Why Is Iris Energy Stock Dropping

Imagine a bustling data center, humming with the energy of countless computers tirelessly crunching complex algorithms. Outside, the sun beats down, reflecting off the metal walls, while inside, a critical operation is underway: mining Bitcoin. But lately, the hum has been accompanied by a different kind of noise – the murmur of investors wondering, "What's going on with Iris Energy?" The stock charts tell a story of turbulence, leaving many to question the future of this once-promising player in the Bitcoin mining world.

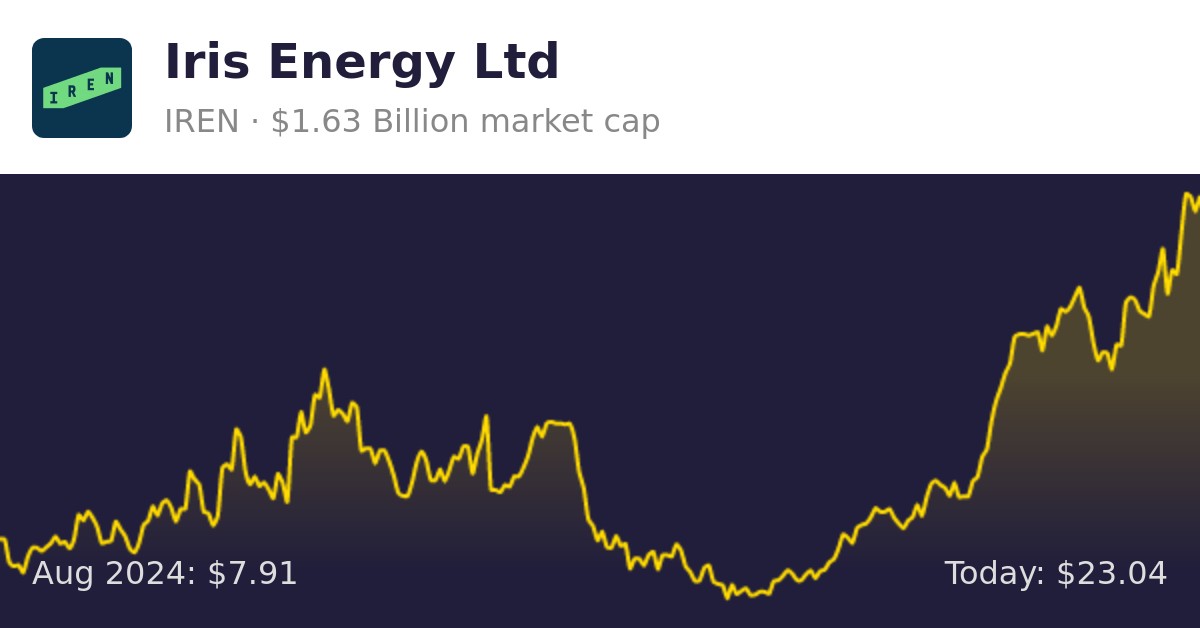

The Australian-based Iris Energy, known for its sustainable approach to Bitcoin mining using renewable energy, has seen its stock price experience a significant decline. This article will delve into the reasons behind this drop, examining the market forces, operational challenges, and financial pressures that have contributed to the company's current situation. We’ll look at how these factors interplay and what they might mean for the future of Iris Energy.

A Bright Start, A Challenging Climb

Founded in 2018, Iris Energy quickly gained attention for its commitment to using 100% renewable energy to power its Bitcoin mining operations. This focus resonated with environmentally conscious investors and helped the company stand out in a crowded field. The company aimed to be a leader in sustainable digital infrastructure.

Early on, Iris Energy secured significant funding and began building out its data center infrastructure, primarily in regions with access to abundant renewable energy sources. The company initially focused on locations in Canada and later expanded to the United States, leveraging hydroelectric power and other green energy options.

