Best Account Software For Small Business

Drowning in spreadsheets? Are you a small business owner who winces at the mere mention of "accounting software?" Let's face it: every penny counts. We're digging into the best accounting software options that won't break the bank. This guide is for the cost-conscious entrepreneur.

Accounting software is a necessary evil. But with the right tools, you can automate tasks, track expenses, and even get ahead on taxes. Forget about expensive CPAs – at least for now!

Shortlist: Accounting Software for Every Budget

The Bare-Bones Bargain: Wave

Free accounting, invoicing, and basic reporting. Ideal for freelancers and very small businesses.

The Feature-Rich Frugal Option: Zoho Books

Competitive pricing with more features than Wave. Scales as your business grows.

The Established Player (with a catch): QuickBooks Online Simple Start

The industry standard, but watch out for those price hikes. Consider the long-term cost.

The Rising Star: Xero

Clean interface and good integrations, can be pricier than other options, but often has promotional offers.

Detailed Reviews

Wave: Free Doesn't Always Mean Priceless

Wave shines for its genuinely free accounting. It's perfect for very small businesses or freelancers with simple needs.

The invoicing is clean and professional. It's easy to track income and expenses.

However, payroll is an add-on and can be expensive. Support is limited, so if you need hand-holding, look elsewhere.

Verdict: Excellent if you’re starting out and on a shoestring budget. Be prepared to upgrade eventually.

Zoho Books: Scaling Up Without Breaking Down

Zoho Books balances affordability with a surprising number of features. It includes invoicing, expense tracking, and basic inventory management.

The interface is user-friendly and integrates well with other Zoho products. Their customer support is also better than Wave.

The reporting isn't as robust as QuickBooks. Some advanced features require higher-tier plans.

Verdict: A solid choice for growing businesses looking for more features without a huge price tag.

QuickBooks Online Simple Start: The Familiar Face

QuickBooks Online Simple Start is the most recognizable name in small business accounting. The interface is intuitive, especially if you're familiar with QuickBooks Desktop.

It offers robust reporting and integrations. It's the most comprehensive option for very small business.

But beware of the price creep! Intuit is notorious for raising prices after the initial discount period. Also, the Simple Start plan has limitations on the number of tracked clients and billable users.

Verdict: Powerful, but carefully monitor those subscription costs. Consider alternatives if you're truly budget-conscious.

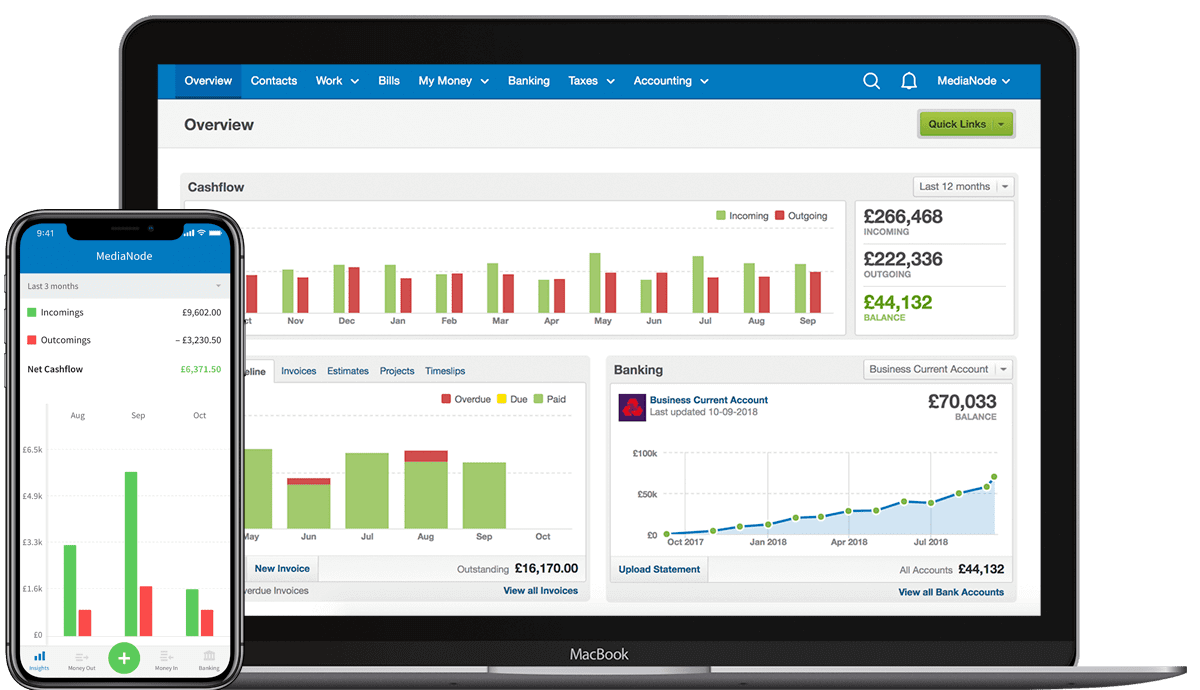

Xero: The Modern Alternative

Xero boasts a modern, clean interface and strong integrations. It's a favorite among those who find QuickBooks clunky.

It offers excellent bank reconciliation features and good mobile apps. Xero also offers good customer support.

Xero can be more expensive than Zoho Books. Payroll is often an add-on, increasing the overall cost.

Verdict: A strong contender, especially if you value a user-friendly interface. Shop around for discounts.

