Why Did The Dodd-frank Act Amend The Investment Advisers Act

The 2008 financial crisis, a period of unprecedented economic turmoil, exposed deep-seated vulnerabilities within the U.S. financial system. One critical area of reform centered on investment advisors, the professionals entrusted with managing trillions of dollars on behalf of individuals and institutions. The resulting legislative response, the Dodd-Frank Wall Street Reform and Consumer Protection Act, significantly amended the Investment Advisers Act of 1940, aiming to enhance oversight, protect investors, and mitigate systemic risk.

At its core, Dodd-Frank's amendments to the Investment Advisers Act sought to re-calibrate regulatory responsibilities, focusing on shifting oversight of certain advisors from the Securities and Exchange Commission (SEC) to state authorities. This re-alignment was coupled with mandates for increased disclosure, enhanced examination authority, and stricter regulation of private fund advisors. The goal was to create a more comprehensive and robust regulatory framework that could better safeguard investors and the broader financial system from future crises.

The Pre-Dodd-Frank Regulatory Landscape

Prior to Dodd-Frank, the Investment Advisers Act of 1940 served as the primary regulatory framework for investment advisors. This Act required advisors managing over a certain threshold of assets to register with the SEC, subjecting them to examinations and regulatory oversight.

However, this system had limitations. The SEC, with its limited resources, struggled to effectively oversee the growing number of investment advisors, leading to concerns about insufficient investor protection. This regulatory gap was particularly pronounced among smaller advisors and those managing private funds, like hedge funds and private equity funds.

Dodd-Frank's Key Amendments and Their Rationale

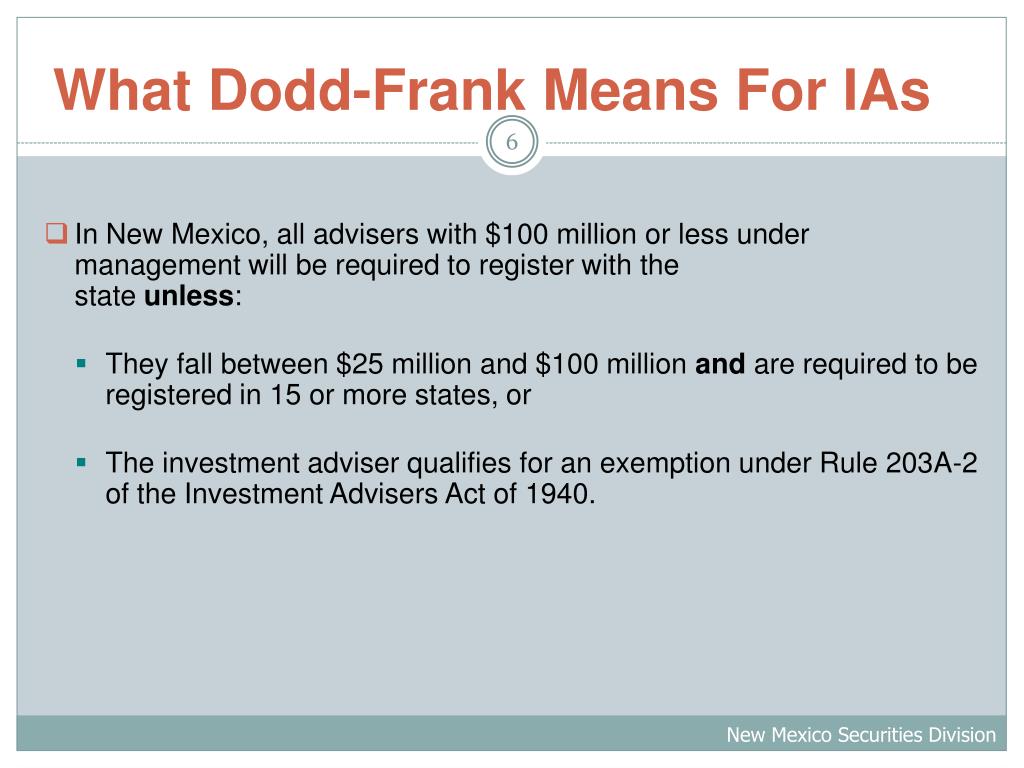

Dodd-Frank introduced several key amendments to the Investment Advisers Act, each designed to address specific weaknesses in the existing regulatory structure. One of the most significant changes was the shift in regulatory responsibilities based on assets under management (AUM).

