Willis Towers Watson Q1 2025 Earnings Date

Imagine a crisp spring morning, the city awakening with a gentle hum. Sunlight streams through the towering glass windows of corporate headquarters. Inside, analysts and executives gather, anticipation hanging in the air like the aroma of freshly brewed coffee. The topic of their focused attention? The upcoming Q1 2025 earnings announcement from global advisory giant, Willis Towers Watson (WTW).

Willis Towers Watson is set to announce its first-quarter 2025 earnings on [Insert Date - e.g., April 29th, 2025], offering a crucial glimpse into the company's performance amidst evolving global market conditions. Investors, employees, and industry observers alike will be keenly watching to see if the firm can sustain its growth trajectory and deliver on its strategic objectives in a dynamic landscape. This earnings report is more than just numbers; it's a barometer of WTW's resilience and adaptability.

A Look Back: WTW's Recent Journey

Before diving into what Q1 2025 might hold, let's briefly revisit Willis Towers Watson's recent past. The company, formed through a significant merger, has navigated a complex integration process while simultaneously adapting to disruptions in the insurance, risk management, and human capital sectors.

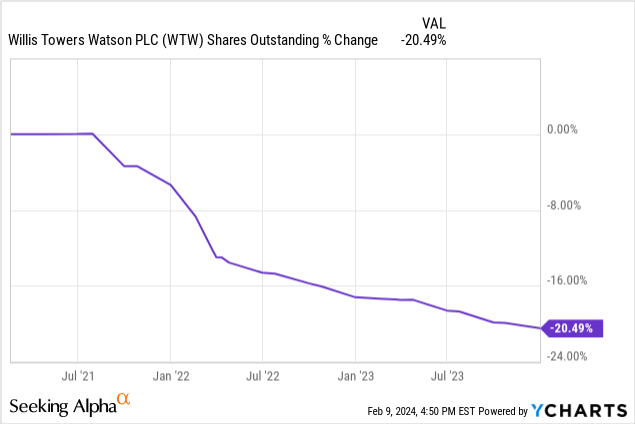

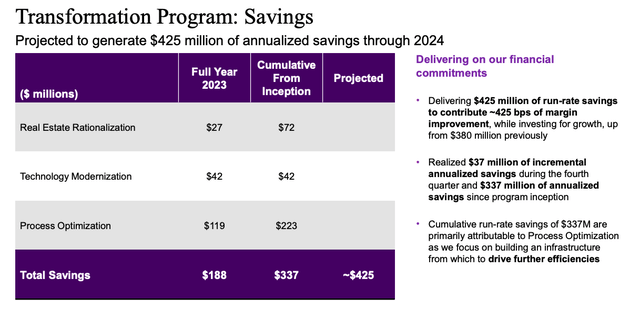

In recent years, WTW has focused on streamlining its operations, investing in technology, and enhancing its client offerings. Strategic acquisitions and divestitures have further shaped its portfolio, reflecting a commitment to high-growth areas and improved profitability.

The success of these efforts will likely be reflected, at least in part, in the upcoming Q1 earnings.

