Why Is Rtx Stock Down Today

Imagine a bustling airport, planes taking off and landing, the hum of jet engines a constant background noise. Now, imagine the intricate systems that keep those planes safely in the air: the advanced avionics, the precise communication tools, the reliable engines. Many of these critical components come from Raytheon Technologies (RTX), a giant in the aerospace and defense industry. But today, the mood surrounding RTX stock seems a little less buoyant, a little less like a smooth takeoff and more like navigating some unexpected turbulence.

The stock price of RTX has experienced a noticeable dip, prompting investors and industry analysts alike to scrutinize the underlying causes. This article delves into the factors contributing to the current downward pressure on RTX stock, examining recent events, financial reports, and broader market trends to provide a comprehensive understanding of the situation.

Understanding Raytheon Technologies

Before diving into the specifics of today’s stock performance, it's crucial to understand the scope and significance of Raytheon Technologies. Formed in 2020 through the merger of Raytheon Company and United Technologies Corporation, RTX is a major player in both the aerospace and defense sectors.

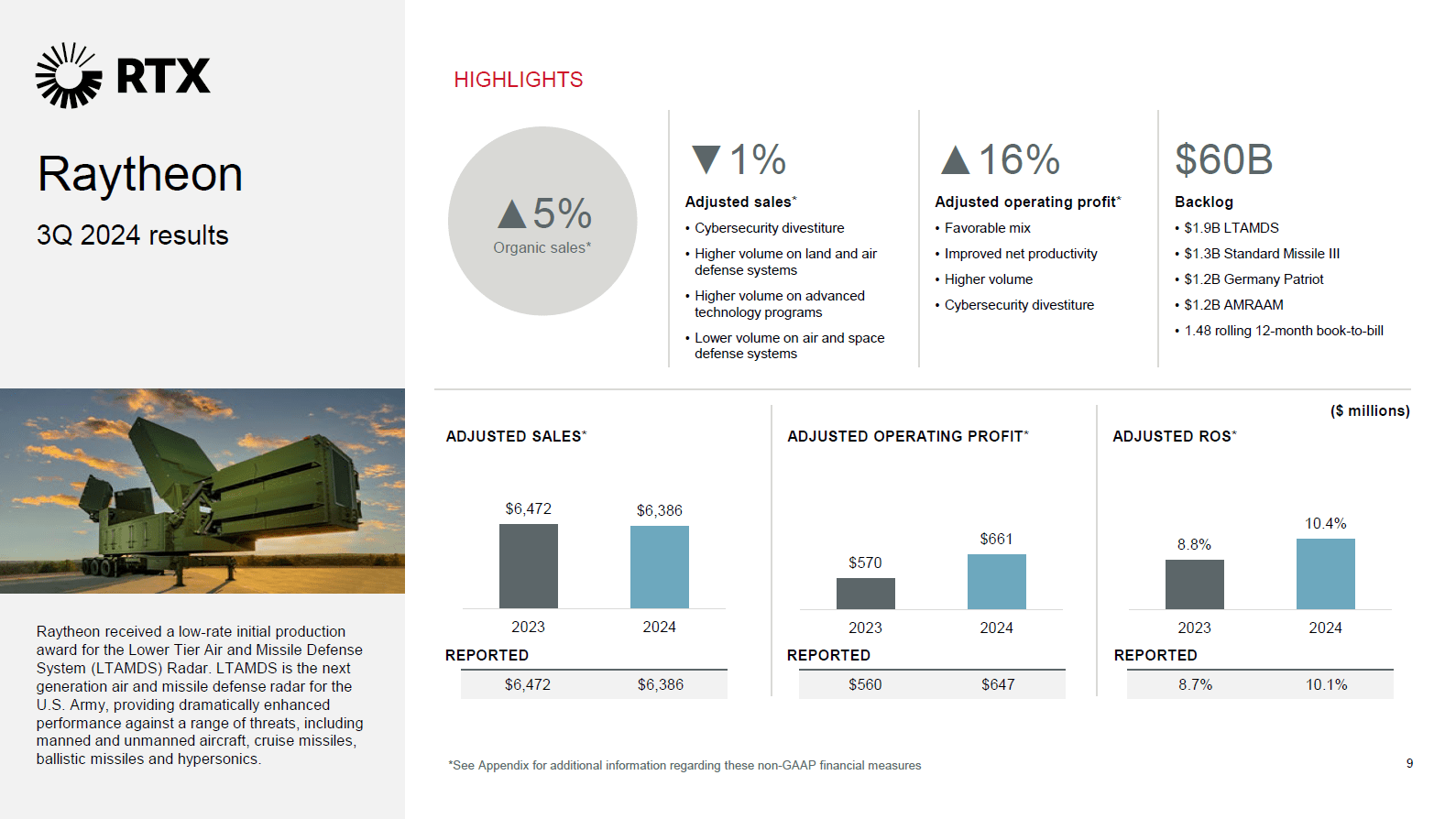

The company operates through three primary segments: Collins Aerospace, Pratt & Whitney, and Raytheon. Collins Aerospace provides technologically advanced systems for commercial and military aircraft. Pratt & Whitney is a leading manufacturer of aircraft engines, while Raytheon specializes in defense and cybersecurity solutions.