The initial public offering (IPO) of Iris Energy in November 2021 marked a significant milestone, raising capital to fuel further expansion. However, the timing coincided with a period of increased volatility in the cryptocurrency market, setting the stage for a challenging journey ahead.

The Bitcoin Price Rollercoaster

The price of Bitcoin is, undeniably, a primary driver of the fortunes of Bitcoin mining companies. When Bitcoin surges, miners reap the rewards, enjoying higher revenue for their efforts. Conversely, when Bitcoin plummets, miners face squeezed profit margins and increased financial strain.

The dramatic drop in Bitcoin's price throughout 2022 and into early 2023 had a direct and significant impact on Iris Energy's profitability. Reduced revenue from mining put pressure on the company's ability to cover its operating expenses and service its debt obligations.

This market downturn exposed vulnerabilities in the business models of many Bitcoin mining companies, including Iris Energy, highlighting the inherent risk associated with the industry. Volatility is the name of the game in the crypto world, and mining companies need to be prepared for wild swings.

Operational Hurdles and Financial Restructuring

Beyond the fluctuating price of Bitcoin, Iris Energy has faced operational challenges that have contributed to its stock decline. Rising energy costs, particularly in certain regions, have increased the company's mining expenses.

The increasing difficulty of mining Bitcoin, a built-in mechanism that makes it harder to mine new blocks as more miners join the network, has also impacted profitability. This requires miners to invest in more powerful and efficient hardware to maintain their competitive edge.

In late 2022, Iris Energy announced a significant restructuring of its debt, involving the sale of some of its mining equipment to reduce its financial burden. This decision, while necessary to address immediate financial concerns, signaled to investors that the company was facing serious challenges.

The Impact of Competition and Regulatory Uncertainty

The Bitcoin mining industry is fiercely competitive, with numerous players vying for a share of the block rewards. This competition puts pressure on profit margins and requires miners to constantly innovate and optimize their operations.

Iris Energy faces competition from larger, well-established mining companies with deeper pockets and more diversified revenue streams. These competitors can often weather market downturns more effectively.

Regulatory uncertainty surrounding Bitcoin and other cryptocurrencies also adds to the challenges faced by Iris Energy. Changes in regulations could significantly impact the company's operations and profitability.

Looking Ahead: Resilience and Adaptation

Despite the recent challenges, Iris Energy remains committed to its mission of sustainable Bitcoin mining. The company has taken steps to reduce its operating costs, optimize its mining operations, and strengthen its financial position.

Iris Energy's focus on renewable energy remains a key differentiator in the market, appealing to environmentally conscious investors. As the world increasingly prioritizes sustainability, this advantage could become even more significant.

The company's management team is actively working to navigate the current market conditions and position Iris Energy for long-term success. Adaptation is key to survival in such an environment.

The Investor Perspective

For investors, the situation with Iris Energy serves as a reminder of the inherent risks associated with investing in the cryptocurrency market. While the potential for high returns exists, so does the risk of significant losses.

It is crucial for investors to conduct thorough research and understand the underlying fundamentals of any company they are considering investing in. This includes assessing the company's financial health, operational efficiency, and competitive landscape.

Diversification is also an important strategy for mitigating risk in the cryptocurrency market. By spreading investments across a range of assets, investors can reduce their exposure to the volatility of any single asset.

A Glimmer of Hope?

The story of Iris Energy is not yet finished. The company's commitment to renewable energy and its efforts to optimize operations could pave the way for a turnaround. However, the path forward will likely be challenging.

The future of Iris Energy will depend on a number of factors, including the price of Bitcoin, the company's ability to control its operating costs, and the regulatory environment surrounding cryptocurrencies. The company is focusing on improving efficiency and expanding capacity.

The resilience and adaptability of Iris Energy will be crucial in determining whether it can weather the current storm and emerge as a stronger player in the Bitcoin mining industry. Only time will tell. But what's clear is that the journey of Iris Energy reflects the dynamic and sometimes unpredictable nature of the cryptocurrency world, and understanding these factors is key to navigating the investment landscape with wisdom and discernment.