Best Accounting System For Small Business

Are you a small business owner tired of watching your hard-earned cash disappear into overpriced accounting software? You're not alone! We understand the struggle of balancing the books while keeping costs down. This review is for you, the budget-conscious entrepreneur, the master of frugality, the cost-cutter who needs a powerful accounting system without breaking the bank.

Accounting software matters. Accurate financial tracking is essential for survival and growth. It allows you to make informed decisions, manage cash flow, and stay compliant with regulations. Skip the fancy bells and whistles – let's focus on what truly matters: affordability and effectiveness.

The Bargain Hunter's Shortlist: Accounting Software Showdown

Here’s a sneak peek at our top picks, tailored for different needs and budgets:

- Best Free Option: Wave Accounting

- Most Affordable Paid Option: Zoho Books

- Best Value for Growing Businesses: QuickBooks Online Simple Start

Detailed Reviews: Unveiling the Hidden Gems

Wave Accounting: Free Doesn't Mean Feeble

Wave Accounting is a completely free accounting solution perfect for freelancers and very small businesses. It handles invoicing, expense tracking, and basic reporting with ease. The user interface is clean and intuitive, making it easy to get started even if you’re not an accounting expert.

However, its payroll functionality is limited and comes with additional fees. Customer support is primarily through online resources. This makes it less ideal for businesses that require extensive assistance.

Zoho Books: Budget-Friendly Powerhouse

Zoho Books offers a compelling blend of affordability and functionality. Its basic plan is surprisingly robust, offering invoicing, expense tracking, bank reconciliation, and detailed reporting. It is well-suited for small businesses seeking to streamline their finances without a hefty price tag.

While the entry-level plan has limitations on the number of users and contacts, the higher tiers are still competitively priced. Zoho Books provides excellent value for money. It has a comprehensive suite of features that rival more expensive alternatives.

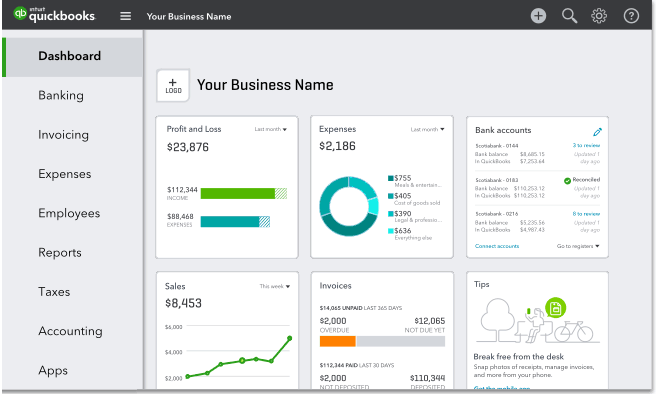

QuickBooks Online Simple Start: The Familiar Choice

QuickBooks Online Simple Start is a popular choice for small businesses, offering a user-friendly interface and a wide range of features. It handles invoicing, expense tracking, sales tax, and basic financial reporting. It is tightly integrated with other QuickBooks products and services.

While Simple Start is feature-rich, it is more expensive than Wave or Zoho Books. Its limitations on the number of users and tracking categories can be restrictive. However, its established reputation and extensive support resources make it a safe bet for many businesses.

Side-by-Side Specs: Comparing the Contenders

| Feature | Wave Accounting | Zoho Books | QuickBooks Online Simple Start | Performance Score (out of 5) |

|---|---|---|---|---|

| Price | Free | Starting at $15/month | Starting at $30/month | N/A |

| Invoicing | Yes | Yes | Yes | 5/5 |

| Expense Tracking | Yes | Yes | Yes | 5/5 |

| Bank Reconciliation | Yes | Yes | Yes | 5/5 |

| Reporting | Basic | Detailed | Basic | 4/5 |

| Payroll | Add-on Fee | Add-on Fee | Add-on Fee | 3/5 |

| Customer Support | Online Resources | Email, Chat, Phone | Chat, Phone | 4/5 |

| User Limit (Base Plan) | Unlimited | 1 | 1 | 3/5 |

Customer Satisfaction: What Are Users Saying?

Based on our research of online reviews and customer feedback, here's a snapshot of user satisfaction:

- Wave Accounting: Praised for its free price tag and ease of use. Some users report limitations in advanced features and customer support.

- Zoho Books: Appreciated for its affordability and comprehensive feature set. Some users find the interface slightly less intuitive than QuickBooks.

- QuickBooks Online Simple Start: Valued for its familiarity and robust feature set. The higher price point is a common complaint.

Maintenance Cost Projections: Beyond the Monthly Fee

Don't just focus on the monthly subscription fee. Consider the long-term costs associated with each software.

Wave Accounting has minimal maintenance costs due to its free nature, but consider the time invested in manual processes if your business grows. Zoho Books offers affordable upgrades as your business scales. QuickBooks Online, while initially more expensive, may require additional training or consulting fees.

Key Takeaways: Making the Right Choice

Choosing the best accounting system for your small business requires careful consideration of your needs and budget. Wave Accounting is a great starting point for freelancers. Zoho Books offers excellent value for growing businesses. QuickBooks Online provides a familiar and robust solution.

Remember to factor in customer satisfaction, maintenance costs, and long-term scalability. Make an informed decision that aligns with your business goals and keeps your finances on track.

Ready to Take Control of Your Finances?

Don't let overpriced accounting software drain your resources. Take advantage of free trials and explore the options discussed in this review. Start saving money and streamlining your finances today!

Frequently Asked Questions (FAQ)

Q: Is free accounting software really good enough for my business?

A: It depends on your business needs. For freelancers and very small businesses with simple accounting requirements, Wave Accounting can be a great option. However, as your business grows, you may need to upgrade to a paid solution with more advanced features.

Q: What if I don't have any accounting experience?

A: All three software options offer user-friendly interfaces and helpful resources. Wave Accounting is particularly known for its simplicity. Consider taking advantage of free trials and online tutorials to get comfortable with the software.

Q: Can I easily switch from one accounting system to another?

A: Switching accounting systems can be complex, but it is possible. Plan the transition carefully, back up your data, and consider hiring a professional to assist with the data migration process. Zoho Books and QuickBooks Online usually have tools to help you import data from other systems.

Q: Do I need to hire an accountant if I use accounting software?

A: While accounting software can automate many tasks, it's still a good idea to consult with an accountant. An accountant can provide valuable advice on tax planning, financial analysis, and compliance issues.