Why Is Hemp Inc Stock So Low

The saga of Hemp, Inc. (OTC: HEMP) is a stark reminder of the volatility and inherent risks within the burgeoning cannabis and hemp industries. Once a darling of penny stock traders, promising untold riches from the "green rush," the company's stock now languishes at fractions of a cent. This dramatic fall from grace begs the question: what forces have conspired to bring Hemp, Inc. to this point?

This article delves into the multifaceted reasons behind Hemp, Inc.'s persistent low stock price. The analysis includes scrutinizing its financial performance, dissecting its business strategy and market position, and examining the broader context of the hemp industry's evolving landscape. It also considers the impact of regulatory hurdles and past controversies that have dogged the company. The goal is to provide a balanced and informed perspective on the challenges facing Hemp, Inc. and the prospects for its future.

Financial Performance and Operational Challenges

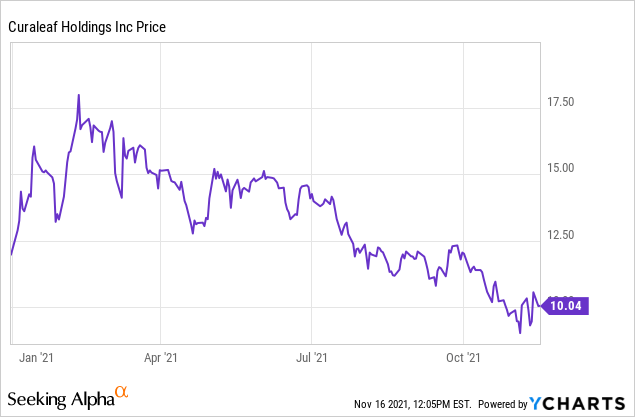

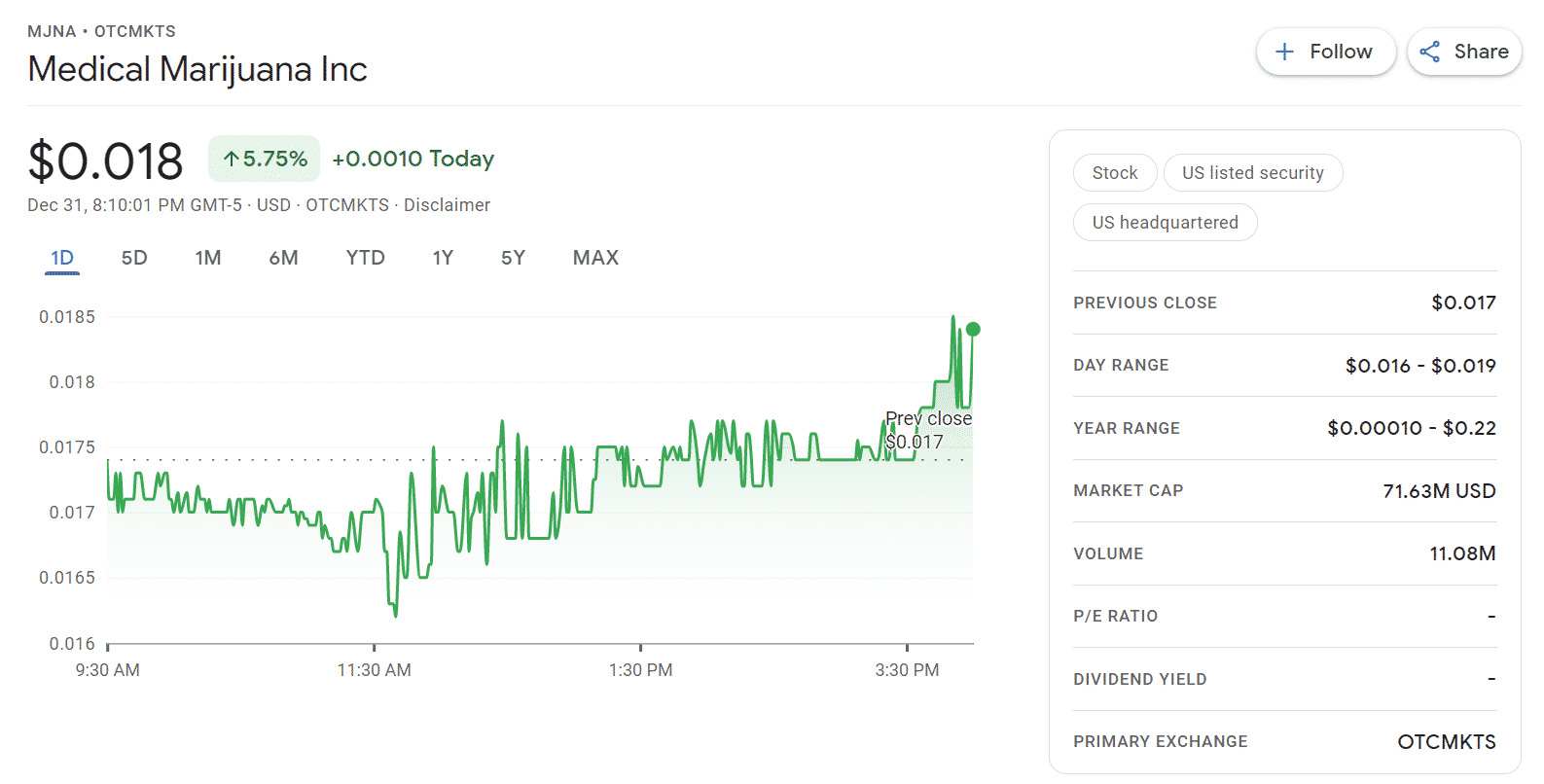

Hemp, Inc.'s financial history reveals a persistent struggle to translate early hype into sustained profitability. SEC filings paint a picture of fluctuating revenues, significant operating losses, and a heavy reliance on equity financing. This pattern has led to substantial shareholder dilution, further depressing the stock price.

For example, recent quarterly reports have shown revenues failing to meet investor expectations. These revenues are consistently overshadowed by high operating expenses. The company's ability to achieve consistent and meaningful revenue growth remains a major concern for investors.

Beyond the numbers, operational challenges have also contributed to the stock's decline. Delays in project execution, shifts in strategic focus, and difficulties in securing necessary permits have plagued the company's efforts. These issues have eroded investor confidence and raised questions about management's ability to deliver on its promises.

