1 Canadian Dollar To Mexican Peso

Imagine strolling through a vibrant market in San Miguel de Allende, the air thick with the scent of spices and the sounds of lively chatter. You're considering a hand-woven blanket, its intricate patterns telling stories of generations past. But as you reach for your wallet, a quick mental calculation flits through your mind: "What's the Canadian dollar doing against the Mexican peso today?" That simple thought connects you to a global dance of currencies, a constant ebb and flow that impacts travel, trade, and the everyday lives of people across borders.

This article delves into the current state of the Canadian dollar (CAD) to Mexican peso (MXN) exchange rate, exploring its historical context, the factors that influence it, and what it means for Canadians traveling to or doing business in Mexico, and vice versa. We’ll examine how this exchange rate impacts tourism, trade, and investment between the two countries.

A Look Back: The CAD-MXN Relationship

The relationship between the Canadian dollar and the Mexican peso is a dynamic one, shaped by a complex interplay of economic forces. Historically, the exchange rate has seen considerable fluctuations, influenced by everything from oil prices to interest rate differentials. These fluctuations have real-world consequences for individuals and businesses alike.

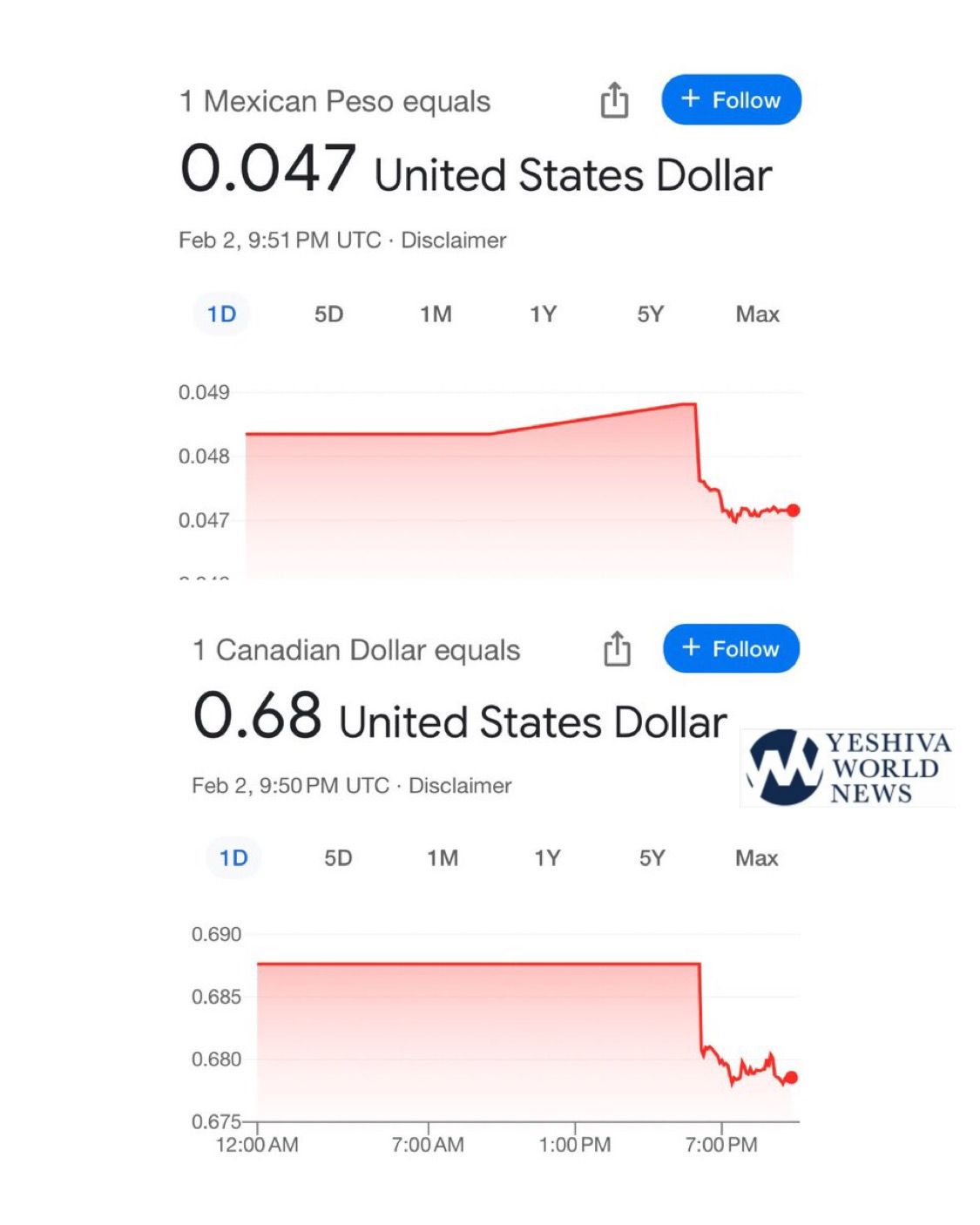

Over the past decade, the CAD-MXN exchange rate has experienced significant volatility. Global economic events, such as the 2008 financial crisis and the COVID-19 pandemic, have triggered sharp movements in the rate.

More recently, factors like inflation rates in both countries, central bank policies, and geopolitical events have played a crucial role in determining the exchange rate.

Decoding the Dance: Factors Influencing the Exchange Rate

Several key factors influence the CAD-MXN exchange rate. Understanding these drivers is crucial for predicting future movements and making informed financial decisions. These factors can be broadly categorized into economic, political, and market sentiment drivers.

Economic factors include interest rate differentials between Canada and Mexico, inflation rates, GDP growth, and trade balances. Higher interest rates in one country tend to attract foreign investment, boosting demand for its currency.

Political stability and government policies also play a significant role. Political uncertainty or changes in government regulations can negatively impact investor confidence and weaken a currency.

