How Many Americans Are One Paycheck Away From Homelessness

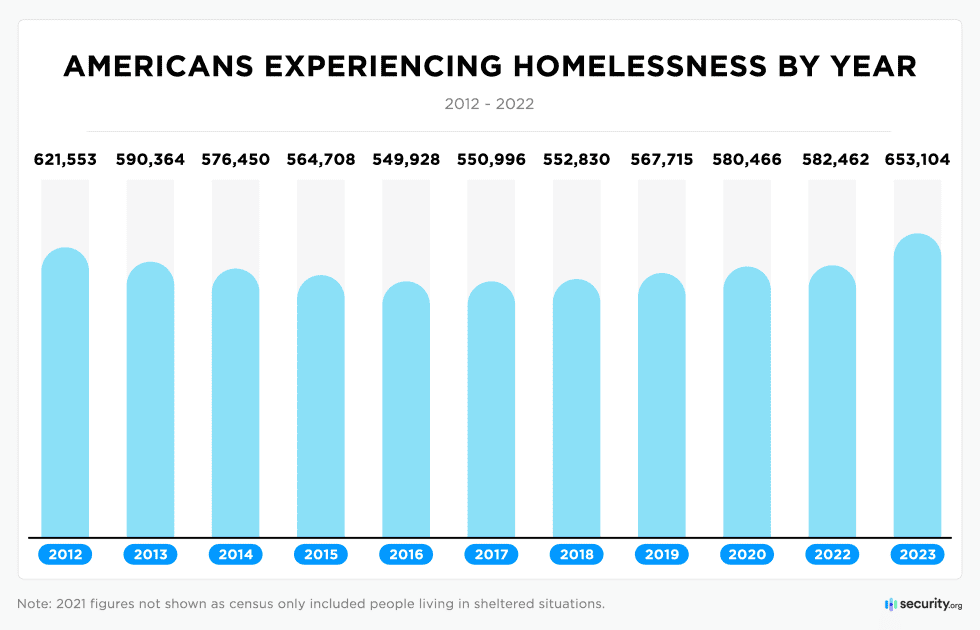

The precariousness of financial stability for many Americans has become increasingly apparent, with a significant portion of the population reportedly just one missed paycheck away from potential homelessness. This vulnerability underscores the challenges of stagnant wages, rising living costs, and a lack of robust emergency savings for a considerable segment of society.

This article examines the prevalence of this financial vulnerability, exploring the data behind the statistics, the factors contributing to this situation, and the potential consequences for individuals and communities across the nation. Understanding the scope and causes of this issue is crucial for developing effective solutions and policies to address the underlying economic insecurities.

The Numbers: A Stark Reality

Several studies and surveys paint a concerning picture of American financial fragility. A 2023 report by NerdWallet, drawing on data from the U.S. Federal Reserve, revealed that around 30% of Americans are living paycheck to paycheck.

This means they are using almost all of their income to cover monthly expenses, leaving little to no buffer for unexpected costs or job loss. Other surveys, like those conducted by PwC and Bankrate, offer similar estimates, consistently showing a substantial portion of the population in a financially vulnerable state.

While the exact percentages vary depending on the methodology and survey population, the underlying trend remains consistent: a large number of Americans are living on the edge.

Factors Contributing to Financial Vulnerability

Several interconnected factors contribute to this widespread financial vulnerability. One key element is the stagnation of wages relative to the rising cost of living.

While the economy has experienced periods of growth, wage increases for many workers have not kept pace with inflation and the increasing prices of essential goods and services, such as housing, healthcare, and education. This disparity leaves less disposable income for savings or unexpected expenses.

