Why Is Bhat Active In The Penny Stock Market

Imagine a bustling trading floor, the air thick with anticipation. Screens flash red and green, a symphony of clicks and hurried whispers filling the room. Among the seasoned veterans, a relatively new name has been making waves in an unexpected corner of the market: Bhat.

While much of the financial world focuses on blue-chip stocks and established companies, Bhat has carved out a niche in the often-volatile, always-intriguing world of penny stocks. But why this particular focus? What draws Bhat to the perceived risks and potential rewards of this specific market segment?

This article delves into the story behind Bhat's active participation in the penny stock market, exploring the motivations, strategies, and impact of this emerging player. We'll examine the factors that might lead an investor to favor this high-risk, high-reward arena, shedding light on the dynamics of a market often shrouded in mystery.

Understanding the Allure of Penny Stocks

Penny stocks, typically defined as shares trading for under $5 per share, represent a unique proposition for investors. They offer the potential for significant gains, albeit accompanied by substantial risks. This inherent volatility can be both a curse and a blessing, depending on one's investment strategy and risk tolerance.

For some, the allure lies in the possibility of uncovering undervalued companies with untapped potential. These investors believe that through careful research and due diligence, they can identify hidden gems poised for exponential growth.

Others are drawn to the fast-paced nature of penny stock trading, where prices can fluctuate dramatically in short periods. This environment attracts those who thrive on rapid decision-making and are comfortable with a higher level of risk.

Bhat's Background and Investment Philosophy

While specifics about Bhat's personal background remain largely private, available information suggests a strong foundation in financial analysis and a keen interest in identifying emerging market trends. Precise details are scarce, and much of the information is gleaned from public records and industry observations.

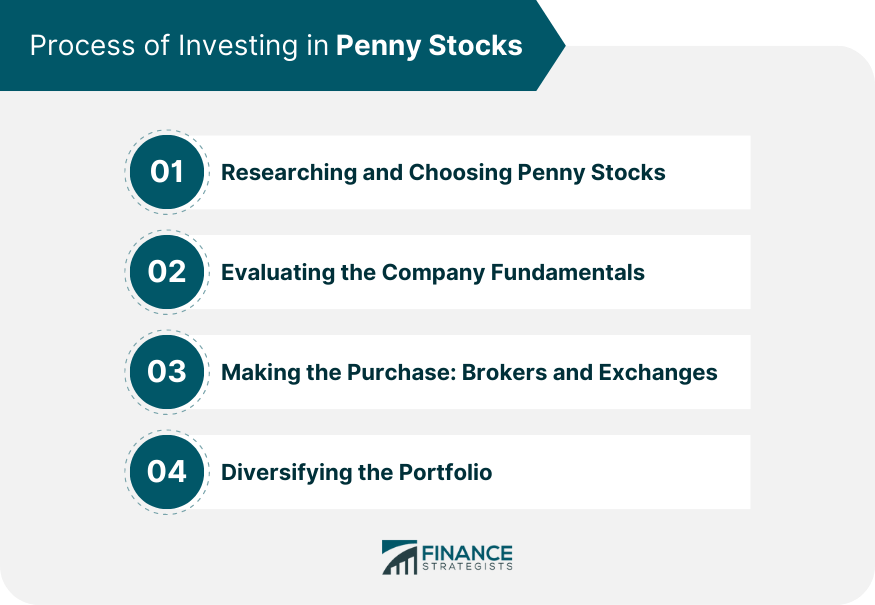

Reports indicate that Bhat's investment philosophy is rooted in a combination of fundamental and technical analysis. This approach involves examining a company's financial statements, management team, and competitive landscape, while also studying price charts and trading volumes to identify potential entry and exit points.

Furthermore, Bhat seems to favor a long-term investment horizon, focusing on companies with strong growth potential rather than short-term speculative plays. This strategy, while not eliminating risk, suggests a disciplined approach to navigating the volatile penny stock market.

Motivations Behind Penny Stock Activity

Several factors could explain Bhat's active participation in the penny stock market. One possibility is the potential for higher returns compared to more established stocks. While blue-chip companies offer stability and consistent growth, penny stocks can, in some cases, deliver exponential gains if the underlying company succeeds.

Another factor could be the opportunity to influence smaller companies. By acquiring a significant stake in a penny stock company, Bhat might be able to play a more active role in shaping its direction and strategy. This level of influence is often unattainable with larger, more established corporations.

It's also conceivable that Bhat sees the penny stock market as an overlooked and undervalued asset class. By focusing on this niche, Bhat may be able to identify opportunities that other investors have missed, leading to outsized returns.

Examining the Risks and Rewards

Investing in penny stocks is not without its challenges. The lack of regulation and transparency in this market segment can make it vulnerable to manipulation and fraud. Investors must be vigilant and conduct thorough due diligence before investing in any penny stock.

Liquidity can also be a concern, as penny stocks may not trade as frequently as larger stocks. This can make it difficult to buy or sell shares quickly, especially in large quantities. Price volatility is another significant risk, as penny stocks can experience dramatic price swings in response to news or market sentiment.

However, the potential rewards can be substantial. If an investor correctly identifies a promising penny stock, the gains can far exceed those available in more established markets. The key is to approach penny stock investing with a well-defined strategy, a high tolerance for risk, and a commitment to thorough research.

The Impact of Bhat's Involvement

Bhat's active participation in the penny stock market has not gone unnoticed. Industry observers have noted the increased trading volume and price movements in certain penny stocks associated with Bhat's investments.

This increased attention can be both positive and negative. On one hand, it can bring greater visibility to promising companies, attracting further investment and fueling growth. On the other hand, it can also create artificial price bubbles and increase the risk of manipulation.

It's important to note that Bhat's activities should not be interpreted as endorsements or recommendations to invest in any particular penny stock. Investors must always conduct their own research and make informed decisions based on their individual circumstances and risk tolerance.

Looking Ahead

The future of Bhat's involvement in the penny stock market remains uncertain. Whether Bhat will continue to focus on this niche, or eventually shift to larger, more established markets, is yet to be seen.

However, one thing is clear: Bhat's activities have highlighted the potential, and the risks, of penny stock investing. This has sparked a renewed interest in this often-overlooked market segment, prompting investors to take a closer look at the opportunities and challenges it presents.

Ultimately, the story of Bhat in the penny stock market serves as a reminder of the diverse strategies and motivations that drive the financial world. It underscores the importance of careful research, disciplined risk management, and a willingness to explore unconventional investment opportunities.