Which Statements Are True According To The Law Of Supply

Economic confusion reigns as understanding the Law of Supply proves crucial for businesses and consumers. Misinterpretations could lead to faulty market predictions and skewed investment decisions.

This report dissects the core tenets of the Law of Supply, separating fact from fiction. We clarify which statements accurately reflect this foundational economic principle.

Understanding the Law of Supply: The Basics

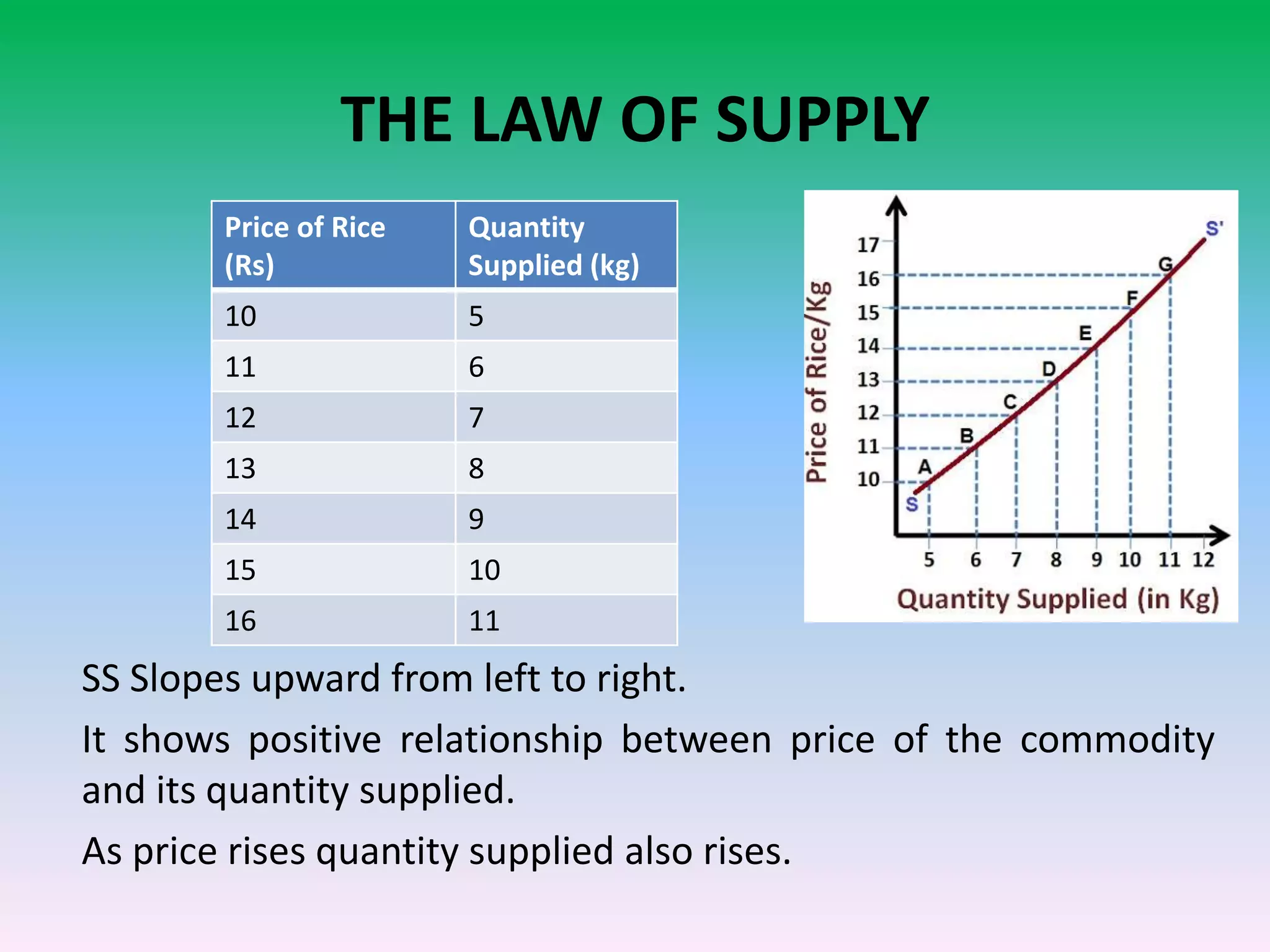

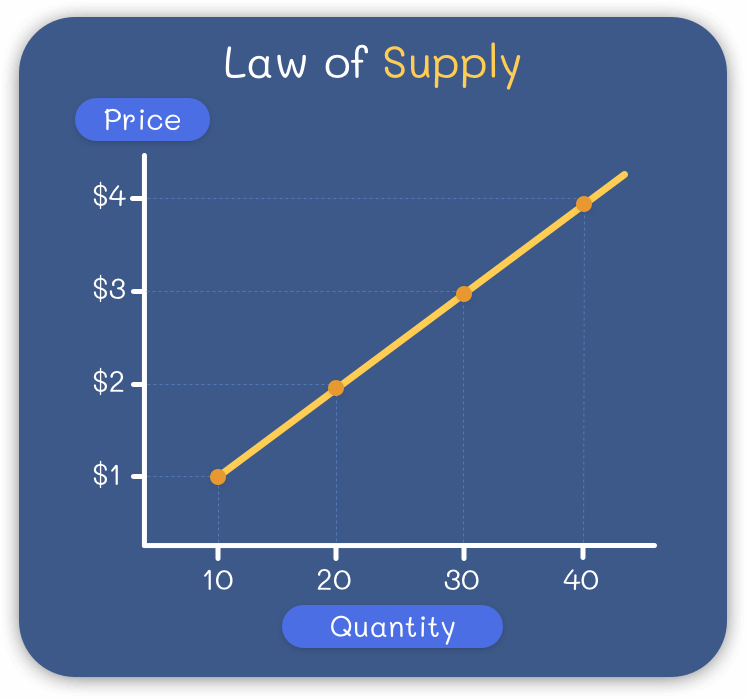

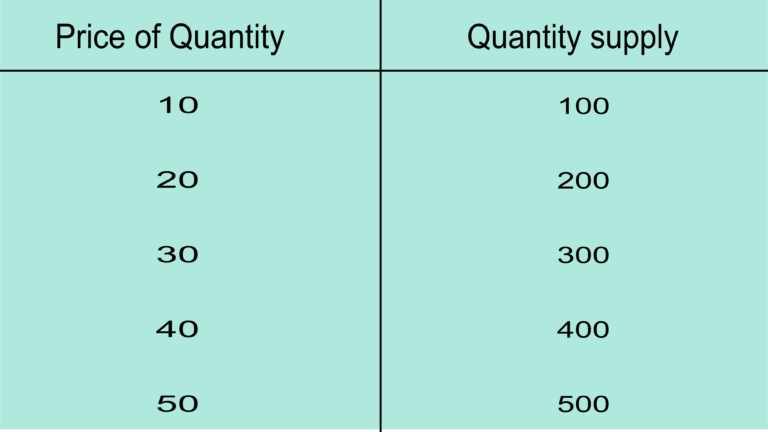

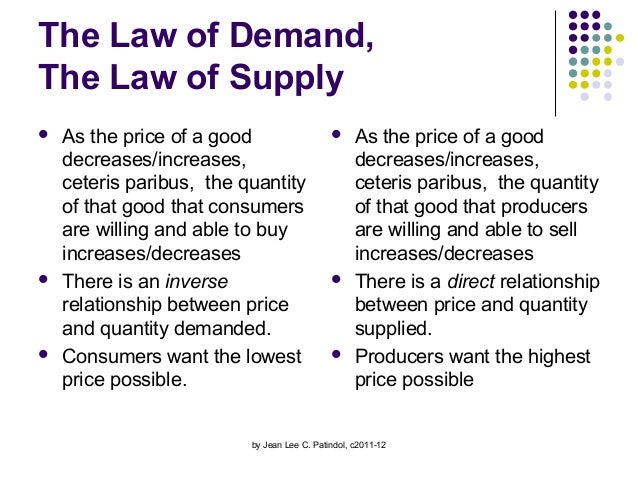

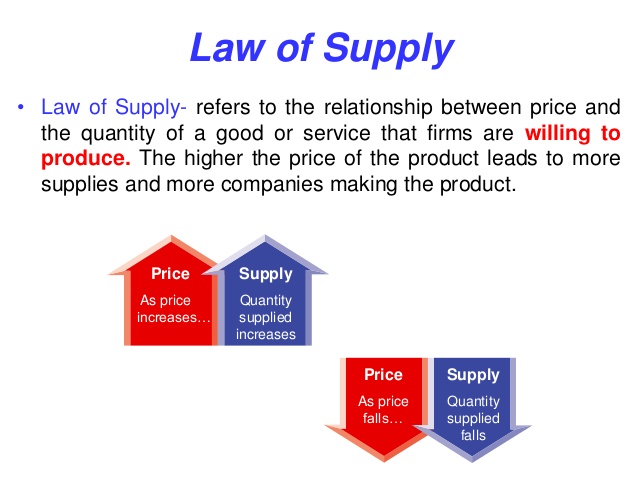

The Law of Supply states that, all other factors being equal, an increase in price results in an increase in quantity supplied. Conversely, a decrease in price results in a decrease in quantity supplied.

