Why Is Budgeting Important To Your Life

Imagine waking up with a sense of calm, not the usual knot of anxiety tightening in your stomach as you contemplate looming bills. Envision knowing exactly where your money is going, not feeling like it’s disappearing into some financial black hole. This isn't a pipe dream; it's the reality that budgeting can unlock, transforming financial stress into a feeling of control and empowerment.

At its core, budgeting is simply a plan for your money. It's about consciously deciding where your income will go, rather than letting it drift away on impulse buys and forgotten subscriptions. This article explores why embracing budgeting, regardless of your income level, can be one of the most impactful decisions you make for your overall well-being.

Taking Control of Your Financial Destiny

Budgeting isn't about deprivation. It's about prioritization. It's about identifying what truly matters to you and allocating your resources accordingly. As Dave Ramsey, a well-known personal finance expert, famously said, "A budget is telling your money where to go instead of wondering where it went."

It provides clarity. A budget illuminates your spending habits, often revealing areas where you can easily cut back. It also makes sure there is sufficient cash flow for paying debt.

Understanding Your Spending Habits

The first step in any successful budget is understanding where your money is currently going. This involves tracking your income and expenses for a period, typically a month. There are numerous apps and tools available to simplify this process, from simple spreadsheets to sophisticated financial management platforms.

Many individuals are surprised to discover how much they spend on seemingly insignificant items like daily coffees, takeout lunches, or recurring subscriptions they no longer use. Identifying these “money leaks” is crucial for creating a budget that aligns with your goals.

Setting Financial Goals

A budget without goals is like a ship without a rudder. What are you saving for? A down payment on a house? Paying off debt? Early retirement? Defining your financial objectives provides the motivation and direction necessary to stick to your budget. According to a study by the Financial Planning Standards Council (FPSC), people with financial plans are significantly more likely to feel confident about their financial future.

Think of your goals as milestones. Each month that you stay within your budget brings you closer to achieving them. Small victories can build momentum and foster a sense of accomplishment, reinforcing positive financial habits.

The Benefits Beyond the Numbers

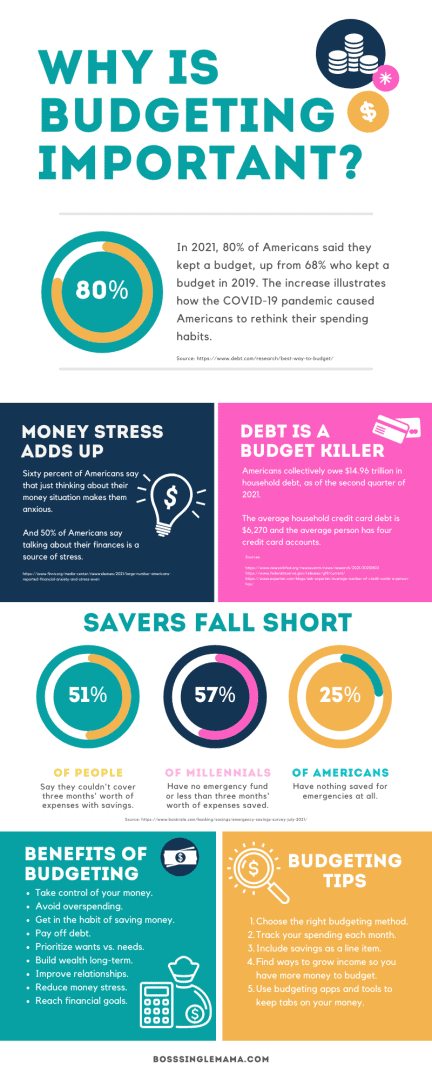

The advantages of budgeting extend far beyond simply tracking income and expenses. It can reduce stress, improve relationships, and even enhance your overall sense of well-being.

Financial stress is a major contributor to anxiety and depression. When you have a budget in place, you are less likely to worry about money because you have a clear plan for managing it. This increased sense of control can lead to greater peace of mind and improved mental health.

Improved Relationships

Money is a frequent source of conflict in relationships. A shared budget can create transparency and open communication, fostering a sense of teamwork and collaboration. It makes it easier to discuss financial goals and make joint decisions about spending, reducing the likelihood of disagreements and resentment.

Budgeting promotes financial accountability, each partner is able to understand how the other party manages his/her money.

Building a Secure Future

Budgeting is not just about managing your money today; it's about building a secure financial future. By consistently saving and investing, you can accumulate wealth over time and achieve long-term financial independence.

Having a budget also allows you to anticipate and prepare for unexpected expenses, such as car repairs or medical bills. This preparedness can prevent you from going into debt and further destabilizing your finances.

Embracing the Budgeting Mindset

Budgeting is a skill that can be learned and improved over time. Don't be discouraged if you don't get it perfect right away. The key is to start small, be consistent, and adjust your budget as needed.

Remember, a budget is a tool to help you achieve your goals. It’s not a punishment or a restriction. It is a journey of personal growth and empowerment, and one that can lead to a brighter, more secure financial future. Take the first step today, and discover the freedom that comes with taking control of your money.