Market Position and Competition

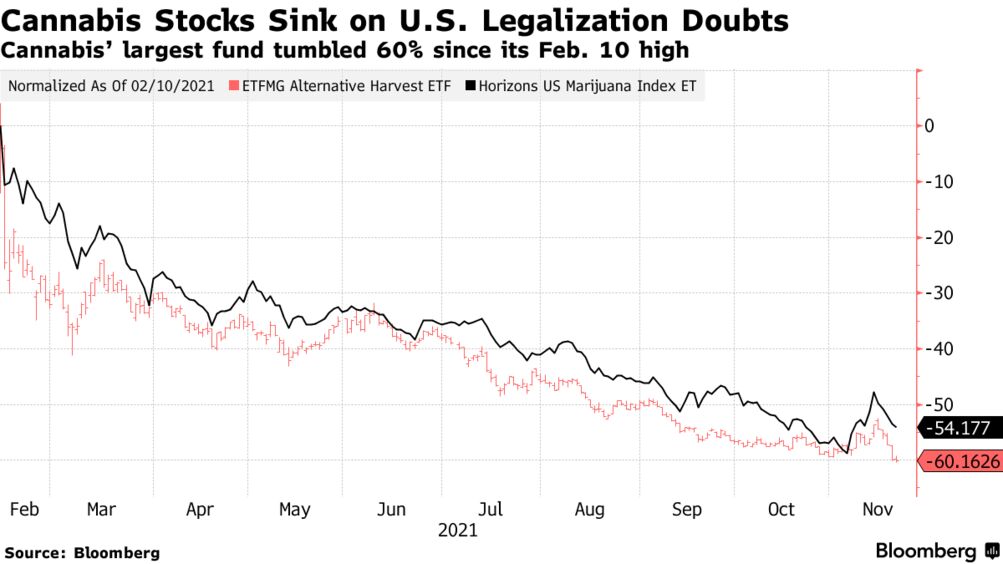

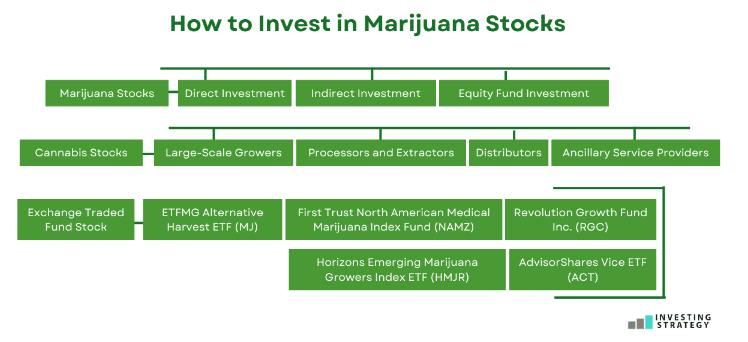

The hemp industry, despite its potential, is fiercely competitive. Numerous companies are vying for market share in various segments, including CBD products, industrial hemp applications, and hemp-based construction materials. Hemp, Inc. faces stiff competition from established players with deeper pockets and more robust distribution networks.

Hemp, Inc.’s first-mover advantage has been diminished by the rapid proliferation of competitors. These competitors often possess superior marketing capabilities and more efficient production processes. This intensifying competition puts downward pressure on prices and further strains Hemp, Inc.'s profitability.

Furthermore, changing consumer preferences and evolving market trends require companies to adapt quickly. Hemp, Inc.'s ability to innovate and maintain a competitive edge in this dynamic environment is crucial for its long-term survival.

Regulatory Hurdles and Legal Battles

The regulatory landscape surrounding hemp and CBD products remains complex and often unclear. Federal, state, and local regulations vary significantly, creating uncertainty and compliance challenges for companies operating in this space. Hemp, Inc. has faced its fair share of regulatory hurdles and legal battles, which have negatively impacted its stock price.

For instance, the Food and Drug Administration's (FDA) stance on CBD has been a major source of uncertainty. The lack of clear regulatory guidelines has hampered the development of a stable and predictable market for CBD products. This situation has created challenges for Hemp, Inc., which has invested heavily in this area.

Past legal disputes and regulatory investigations have also taken a toll on the company's reputation and financial resources. These events have fueled investor skepticism and contributed to the persistent low stock price.

Past Controversies and Reputation

Hemp, Inc. has been embroiled in several controversies over the years, including allegations of misleading promotional campaigns and questionable financial practices. These incidents have damaged the company's reputation and eroded investor trust. Regaining that trust will be a long and arduous process.

