Best Small Business Accounting Software

Running a small business is a whirlwind. Juggling sales, marketing, and customer service leaves little time for the nitty-gritty, like accounting. But here's the thing: solid accounting isn't just about taxes. It's about knowing your numbers, making informed decisions, and ultimately, growing your business.

Choosing the right small business accounting software can be a game-changer. This guide is for the first-time buyer, overwhelmed by options, seeking clarity and a practical solution.

Why Small Business Accounting Software Matters

Think of accounting software as your business's financial command center. It helps track income and expenses, manages invoices, and creates financial reports.

Without it, you're relying on spreadsheets (prone to errors) or worse, guesswork. Good software provides real-time insights into your profitability and cash flow, which are crucial for making smart business decisions.

Top 5 Small Business Accounting Software: A Comparison

| Software | Starting Price (Monthly) | Key Features | Ease of Use | Customer Support |

|---|---|---|---|---|

| QuickBooks Online | $30 | Invoicing, expense tracking, payroll integration, reporting | Moderate | Extensive online resources, phone support |

| Xero | $25 | Invoicing, bank reconciliation, inventory management, project tracking | Moderate | 24/7 online support |

| FreshBooks | $17 | Invoicing, time tracking, project management, payments | Very Easy | Email and phone support |

| Zoho Books | $0 (for very small businesses), $20 | Invoicing, expense tracking, banking integration, reporting | Moderate | Email and phone support |

| Sage Business Cloud Accounting | $25 | Invoicing, cash flow management, reporting, VAT (if applicable) | Moderate | 24/7 online support |

Detailed Reviews of the Top 5

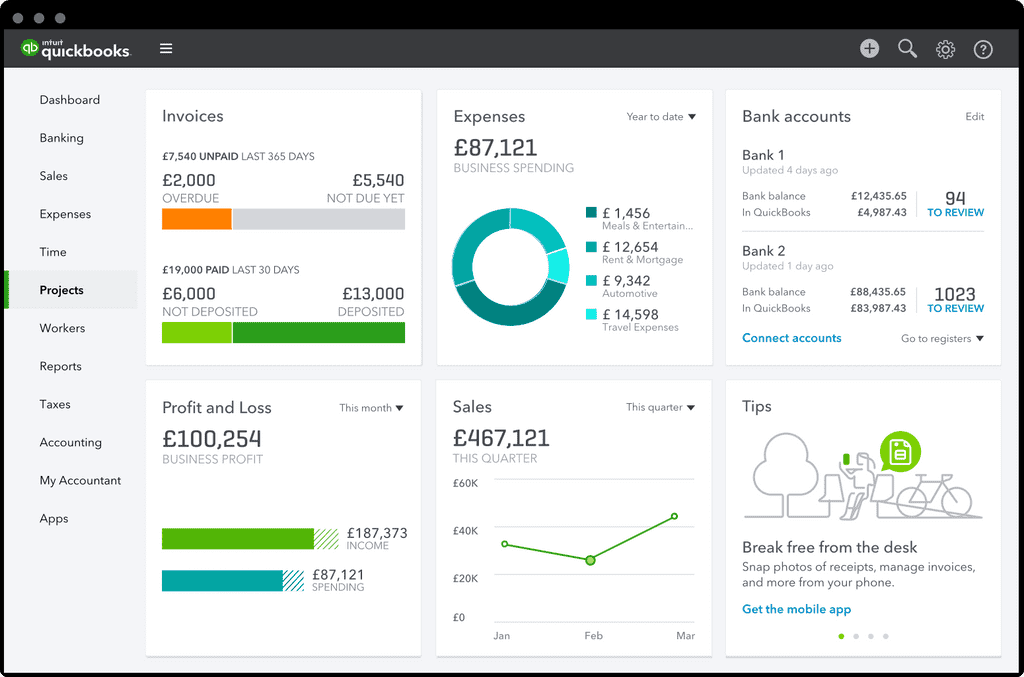

QuickBooks Online

QuickBooks Online is the industry heavyweight. It's feature-rich, catering to a wide range of business needs. Integrations are plentiful, making it easy to connect with other business tools.

The downside? Its complexity can be overwhelming for beginners. The pricing structure can also become expensive as your business grows and you need more features.

Xero

Xero is another popular choice known for its clean interface. It excels in bank reconciliation and provides excellent collaboration tools for accountants and bookkeepers.

Some users find the reporting features less customizable than QuickBooks. The starter plan has limitations on the number of invoices and bills you can send/enter.