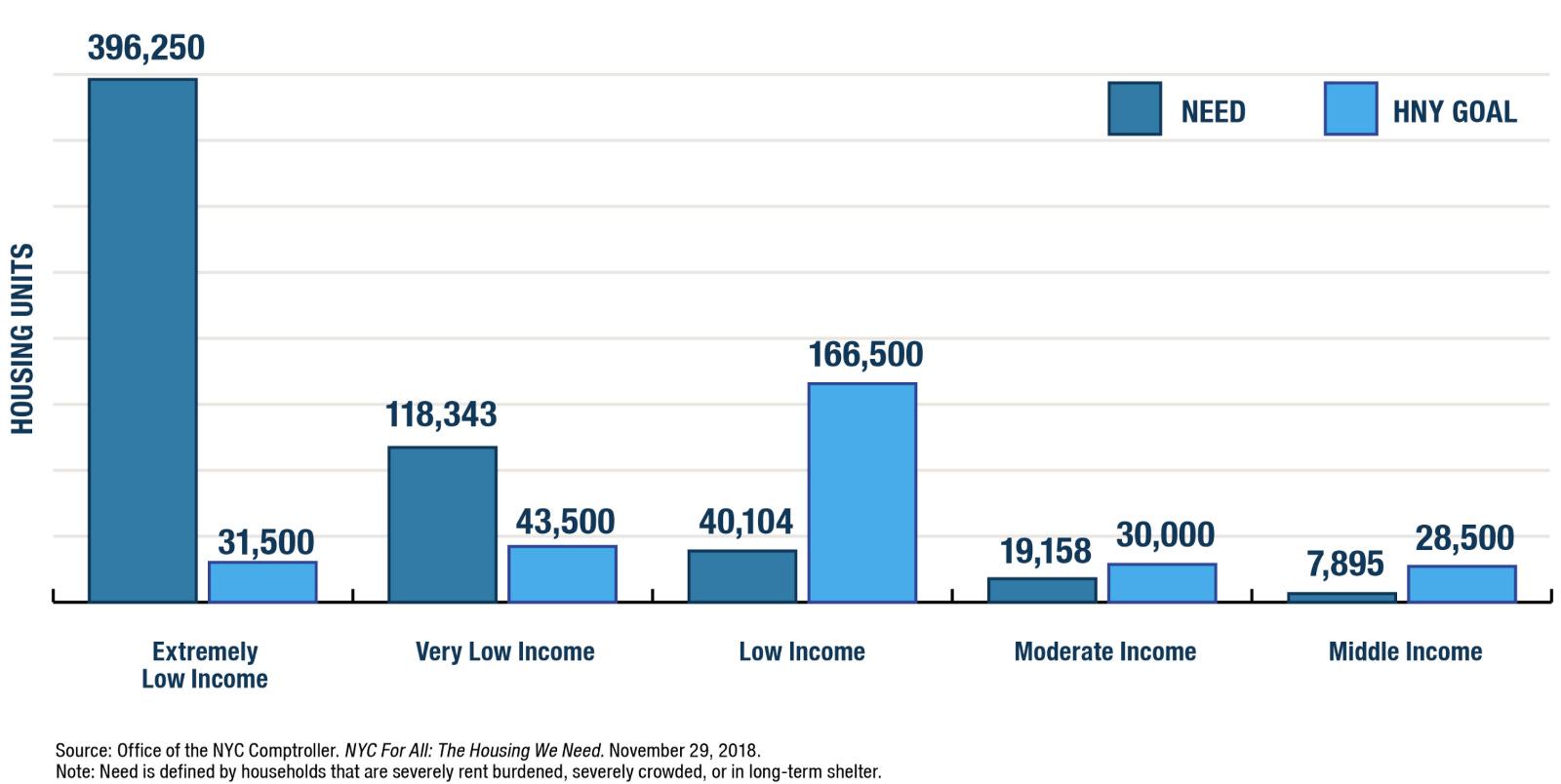

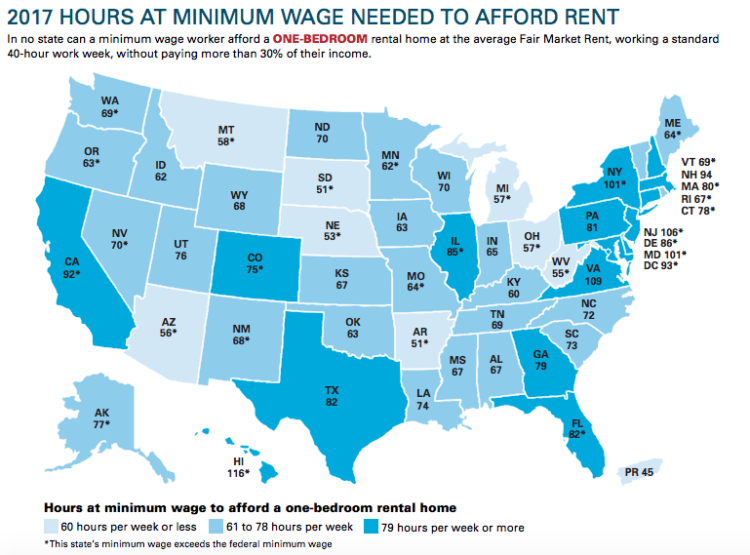

The lack of affordable housing is another major contributing factor. In many urban and suburban areas, rental costs and home prices have soared, making it increasingly difficult for individuals and families to find stable and affordable housing.

