Getpurdentix Reviews And Complaints Consumer Reports

A cloud of uncertainty hangs over GetPurudentix, a relatively new entrant in the burgeoning online personal finance management sector. Claims of simplified budgeting, automated savings, and personalized investment advice are being met with a growing chorus of user complaints and skeptical reviews. Is GetPurudentix a revolutionary tool for financial empowerment, or a misleading platform preying on vulnerable consumers?

This article delves into the mounting criticisms surrounding GetPurudentix, analyzing Consumer Reports findings, dissecting user complaints, and examining the company's responses. Our investigation aims to provide a balanced and comprehensive overview, enabling readers to make informed decisions about whether GetPurudentix aligns with their financial needs and risk tolerance.

User Complaints: A Common Thread of Frustration

A significant portion of the negative feedback directed towards GetPurudentix centers on unexpected fees and opaque pricing structures. Many users report being lured in by initial promises of a free trial or basic service, only to find themselves hit with recurring charges they were not adequately informed about. These charges often relate to premium features or access to specific investment tools.

The lack of transparency surrounding these fees has led to accusations of deceptive marketing practices. Users argue that the company intentionally buries crucial pricing information within lengthy terms of service agreements or fails to provide clear explanations during the onboarding process. This practice leaves many feeling misled and financially exploited.

Beyond the issue of fees, numerous complaints highlight problems with the platform's functionality and customer service. Users have reported glitches in the budgeting tools, inaccuracies in investment tracking, and difficulties in withdrawing funds.

These technical issues are often compounded by a slow and unresponsive customer support system. Many users claim their inquiries go unanswered for days, or that they receive generic responses that fail to address their specific concerns. This poor customer service adds to the frustration and distrust surrounding the platform.