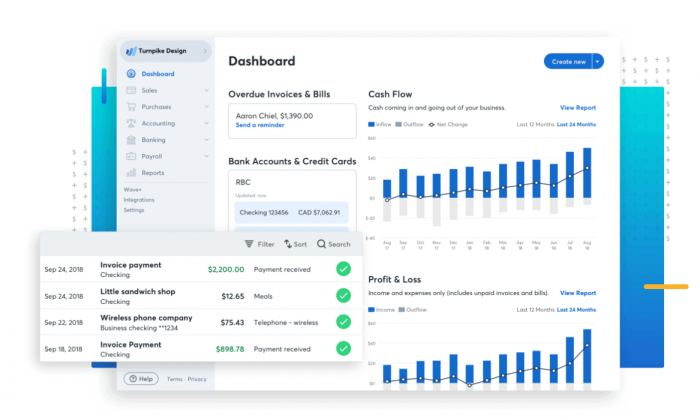

FreshBooks

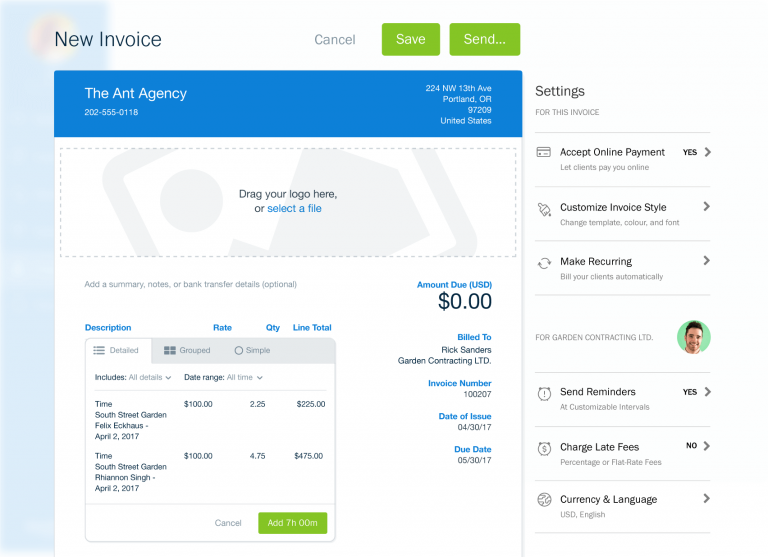

FreshBooks is designed specifically for service-based businesses. It shines in invoicing, time tracking, and project management. Its user-friendly interface makes it a great option for those new to accounting software.

It's less suitable for businesses that need inventory management or complex accounting features. Reporting capabilities are not as robust as other options.