High housing costs consume a significant portion of income, leaving less for other necessities and reducing the ability to save for emergencies. Unexpected medical bills can also quickly deplete savings, pushing individuals closer to the brink.

The Impact of Job Loss

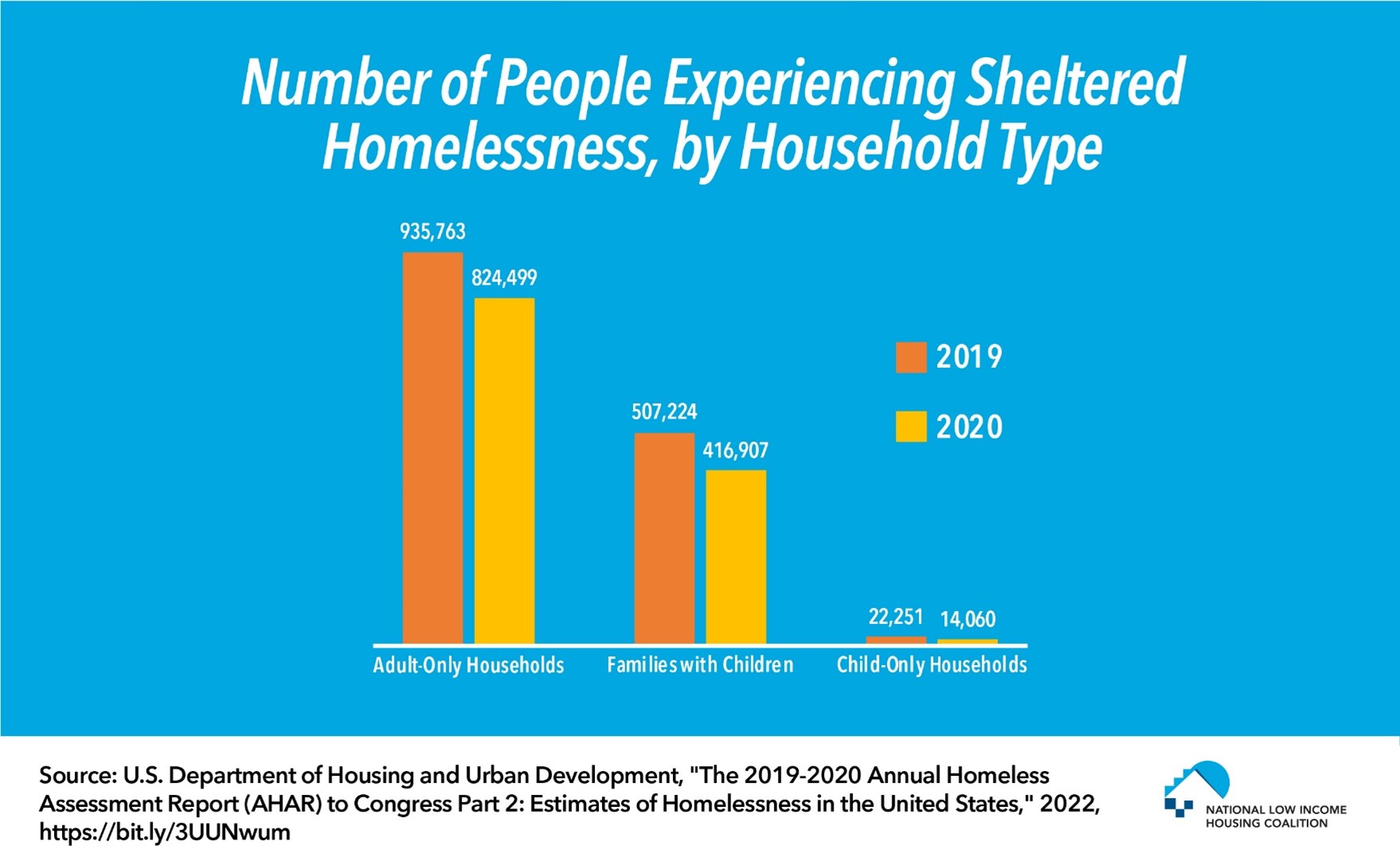

For those living paycheck to paycheck, job loss can be catastrophic. Without a financial safety net, individuals can quickly fall behind on rent or mortgage payments, face eviction or foreclosure, and ultimately experience homelessness.