Side-by-Side Specs Table

| Feature | Wave | Zoho Books | QuickBooks Online Simple Start | Xero | Performance Score (Out of 5) |

|---|---|---|---|---|---|

| Pricing | Free (Accounting & Invoicing) | Starts at $15/month | Starts at $30/month | Starts at $27/month | Wave: 5, Zoho: 4, QuickBooks: 3, Xero: 3 |

| Invoicing | Unlimited | Unlimited | Unlimited | Unlimited | All: 5 |

| Expense Tracking | Yes | Yes | Yes | Yes | All: 4 |

| Reporting | Basic | Good | Robust | Good | Wave: 2, Zoho: 4, QuickBooks: 5, Xero: 4 |

| Integrations | Limited | Good | Excellent | Excellent | Wave: 2, Zoho: 4, QuickBooks: 5, Xero: 5 |

| Customer Support | Limited | Good | Good | Good | Wave: 2, Zoho: 4, QuickBooks: 4, Xero: 4 |

| Payroll | Add-on (Paid) | Add-on (Paid) | Add-on (Paid) | Add-on (Paid) | Wave: 3, Zoho: 3, QuickBooks: 3, Xero: 3 |

Customer Satisfaction Survey Data

Based on user reviews and surveys, here's a snapshot of customer satisfaction:

- Wave: Users appreciate the price (free!) and ease of use. Complaints include limited features and poor support.

- Zoho Books: Users praise its affordability and feature set. Some find the interface less intuitive than QuickBooks.

- QuickBooks Online Simple Start: Users value the comprehensive features and integrations. Price increases are a major concern.

- Xero: Users love the modern interface and integrations. Some consider it expensive.

Maintenance Cost Projections

Consider these costs beyond the monthly subscription:

- Wave: Primarily time spent learning the software and self-help support.

- Zoho Books: Potential costs for upgrading to higher-tier plans as your business grows.

- QuickBooks Online Simple Start: Likely annual price increases, plus the cost of add-ons like payroll.

- Xero: Similar to QuickBooks, watch out for price increases and add-on costs.

Key Takeaways

Choosing the right accounting software is crucial. Evaluate your needs and budget. Consider long-term costs, not just initial prices.

Wave is best for tiny operations on a tight budget. Zoho Books offers a good balance of features and price. QuickBooks Online Simple Start is powerful but potentially expensive. Xero is a strong contender with a modern interface.

Don't forget to factor in customer support and ease of use. Choose a solution that fits your accounting knowledge level.

Call to Action

Now that you're armed with this information, take advantage of free trials! Test out the software that seems like the best fit for your business. Remember to factor your business size, needs, and budget when making a decision. Start saving money and streamlining your accounting today!

Frequently Asked Questions (FAQ)

Q: Is free accounting software really good enough?

A: It depends on your needs. If you have very simple accounting requirements, Wave might be sufficient. As your business grows, you'll likely need to upgrade to a paid solution.

Q: What if I hate accounting?

A: Choose software with a user-friendly interface and good customer support. Consider hiring a bookkeeper or accountant if you're completely overwhelmed.

Q: How important are integrations?

A: Integrations can save you a lot of time. If you use other software like CRM or e-commerce platforms, make sure your accounting software integrates seamlessly.

Q: What about mobile apps?

A: Mobile apps are essential for managing your finances on the go. Make sure the software offers a user-friendly mobile app for invoicing and expense tracking.

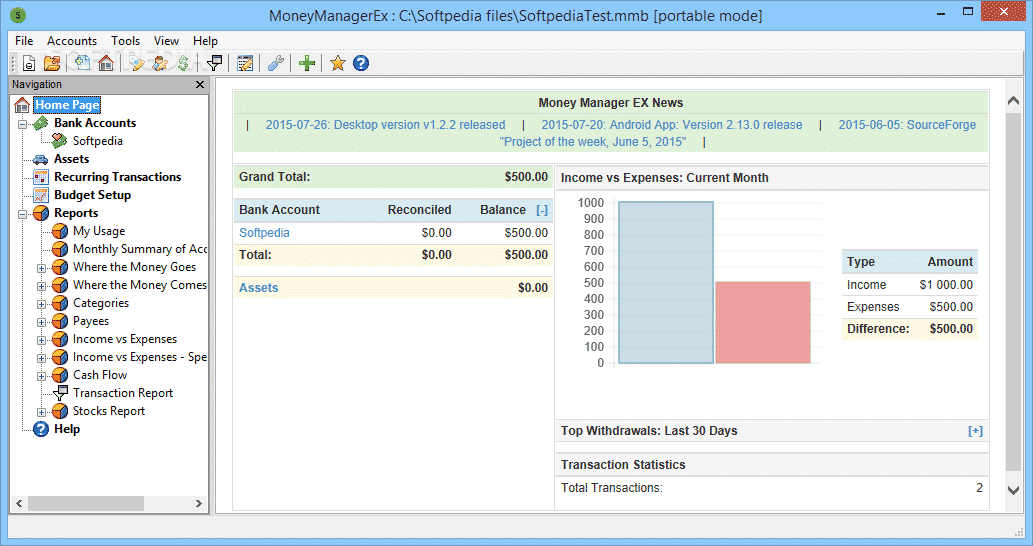

Q: Should I choose cloud-based or desktop software?

A: Cloud-based software offers more flexibility and accessibility. You can access your data from anywhere with an internet connection. Desktop software can be more secure but requires manual backups and updates.