Why Is The Yen Getting Stronger

The Yen's Got Game! Why is Japan's Currency Suddenly Showing Off?

Ever heard someone say the Yen is flexing its muscles? It's true! The Japanese currency has been doing some financial gymnastics lately. What's behind this surprising show of strength?

Think of the currency market as a giant tug-of-war. Lots of forces are pulling and pushing. Understanding those forces is like unlocking a secret code!

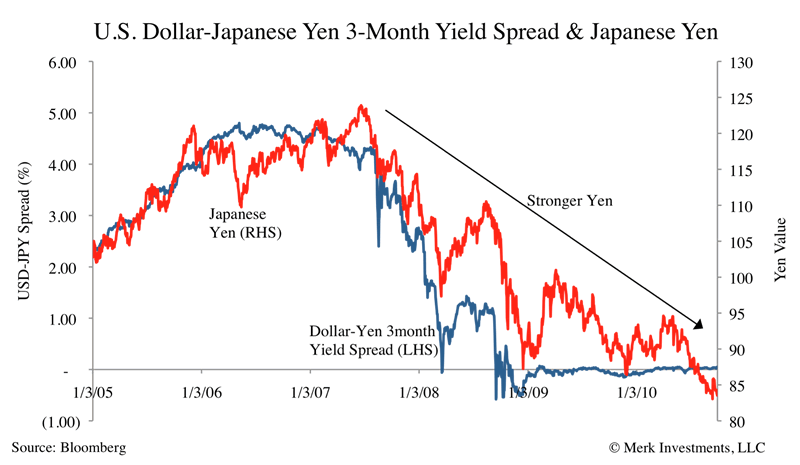

The Interest Rate Tango

Interest rates play a big role. Imagine them as the beat of the financial world. When interest rates in Japan go up, holding Yen becomes more attractive.

It’s like suddenly offering a better return on your savings account. People want to get in on that action! This increased demand can lead to a stronger Yen.