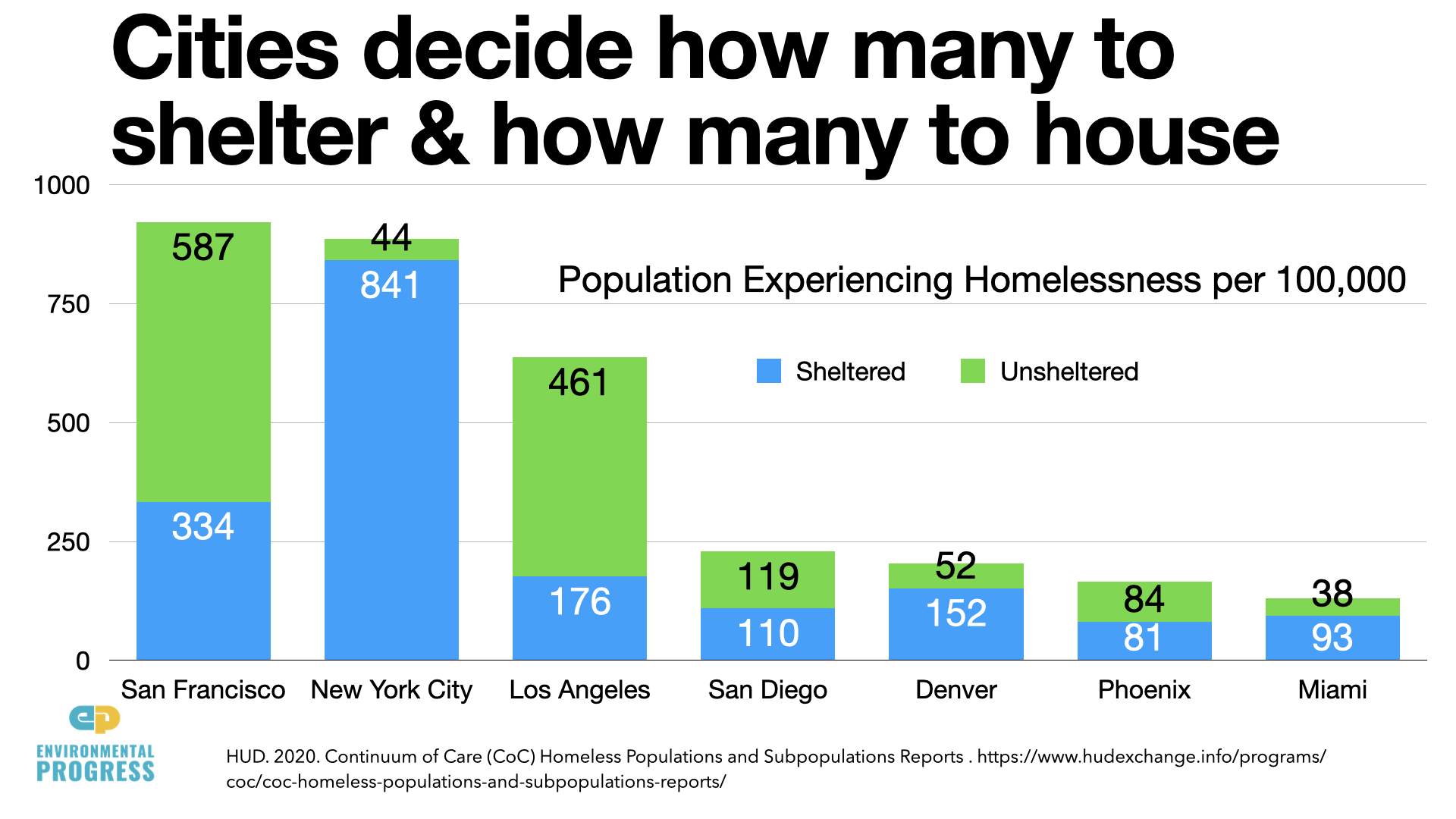

The social and economic consequences of homelessness are profound, affecting not only individuals and families but also communities and public resources. The loss of income and housing can create a cascade of problems, including food insecurity, mental health issues, and increased reliance on social services.

Homelessness also strains local resources, requiring increased funding for shelters, outreach programs, and healthcare services. The cycle of poverty and homelessness can be difficult to break, perpetuating financial instability across generations.

Who is Most Vulnerable?

