$100 Approval Loan Deposited To Prepaid Debit Card

A new financial product offering $100 loans deposited directly onto prepaid debit cards is gaining traction, prompting both interest and scrutiny from consumer advocacy groups.

This offering, aimed at individuals facing immediate financial needs, presents a potentially quick solution but also raises questions about accessibility, fees, and potential for debt traps.

What is the $100 Prepaid Debit Card Loan?

The $100 Approval Loan Deposited To Prepaid Debit Card is a short-term loan designed to provide immediate access to funds. Instead of traditional bank transfers, the loan amount is loaded onto a prepaid debit card, which the borrower receives either physically or virtually.

This method aims to circumvent the need for a traditional bank account, making it accessible to a broader range of individuals, particularly those who are unbanked or underbanked.

The service is primarily offered online by various fintech companies, with application processes often streamlined for quick approval.

Who is Offering These Loans?

Several fintech companies have entered this market, each offering slightly different terms and conditions. ACE Cash Express and Netspend, while not directly offering this exact loan product, are established players in the prepaid debit card and short-term loan industries, suggesting a potential market and infrastructure for such services.

Smaller, digitally native companies are also emerging, capitalizing on the demand for accessible and quick loans. These companies often utilize online advertising and social media to reach their target audience.

It's important for consumers to research thoroughly the specific lender's reputation and read reviews before committing to a loan.

The Mechanics: How it Works

The process generally involves completing an online application with basic personal and financial information. Approval is often based on factors such as income verification and identity confirmation.

Once approved, the $100 loan is deposited onto the prepaid debit card, and the borrower receives the card details, either physically by mail or virtually via email or app.

The card can then be used for online purchases, in-store transactions, or ATM withdrawals. Repayment is typically automated, with funds withdrawn from the prepaid card on the agreed-upon due date.

Significance and Potential Impact

The emergence of these loans highlights the ongoing need for accessible financial services for individuals with limited resources. A 2017 report by the Federal Deposit Insurance Corporation (FDIC) found that 8.4 million U.S. households were unbanked.

This statistic underscores the demand for alternative financial solutions like prepaid debit card loans. By providing a quick and relatively simple way to access funds, these loans can address immediate financial needs such as unexpected bills or emergency expenses.

However, the ease of access and the associated fees and interest rates can pose risks for borrowers.

Concerns and Criticisms

Consumer advocacy groups have voiced concerns about the potential for these loans to trap vulnerable individuals in a cycle of debt. The Consumer Financial Protection Bureau (CFPB) has issued warnings about the high costs associated with short-term loans.

The interest rates and fees associated with these $100 loans can be significantly higher than those of traditional loans. Borrowers may face challenges repaying the loan on time, leading to additional fees and accumulating debt.

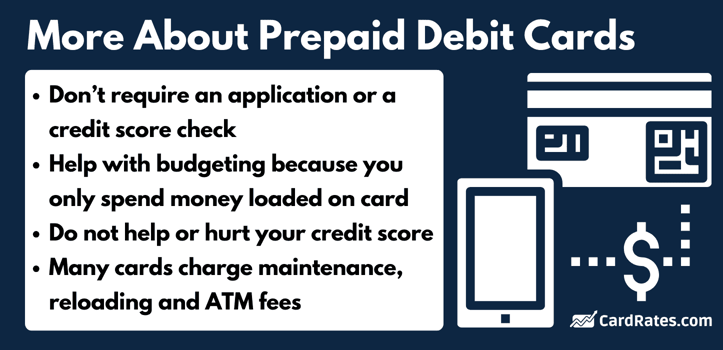

Furthermore, the reliance on prepaid debit cards can also expose borrowers to additional fees associated with card usage, such as ATM withdrawal fees or monthly maintenance fees.

Looking Ahead

The future of $100 prepaid debit card loans will likely depend on regulatory oversight and consumer awareness. Increased transparency regarding fees and interest rates is crucial to protect borrowers.

Education initiatives aimed at promoting financial literacy and responsible borrowing practices can also help mitigate the risks associated with these loans. The National Foundation for Credit Counseling (NFCC) and similar organizations offer resources for individuals seeking financial advice and support.

As the fintech landscape continues to evolve, it is essential for regulators, industry stakeholders, and consumer advocacy groups to work together to ensure that financial products are both accessible and responsible.