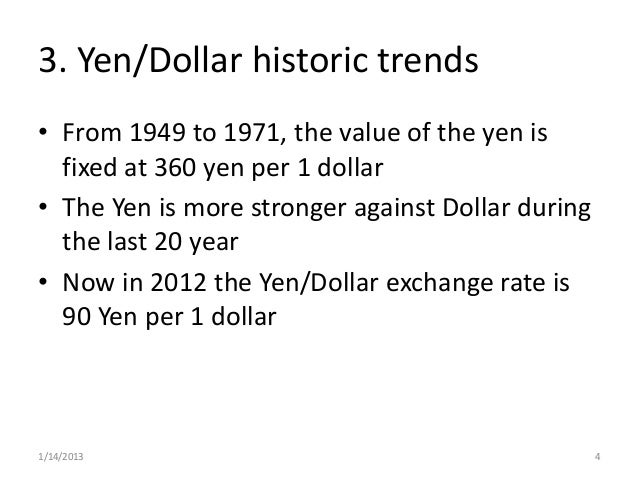

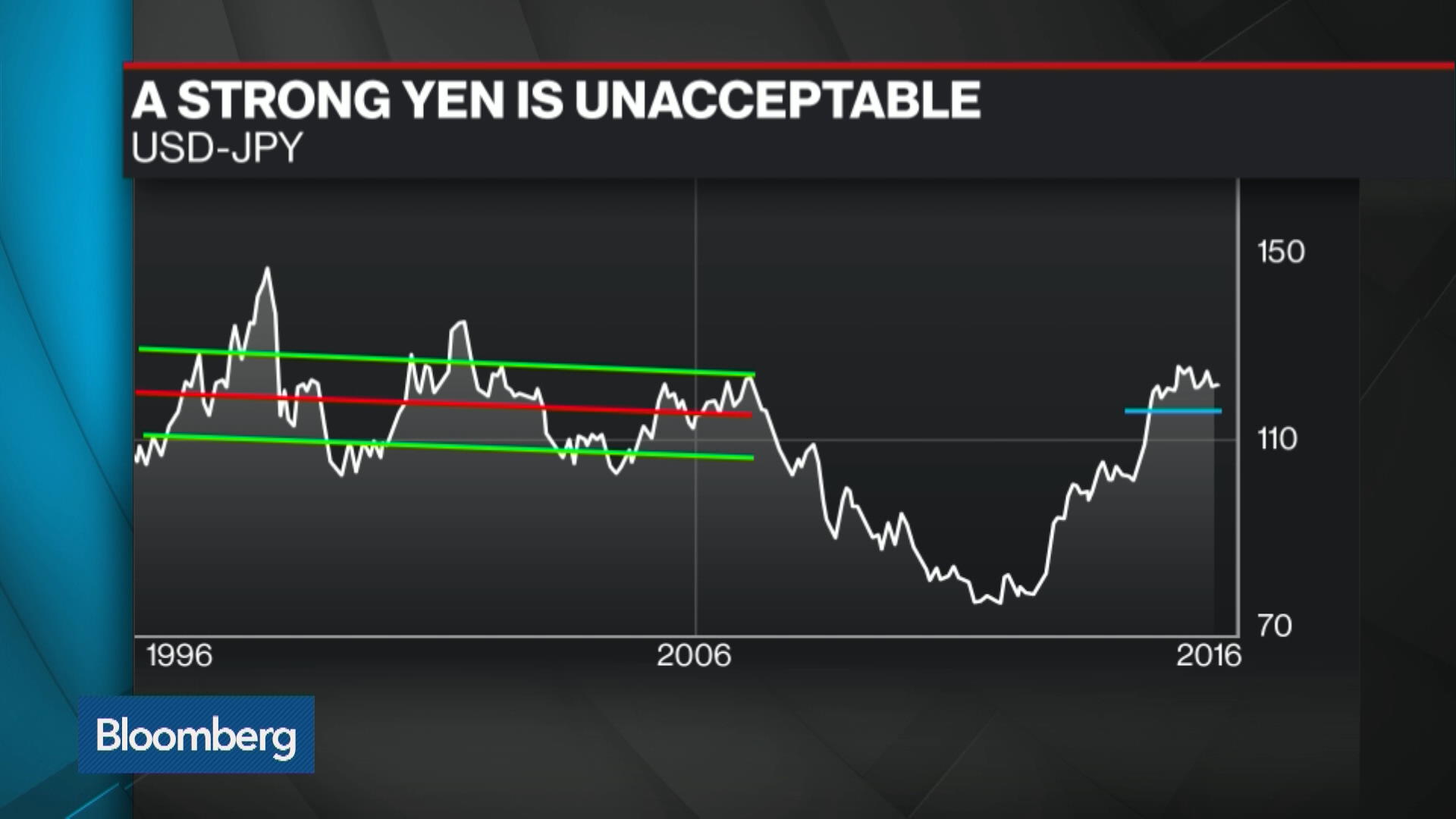

For a long time, Japan kept its interest rates super low. Now, there's speculation they might nudge them higher. This anticipation alone can give the Yen a boost.

America's Role in the Drama

What happens in the U.S. matters a lot. The U.S. economy and the Federal Reserve (the Fed) heavily influence global finance. If the Fed decides to cool its jets on raising interest rates, the Yen could benefit.

A less aggressive Fed makes the dollar less appealing. This gives other currencies, including the Yen, some breathing room to potentially strengthen.

Safe Haven Shenanigans

Sometimes, the world gets a little… squirrelly. When there's economic uncertainty or geopolitical tension, investors seek safe havens. The Yen often gets a reputation as one of these safe harbors.

It is believed that during turmoil, people flock to the Yen as a stable place to park their money. That increased demand drives up its value. The Yen becomes the financial equivalent of a cozy blanket during a thunderstorm.

The Speculation Station

Don’t forget the speculators! These are the folks who try to predict where currencies are headed. If they believe the Yen will rise, they'll buy it. This buying pressure can further amplify its strength.

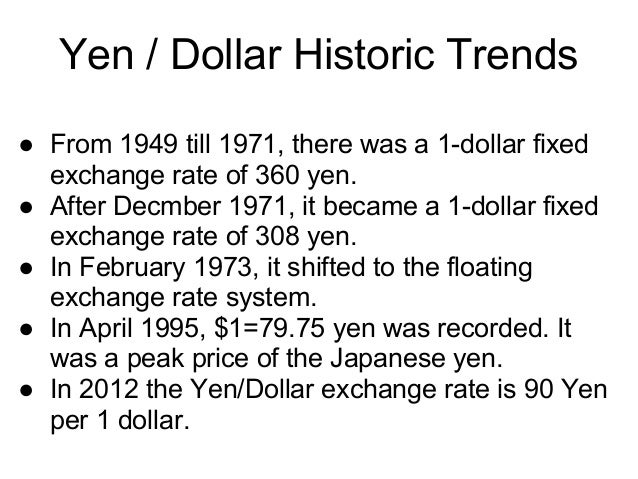

What Makes the Yen so Special?

Japan has a huge economy. It's a major exporter and a significant global player. This economic heft gives the Yen some serious weight.

Also, Japan has historically run a current account surplus. This means it exports more than it imports. This creates a natural demand for the Yen.

Why Should You Care?

A stronger Yen can impact everything from the price of Japanese goods to the performance of the stock market. If you're planning a trip to Japan, a stronger Yen means things might be a bit more expensive.

It’s all interconnected! Global finance is like a giant spider web. Pull one thread, and the whole thing vibrates.

The Bottom Line

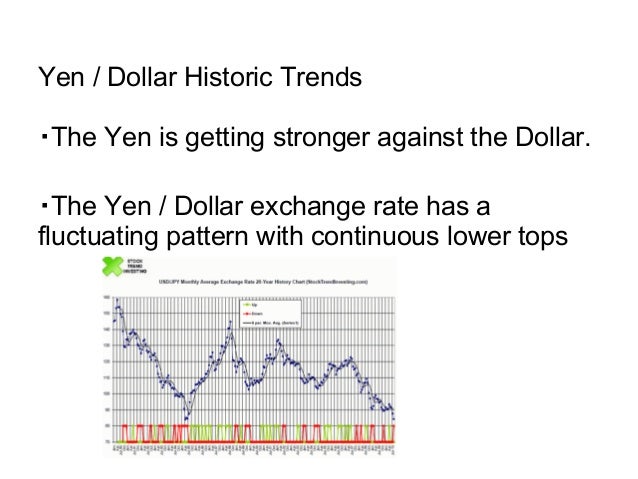

The Yen's strength is a result of a complex interplay of factors. Interest rates, U.S. monetary policy, safe-haven demand, and speculation all contribute. It's a financial dance with many partners.

So, the next time you hear about the Yen making moves, remember this: it's not just about numbers. It's about the story the numbers tell! It's the economy showing off.

Keep an eye on the Bank of Japan and the Federal Reserve. Their decisions will be important! Consider the risk sentiment. Are investors feeling confident or cautious? These are the clues to understanding the Yen's next act.

Ultimately, predicting the future of any currency is tough. But understanding the factors at play makes it a fascinating show to watch!