Georgia Electronic Consumer Products Or Home Warranty Surety Bond

Did you know that the Georgia Department of Law's Consumer Protection Division received over 12,000 consumer complaints in 2023? A significant portion of these likely related to defective consumer products and warranty issues. This highlights the importance of consumer protection laws and surety bonds in Georgia.

Understanding Georgia's Surety Bond Requirements

In Georgia, businesses selling electronic consumer products or offering home warranties often need to obtain a surety bond. This bond acts as a financial guarantee that the business will comply with all applicable laws and regulations.

But what exactly does that mean for your business?

What is a Georgia Electronic Consumer Products or Home Warranty Surety Bond?

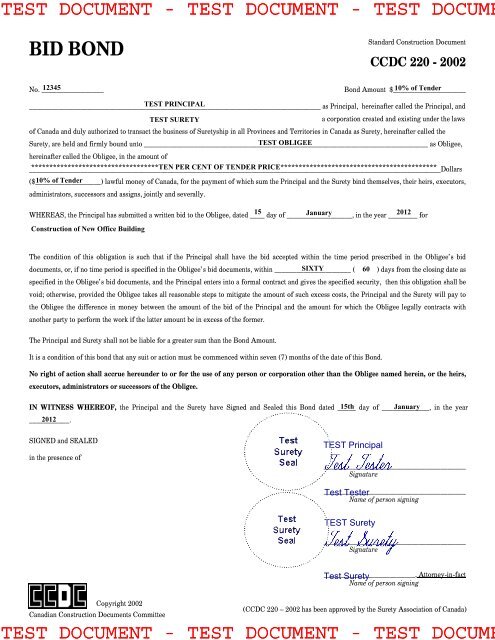

A surety bond is a three-party agreement.

The principal (your business) purchases the bond. The obligee (typically the state of Georgia) requires the bond. The surety company provides the financial backing.

Essentially, the surety bond ensures that if your business fails to fulfill its obligations to customers, the surety company will provide financial compensation to those harmed parties, up to the bond amount.

Why is a Surety Bond Required?

The State of Georgia requires these bonds to protect consumers. These bonds offer financial recourse if a business engages in unethical or illegal practices.

This includes things like failing to honor warranties, misrepresenting product features, or engaging in fraudulent sales practices.

The bond ensures consumer confidence in the marketplace.

Who Needs This Type of Bond?

Generally, businesses that sell or service electronic consumer products with warranties or offer home warranty services in Georgia need this bond.

This can include retailers selling electronics, appliance repair companies, and home warranty providers.

Check with the Georgia Department of Law's Consumer Protection Division to determine your specific requirements.

Benefits of Complying with Bond Requirements

Beyond simply fulfilling a legal obligation, obtaining a surety bond offers numerous benefits.

It builds trust with your customers, differentiating you from competitors. It demonstrates your commitment to ethical business practices. It protects your business from potentially devastating lawsuits.

A bond can actually enhance your reputation and attract more customers.

Factors Affecting Bond Cost

The cost of a surety bond is a percentage of the total bond amount. This is called the premium.

Several factors influence your premium rate. These include your business's credit history, financial stability, and experience in the industry.

Businesses with strong credit and a solid track record typically qualify for lower rates.

How to Obtain a Georgia Electronic Consumer Products or Home Warranty Surety Bond

