. If impairment is identified, the asset's value is written down, recognizing a loss in the financial statements.

The Impact on Financial Statements

Proper classification of intangible assets significantly impacts a company's financial statements. Incorrect classification can lead to misstated earnings and an inaccurate representation of financial position.

Intangible assets are reported on the balance sheet, providing insights into a company's long-term value drivers. Amortization expense is recognized on the income statement, impacting net income.

Investors and analysts rely on this information to assess a company's profitability, solvency, and overall financial health. Therefore, accuracy is paramount.

Where to Find More Information

Companies should consult accounting standards, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), for detailed guidance on intangible asset accounting. These standards provide comprehensive rules and regulations for recognition, measurement, and disclosure.

The Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) regularly update these standards to reflect evolving business practices.

Furthermore, consulting with qualified accounting professionals can provide tailored advice based on specific business circumstances.

Next Steps

Businesses must meticulously review their asset portfolios to ensure accurate classification. This involves understanding the nature and characteristics of each asset.

Review your asset register and ensure that all intangible assets are properly identified and valued. Consult with accounting professionals for support.

Continued monitoring of accounting standards and industry best practices is essential. Stay informed about any changes that may affect intangible asset accounting and reporting.