Best Small Business Financial Software

Running a small business is a rollercoaster. Keeping track of finances shouldn't be another loop-de-loop adding to the stress.

That's where financial software comes in. This article is tailored for first-time buyers, guiding you through the sometimes-overwhelming world of small business financial management software. We'll cut through the jargon and help you find the right tool to tame your finances.

Why Small Business Financial Software Matters

Think of financial software as your business's central nervous system. It helps you track income, manage expenses, create invoices, and even prepare for tax season. Without it, you're essentially flying blind, relying on spreadsheets (shudder!) or, worse, gut feelings.

Proper financial software offers real-time insights into your business's health. It allows you to make informed decisions based on data, not just hunches.

By automating tasks like invoicing and reconciliation, it frees up valuable time for you to focus on growth.

Top 5 Small Business Financial Software Solutions Compared

| Software | Starting Price (Monthly) | Key Features | Ease of Use (Rating 1-5) | Customer Support |

|---|---|---|---|---|

| QuickBooks Online | $30 | Invoicing, expense tracking, payroll integration, reporting | 4 | Phone, chat, community forum |

| Xero | $25 | Bank reconciliation, inventory management, project tracking, invoicing | 4.5 | Email, chat, help center |

| Zoho Books | $20 | Invoicing, expense tracking, time tracking, CRM integration | 3.5 | Email, phone, chat |

| FreshBooks | $15 | Invoicing, time tracking, project management, expense tracking | 5 | Email, phone, chat |

| Wave Accounting | Free (with paid payroll and payment processing) | Invoicing, expense tracking, basic accounting | 4 | Email, help center |

Detailed Reviews

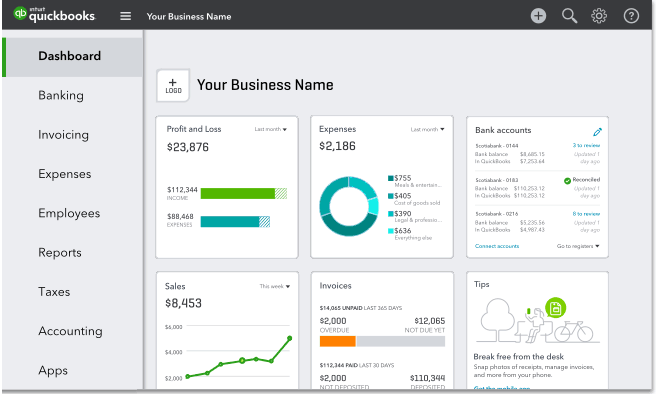

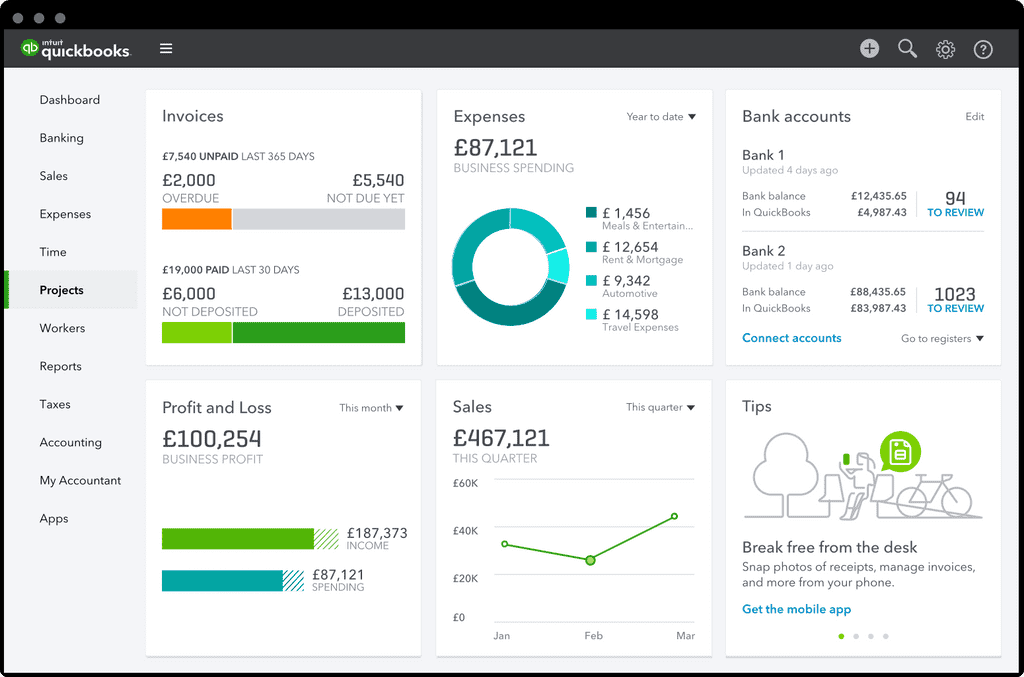

QuickBooks Online: The Industry Standard

QuickBooks Online is often the first name that comes to mind when discussing small business accounting. It's a comprehensive solution with a wide range of features. It integrates seamlessly with many third-party apps, which is a plus for growing businesses.

However, the pricing can quickly escalate as you add features or users. The interface, while familiar to many, can sometimes feel cluttered.