Factors Influencing Q1 2025 Performance

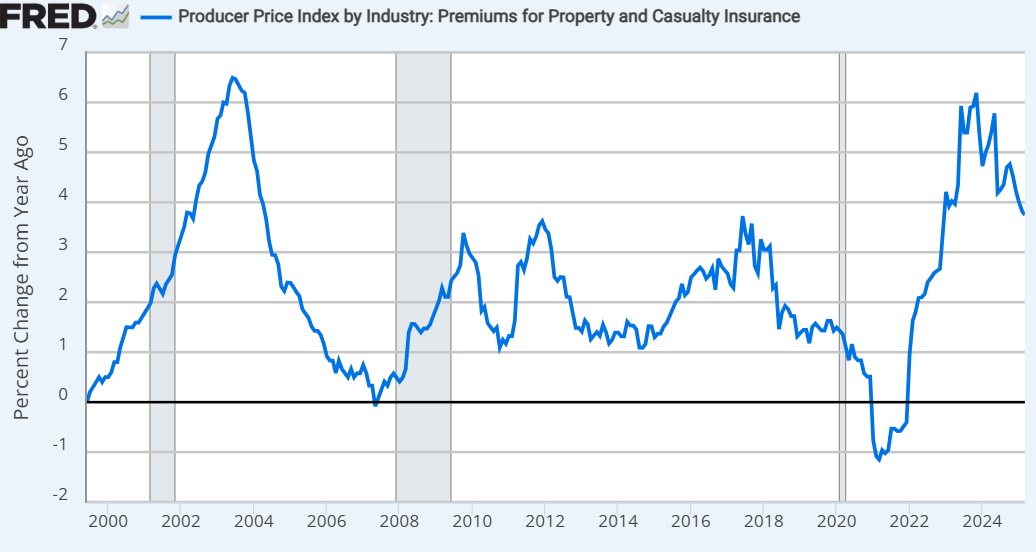

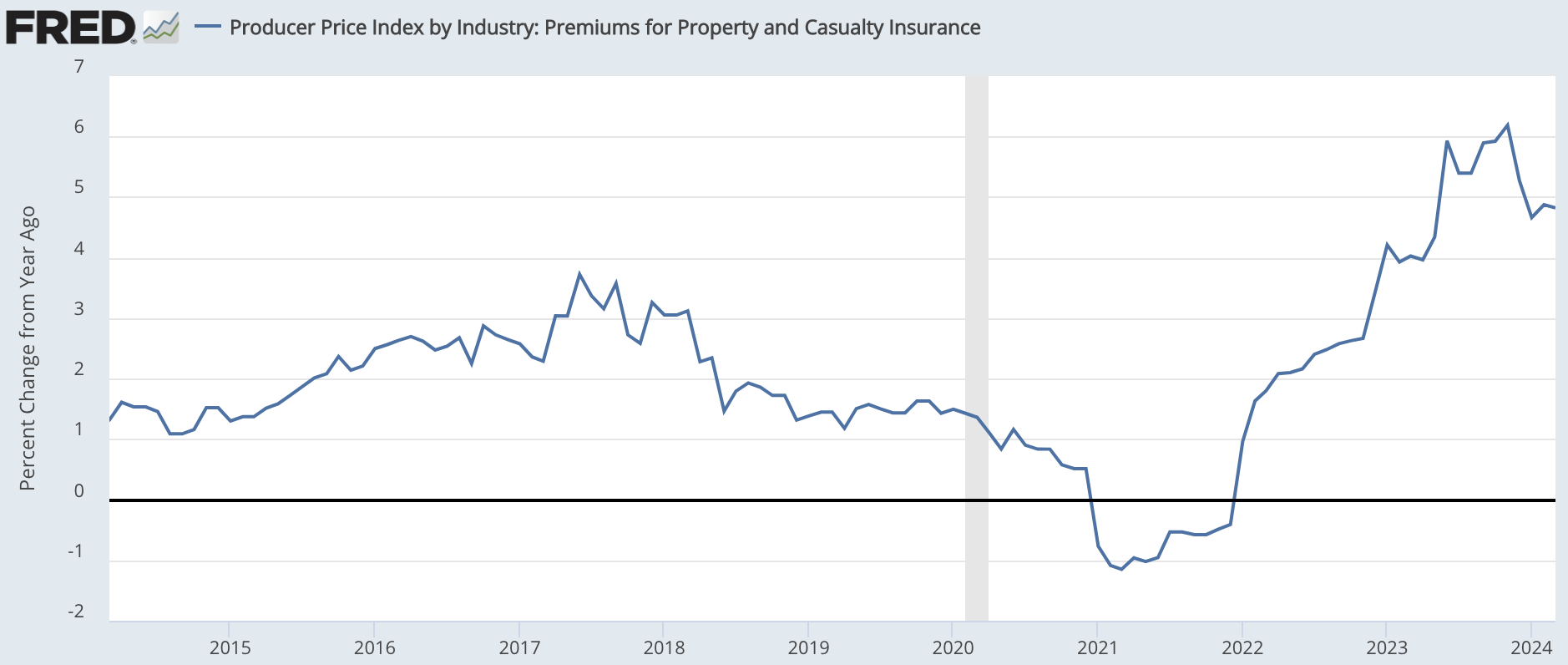

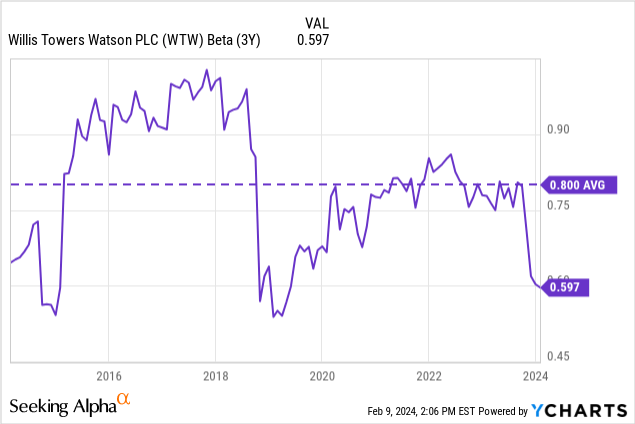

Several factors could significantly influence Willis Towers Watson's Q1 2025 performance. The global economic climate, characterized by fluctuating interest rates and inflationary pressures, plays a vital role.

Changes in regulatory environments, particularly in the insurance and reinsurance industries, can also impact WTW's revenue streams. Furthermore, the demand for risk management and human capital consulting services is closely tied to overall business confidence and investment levels.

The geopolitical landscape and potential for unexpected events always add an element of uncertainty, influencing risk appetites and demand for WTW's expertise.