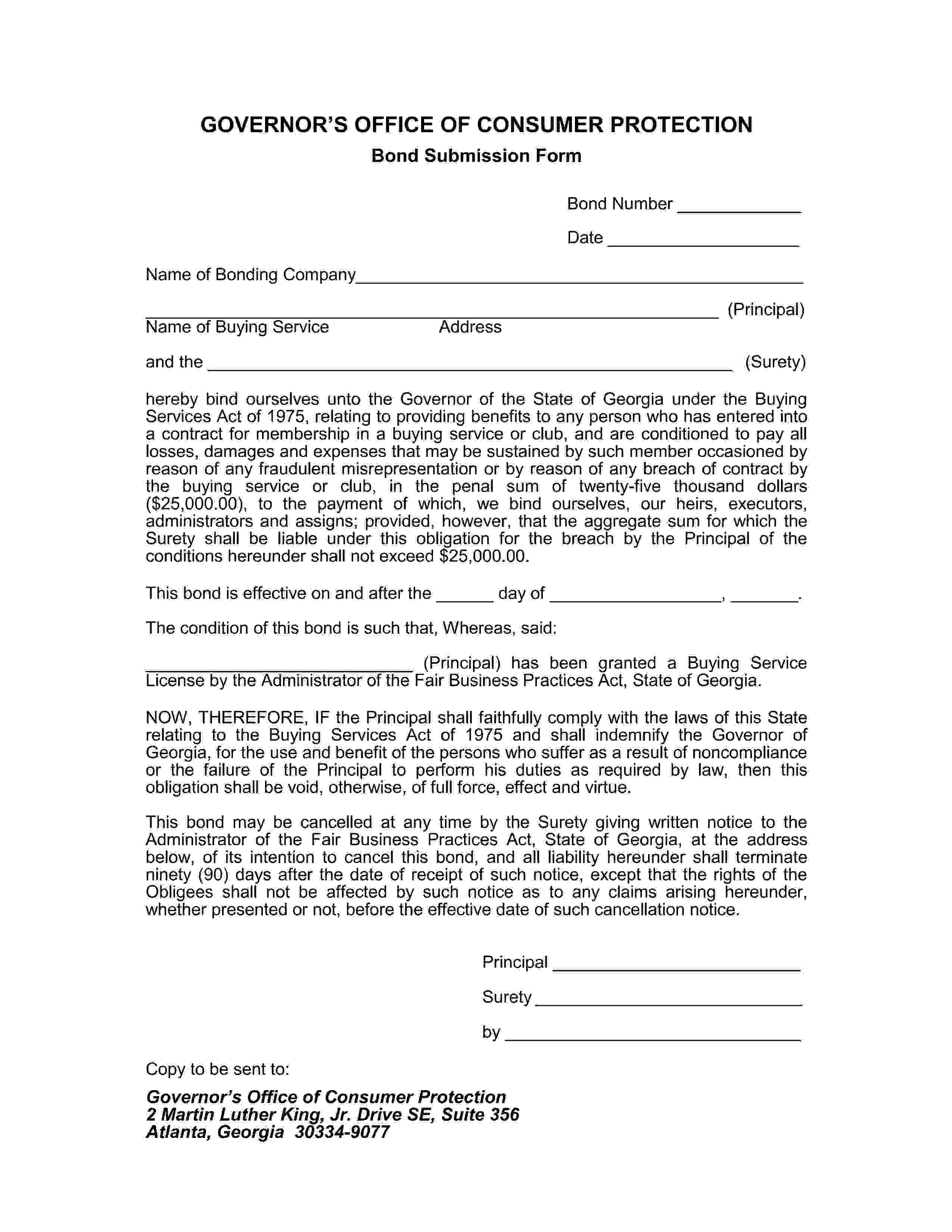

The process of obtaining a surety bond is straightforward.

First, you'll need to contact a reputable surety bond agency. They will assess your business's risk profile and provide you with a quote.

You'll then need to complete an application and provide any required documentation, such as financial statements.

Once approved, you'll pay the premium and receive your bond. Keep a copy of the bond for your records and provide the original to the required Georgia agency.

Key Considerations

Make sure to select a reputable surety company. Do your research and read online reviews.

Understand the terms and conditions of the bond. Know your obligations and potential liabilities.

Maintain accurate records. This will help you quickly address any customer complaints or warranty claims.

Staying Compliant

It's crucial to stay up-to-date on any changes to Georgia's consumer protection laws. Regular review your business practices.

Ensure your employees are properly trained on warranty policies and customer service best practices. Proactive compliance is essential for avoiding potential claims against your bond.

By understanding the requirements of a Georgia Electronic Consumer Products or Home Warranty Surety Bond, your business can protect consumers, build trust, and thrive in the marketplace.

For more detailed information, consult with the Georgia Department of Law's Consumer Protection Division [https://consumer.georgia.gov/] or a qualified legal professional. The BBB is also a great resource for reliable information [https://www.bbb.org/].

