Why Did I Get A Letter From Cetera Advisor Networks

The crisp morning air carried a peculiar scent of old paper and fresh ink as I retrieved the mail. Among the usual bills and flyers, a cream-colored envelope stood out, bearing the name Cetera Advisor Networks. A flicker of curiosity mixed with a hint of apprehension danced within me. What could this be about?

If you've recently received a letter from Cetera Advisor Networks, you're likely experiencing a similar mix of emotions. This article aims to demystify the situation, shedding light on the possible reasons why you might be contacted by this large independent broker-dealer and registered investment adviser, and what steps you might consider taking next.

Understanding Cetera Advisor Networks

Cetera Advisor Networks is part of Cetera Financial Group, one of the nation's largest networks of independent financial advisors. They don't directly employ advisors. Instead, they provide resources and support to independent financial professionals who operate their own practices under the Cetera umbrella.

This network model allows advisors to offer a wide range of financial products and services, while benefiting from Cetera's compliance oversight, technology platform, and marketing support. Cetera emphasizes personalized financial advice, delivered through its network of independent advisors.

Possible Reasons for the Letter

So, why did you receive a letter? Several scenarios could explain this.

Your Previous Advisor Joined Cetera

One common reason is that your previous financial advisor has affiliated with Cetera Advisor Networks. Independent advisors frequently change firms as they seek better resources, technology, or support for their practice.

The letter is likely an introductory communication, informing you of their move and reassuring you that they will continue to manage your accounts. This transition often includes important paperwork to officially transfer your accounts to the new affiliation.

Acquisition or Merger

Cetera Financial Group frequently grows through acquisitions of other firms or broker-dealers. If your previous financial firm was acquired by or merged with a firm affiliated with Cetera, you'll receive a notification letter.

These changes don't always mean a change in your advisor, but it’s crucial to understand any shifts in fees, account management, or available products.

Data Breach Notification

In the unfortunate event of a data breach affecting Cetera or one of its affiliated firms, you might receive a notification letter. These letters are legally required and outline the details of the breach and steps you should take to protect your information.

Pay close attention to the instructions in the letter, such as monitoring your credit report and changing passwords. Be cautious of potential phishing attempts that might follow a data breach notification.

Inactive Account Outreach

If you have an inactive account through a financial advisor that is affiliated with Cetera, you may receive a letter as part of their regular compliance procedures. They might be trying to update their records or ensure you're aware of the account's existence.

This is a good opportunity to review the account's purpose and whether it still aligns with your financial goals. Don’t hesitate to ask questions about any associated fees.

Compliance or Regulatory Matters

Sometimes, letters from financial firms relate to compliance matters or regulatory requirements. This could involve changes to account agreements, updates to privacy policies, or notifications about regulatory actions.

While these letters can seem daunting, they are usually routine and require you to acknowledge receipt or take a specific action to remain compliant.

Steps to Take After Receiving the Letter

Regardless of the reason for the letter, it's important to take certain steps to understand its significance and protect your financial interests.