Re-alignment of Regulatory Authority: Dodd-Frank mandated that investment advisors with less than $100 million in AUM register with state securities regulators rather than the SEC. This change aimed to streamline the SEC's oversight, allowing it to focus its resources on larger advisors and those managing riskier assets. The shift also empowered state regulators to better protect investors within their jurisdictions.

Enhanced Regulation of Private Fund Advisors: The Act brought greater scrutiny to advisors managing private funds, requiring many to register with the SEC for the first time. This change was driven by concerns that the lack of transparency and regulation in the private fund industry contributed to systemic risk during the financial crisis. Registration required these advisors to disclose detailed information about their operations, investment strategies, and potential conflicts of interest.

Increased Disclosure Requirements: Dodd-Frank mandated increased disclosure requirements for all registered investment advisors, including information about their fees, investment strategies, and potential conflicts of interest. These enhanced disclosures were intended to provide investors with more transparent information, enabling them to make more informed investment decisions.

Enhanced Examination Authority: The Act granted the SEC greater authority to conduct examinations of registered investment advisors. This increased examination authority allowed the SEC to proactively identify and address potential compliance issues, further protecting investors from fraud and misconduct.

The Impact and Effectiveness of the Amendments

The impact of Dodd-Frank's amendments to the Investment Advisers Act has been widely debated. Proponents argue that the reforms have significantly enhanced investor protection and reduced systemic risk.

The shift in regulatory responsibilities has allowed the SEC to focus its resources on larger and more complex advisors. Stricter regulation of private fund advisors has increased transparency in the private fund industry. These changes are significant benefits of Dodd-Frank.

Critics argue that the reforms have created unnecessary compliance burdens for smaller investment advisors. Some also contend that the costs of compliance outweigh the benefits, particularly for smaller firms. These complaints are valid, and compliance is costly, but many believe the benefits outweigh the risk.

Perspectives on the Dodd-Frank Amendments

There are varying perspectives on the effectiveness of Dodd-Frank's amendments. Investor advocacy groups generally support the reforms, arguing that they have strengthened investor protection and increased transparency. They emphasize the importance of strong regulatory oversight in preventing future financial crises.

Investment advisory firms have a more mixed view. Larger firms generally support the increased regulatory certainty provided by the amendments, while smaller firms express concerns about the compliance costs. Some argue that the regulations are overly burdensome and stifle innovation.

"Dodd-Frank was necessary to protect investors and the integrity of the financial markets," says Barbara Roper, Director of Investor Protection at the Consumer Federation of America. "The reforms have created a more level playing field and reduced the risk of another financial crisis."

Regulatory experts offer diverse opinions. Some believe that the amendments have been largely successful in achieving their goals, while others argue that they have created unintended consequences. There is ongoing debate about the optimal level of regulation and the balance between investor protection and economic growth.

The Future of Investment Advisor Regulation

The regulatory landscape for investment advisors is constantly evolving. As financial markets become more complex and new investment products emerge, regulators must adapt to address emerging risks. The SEC continues to refine its rules and regulations to improve investor protection and promote market integrity.

Technological innovation is also playing a significant role in shaping the future of investment advisor regulation. The rise of robo-advisors and other automated investment platforms is creating new challenges and opportunities for regulators. The regulatory framework will need to adapt to accommodate these technological advancements while ensuring that investors are adequately protected.

Looking ahead, ongoing debates about the appropriate scope and intensity of regulation will continue to shape the regulatory landscape for investment advisors. Striking the right balance between protecting investors, promoting market efficiency, and fostering innovation will be crucial to ensuring the long-term health and stability of the financial system.

:max_bytes(150000):strip_icc():format(webp)/dodd-frank-financial-regulatory-reform-bill.asp-final-5ae832d396f345ee8706cdac55670ebf.png)