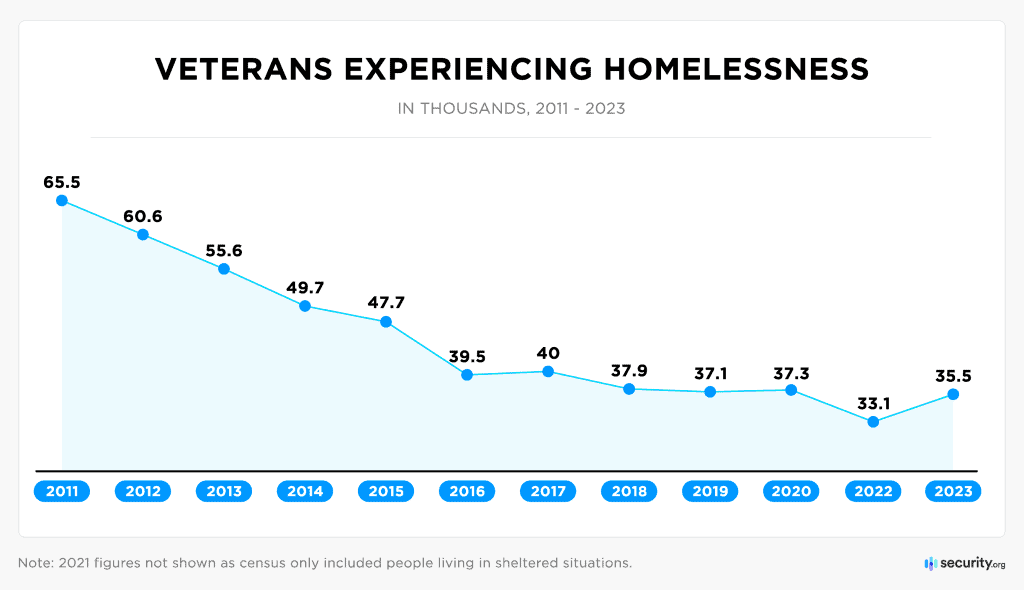

While financial vulnerability affects individuals across various demographics, certain groups are disproportionately at risk. Low-income workers, particularly those in industries with unstable employment or low wages, are among the most vulnerable.

Minority communities, who often face systemic barriers to economic opportunity, also experience higher rates of financial insecurity. Single-parent households, especially those headed by women, often struggle to make ends meet due to limited income and the challenges of balancing work and childcare responsibilities.

Young adults, burdened with student loan debt and entering a competitive job market, also face significant financial challenges. Senior citizens on fixed incomes may struggle to keep up with rising costs, particularly healthcare expenses.

Potential Solutions and Policy Implications

Addressing the issue of financial vulnerability requires a multi-faceted approach. Increasing the minimum wage, expanding access to affordable housing, and strengthening social safety nets are crucial steps.

Policies that promote wage growth, such as collective bargaining and job training programs, can help improve financial stability for low-wage workers. Investing in affordable housing initiatives, such as rent control and subsidized housing programs, can alleviate the burden of high housing costs.

Expanding access to affordable healthcare and providing financial assistance for medical expenses can help prevent unexpected medical bills from pushing individuals into financial distress. Strengthening unemployment benefits and providing job placement assistance can help those who lose their jobs to quickly regain financial stability.

A Human Perspective

The statistics on financial vulnerability represent real people facing difficult circumstances. Stories of individuals struggling to make ends meet highlight the human cost of economic insecurity.

For example, a single mother working two jobs to provide for her children, or a senior citizen forced to choose between food and medication, illustrate the challenges faced by those living on the edge.

These personal stories underscore the urgency of addressing the underlying causes of financial vulnerability and developing effective solutions to support those in need.

Conclusion

The fact that a significant portion of Americans are just one paycheck away from homelessness is a stark reminder of the fragility of financial stability in the modern economy. Addressing this issue requires a comprehensive approach that tackles the root causes of economic insecurity and provides support for those at risk.

By increasing wages, expanding access to affordable housing and healthcare, and strengthening social safety nets, we can create a more equitable and secure society for all. Investing in the financial well-being of individuals and families is not only a moral imperative but also a crucial step towards building a stronger and more resilient economy.

Ignoring this issue will only exacerbate the problem, leading to increased homelessness, poverty, and social unrest. It is time for policymakers, businesses, and communities to work together to create a future where everyone has the opportunity to achieve financial security and stability.