Will Chase Let You Overdraft At Atm

Chase Bank customers attempting to withdraw cash at ATMs may face unexpected overdraft fees if their account balance is insufficient. A change in policy and recent customer experiences suggest overdraft protection might not always extend to ATM withdrawals, creating potential financial pitfalls.

This article breaks down the current state of Chase's ATM overdraft policies, clarifying when you can expect protection and when you might face a fee, aiming to equip customers with the knowledge to avoid these charges.

ATM Overdrafts at Chase: What You Need to Know

The key question for Chase customers is: will you be allowed to overdraft your account at an ATM? The answer isn't always straightforward.

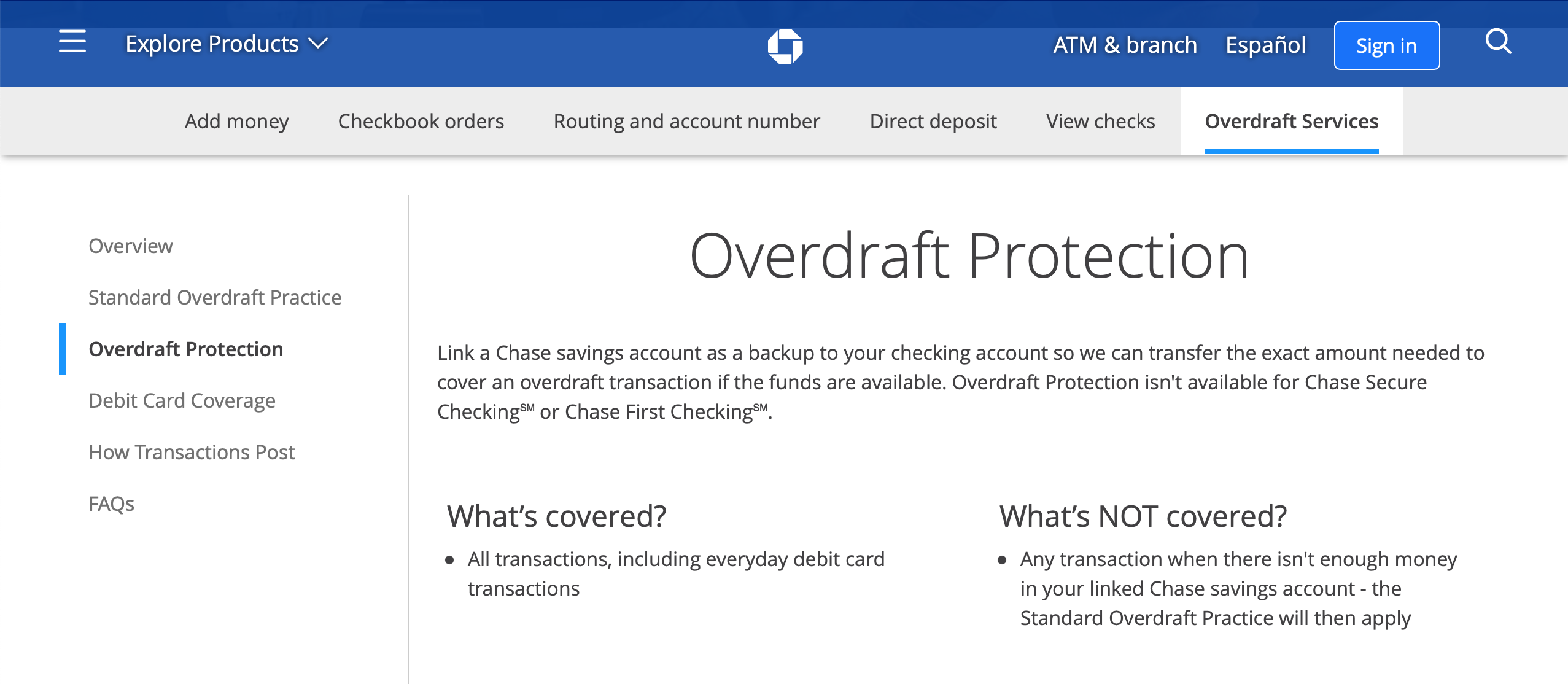

Traditionally, Chase's overdraft protection allows transactions to be approved even if your account balance is zero, up to a certain limit. However, ATM withdrawals appear to be treated differently than debit card purchases or checks in some instances.

Chase representatives state that customers enrolled in overdraft protection will generally have ATM withdrawals covered if they have linked backup accounts. If funds are available in the backup account, the transaction will go through and a transfer fee (typically $12.50) will be charged, but an overdraft fee (currently $34) will be avoided.

However, customer reports suggest that withdrawals can be denied even with overdraft protection. Some customers have found they are denied the transaction at the ATM if the funds are not directly available in their checking account, even if they have an eligible backup account for overdraft protection.