Key Areas to Watch

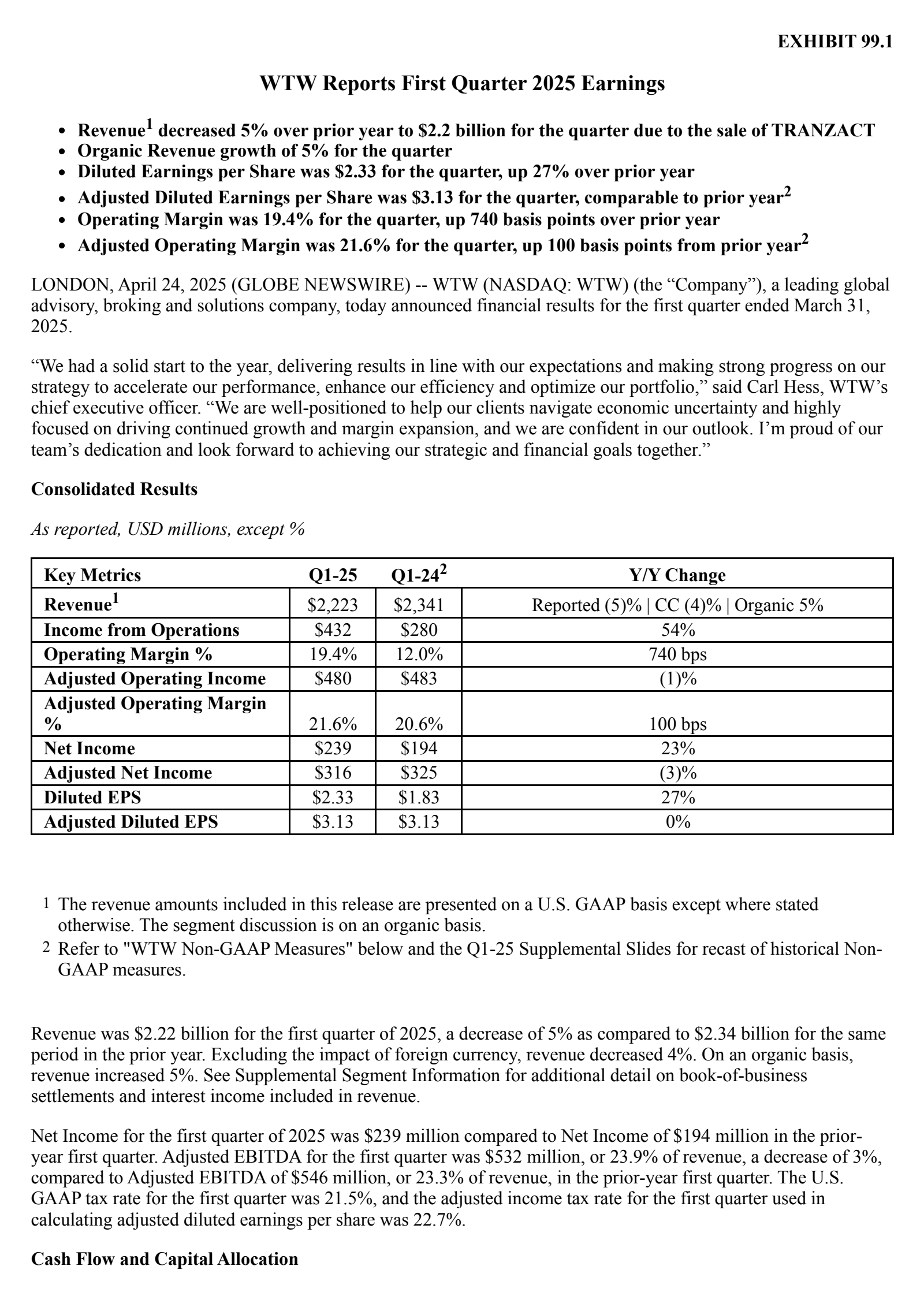

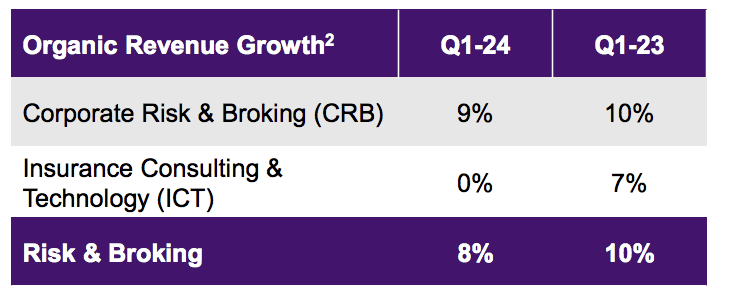

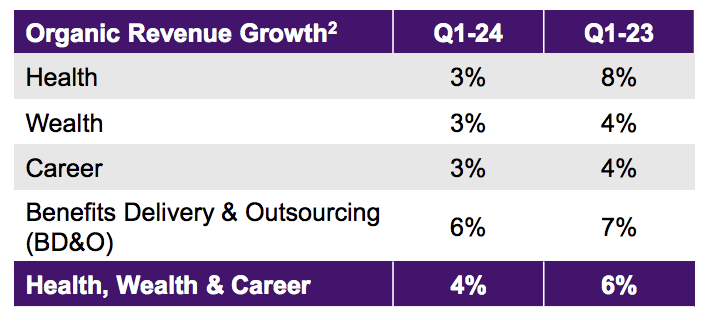

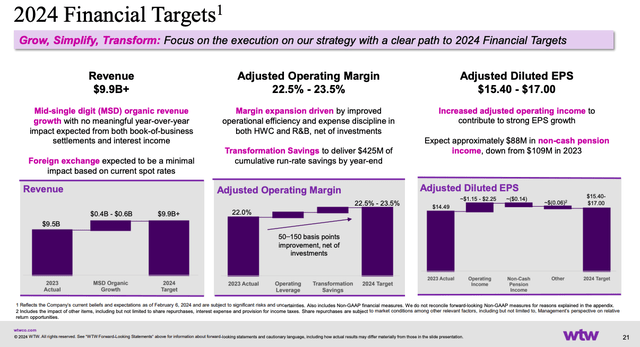

Analysts will be paying close attention to several key metrics within the Q1 2025 earnings report. Organic revenue growth, a measure of WTW's underlying business strength, will be a primary focus. It provides insight into the company's ability to generate revenue from existing operations, excluding the impact of acquisitions or currency fluctuations.

Profit margins are also critical, reflecting WTW's efficiency in managing its costs and converting revenue into profit. Any improvements in profit margins would signal effective cost control measures and successful pricing strategies.

New business wins and client retention rates will offer further clues about WTW's competitive positioning and its ability to attract and retain clients in a competitive market.

Furthermore, the earnings call following the report will be invaluable for understanding management's outlook on the rest of the year. Investor relations website for Willis Towers Watson will also provide a useful source of this information.

The Significance of Technology and Innovation

In today's rapidly evolving business landscape, technology and innovation are paramount. Willis Towers Watson has been investing heavily in digital solutions and data analytics to enhance its service offerings and improve operational efficiency.

These investments aim to provide clients with more insightful risk assessments, personalized advice, and streamlined processes. The extent to which these investments are yielding tangible results will likely be evident in the Q1 2025 earnings.

Expect questions on the earnings call about AI and its potential impact on WTW's business.

Industry Perspectives and Analyst Expectations

Industry analysts have offered various perspectives on what to expect from Willis Towers Watson's Q1 2025 earnings. Some anticipate continued growth, driven by strong demand for risk management and human capital solutions.

Others express caution, citing the challenging economic environment and potential headwinds from regulatory changes. The consensus view generally points to steady performance, but with a keen eye on cost management and organic growth.