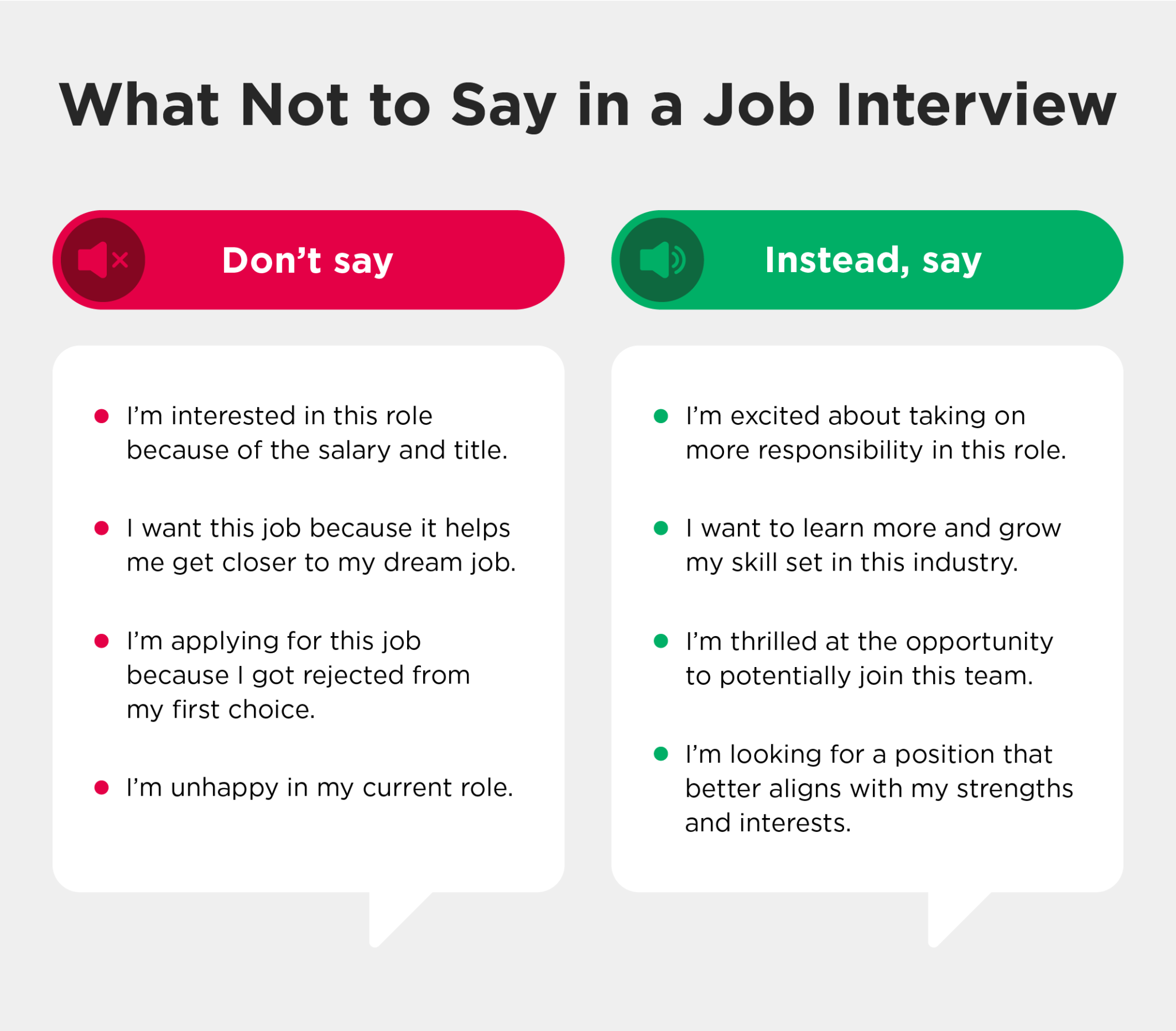

Read Carefully and Understand

The first and most important step is to read the letter carefully. Highlight key details, such as the sender's name, contact information, and the purpose of the communication.

If the language is unclear or you don't understand the content, don't hesitate to seek clarification.

Contact Your Financial Advisor

If the letter mentions your financial advisor, reach out to them directly. They can provide context, answer your questions, and guide you through any necessary actions.

This is a great opportunity to discuss your financial goals and ensure they are still aligned with your investment strategy.