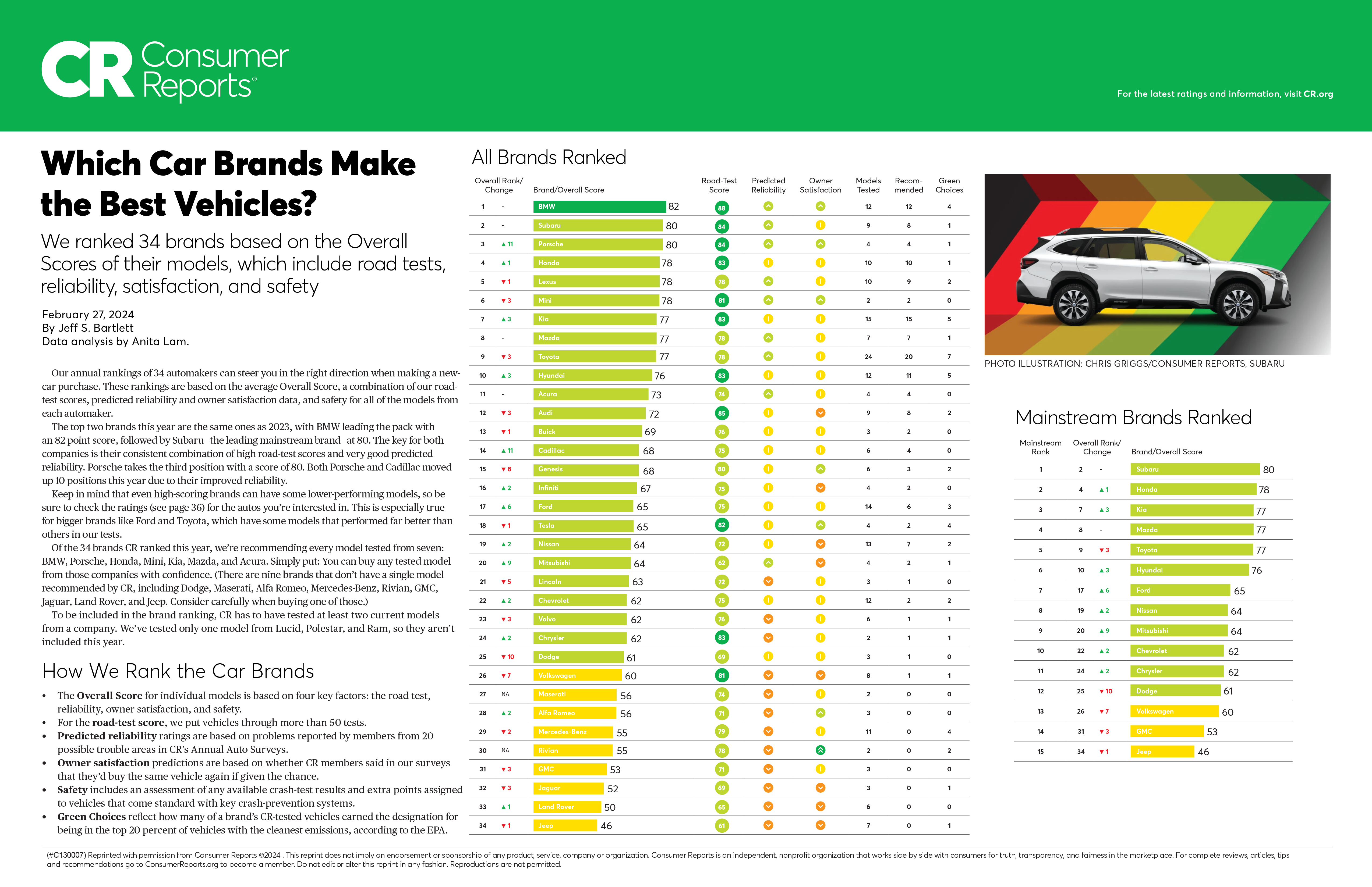

Consumer Reports Weighs In: Cautious Assessment

Consumer Reports, a non-profit organization known for its independent product testing and consumer advocacy, recently published a preliminary assessment of GetPurudentix. While stopping short of an outright negative rating, the report raised several red flags, echoing many of the concerns voiced by individual users.

The Consumer Reports analysis specifically highlighted the lack of clarity in the fee structure and the potential for users to unknowingly incur charges. They also expressed reservations about the limited investment options available through the platform and the potential risks associated with relying solely on GetPurudentix's automated investment recommendations.

Furthermore, the report emphasized the importance of thorough due diligence before entrusting any online platform with sensitive financial information. They advised users to carefully review the terms of service, compare pricing with competing services, and seek independent financial advice from a qualified professional.

GetPurudentix's Response: Defensiveness and Promises of Improvement

In response to the mounting criticisms and the Consumer Reports assessment, GetPurudentix has issued a series of statements defending its practices. The company maintains that its pricing structure is clearly outlined in its terms of service and that users are responsible for reading and understanding these terms before signing up.

However, they have also acknowledged the need for greater transparency and improved customer communication. GetPurudentix has pledged to simplify its fee structure, enhance its customer support channels, and provide more user-friendly tutorials on navigating the platform.

Whether these promises will translate into meaningful improvements remains to be seen. Skeptics argue that GetPurudentix's response is merely a PR move designed to mitigate the damage to its reputation and attract new customers. They point to the company's continued reliance on ambiguous language and aggressive marketing tactics as evidence of its underlying intentions.

The Broader Context: Risks of Online Financial Platforms

The controversy surrounding GetPurudentix underscores the broader risks associated with entrusting personal finances to online platforms. While these platforms can offer convenience and accessibility, they also present unique challenges in terms of security, transparency, and consumer protection.

Users should be aware of the potential for data breaches, algorithmic bias in investment recommendations, and the difficulty of resolving disputes with companies operating primarily online. It's imperative to approach these platforms with a healthy dose of skepticism and to prioritize due diligence before sharing sensitive financial information.

Protecting Yourself: Key Considerations

Before signing up for any online financial platform, consider the following:

- Read the fine print: Carefully review the terms of service, paying close attention to pricing, fees, and cancellation policies.

- Compare services: Research competing platforms and compare their features, fees, and customer reviews.

- Seek independent advice: Consult with a qualified financial advisor to discuss your financial goals and risk tolerance.

- Protect your data: Use strong passwords, enable two-factor authentication, and regularly monitor your accounts for suspicious activity.

Looking Ahead: Regulatory Scrutiny and Consumer Empowerment

The growing number of complaints against GetPurudentix and similar platforms may attract increased scrutiny from regulatory agencies like the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB). These agencies have the power to investigate deceptive marketing practices, enforce consumer protection laws, and impose penalties on companies that violate these laws.

Ultimately, the responsibility for protecting oneself in the online financial marketplace rests with individual consumers. By staying informed, exercising caution, and demanding transparency, consumers can empower themselves to make sound financial decisions and avoid being taken advantage of by unscrupulous platforms.

As the GetPurudentix situation unfolds, it serves as a stark reminder of the importance of vigilance and informed decision-making in the rapidly evolving world of online personal finance. The future of GetPurudentix hinges on its ability to address the legitimate concerns raised by users and demonstrate a genuine commitment to transparency and customer satisfaction.

![Getpurdentix Reviews And Complaints Consumer Reports DentiCore Reviews [2025]: Scam Complaints & Consumer Reports](https://honestproreview.com/wp-content/uploads/2024/03/denticore-official-website-1536x240.png)