1099 Combined Federal State Filing Program

A silent revolution is occurring in how businesses handle their 1099 filings. Many businesses are unaware of a streamlined process designed to ease the burden of reporting non-employee compensation and other miscellaneous income. This process aims to reduce errors and improve tax compliance, but its adoption remains uneven across the country.

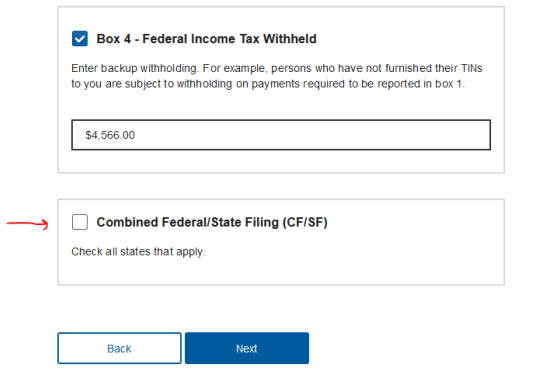

The Combined Federal/State Filing (CF/SF) Program is a partnership between the IRS and participating states. It allows businesses to submit 1099 information returns to the IRS electronically, who then automatically forwards the state portion of the data to participating states. This system is intended to simplify the filing process for businesses that pay independent contractors, vendors, or other recipients who are not employees.

Understanding the CF/SF Program

The core of the CF/SF program lies in its efficiency. Instead of businesses submitting 1099 forms to both the IRS and individual state tax agencies, the IRS acts as a central hub.

Once the federal filing is complete, the IRS electronically transmits the relevant data to the appropriate state tax departments, streamlining the entire process.

This reduces the administrative overhead for businesses, minimizes the risk of discrepancies between federal and state filings, and potentially reduces the likelihood of penalties for non-compliance.

Eligibility and Participation

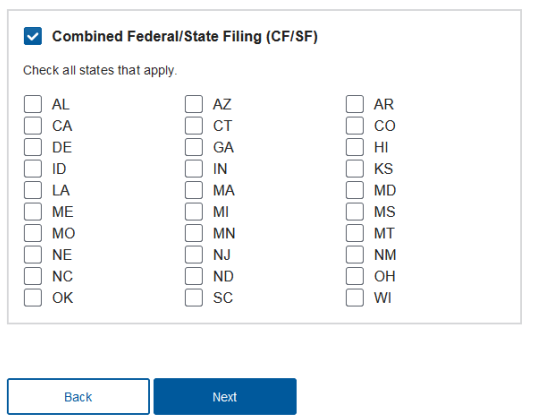

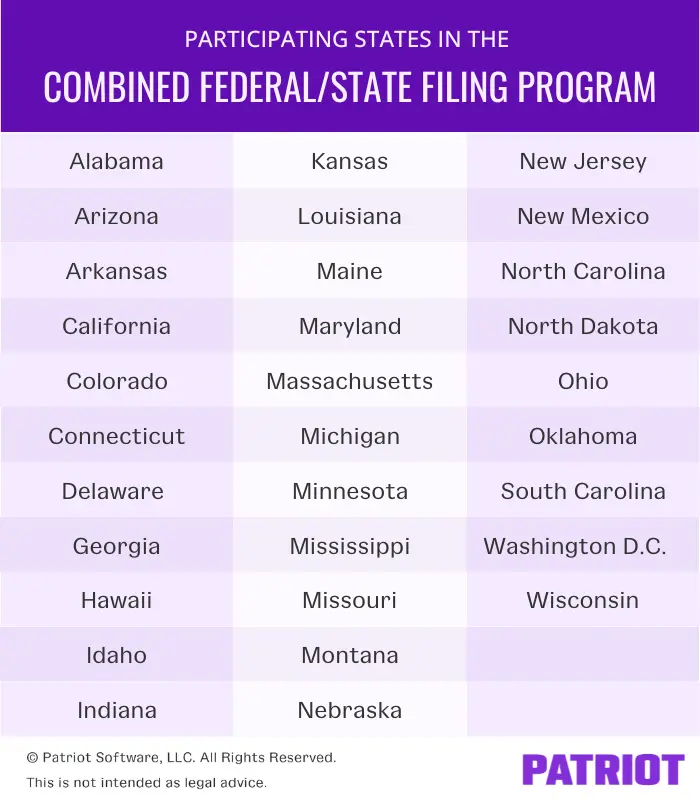

Not all states participate in the CF/SF Program. As of 2024, a significant number of states are part of the program, but it's crucial for businesses to verify whether the states they operate in are participants.

