First Time Personal Loans No Credit History Online

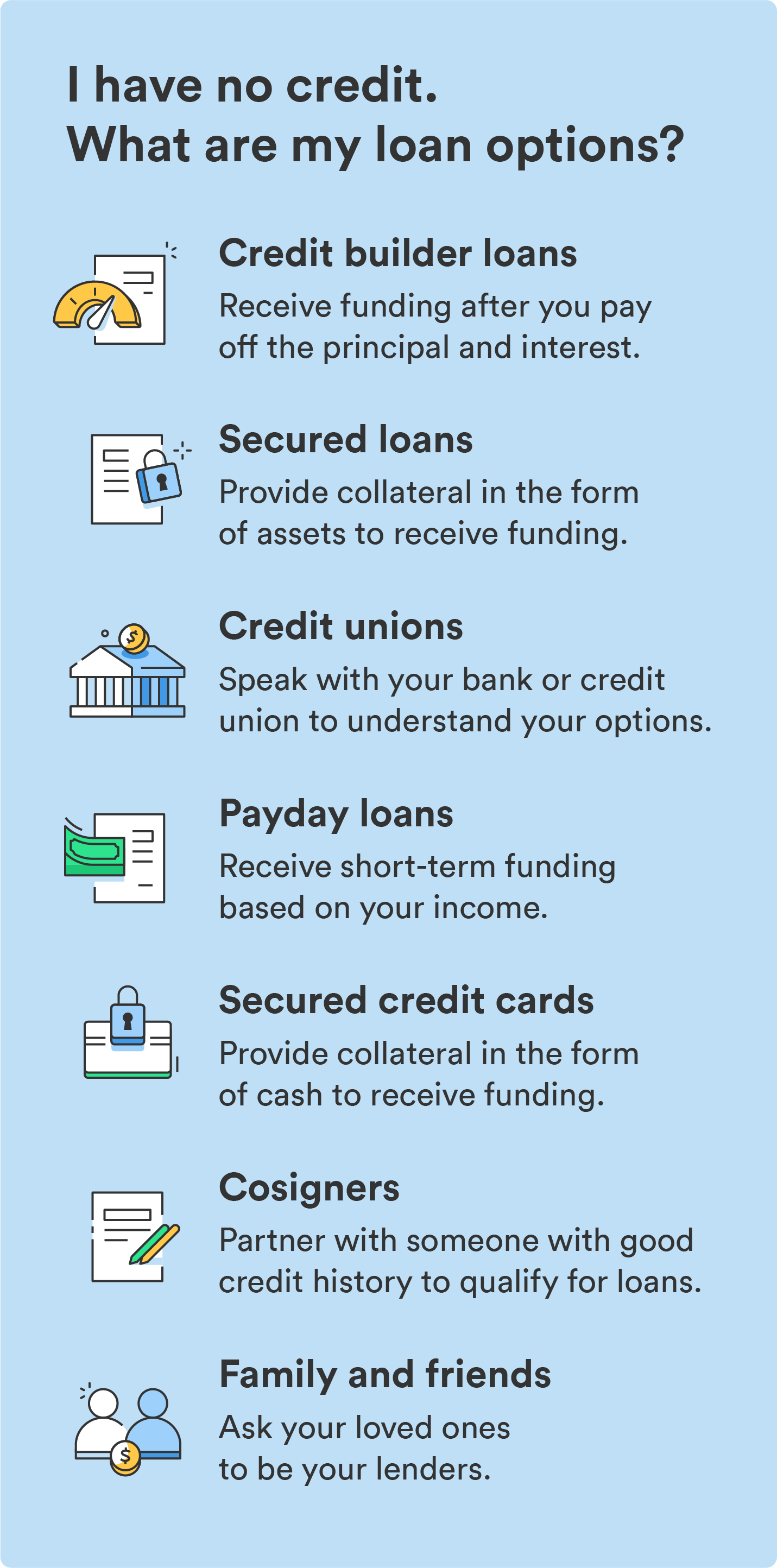

For millions of Americans with little to no credit history, accessing personal loans has long been a significant hurdle. Now, a growing number of online lenders are emerging, offering first-time personal loans specifically designed for individuals with thin or non-existent credit files, potentially opening doors to financial opportunities previously out of reach.

These loans represent a shift in the lending landscape, addressing a significant gap in access to credit for a large segment of the population. This article examines this trend, its implications, and the factors consumers should consider before applying.

The Rise of First-Time Personal Loans

The traditional lending model heavily relies on credit scores, making it difficult for young adults, recent immigrants, or those who have primarily used cash to qualify for loans.

