Which Would Be Most Helpful When Considering A Large Expenditure

Did you know that over 60% of businesses fail within the first ten years? Making informed decisions about large expenditures can be a make-or-break moment. This article helps you navigate that crucial aspect of business management.

Consider a local bakery contemplating the purchase of a state-of-the-art oven. Is this expenditure justified? We'll explore the most helpful approach.

Why Careful Expenditure Analysis Matters

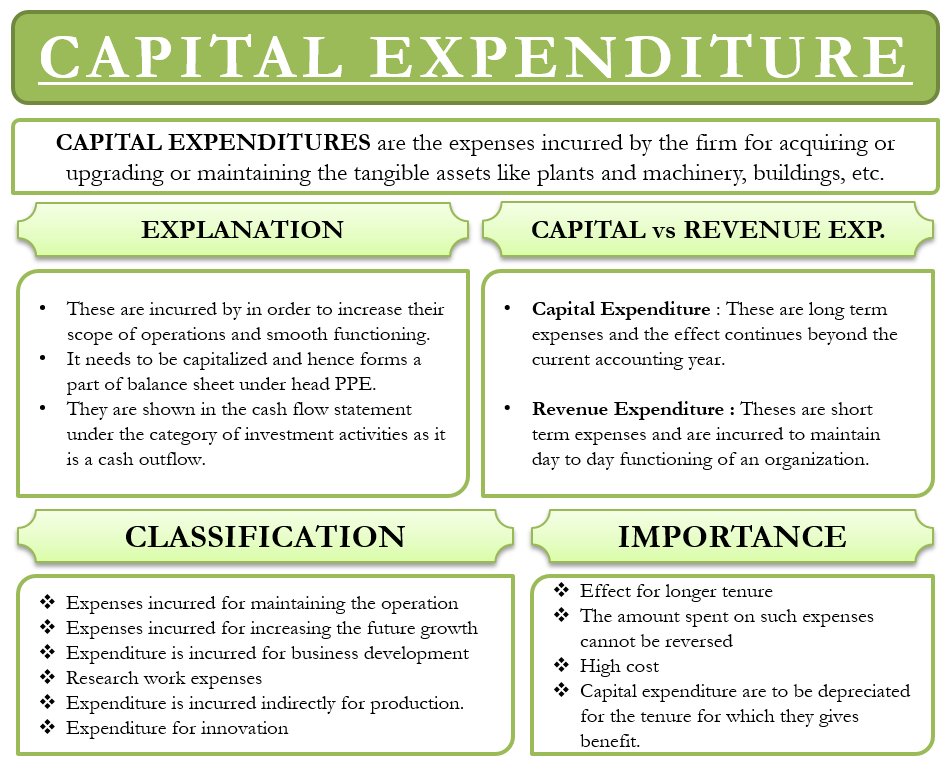

Large expenditures are significant investments that can drastically impact a company's financial health. Poor decisions can lead to cash flow problems, debt accumulation, and even bankruptcy.

Conversely, strategic investments can drive growth, increase efficiency, and enhance profitability. These decisions require careful consideration and a robust analytical framework.

The Power of Return on Investment (ROI) Analysis

One of the most powerful tools for evaluating large expenditures is Return on Investment (ROI) analysis. ROI helps determine the profitability of an investment relative to its cost.

It's calculated as: (Net Profit / Cost of Investment) x 100. A higher ROI indicates a more profitable investment.

For the bakery, the ROI on the new oven would involve estimating the increased revenue from higher production and improved product quality, minus the cost of the oven and any associated expenses.

Beyond the Numbers: Qualitative Factors

While ROI is crucial, it's essential to consider qualitative factors that may not be easily quantifiable. These factors can significantly influence the overall success of an investment.

Consider factors such as improved employee morale, enhanced brand reputation, or reduced environmental impact. These aspects, though difficult to measure directly in monetary terms, contribute to long-term value.

The bakery might see increased customer loyalty due to improved bread quality from the new oven. That is not always measurable but very important.

Scenario Planning and Sensitivity Analysis

Business conditions are never certain. Thus, scenario planning and sensitivity analysis are crucial for evaluating potential risks and rewards.

Scenario planning involves creating different possible future scenarios. For instance, the bakery might consider scenarios with varying levels of customer demand or changes in ingredient costs.

Sensitivity analysis examines how changes in key assumptions, such as sales volume or operating costs, affect the investment's profitability. This helps identify the most critical variables and assess the project's vulnerability.

Prioritize Due Diligence

Due diligence is essential before committing to a large expenditure. It involves a thorough investigation of the investment opportunity and all associated risks.

This might include researching the vendor's reputation, verifying technical specifications, and conducting market research. This can save the business from unforeseen problems.

The bakery should research the oven manufacturer, read customer reviews, and compare features and prices from different suppliers before deciding.

Financing Considerations

How the expenditure will be financed is a critical aspect. Debt financing, equity financing, or internal funding are all options.

Each option has its own implications for the company's financial structure and risk profile. Analyze interest rates, repayment terms, and the impact on cash flow.

For example, if the bakery takes out a loan for the new oven, it must carefully consider the monthly payments and their impact on profitability.

Regular Monitoring and Evaluation

Once the investment is made, it is crucial to monitor and evaluate its performance regularly. Compare actual results to projections and identify any deviations.

Adjustments may be needed based on the new insights. This iterative process ensures that the investment continues to deliver value.

The bakery should track the oven's energy consumption, maintenance costs, and production output to assess whether it is meeting expectations.

Seeking Expert Advice

Don't hesitate to seek expert advice from financial advisors, industry consultants, or other professionals. Their insights can provide valuable perspectives and help avoid costly mistakes.

External consultants can offer unbiased evaluations and specialized knowledge. This can be the best investment of them all.

For complex decisions, the bakery might consult with a financial advisor to assess the potential tax implications of the investment or an industry consultant to evaluate the latest baking technology.

Conclusion

Carefully considering ROI, qualitative factors, scenario planning, due diligence, financing, and performance monitoring is essential for making informed decisions about large expenditures. By employing these strategies, businesses can increase the likelihood of successful investments and sustainable growth.

Remember to seek expert advice when needed. This process is critical for long-term financial health. According to a study by Dun & Bradstreet, businesses that engage in strategic planning are twice as likely to experience growth. [1]

Proper planning will always be time well spent, creating an advantageous pathway to success in business.

[1] Dun & Bradstreet. (n.d.). *Key Ingredients for Business Success*. https://www.dnb.com/perspectives/small-business-growth/key-ingredients-business-success.html

+Long-Range+Budgets.+Encompass+relatively+lengthy+period%2C+generally+2–5+years+or+more..jpg)