The IRS publishes a list of participating states annually on its website, including specific information on which 1099 forms are eligible for combined filing in each state.

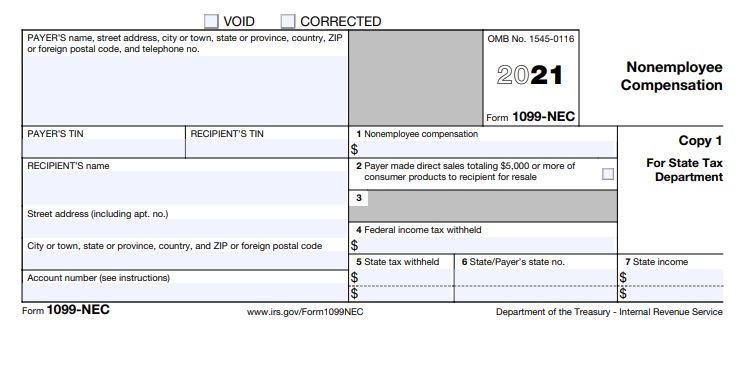

Forms commonly covered include 1099-NEC (Nonemployee Compensation), 1099-MISC (Miscellaneous Income), and 1099-DIV (Dividends and Distributions).

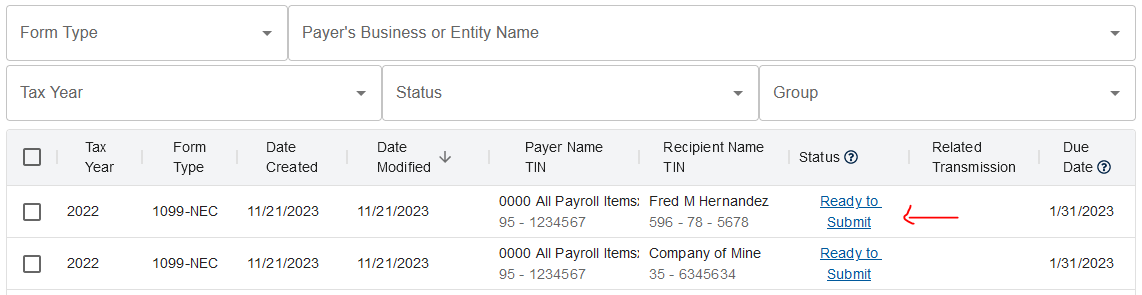

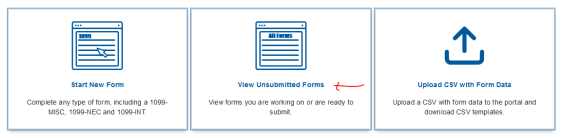

Furthermore, eligibility extends to businesses that file 1099 forms electronically. The IRS mandates electronic filing for businesses filing 10 or more information returns of any type, so most companies already meet this requirement.

However, even businesses filing fewer than 10 forms are encouraged to file electronically for increased accuracy and faster processing.

There are specific state requirements that must be fulfilled, such as income thresholds or specific coding requirements. These vary depending on the state.

Benefits for Businesses

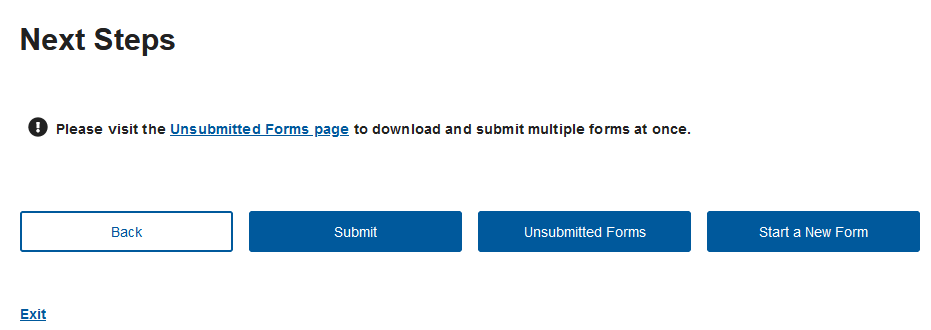

The most significant advantage of the CF/SF Program is the reduction in administrative burden. Businesses save time and resources by submitting 1099 information only once to the IRS.

