Which Statements Are True About Factoring Accounts

Imagine a small business owner, Sarah, staring at a stack of unpaid invoices. Her dream of expanding her bakery is on hold, not because of a lack of customers, but because of slow-paying clients. The weight of managing cash flow feels heavier than a bag of flour, and she wonders if there’s a way to get her hands on the money she’s already earned, without taking out another loan.

For many business owners like Sarah, factoring accounts, also known as invoice factoring, can be a lifeline. But what exactly is factoring, and more importantly, what are the truths and misconceptions surrounding it? This article dives into the world of factoring accounts to clarify some common statements and separate fact from fiction, providing a comprehensive understanding for businesses considering this financial tool.

Understanding Factoring Accounts

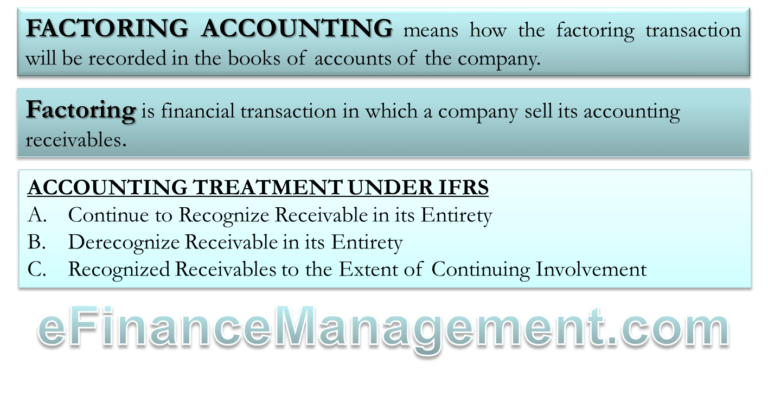

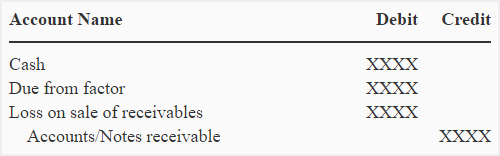

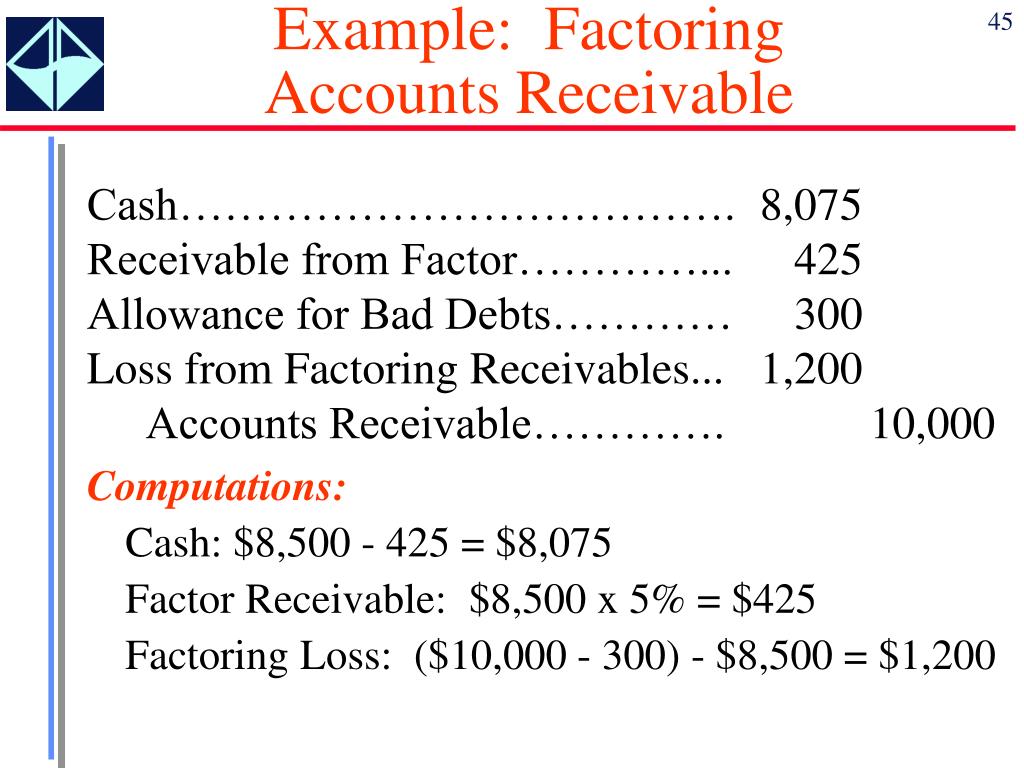

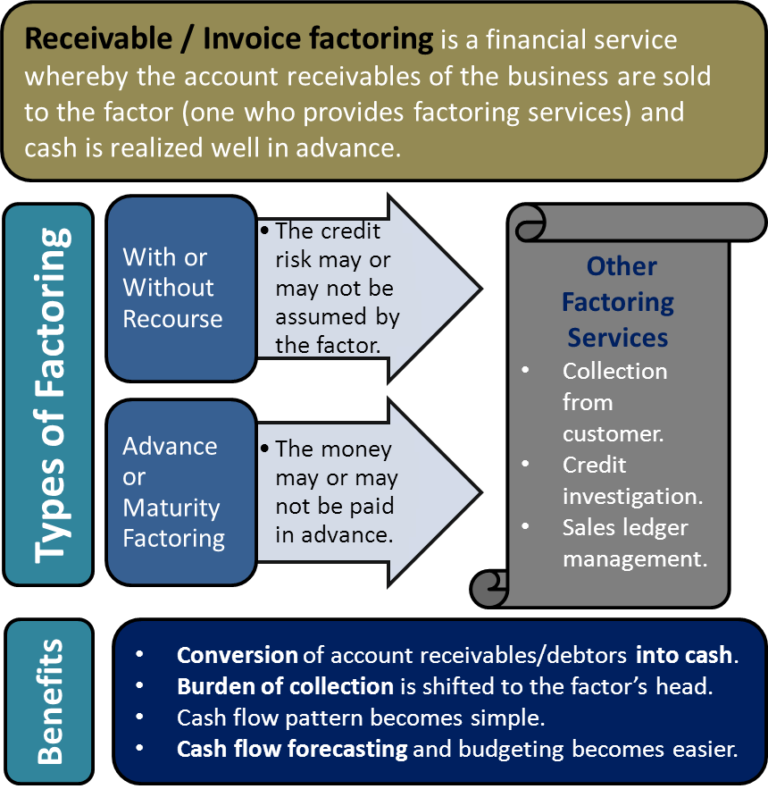

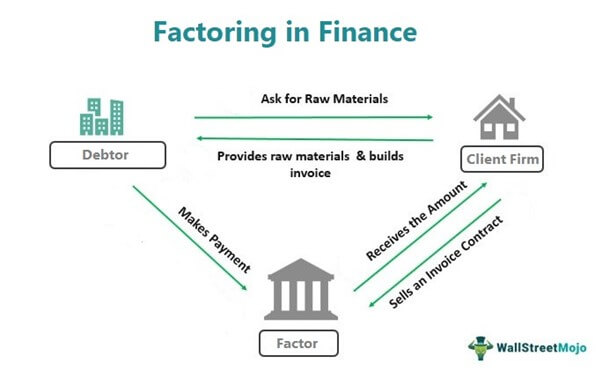

Factoring is a financial transaction where a business sells its accounts receivable (invoices) to a third party (the factor) at a discount.

In essence, the business receives immediate cash for invoices that would otherwise take weeks or months to be paid.

This immediate cash flow can be crucial for covering operational expenses, funding growth, or simply maintaining financial stability.

Statement 1: Factoring is a Loan.