Online forums and social media platforms are rife with negative commentary about the company. This negative sentiment reflects a deep-seated distrust among some investors. Overcoming this perception is critical for Hemp, Inc.'s future success.

The company's association with David Tobias, formerly known as Bruce Perlowin, has also drawn scrutiny. His past legal troubles have raised questions about the company's leadership and governance.

Reverse Stock Splits and Dilution

Hemp, Inc. has implemented several reverse stock splits in an attempt to artificially inflate its stock price and maintain exchange listing requirements. However, these measures have often had the opposite effect, further depressing the stock price and eroding shareholder value.

Reverse stock splits reduce the number of outstanding shares while increasing the price per share. But without underlying improvements in the company's financial performance, this strategy is often unsustainable. They also signal to investors that the company is struggling and may need to raise capital through further stock offerings.

The constant dilution of shares to raise capital has been a recurring theme in Hemp, Inc.'s history. This dilution disproportionately affects existing shareholders, reducing their ownership stake and further suppressing the stock price.

The Future of Hemp, Inc.

The future of Hemp, Inc. remains uncertain. Whether the company can successfully navigate the challenges it faces and turn its fortunes around depends on several factors. These factors include its ability to improve its financial performance, adapt to the evolving market landscape, and regain investor trust.

If Hemp, Inc. can demonstrate sustainable revenue growth, streamline its operations, and effectively manage its debt, it may have a chance to recover. However, the road ahead is fraught with obstacles, and the company must overcome significant hurdles to achieve long-term success.

Ultimately, the fate of Hemp, Inc.'s stock price hinges on its ability to execute its business strategy effectively and deliver tangible results to its shareholders. Investors are likely to remain cautious until the company can demonstrate a clear path to profitability and sustainability.

:max_bytes(150000):strip_icc()/YTDCanadianMarijuanaStockReturn5-5-221-c246c18b06ca46fcbad6d4ba2600d5cc.png)