Recent Events Impacting RTX Stock

Several recent events appear to be influencing the stock's trajectory. A significant factor is the recent recall and inspection of Pratt & Whitney's PW1100G-JM engines, used in Airbus A320neo aircraft.

This recall stems from a potential issue with contaminated powder metal, which could lead to engine failure. The inspection and replacement process is expected to be lengthy and costly. The financial implications of this recall are substantial, impacting RTX's near-term earnings and casting a shadow of uncertainty over future performance, as highlighted in the company's recent statements.

Furthermore, broader economic concerns are playing a role. Fears of a potential recession and rising interest rates have led to increased market volatility.

Investors are becoming more risk-averse, leading to a sell-off in various sectors, including aerospace and defense. The overall market sentiment impacts even fundamentally sound companies like RTX.

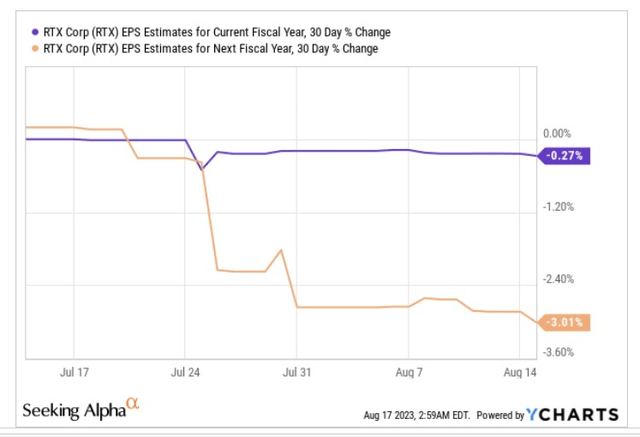

Financial Performance and Analyst Ratings

Recent financial reports offer further insight into the situation. While RTX has generally demonstrated strong performance, the projected costs associated with the engine recall have dampened investor enthusiasm.

Analysts are closely monitoring the situation, with some adjusting their ratings and price targets for the stock. Many maintain a positive long-term outlook, citing the company's robust order backlog and exposure to growing defense spending. However, they acknowledge the near-term challenges posed by the engine issue.

"The PW1100G-JM engine issue presents a significant headwind for RTX in the coming quarters," said a lead analyst at a prominent investment firm. "While we remain optimistic about the company's long-term prospects, we are adjusting our short-term expectations to account for the anticipated costs and disruptions."

These kinds of statements impact market confidence and influence stock valuation.

Supply Chain Constraints and Geopolitical Factors

Like many manufacturers, Raytheon Technologies has faced supply chain constraints in recent years. These disruptions, stemming from the COVID-19 pandemic and ongoing geopolitical tensions, have impacted production and increased costs.

While supply chain issues have eased somewhat, they continue to pose a challenge. Geopolitical factors, particularly the ongoing conflicts and heightened tensions around the globe, also influence RTX's business.

Increased defense spending driven by these tensions could ultimately benefit RTX. However, uncertainty surrounding these events can also create volatility in the stock market.

Looking Ahead: What's Next for RTX?

The future trajectory of RTX stock will depend on several key factors. Successfully managing the PW1100G-JM engine recall and minimizing its financial impact is paramount.

Continued growth in defense spending and strong execution on existing contracts will also be crucial. Monitoring broader economic trends and adapting to changing market conditions is necessary.

The company's ability to navigate these challenges and capitalize on its strengths will determine its long-term success.

Broader Market Context

It's also crucial to view RTX's situation within the broader market context. The aerospace and defense industry is subject to cyclical trends and external factors, like government policies and technological advancements.

Changes in government regulations and defense budgets can significantly impact companies like RTX. Furthermore, advancements in areas such as artificial intelligence and autonomous systems are transforming the industry landscape.

Raytheon Technologies needs to adapt to these changes and invest in innovation to maintain its competitive edge.

Investor Sentiment and Risk Tolerance

Investor sentiment plays a crucial role in stock market dynamics. News headlines, social media buzz, and overall market psychology can all influence buying and selling decisions.

In times of uncertainty, investors often become more risk-averse and gravitate towards safer assets. Understanding the psychological factors driving market behavior is as important as analyzing financial data.

It influences investor perceptions and therefore stock prices.

Conclusion: Navigating the Turbulence

The dip in RTX stock today is a confluence of factors, ranging from specific company challenges like the engine recall to broader economic and geopolitical concerns. While the near-term outlook may appear turbulent, the underlying strength of Raytheon Technologies and its position in critical industries suggest resilience.

The company's innovative technologies and significant role in aerospace and defense continue to be important. For investors, navigating this situation requires a balanced perspective: acknowledging the current challenges while remaining mindful of the company's long-term potential and the broader forces shaping the market. It’s about understanding that even the most seasoned pilots sometimes encounter turbulence, but with careful navigation and a steady hand, they can chart a course towards smoother skies.

:max_bytes(150000):strip_icc()/RTX_2025-01-28_10-46-53-3ebf02a7f5d543d4bab9df7070ff9709.png)