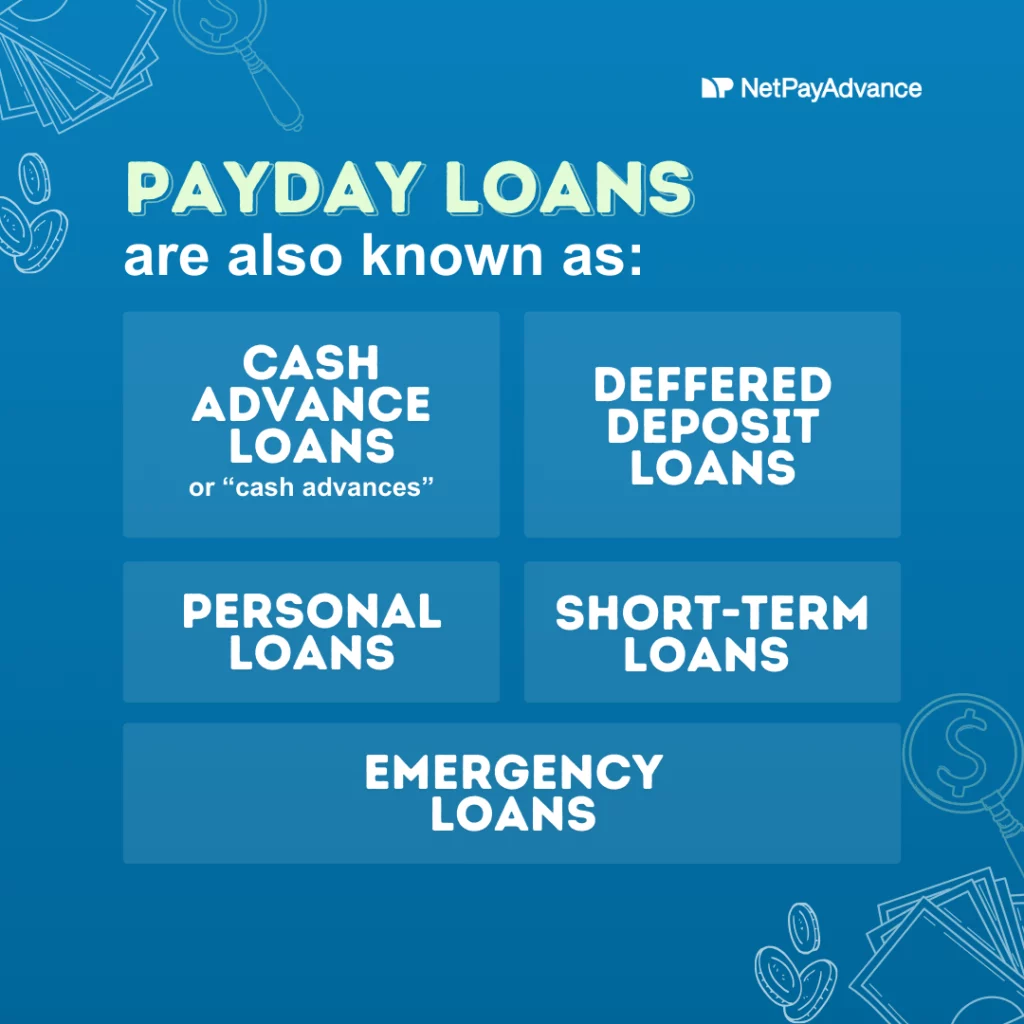

These new online platforms utilize alternative data sources, such as bank account information, employment history, and educational background, to assess creditworthiness. This broader approach allows lenders to evaluate potential borrowers beyond the limitations of a traditional credit report.Who: Several online lenders, including companies like OppLoans, SeedFi, and Upgrade, are pioneering these first-time personal loan products. What: These loans are unsecured personal loans designed for individuals with limited or no credit history. Where: These loans are primarily offered online, accessible nationwide in most states.

When: This trend has gained momentum in recent years, particularly since the rise of fintech and the increasing availability of alternative data. Why: The demand for these loans is driven by the large number of "credit invisible" individuals and the desire for greater financial inclusion. How: These lenders use alternative data and sophisticated algorithms to assess risk and offer loans with varying interest rates and repayment terms.

Key Features and Considerations

These first-time personal loans often come with higher interest rates compared to loans offered to borrowers with established credit.

The risk associated with lending to individuals with limited credit history necessitates a higher premium. Borrowers should carefully compare interest rates and fees from multiple lenders to find the most favorable terms.Loan amounts are often smaller, typically ranging from $500 to $5,000, allowing borrowers to build credit responsibly without taking on excessive debt. Many lenders also report payment activity to credit bureaus, enabling borrowers to establish or improve their credit scores over time.

This reporting is crucial for borrowers seeking to access more favorable financial products in the future.Important Considerations: Before applying for a first-time personal loan, borrowers should carefully evaluate their financial situation and ensure they can comfortably afford the monthly payments.

"It's essential to borrow responsibly and avoid taking on debt that you can't manage,"warns Jane Doe, a financial advisor at Acme Financial Services. Additionally, borrowers should be wary of predatory lenders offering loans with exorbitant interest rates or hidden fees.

Potential Impact and Future Outlook

These first-time personal loans have the potential to significantly impact financial inclusion. By providing access to credit, they can empower individuals to achieve their financial goals, such as starting a business, consolidating debt, or covering unexpected expenses.

The loans can also play a crucial role in building credit, paving the way for future access to mortgages, auto loans, and other financial products.The Consumer Financial Protection Bureau (CFPB) has been monitoring the growth of alternative data-based lending. The CFPB aims to ensure that these practices are fair, transparent, and do not discriminate against protected classes.

Their oversight is vital to protecting consumers and fostering a responsible lending environment.As technology continues to evolve and alternative data becomes more readily available, the market for first-time personal loans is expected to grow further.

This growth could lead to increased competition among lenders, potentially driving down interest rates and improving loan terms for borrowers.However, ongoing scrutiny and regulatory oversight are necessary to ensure that these loans remain accessible, affordable, and beneficial for those seeking to establish their creditworthiness.

The long-term success of these programs hinges on responsible lending practices and informed consumer choices.