Why Did My Credit Score Disappear

Imagine checking your credit score, a number you rely on for everything from loan approvals to renting an apartment, only to find it's vanished. This unsettling scenario is more common than you might think, leaving individuals confused, frustrated, and potentially facing significant financial hurdles. Understanding why a credit score can disappear is crucial for protecting your financial well-being.

This article delves into the various reasons behind a missing credit score, offering insights into how the credit reporting system works and what steps you can take to regain your score. We'll explore factors ranging from inactivity and data errors to identity theft and the impact of short credit histories, providing a comprehensive guide to navigating this often-perplexing situation. By understanding the causes and solutions, you can take proactive steps to ensure your creditworthiness remains intact.

Why Your Credit Score Might Vanish

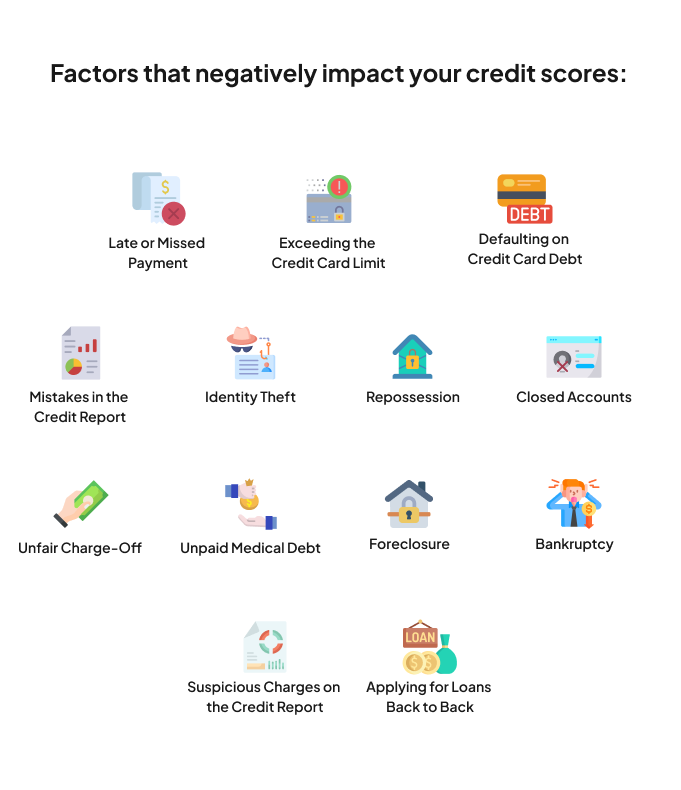

Several factors can contribute to the sudden disappearance of your credit score. The most common reasons relate to credit inactivity, insufficient credit history, errors in your credit report, and potential cases of identity theft.

Inactivity and Insufficient Credit History

A credit score is built on consistent and recent credit activity. If you haven't used any credit accounts for an extended period, usually 12-24 months, the credit bureaus might consider your file inactive.

This inactivity can lead to a lack of sufficient data to generate a score, causing it to disappear. Similarly, if you are new to credit and haven't established a substantial credit history, you might not have a score to begin with.

FICO, one of the leading credit scoring agencies, requires a certain amount of data to create a reliable score. A thin credit file, meaning few or no credit accounts, may not meet this threshold.

Errors in Your Credit Report

Mistakes on your credit report can also lead to your score disappearing. This can happen if your personal information, such as your name, address, or Social Security number, is incorrect or incomplete.

Errors can also arise from accounts being incorrectly reported as closed or delinquent. When significant errors are present, the credit bureaus might be unable to accurately generate a score until the discrepancies are resolved.

According to the Federal Trade Commission (FTC), consumers should regularly review their credit reports to identify and dispute any inaccuracies. Disputing errors is a crucial step in restoring your credit score.

Identity Theft and Fraud

Identity theft is a serious concern that can have devastating consequences for your credit. If someone steals your personal information and opens fraudulent accounts in your name, it can severely damage your credit report and potentially cause your score to disappear.

Fraudulent activity can lead to incorrect information being added to your credit file, making it impossible to calculate an accurate score. If you suspect identity theft, it's essential to report it immediately to the credit bureaus and file a report with the FTC.

Implementing safeguards, such as monitoring your credit report regularly and using strong, unique passwords, can help protect you from identity theft.

Other Contributing Factors

There are other less common, but still possible, reasons for a disappearing credit score. For example, if you've recently emerged from bankruptcy, it may take some time for your credit score to reappear as you rebuild your credit.

Additionally, if you've only been using alternative credit data, such as rent and utility payments, and it's not being reported to the major credit bureaus, it might not be enough to generate a traditional credit score. The scoring model requires traditional credit information.

It's important to understand which credit scoring model a lender is using, as different models may require different information or have different scoring thresholds.

Regaining Your Credit Score

If your credit score has disappeared, don't panic. There are several steps you can take to reinstate it. The first step is to obtain copies of your credit reports from all three major credit bureaus: Equifax, Experian, and TransUnion.

You are entitled to a free credit report from each bureau annually at AnnualCreditReport.com. Review these reports carefully for any errors or inaccuracies.

Disputing Errors and Building Credit

If you find any errors on your credit report, dispute them immediately with the relevant credit bureau. You'll need to provide documentation to support your claim. The credit bureau is required to investigate the dispute and correct any errors within a reasonable timeframe.

If your credit score disappeared due to inactivity or a thin credit file, the best way to rebuild it is to start using credit responsibly. Consider applying for a secured credit card, which requires a cash deposit as collateral.

Another option is to become an authorized user on a trusted family member's or friend's credit card. Make sure the cardholder has a good credit history and that the card issuer reports authorized user activity to the credit bureaus.

Maintaining a Healthy Credit Profile

Once you've established or rebuilt your credit score, it's crucial to maintain a healthy credit profile. Make all your payments on time, every time. Late payments can significantly damage your credit score.

Keep your credit utilization ratio low, ideally below 30%. This means using only a small portion of your available credit. Avoid maxing out your credit cards, as this can negatively impact your credit score.

Regularly monitor your credit report for any suspicious activity. Sign up for credit monitoring services, many of which offer alerts for changes to your credit file.

The Future of Credit Scoring

The credit scoring landscape is evolving, with new models and alternative data sources emerging. Some lenders are starting to incorporate data such as rent and utility payments into their credit assessments, which could help individuals with thin credit files establish creditworthiness.

However, it's important to remember that traditional credit scores still play a significant role in lending decisions. Maintaining a good credit history with traditional credit accounts remains essential for accessing favorable interest rates and loan terms.

Understanding the factors that influence your credit score and taking proactive steps to manage your credit wisely will ultimately lead to greater financial stability and opportunity. Protecting your credit health is an ongoing process, requiring diligence and awareness.