Market sentiment leading up to the earnings release will also play a crucial role in shaping investor reactions.

Beyond the Numbers: WTW's Broader Impact

Willis Towers Watson's performance extends beyond mere financial metrics. As a leading global advisory firm, WTW plays a significant role in helping organizations navigate complex risks and optimize their human capital strategies.

Its work impacts businesses of all sizes, across various industries, contributing to economic stability and growth. The company's commitment to sustainability and responsible business practices also adds another layer of significance to its operations.

WTW's consulting services help companies improve their own ESG performance.

Looking Ahead: Challenges and Opportunities

The road ahead for Willis Towers Watson is paved with both challenges and opportunities. The company faces ongoing competition from other consulting firms and insurance brokers, requiring it to continuously innovate and differentiate its offerings.

The evolving needs of clients, particularly in areas such as cybersecurity and climate risk, also present opportunities for growth. By effectively addressing these challenges and capitalizing on emerging opportunities, WTW can solidify its position as a leader in the global advisory space.

The Q1 2025 earnings will provide valuable insights into the company's progress in navigating this dynamic landscape.

Conclusion: A Moment of Reflection

As the clock ticks down to the Q1 2025 earnings announcement, the atmosphere around Willis Towers Watson is one of careful optimism. This report is more than a snapshot of the past quarter; it is a signpost pointing toward the future. It reflects not only the hard work and strategic decisions of the company's leadership but also the broader economic forces shaping the global business environment.

Whether the numbers exceed expectations or fall short, the true value lies in the insights gained and the lessons learned. These are the tools that Willis Towers Watson will use to navigate the complexities of the future and continue to deliver value to its clients, employees, and shareholders.

The future of WTW and their growth is one to look forward to.

/Willis Towers Watson Public Limited Co phone-by viewimage by Shutterstock.jpg)