Xero: The Cloud-Based Innovator

Xero is a strong contender with a focus on cloud-based accessibility. It boasts excellent bank reconciliation capabilities, saving time and reducing errors. The interface is clean and intuitive, making it a user-friendly option.

Xero's reporting features are robust, offering valuable insights into your business performance. While generally well-regarded, some users report occasional issues with customer support responsiveness.

Zoho Books: The Budget-Friendly Powerhouse

Zoho Books is a compelling option for businesses looking for a balance between affordability and functionality. It offers a suite of features comparable to QuickBooks and Xero at a lower price point. Integration with other Zoho apps, like Zoho CRM, is a major advantage.

The interface might not be as polished as some competitors. Some users find the learning curve slightly steeper.

FreshBooks: The Invoicing Guru

If invoicing is your primary concern, FreshBooks is an excellent choice. It's known for its intuitive interface and user-friendly invoicing tools. It also offers solid time tracking and project management features.

However, FreshBooks lacks some of the advanced accounting features found in QuickBooks or Xero. It's best suited for service-based businesses with straightforward accounting needs.

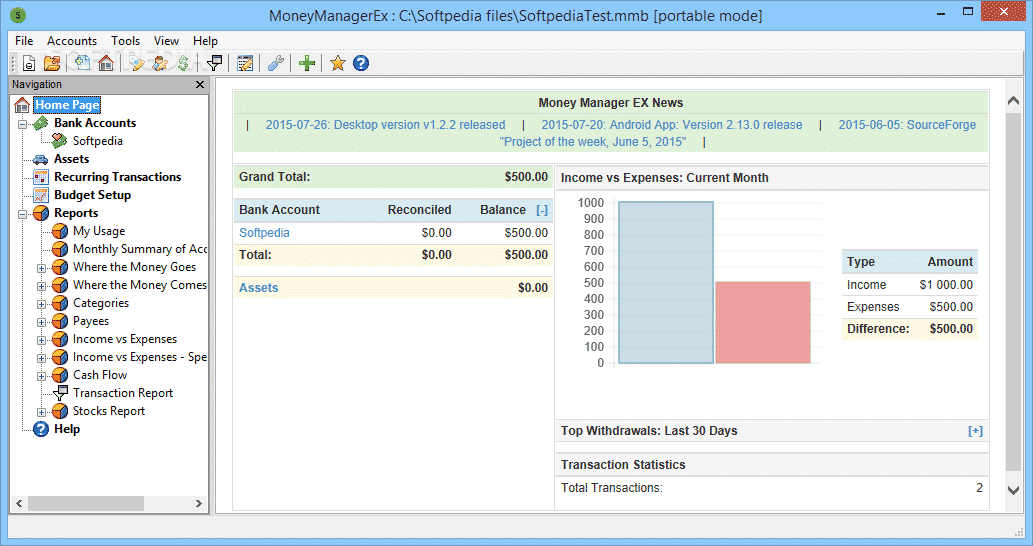

Wave Accounting: The Free Option (with Caveats)

Wave Accounting is a truly free accounting software. It's a great option for very small businesses or freelancers just starting out. It offers basic invoicing and expense tracking features without a monthly fee.

The catch? Wave charges for payroll and payment processing. While the free version is tempting, it may not be sufficient as your business grows.

Used vs. New: A Non-Issue with Software

Unlike physical products, the "used vs. new" debate doesn't really apply to financial software. You're always accessing the latest version of the software as a service (SaaS) model. Subscription plans are the standard, so you're always getting the most up-to-date features and security patches.

However, migrating data from a previous system can be a challenge. Consider the time and effort involved in data migration when switching from one software to another.

Reliability Ratings by Brand

Reliability is crucial when it comes to financial software. You need to be able to trust that the software will accurately track your finances and that your data will be secure.

- QuickBooks Online: Generally reliable, but some users report occasional glitches and integration issues.

- Xero: Known for its stability and uptime.

- Zoho Books: Considered reliable, with fewer reported issues than QuickBooks.

- FreshBooks: Very reliable, with a focus on user-friendliness and stability.

- Wave Accounting: Reliability can be inconsistent, especially with the free version.

Checklist: 5 Must-Check Features Before Buying

- Invoicing: Does it allow you to create professional invoices and track payments?

- Expense Tracking: Can you easily record and categorize expenses?

- Bank Reconciliation: Does it automate the process of matching bank transactions with your accounting records?

- Reporting: Does it provide insightful reports on your business's financial performance?

- Integration: Does it integrate with other tools you use, such as your CRM or payment processor?

Key Takeaways

Choosing the right financial software is a crucial decision for any small business. QuickBooks Online is the industry leader, but it may not be the best fit for everyone.

Xero offers a clean and user-friendly experience, while Zoho Books provides a good balance of features and affordability. FreshBooks excels at invoicing, and Wave Accounting is a decent free option for very small businesses.

Consider your business's specific needs, budget, and technical expertise. Take advantage of free trials to test out different software before committing to a subscription.

Ready to Simplify Your Finances?

Don't let financial management be a headache. Start your free trial with one (or more!) of the software solutions we've discussed. Take control of your business's finances and set yourself up for success. You won't regret it!