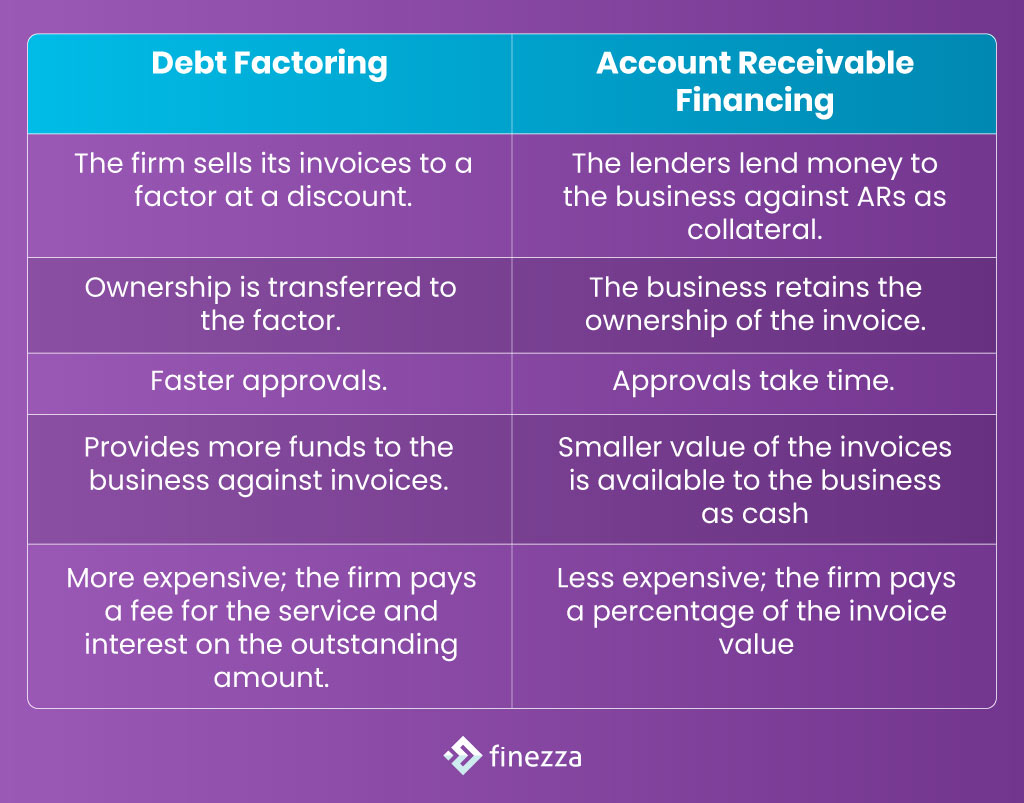

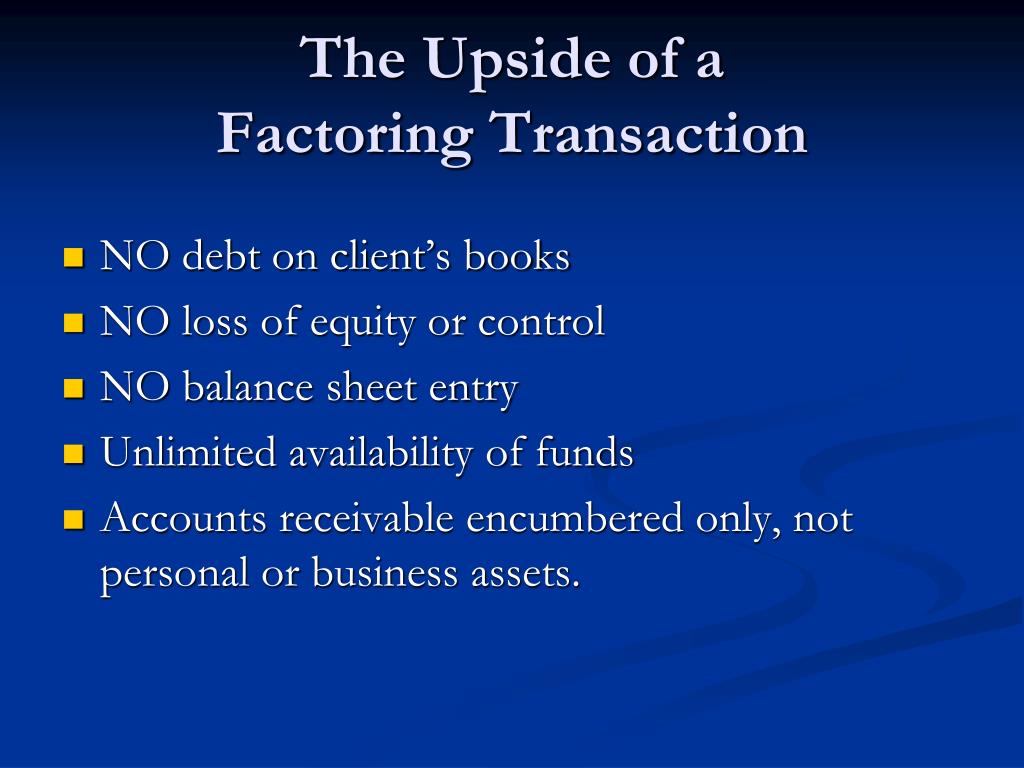

This statement is false. Factoring is not a loan.