Market sentiment, often driven by news and expectations about future economic performance, can also significantly influence the exchange rate. For example, positive news about the Mexican economy could strengthen the peso against the Canadian dollar. Consider the ripple effect after the recent Mexican federal elections; it’s a perfect demonstration of the peso’s sensitivity to political winds.

The Role of Central Banks

Both the Bank of Canada and Banco de México actively manage their respective monetary policies. These policies, which include setting interest rates and managing the money supply, have a direct impact on the exchange rate.

For example, if the Bank of Canada raises interest rates to combat inflation, the Canadian dollar may appreciate against the Mexican peso.

Conversely, if Banco de México lowers interest rates to stimulate economic growth, the peso may depreciate against the Canadian dollar.

Impact on Travel and Tourism

The CAD-MXN exchange rate has a direct impact on Canadians traveling to Mexico and Mexicans visiting Canada. A stronger Canadian dollar means that Canadians can purchase more goods and services in Mexico, making travel more affordable.

Conversely, a weaker Canadian dollar makes travel to Mexico more expensive for Canadians, while making Canada a more attractive destination for Mexican tourists.

For Canadian snowbirds seeking warmer climates during the winter months, a favorable exchange rate can significantly reduce their cost of living in Mexico. This is important for retirees on fixed incomes.

Trade and Investment Implications

The exchange rate also plays a crucial role in trade and investment between Canada and Mexico. A weaker Canadian dollar makes Canadian exports more competitive in the Mexican market.

It also makes Mexican exports more expensive for Canadian consumers. This can affect the balance of trade between the two countries.

Fluctuations in the exchange rate can also impact foreign direct investment (FDI) flows. A stable and predictable exchange rate encourages businesses to invest in both countries.

NAFTA/CUSMA and Currency

The North American Free Trade Agreement (NAFTA), and its successor, the Canada-United States-Mexico Agreement (CUSMA), have significantly impacted trade and investment between Canada and Mexico. The exchange rate plays a crucial role in realizing the full benefits of these trade agreements.

CUSMA, while aiming to modernize trade relations, still leaves the exchange rate exposed to market forces. This dynamic affects pricing and competitiveness of goods crossing borders.

For Canadian businesses importing goods from Mexico, a favorable exchange rate can reduce costs and increase profitability. Conversely, for Canadian businesses exporting to Mexico, a less favorable exchange rate can make their products more expensive and less competitive.