Factors Influencing ATM Overdraft Decisions

Several factors can determine whether Chase allows an ATM overdraft. These include your account history, the availability of backup accounts, and potentially, the specific ATM you're using.

Customers with a strong banking history at Chase may be more likely to have overdrafts approved. It is crucial to ensure that all backup accounts, such as savings accounts or credit lines, are properly linked to your checking account for overdraft protection.

The ATM itself might play a role. Older machines, or those with outdated software, may not always be fully integrated with the latest overdraft protection protocols.

Avoiding ATM Overdraft Fees

The simplest way to avoid overdraft fees is to monitor your account balance regularly. Chase's mobile app and online banking platform make this easy.

Sign up for low balance alerts. Chase offers alerts that notify you when your balance falls below a certain threshold, giving you time to transfer funds and avoid overdrafts.

Consider opting out of overdraft coverage. While this means transactions will be denied if you don't have sufficient funds, it prevents overdraft fees. Be aware that opting out may result in declined transactions at ATMs and points of sale.

Conflicting Information and Customer Experiences

The key issue is the inconsistency reported by users. Some Chase customers insist they were told by bank representatives that overdraft protection applies to ATM withdrawals.

Others report that even with the same overdraft protection setup, their ATM withdrawals were denied due to insufficient funds, resulting in a potentially stranded situation.

This disparity highlights a need for greater transparency and clearer communication from Chase regarding its ATM overdraft policies.

Moving Forward: What Can You Do?

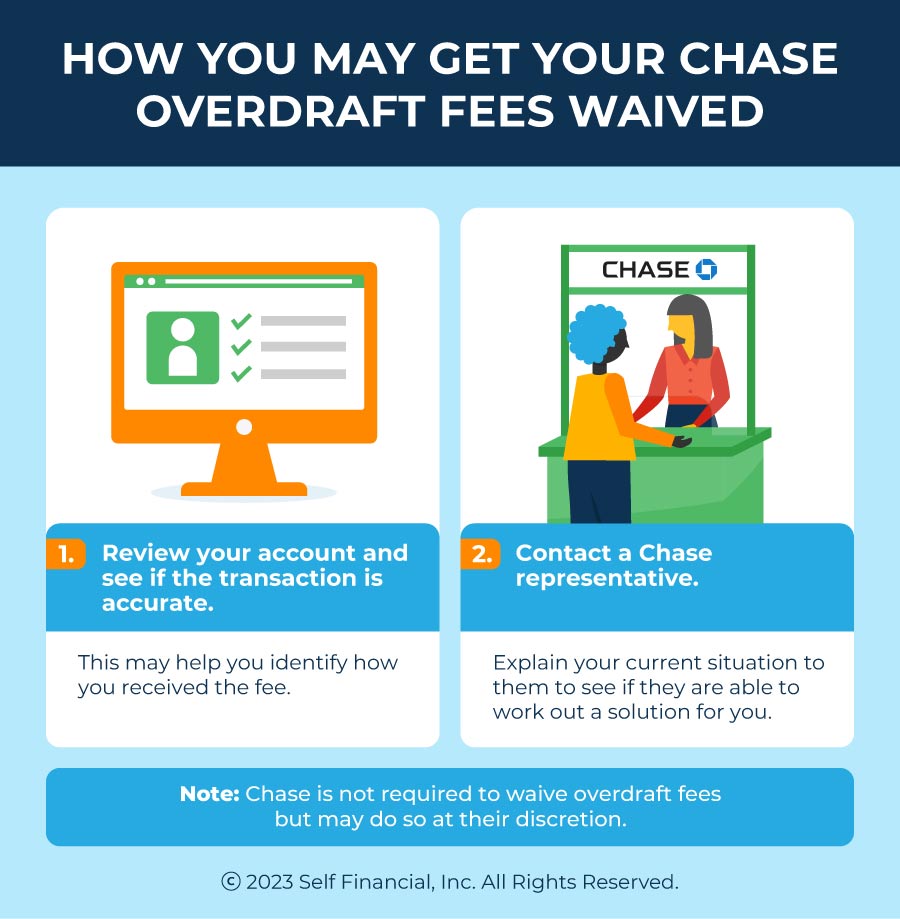

Chase customers should immediately contact their bank representative to clarify their personal overdraft protection settings. Request written confirmation of what overdraft services are active on their accounts.

Carefully review your account statements for any unexpected overdraft fees. If you believe you were wrongly charged, file a dispute with Chase immediately.

Monitor your account balance closely before attempting ATM withdrawals. Consider using alternative methods of obtaining cash, such as cash-back options at grocery stores, to avoid potential overdrafts.

:max_bytes(150000):strip_icc()/Primary-Image-best-banks-for-overdraft-protection-in-2023-7373737-021f64b189a5464e85a9bde5daf5a610.jpg)