Instead, it's the sale of an asset – your invoices.

Unlike a loan, factoring doesn't create debt on your balance sheet.

Statement 2: Factoring is Only for Businesses in Trouble.

This statement is a common misconception.

While factoring can be helpful for businesses facing cash flow challenges, it's also used by healthy, growing companies to accelerate their cash flow and capitalize on opportunities.

Many businesses use factoring proactively to fund expansion, invest in new equipment, or take advantage of early payment discounts from suppliers.

Statement 3: Factoring is Expensive.

The truth is, factoring involves fees, but whether it's considered "expensive" depends on the business's perspective and circumstances.

Factors typically charge a percentage of the invoice value, which can range from 1% to 5% depending on factors such as the volume of invoices factored, the creditworthiness of the business's customers, and the length of the payment terms.

However, businesses should weigh the cost against the benefits of improved cash flow, reduced administrative burden, and the ability to seize growth opportunities.

Statement 4: All Factoring Agreements are the Same.

This statement is definitely not true.

Factoring agreements can vary significantly in terms of fees, recourse provisions, advance rates, and other terms.

It's crucial for businesses to carefully review and compare different factoring agreements before committing to one.

Statement 5: Factoring Always Requires Customer Notification.

This statement depends on the type of factoring agreement.

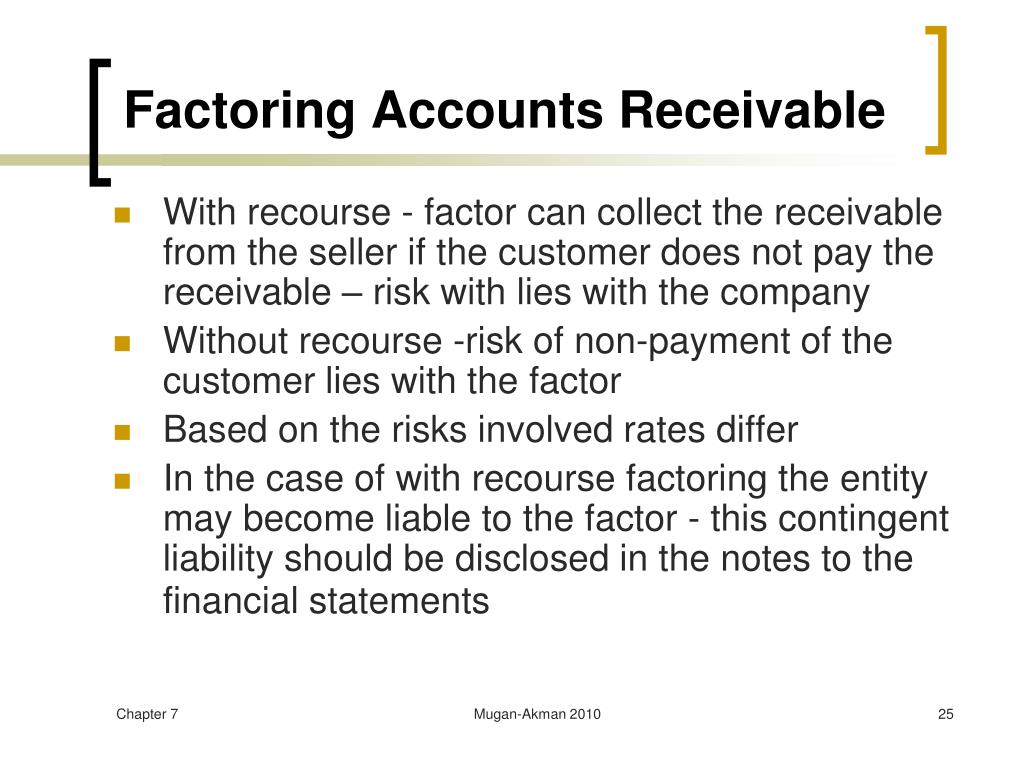

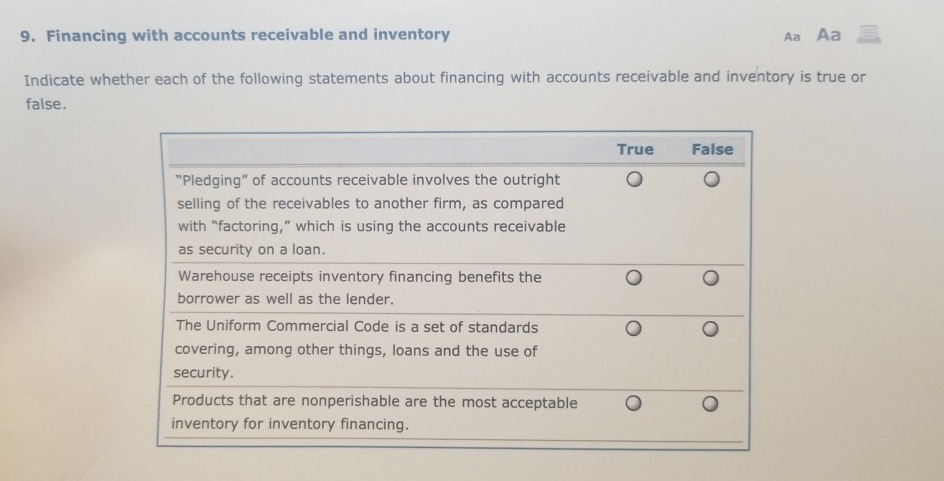

There are two main types of factoring: recourse and non-recourse.

In recourse factoring, the business is responsible for repurchasing the invoice if the customer doesn't pay.

In non-recourse factoring, the factor assumes the risk of non-payment due to the customer's insolvency (but not disputes regarding the product/service quality).

Both recourse and non-recourse factoring can be done on a notification or non-notification basis.

With notification factoring, the business's customers are informed that the invoices have been factored and are directed to pay the factor directly.

Non-notification factoring keeps the arrangement private; the business collects payments from its customers and then forwards them to the factor.

Statement 6: Factoring is Difficult to Set Up.

While the process involves due diligence, setting up a factoring arrangement is generally less complex than obtaining a traditional bank loan.

Factoring companies typically focus on the creditworthiness of the business's customers, rather than the business itself, which can make it easier for startups and companies with limited credit history to qualify.

The application process usually involves providing information about the business, its customers, and its invoices.