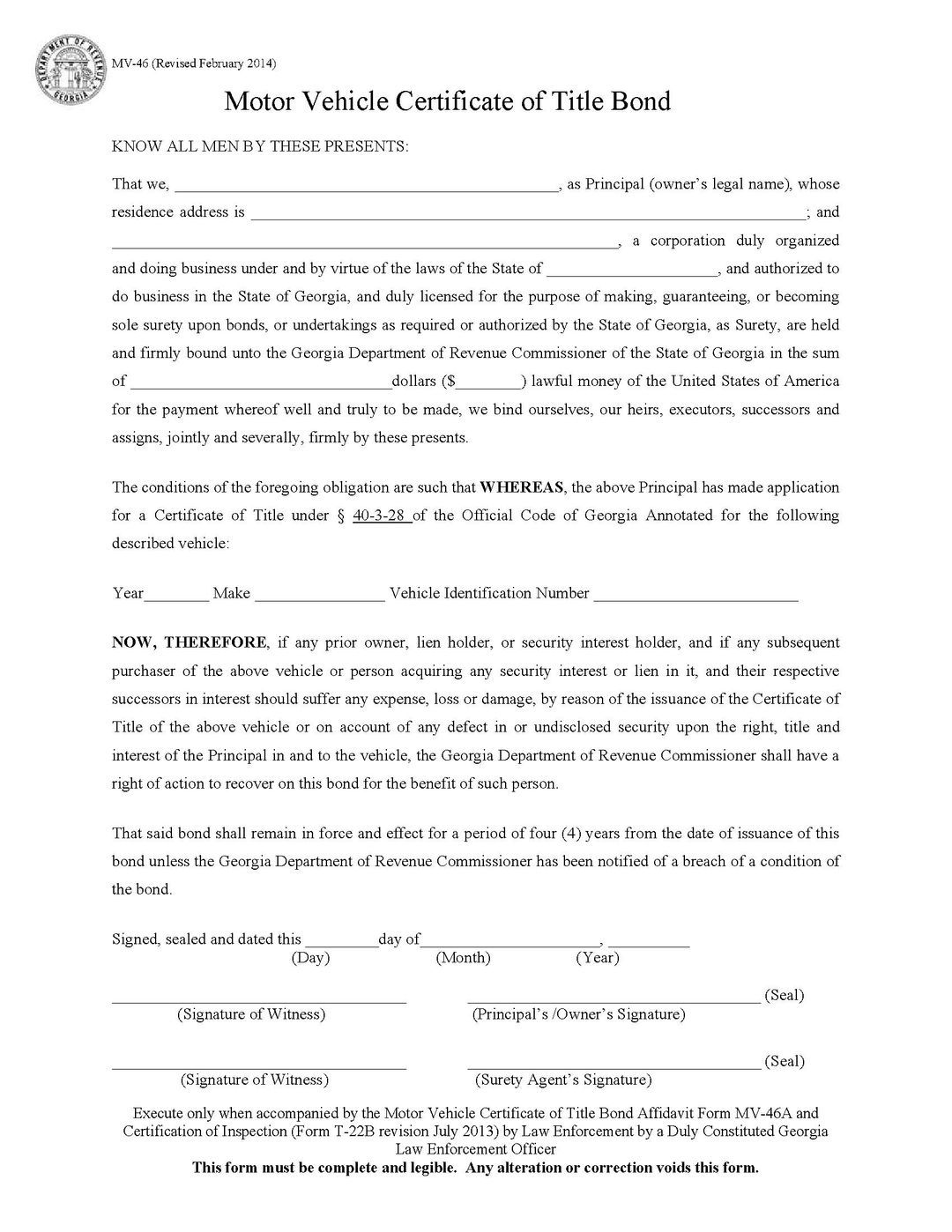

![Georgia Electronic Consumer Products Or Home Warranty Surety Bond How to Fill Out a Surety Bond Form [Step by Step] - ZipBonds](https://zipbonds.com/wp-content/uploads/2023/06/Screen-Shot-2023-06-01-at-2.29.34-PM-789x1024.png)

:max_bytes(150000):strip_icc()/home-warranty-worth-it.asp_FINAL-b459d9b5649e421b96017d1d3d9e0fda.png)