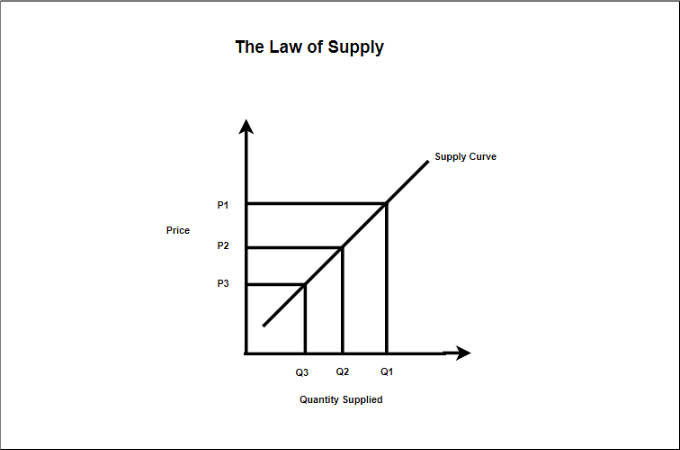

This relationship is a direct one: price and quantity supplied move in the same direction.

A supply curve graphically represents this relationship. It slopes upward, reflecting the positive correlation between price and quantity.

True Statements According to the Law of Supply

The following statements accurately reflect the Law of Supply:

"As the price of wheat increases, farmers will likely plant more wheat." This exemplifies the direct relationship between price and quantity supplied.

"If the cost of producing smartphones falls, manufacturers will be willing to supply more smartphones at the same price." This refers to a shift of the supply curve to the right due to a change in production costs, a factor that influences supply.

"A decrease in the market price of gasoline will lead to a decrease in the quantity of gasoline supplied." This directly demonstrates the law of supply in action.

"If a new tax is imposed on the production of cars, the quantity supplied of cars will likely decrease at every price level." This highlights how input costs affect the overall supply available.

"Higher lumber prices incentivize logging companies to increase their output." Increased profit margins directly stimulate production.

False or Misleading Statements

The following statements are either false or require significant qualification when considering the Law of Supply:

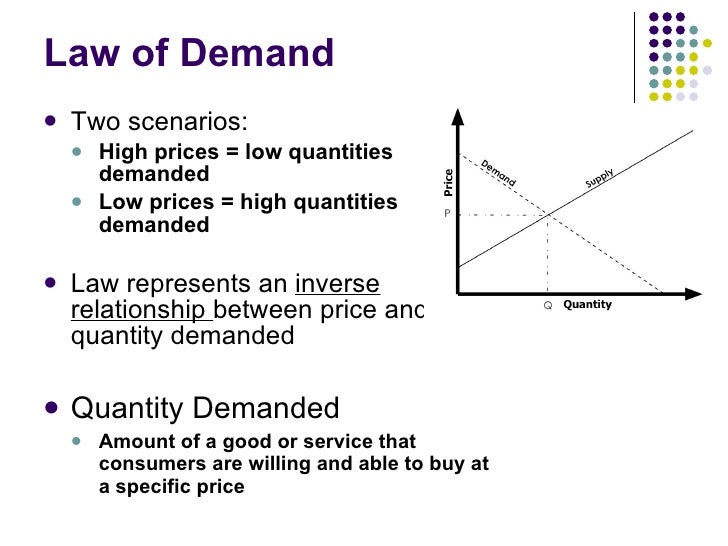

"Demand drives supply." While demand influences the market, the Law of Supply focuses on the producers' response to price changes, irrespective of demand.

"Supply is always perfectly elastic." Supply elasticity varies. It is influenced by factors like production capacity and the availability of resources. Perfectly elastic supply is a theoretical extreme.

"The Law of Supply applies equally to all goods and services." The Law is a general principle. Its impact varies depending on the specific product, market conditions, and external factors.

"Governments cannot affect supply." Regulations, taxes, and subsidies can all significantly alter supply. Government intervention plays a major role.

"Supply is fixed regardless of price." This describes perfectly inelastic supply, a rare scenario. Most goods respond to price fluctuations.

Factors Influencing Supply Beyond Price

While the Law of Supply emphasizes price, other factors shift the entire supply curve.

Technology: Advancements can lower production costs, increasing supply.

Input Costs: Changes in the cost of raw materials, labor, or energy affect supply.

Number of Sellers: More producers increase overall market supply.

Expectations: Anticipations about future prices influence current supply decisions.

Government Policies: Taxes, subsidies, and regulations impact production costs and supply.

Examples in the Real World

The energy sector vividly illustrates the Law of Supply. Higher oil prices typically lead to increased drilling activity.

Agriculture also reflects this principle. Farmers adjust planting based on projected market prices.

Manufacturing demonstrates the law. Increased demand can drive up prices, incentivizing increased production.

Conclusion: Staying Informed

A correct understanding of the Law of Supply is vital. Further research and continuous monitoring of market conditions are essential for accurate economic analysis.

Economic institutions and news outlets will continue to track supply trends. Stay informed about evolving market dynamics.

Consult with financial advisors. Navigate complex economic landscapes and making informed financial decisions.

:max_bytes(150000):strip_icc()/terms_l_lawofsupply_FINAL-63c8fbc006fb4bf4aeb50ea439991efa.jpg)