Verify the Information

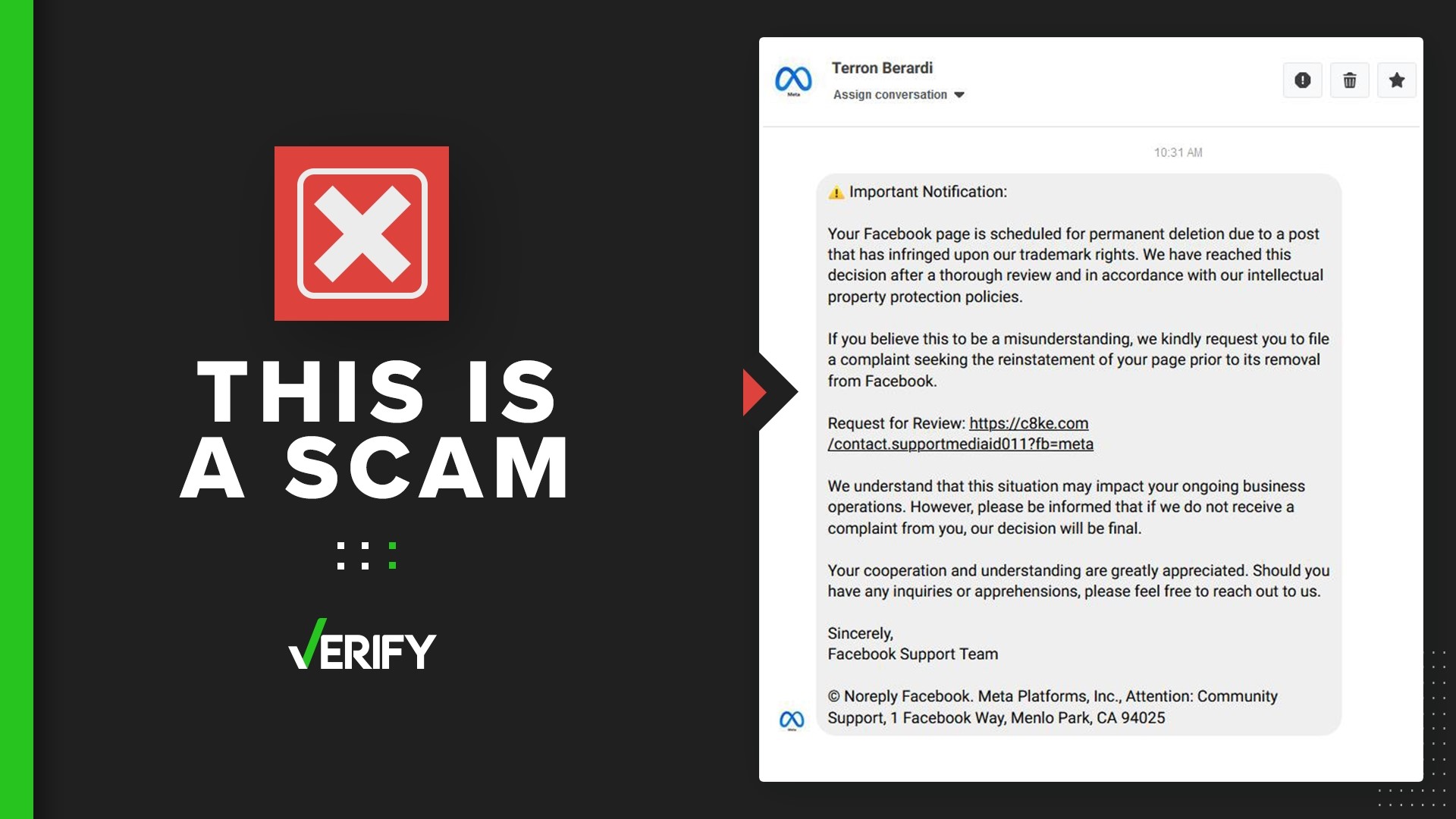

Before taking any action, verify the information in the letter. Look up Cetera Advisor Networks' official website and contact them directly using the information provided there. This helps ensure the letter is legitimate and not a scam.

Be especially cautious of any requests for personal or financial information via email or phone. Legitimate firms rarely ask for sensitive information through unsecure channels.

Review Your Account Statements

Check your recent account statements for any unusual activity or discrepancies. Confirm that your account information is accurate and that all transactions are authorized.

If you notice anything suspicious, report it immediately to your advisor and Cetera's compliance department.

Seek Independent Advice

If you have concerns about the information in the letter or are unsure how to proceed, consider seeking independent financial advice from a qualified professional who is not affiliated with Cetera.

They can provide an unbiased assessment of your situation and help you make informed decisions.

Looking Ahead

Receiving a letter from Cetera Advisor Networks doesn't necessarily signify a problem. It could be a routine notification, an update about your advisor, or information about a firm merger.

By taking a proactive approach—carefully reading the letter, contacting your advisor, verifying information, and seeking independent advice if needed—you can ensure your financial well-being is protected. Knowledge is power, and understanding the reasons behind the communication empowers you to make informed choices about your financial future.

As I refolded the letter, the initial apprehension had subsided, replaced by a sense of empowerment. The key, I realized, was not to fear the unknown, but to approach it with curiosity and a willingness to learn. After all, managing our finances is a lifelong journey, and every letter, every statement, every piece of information is a step along the way.

![Why Did I Get A Letter From Cetera Advisor Networks Free Printable Appeal Letter Templates [Sample PDF] Reconsideration](https://www.typecalendar.com/wp-content/uploads/2023/05/Appeal-Letter-1-768x1086.jpg)

![Why Did I Get A Letter From Cetera Advisor Networks Free Printable College Rejection Letter Templates [PDF, Word] Sample](https://www.typecalendar.com/wp-content/uploads/2023/05/College-Rejection-Letter-1-768x1086.jpg)