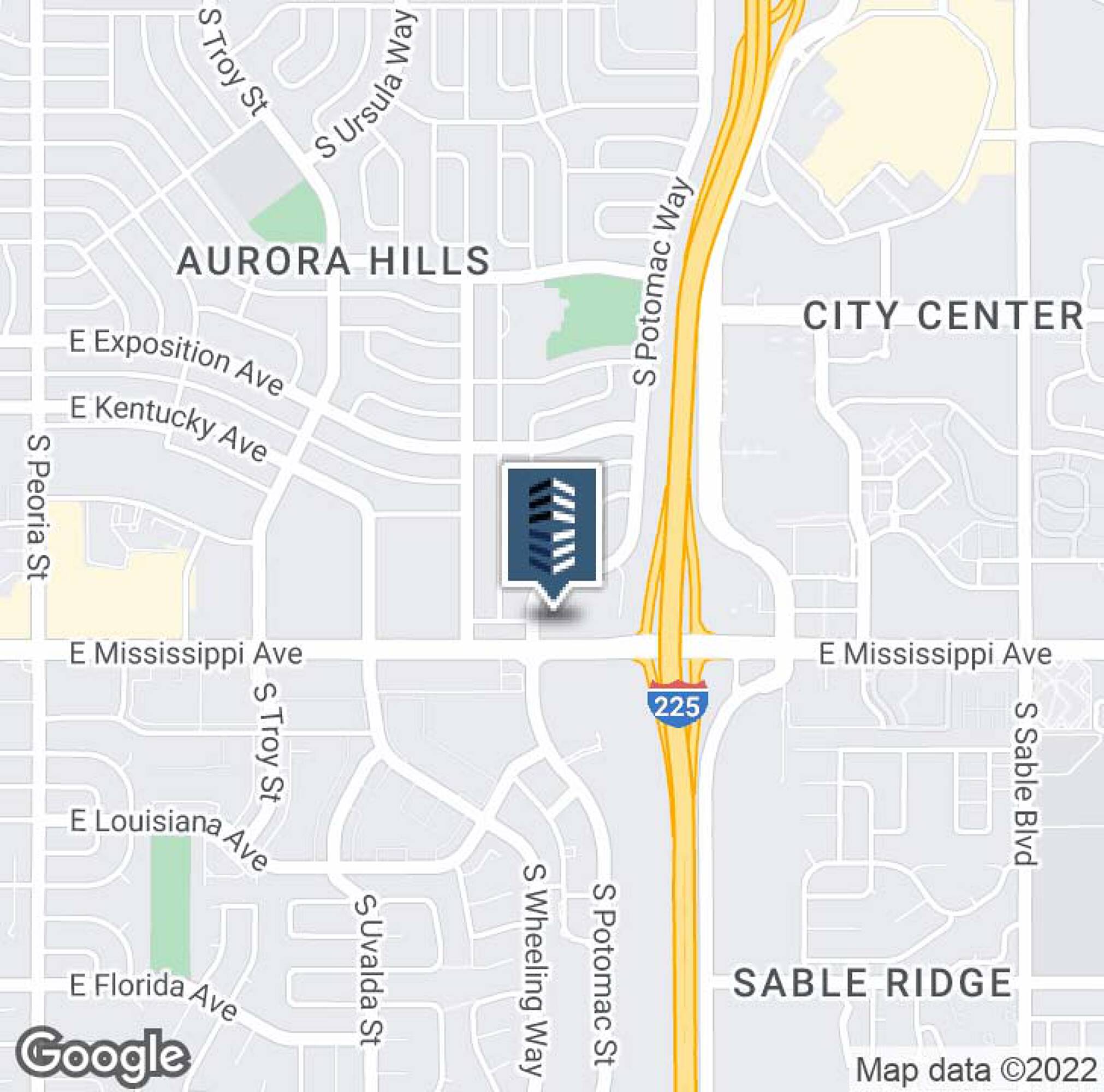

13701 E Mississippi Ave Ste 320 Aurora Co 80012

Aurora, Colorado – A quiet office suite at 13701 E Mississippi Ave Ste 320 has become the focal point of an emerging legal battle involving allegations of deceptive business practices and consumer exploitation.

At the heart of the controversy is American Financial Advocates (AFA), a company operating from this address, which is accused of misleading clients seeking debt relief and financial assistance. The accusations, detailed in multiple complaints filed with the Better Business Bureau (BBB) and the Colorado Attorney General's office, raise serious questions about the company’s operational transparency and ethical conduct.

American Financial Advocates, according to its website, offers services aimed at helping individuals and families navigate complex financial challenges, including debt consolidation, credit counseling, and financial planning.

Allegations of Deceptive Practices

The core of the allegations against AFA centers on claims that the company makes unrealistic promises regarding debt reduction and provides inadequate or misleading information about fees and service terms.

Several complainants allege that they were led to believe that AFA would significantly reduce their debt burden, only to discover that the actual results fell far short of initial projections. These customers claim that the company failed to deliver on its promises and that the fees charged were excessive and not clearly disclosed upfront.

The BBB has given American Financial Advocates a "C" rating, reflecting the organization's concerns about the volume of complaints and the company's response to those complaints. The BBB report details a pattern of customer grievances related to contract issues and service quality.

Who is Involved?

The complaints primarily target American Financial Advocates and its representatives, whose names frequently appear in customer testimonials and online reviews. While the specific individuals vary across different complaints, the recurring theme involves dissatisfaction with the sales and service delivery processes.

The Colorado Attorney General's office has acknowledged receiving complaints about AFA and confirmed that they are reviewing the allegations to determine if further action is warranted. This review could lead to a formal investigation or legal proceedings if the company is found to have violated consumer protection laws.

Attempts to reach representatives at American Financial Advocates for comment were unsuccessful. Calls to the company’s listed phone number resulted in a generic voicemail message.

Potential Impact and Ramifications

The allegations against American Financial Advocates have significant implications for consumers seeking financial assistance in Aurora and beyond.

If proven true, the deceptive practices could leave vulnerable individuals in a worse financial situation than they were before engaging with the company. This can create a cycle of debt and financial hardship that is difficult to escape.

Furthermore, the case highlights the importance of due diligence and careful scrutiny when engaging with financial service providers. Experts recommend that consumers thoroughly research companies, read customer reviews, and understand all fees and terms before signing any agreements.

The situation also underscores the role of regulatory bodies like the Colorado Attorney General's office and the BBB in protecting consumers from fraudulent or unethical business practices. These organizations provide resources for consumers to report complaints and access information about companies' track records.

“Consumers should always be wary of promises that seem too good to be true,” says Susan Walker, a financial advisor based in Denver. “Debt relief is a complex process, and it’s essential to work with reputable and transparent providers.”

The outcome of the review by the Colorado Attorney General's office could set a precedent for future cases involving alleged deceptive practices in the financial services industry. A positive outcome for the complainants would likely lead to stricter regulations and increased oversight of similar companies.

Moving Forward

As the legal process unfolds, consumers affected by American Financial Advocates' practices are encouraged to file complaints with the BBB and the Colorado Attorney General's office.

These complaints can help strengthen the case against the company and provide additional evidence of potential wrongdoing. The information gathered will assist in determining the extent of the alleged misconduct and the appropriate course of action.

The office suite at 13701 E Mississippi Ave Ste 320, once a symbol of financial hope for some, now stands as a reminder of the potential risks associated with unregulated or unscrupulous financial service providers. The ongoing investigation will determine whether American Financial Advocates can continue to operate from this location, or face the consequences of its alleged actions.