The Best Accounting Software For Small Business

Running a small business is tough. Juggling sales, marketing, and operations can leave you feeling like you're constantly spinning plates. But what about the numbers? Keeping a close eye on your finances is crucial for survival, and that’s where the right accounting software comes in.

This guide is designed for first-time buyers and owners of small businesses who are exploring accounting software for the first time. We'll delve into the best accounting software options, comparing features, pricing, and reliability, to help you find the perfect fit for your business needs.

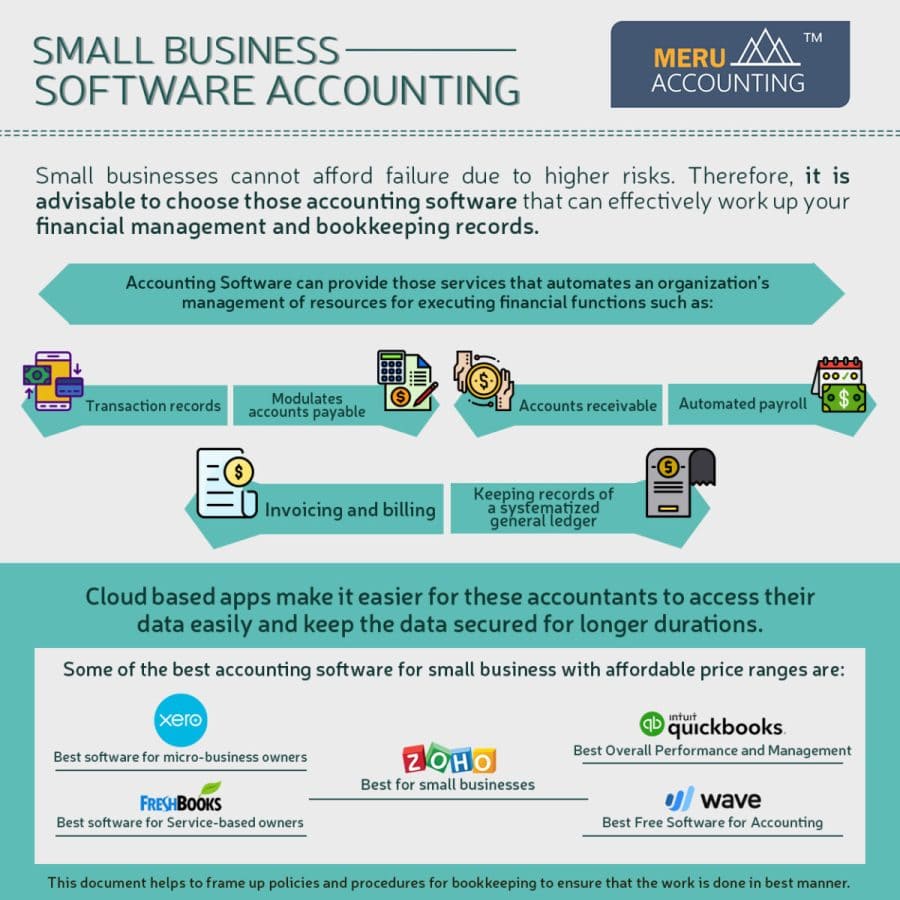

Why Accounting Software Matters for Small Businesses

Think of accounting software as your financial command center. It automates tedious tasks, provides real-time insights into your cash flow, and helps you stay compliant with tax regulations.

Without it, you're stuck with spreadsheets and manual calculations, increasing the risk of errors and wasting valuable time. Investing in the right software can free you up to focus on what you do best: growing your business.

Top 5 Accounting Software Options: A Quick Comparison

| Software | Starting Price (per month) | Key Features | Warranty/Support |

|---|---|---|---|

| QuickBooks Online | $30 | Invoicing, expense tracking, payroll integration | Phone & chat support |

| Xero | $25 | Bank reconciliation, inventory management, project tracking | 24/7 email & chat support |

| Zoho Books | $20 | Client portal, time tracking, automated workflows | Email, phone, & chat support |

| FreshBooks | $17 | Invoice customization, time tracking, project profitability | Email & phone support |

| Sage Business Cloud Accounting | $25 | Cash flow forecasting, advanced reporting, multi-currency | 24/7 online support |