This simplifies the compliance process and reduces the risk of errors that can occur when manually preparing and submitting separate state filings.

The program also promotes greater accuracy. By having the IRS transmit data directly to the states, it minimizes the potential for data entry errors or discrepancies during manual transfers.

Cost savings are another notable benefit. Reducing the time and resources devoted to 1099 filings translates to lower administrative costs for businesses, particularly for those operating in multiple states.

Many tax professionals view the CF/SF program as a best practice. According to Sarah Miller, CPA, "The CF/SF Program has been a game-changer for many of my clients. It has significantly reduced the time spent on 1099 filings and helped minimize errors, which ultimately saves them money and reduces their stress during tax season."

Reduced risk of penalties is an underrated benefit.

Challenges and Considerations

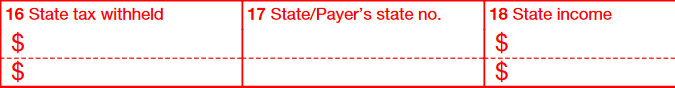

Despite its advantages, the CF/SF Program presents some challenges. One key challenge is the variation in state requirements. Even though the IRS handles the data transmission, businesses still need to understand the specific filing requirements of each participating state.

This includes understanding income thresholds, specific coding requirements, and any state-specific forms or schedules that may need to be filed separately.

Lack of awareness remains a barrier. Many businesses, especially small businesses, are simply unaware of the CF/SF Program and its benefits.

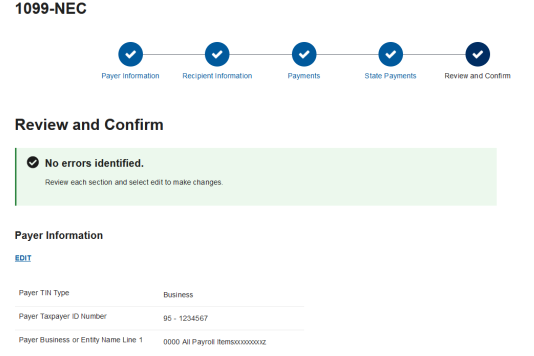

The program relies on accurate data reporting at the federal level. If the information submitted to the IRS is incorrect or incomplete, those errors will be transmitted to the states, potentially leading to penalties.

Businesses must ensure that they have accurate and up-to-date information for all payees, including names, addresses, and taxpayer identification numbers.

The IRS emphasizes the importance of verifying payee information through the IRS TIN Matching program to minimize errors.

Future of the CF/SF Program

The CF/SF Program is likely to expand in the future as more states recognize its benefits. The trend toward greater automation and data sharing in tax administration suggests that combined filing programs will become increasingly prevalent.

Some anticipate that more standardization may occur in the future, with states adopting more uniform requirements for 1099 filings. This would further simplify the process for businesses operating in multiple states.

Continued education and outreach are essential to increase awareness and adoption of the CF/SF Program. The IRS and state tax agencies can play a crucial role in educating businesses about the program's benefits and providing resources to help them comply with filing requirements.

Technology will continue to play a key role in the evolution of the CF/SF Program. As tax software and filing platforms become more sophisticated, they will offer more seamless integration with the program, automating the process of data transmission and ensuring compliance with state-specific requirements. The IRS continues to update its systems.

This includes leveraging cloud-based solutions and data analytics to improve the accuracy and efficiency of 1099 filings.

These advancements will make the CF/SF Program even more attractive to businesses of all sizes.

While the Combined Federal/State Filing Program offers a significant simplification for businesses handling 1099 forms, diligence is key. Understanding specific state requirements is paramount. By embracing this system and staying informed, businesses can streamline their tax compliance and minimize potential errors.