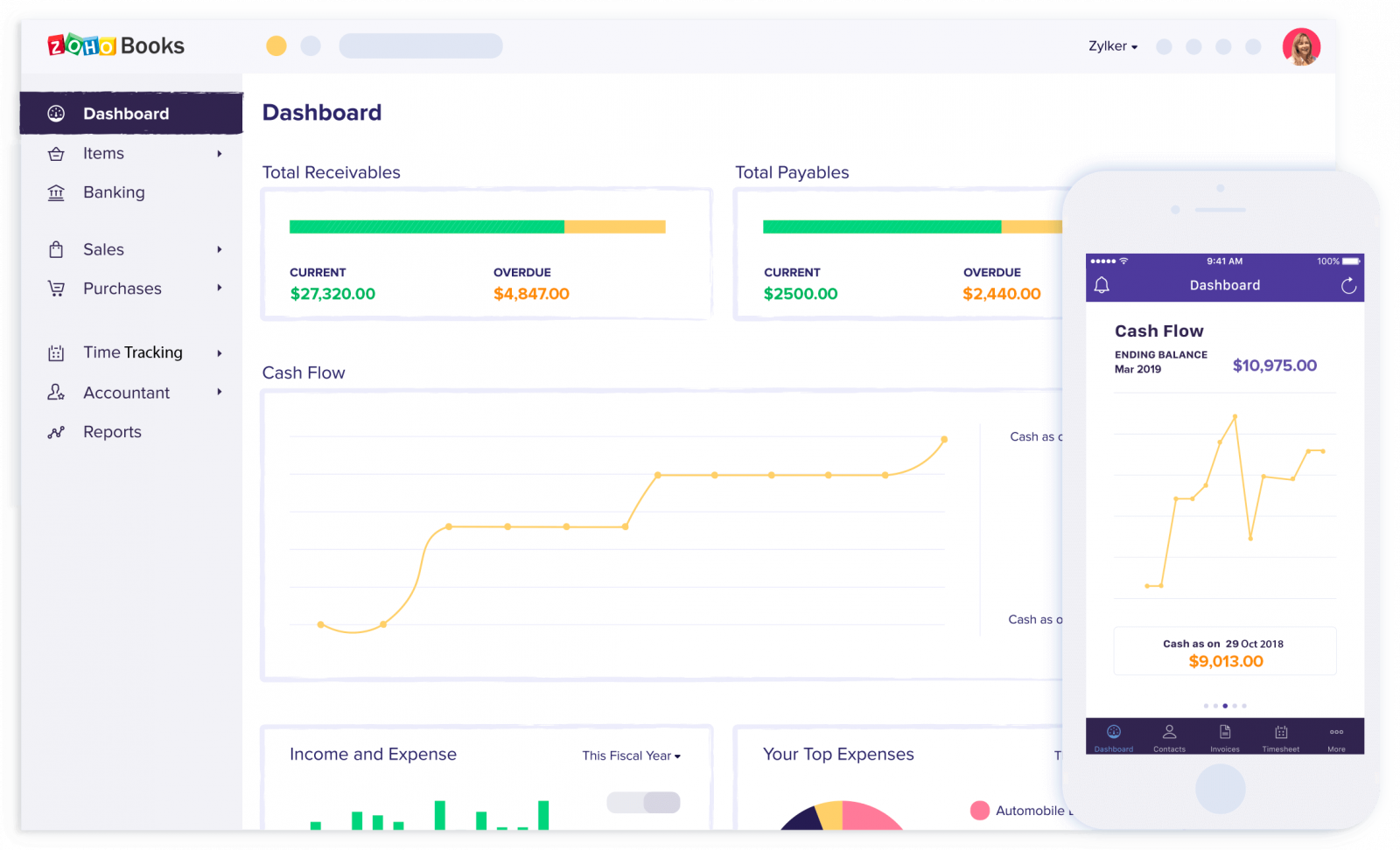

Zoho Books

Zoho Books offers a comprehensive suite of features at a competitive price. It's part of the larger Zoho ecosystem, making it a good choice if you already use other Zoho products.

The interface can feel a bit clunky compared to some of its competitors. Customer support has mixed reviews.

Sage Business Cloud Accounting

Sage Business Cloud Accounting is a solid choice for businesses that need robust reporting and cash flow management. It's particularly well-suited for UK-based businesses needing VAT support.

The interface isn't as modern or intuitive as some other options. Certain features require higher-tier plans.

Used vs. New: Is Refurbished Accounting Software an Option?

Unlike physical assets, buying "used" accounting software isn't really a thing. Accounting software is typically sold as a subscription. You are always using the current version.

Therefore, the relevant question is whether to choose a feature-rich, complex platform for the future or a simple one that perfectly meets your current needs.

Reliability Ratings by Brand

While no software is perfect, some brands have a better track record for reliability. QuickBooks and Xero generally receive high marks for uptime and stability. FreshBooks is also known for its reliability, given its focus on simplicity.

User reviews sometimes report occasional glitches or integration issues with all platforms. Always check recent reviews before making a decision.

Checklist: 5 Must-Check Features Before Buying

- Invoicing: Can you easily create and send professional invoices? Can you automate recurring invoices?

- Expense Tracking: Can you easily record and categorize expenses? Can you connect your bank accounts and credit cards for automatic import?

- Reporting: Does the software provide the reports you need to track your business performance (e.g., profit and loss, balance sheet, cash flow statement)?

- Bank Reconciliation: Can you easily reconcile your bank statements with your accounting records?

- Integration: Does the software integrate with other tools you use, such as your CRM, e-commerce platform, or payroll system?

Key Takeaways and Considerations

Choosing the best small business accounting software requires careful consideration. Ease of use, features, and price are all important factors.

Consider the size and complexity of your business. Are you a freelancer needing basic invoicing, or a growing company needing inventory management?

Don't be afraid to try free trials before committing to a subscription. This is the best way to see if a particular software is a good fit for your business. Also, make sure the customer support is well-regarded. When issue arises, the customer support will be extremely important.

Ready to Take Control of Your Finances?

Don't let accounting be a source of stress. Armed with the information in this guide, you can confidently choose the right software to streamline your finances and grow your business. Start your free trials today and discover the perfect solution for your needs! You can also consult with a financial advisor to determine the best course of action.