The Benefits of Factoring

Factoring offers several advantages, including improved cash flow, reduced administrative burden, and access to working capital.

By receiving immediate payment for invoices, businesses can better manage their cash flow, pay their bills on time, and invest in growth opportunities.

Factoring can also free up internal resources by outsourcing the invoice collection process to the factor.

In addition, many factoring companies offer value-added services such as credit checks on customers and accounts receivable management.

The Drawbacks of Factoring

Despite its benefits, factoring also has some potential drawbacks.

The fees associated with factoring can be higher than those of traditional financing options.

Businesses also need to carefully consider the potential impact of factoring on their customer relationships, especially if notification factoring is used.

It's important to choose a reputable factoring company that is transparent, ethical, and committed to maintaining positive relationships with the business's customers.

Making an Informed Decision

Before entering into a factoring agreement, businesses should carefully evaluate their needs and objectives.

It's essential to understand the terms of the agreement, including the fees, recourse provisions, and advance rates.

Businesses should also shop around and compare different factoring companies to find the best fit for their needs.

Consulting with a financial advisor can also help businesses determine whether factoring is the right solution for their specific circumstances.

According to a report by the Commercial Finance Association, factoring volume has steadily increased over the past decade, indicating a growing awareness and acceptance of this financing option.

Factoring in Today's Economy

In today's rapidly changing economic landscape, access to working capital is more important than ever for businesses of all sizes.

Factoring can provide a valuable source of funding for companies looking to navigate economic uncertainty, capitalize on growth opportunities, or simply maintain a healthy cash flow.

As technology continues to evolve, factoring is becoming more accessible and efficient, with online platforms and automated processes streamlining the application and funding process.

Conclusion

Factoring accounts is a complex financial tool with both potential benefits and drawbacks.

By understanding the truths and misconceptions surrounding factoring, businesses can make informed decisions about whether it's the right solution for their needs.

Like Sarah, the bakery owner, many entrepreneurs can find factoring to be a valuable resource, unlocking the cash flow they need to fuel their dreams and build a thriving business. The key is to approach it with knowledge and careful consideration, ensuring that it aligns with their long-term financial goals.