Detailed Reviews: Diving Deeper

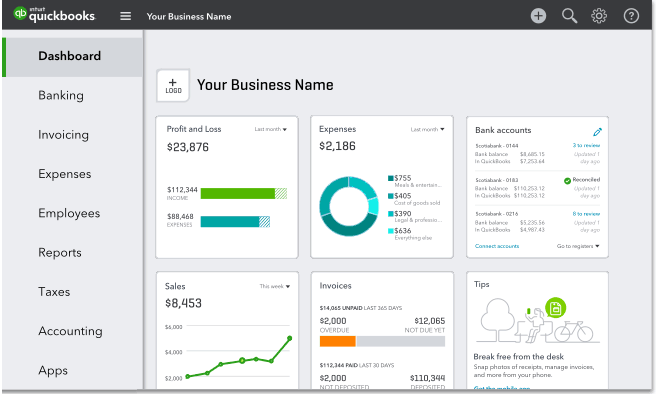

QuickBooks Online

QuickBooks Online is a popular choice for its user-friendly interface and extensive features. It integrates seamlessly with other Intuit products and offers a wide range of apps for customization.

The monthly fee can add up as your business grows and requires more advanced features. But, for many small businesses, the core functionality is more than sufficient.

Xero

Xero stands out for its bank reconciliation capabilities and robust reporting tools. Its dashboard provides a clear overview of your financial health, making it easy to track key metrics.

Some users find the interface slightly less intuitive than QuickBooks. However, its strong accounting features make it a powerful contender.

Zoho Books

Part of the Zoho suite, Zoho Books offers a comprehensive solution for small businesses. It’s particularly strong in customer relationship management (CRM) and workflow automation.

If you're already using other Zoho products, integration is seamless. The pricing is also competitive, making it an attractive option for budget-conscious businesses.

FreshBooks

FreshBooks is designed with service-based businesses in mind. It excels at invoicing, time tracking, and project management, making it perfect for freelancers and consultants.

It focuses more on these specific areas than broader accounting functions. So businesses with complex inventory needs may need to explore other options.

Sage Business Cloud Accounting

Sage Business Cloud Accounting offers a scalable solution for growing businesses. It provides advanced features like cash flow forecasting and multi-currency support.

The interface can be more complex than some of the other options. But it is suitable for businesses that need more advanced accounting capabilities.

Used vs. New Accounting Software: Weighing the Options

While you can't exactly buy "used" accounting software in the traditional sense, you might consider migrating to a different platform that's already been used by another business (if, for example, you acquire another company). Here's a breakdown of the pros and cons:

Used (Migrated) Software: Pros: Potential cost savings (if the acquisition is favorable). Cons: Data migration complexities, unfamiliar system, potential compatibility issues.

New Software: Pros: Clean slate, latest features, full support. Cons: Higher initial cost, learning curve.

Reliability Ratings by Brand

Assessing reliability in software can be tricky, but user reviews and industry reputation provide valuable insights. Generally, QuickBooks and Xero have a solid track record of reliability, backed by large user bases and extensive support resources.

Zoho Books and FreshBooks also boast high reliability ratings, especially within their niche areas. Sage is a well-established company, so its reliability is generally good.

Checklist: 5 Must-Check Features Before Buying

- Ease of Use: Can you and your team navigate the software easily?

- Integration: Does it integrate with your existing tools (e.g., CRM, payment processors)?

- Reporting: Does it provide the reports you need to track your business performance?

- Scalability: Can it grow with your business?

- Support: What type of support is offered (e.g., phone, email, chat)?

Key Takeaways: Making the Right Choice

Choosing the right accounting software is a critical decision for your small business. Consider your specific needs, budget, and technical expertise when evaluating your options.

Remember to factor in the ease of use, integration capabilities, reporting features, scalability, and support offered by each software. By carefully weighing these factors, you can find the perfect accounting solution to streamline your finances and drive growth.

Ready to Take Control of Your Finances?

Don't let manual accounting hold your business back. Explore the options discussed in this guide and take advantage of free trials to find the perfect fit for your needs. Start simplifying your finances today!

![The Best Accounting Software For Small Business Top 11 Accounts Receivable Software In 2025 [TOP RATED]](https://www.softwaretestinghelp.com/wp-content/qa/uploads/2021/01/Small-Business-Accounting-Software.png)