Xrp Etf Launch April 2024 Blackrock Grayscale

Breaking: A potential XRP Exchange-Traded Fund (ETF) launch is generating significant buzz with rumors pointing towards an April 2024 release, potentially involving asset management giants BlackRock and Grayscale. This development could revolutionize access to XRP for both retail and institutional investors.

The introduction of an XRP ETF would mark a watershed moment for the cryptocurrency, potentially unlocking billions in new investment and signaling a growing acceptance of digital assets within traditional financial markets.

The Rumor Mill Churns: BlackRock and Grayscale in the Mix?

Speculation regarding a potential XRP ETF launch in April 2024 has intensified, fueled by unconfirmed reports linking BlackRock and Grayscale to the initiative.

While neither firm has officially confirmed their involvement, industry analysts are closely monitoring their movements and pronouncements for any indication of their plans.

The presence of either of these major players would lend significant credibility and weight to the potential XRP ETF.

What We Know: Confirmed Facts About XRP ETF Prospects

Currently, there are no officially approved XRP ETFs in the United States.

The SEC has yet to approve any spot XRP ETF applications, although the success of Bitcoin ETFs suggests a shift in regulatory attitudes towards cryptocurrency-based investment vehicles.

Ripple's ongoing legal battle with the SEC, concerning whether XRP constitutes a security, has been a major hurdle to any ETF approval.

Ripple vs. SEC: A Crucial Factor

The outcome of the Ripple vs. SEC lawsuit remains a critical determinant for the viability of an XRP ETF.

A favorable ruling for Ripple would significantly increase the likelihood of the SEC approving an XRP ETF, removing a key legal overhang.

Conversely, an unfavorable ruling could indefinitely delay or even preclude the launch of such a fund.

Grayscale's Position: A Ready-Made Vehicle?

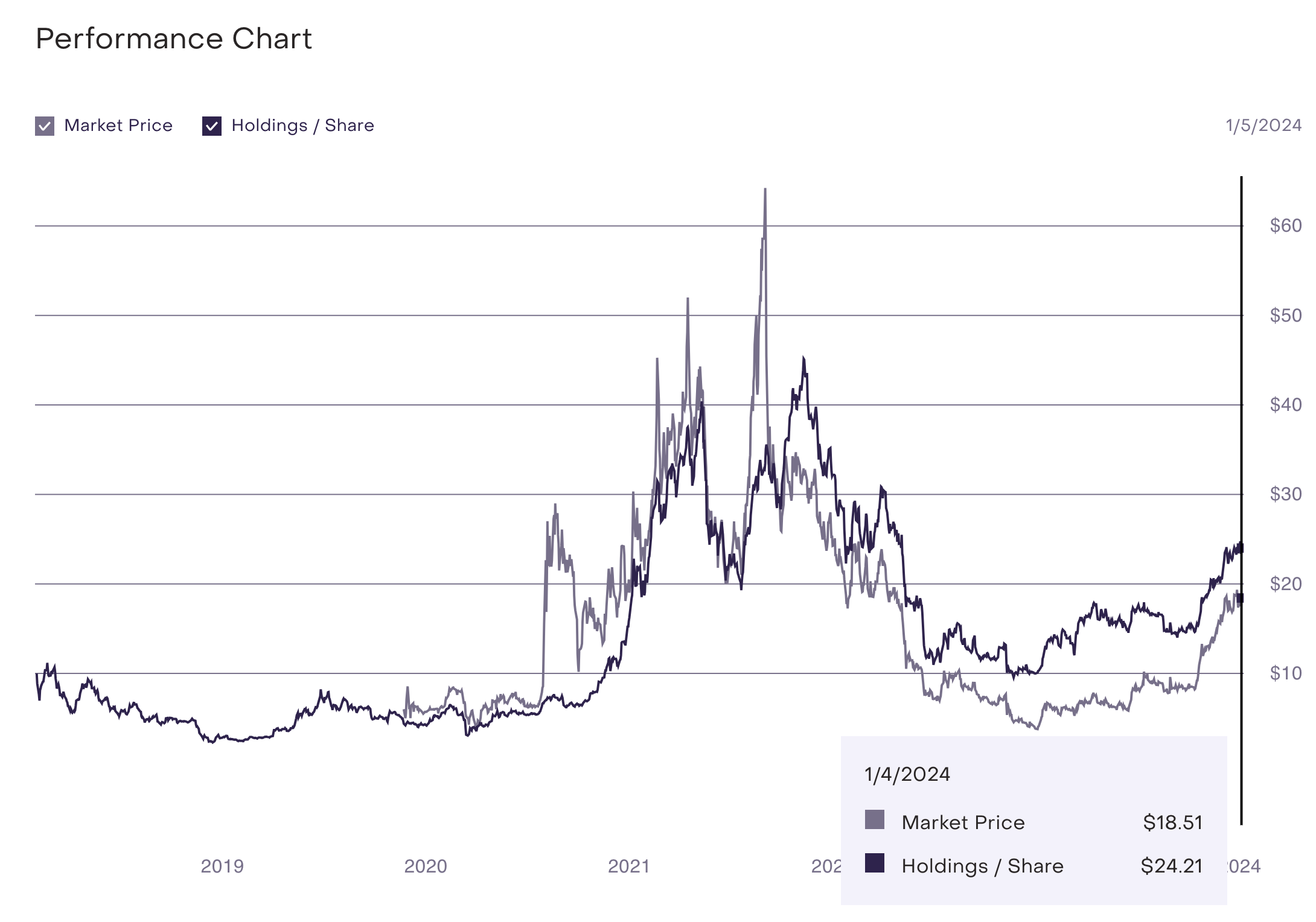

Grayscale, known for its cryptocurrency investment products, is closely watched given its existing trust structure for XRP.

The possibility of converting the Grayscale XRP Trust (GXRP) into an ETF, similar to its successful conversion of the Bitcoin Trust (GBTC), is a subject of much discussion.

This conversion path offers a potentially faster and more efficient route to an XRP ETF.

BlackRock's Interest: A New Frontier?

BlackRock, the world's largest asset manager, has already ventured into the cryptocurrency space with a Bitcoin ETF.

Their potential entry into the XRP ETF market would signal a further expansion of their digital asset offerings and a growing confidence in the long-term viability of cryptocurrencies.

However, any involvement from BlackRock remains purely speculative at this time.

Who Stands to Benefit? Potential XRP ETF Impact

The launch of an XRP ETF would likely benefit a wide range of stakeholders.

Individual investors would gain easier access to XRP through a regulated and familiar investment vehicle.

Institutional investors, previously hesitant due to regulatory concerns, could allocate capital to XRP through an ETF.

Furthermore, Ripple, the company behind XRP, could see increased adoption and legitimacy for its technology.

April 2024: Is the Launch Date Realistic?

The rumored April 2024 launch date remains unconfirmed and should be treated with caution.

Regulatory approval processes, especially those involving the SEC, can be lengthy and unpredictable.

Several factors, including the outcome of the Ripple case and the SEC's evolving stance on cryptocurrency ETFs, will influence the timeline.

What's Next: Monitoring Key Developments

Investors and industry observers should closely monitor several key developments in the coming weeks and months.

These include any official announcements from BlackRock, Grayscale, or Ripple regarding an XRP ETF.

Furthermore, progress in the Ripple vs. SEC lawsuit will be crucial in shaping the future of XRP and its potential for ETF inclusion.

The SEC's stance on similar applications will be a key indicator.

Stay tuned for further updates as this story develops.