Future Outlook and Predictions

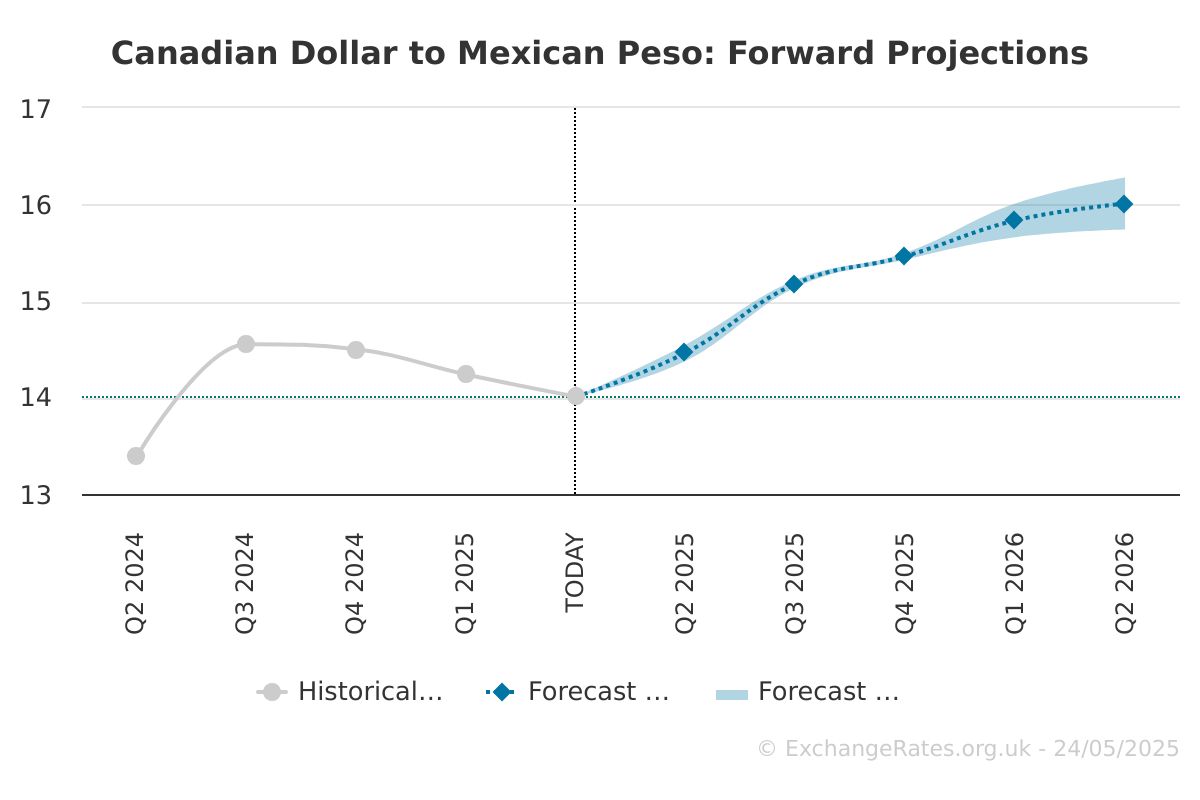

Predicting future movements in the CAD-MXN exchange rate is a challenging task. However, analyzing current economic trends and expert forecasts can provide some insights. Numerous economic think tanks regularly publish reports on currency forecasts, factoring in everything from inflation projections to anticipated central bank policy shifts.

Most analysts agree that the exchange rate will likely remain volatile in the near term, influenced by global economic uncertainty and geopolitical risks. Factors such as the ongoing war in Ukraine and the potential for further interest rate hikes by central banks could contribute to this volatility.

Longer-term, the exchange rate will likely be driven by the relative economic performance of Canada and Mexico, as well as by changes in government policies and market sentiment.

"The CAD-MXN exchange rate is a constantly evolving story, with new chapters being written every day." - Dr. Elena Rodriguez, Economist at the Canadian Council for the Americas

Practical Tips for Navigating the Exchange Rate

For Canadians traveling to or doing business in Mexico, it's essential to be aware of the exchange rate and take steps to mitigate potential risks. Consider using hedging strategies to protect against adverse exchange rate movements.

Shop around for the best exchange rates before exchanging currency. Banks, credit unions, and online currency exchange services offer different rates. Online tools offer quick, updated conversions, providing a snapshot of the day’s rate.

Be mindful of transaction fees when exchanging currency. Some services charge high fees that can significantly reduce the amount of currency you receive.

Conclusion: A Borderless Economy

The CAD-MXN exchange rate is more than just a number; it's a reflection of the interconnectedness of the Canadian and Mexican economies. It influences everything from tourism and trade to investment and the everyday lives of people in both countries.

By understanding the factors that drive the exchange rate and taking steps to manage potential risks, Canadians and Mexicans can navigate this complex landscape and benefit from the opportunities that cross-border trade and investment provide. The exchange rate is a thread woven through the fabric of our shared North American prosperity, constantly adjusting, yet always connecting us.

So, the next time you’re considering that hand-woven blanket in San Miguel de Allende, remember that the exchange rate is not just a financial detail; it’s part of a larger story of economic exchange, cultural connection, and the ever-evolving relationship between Canada and Mexico.