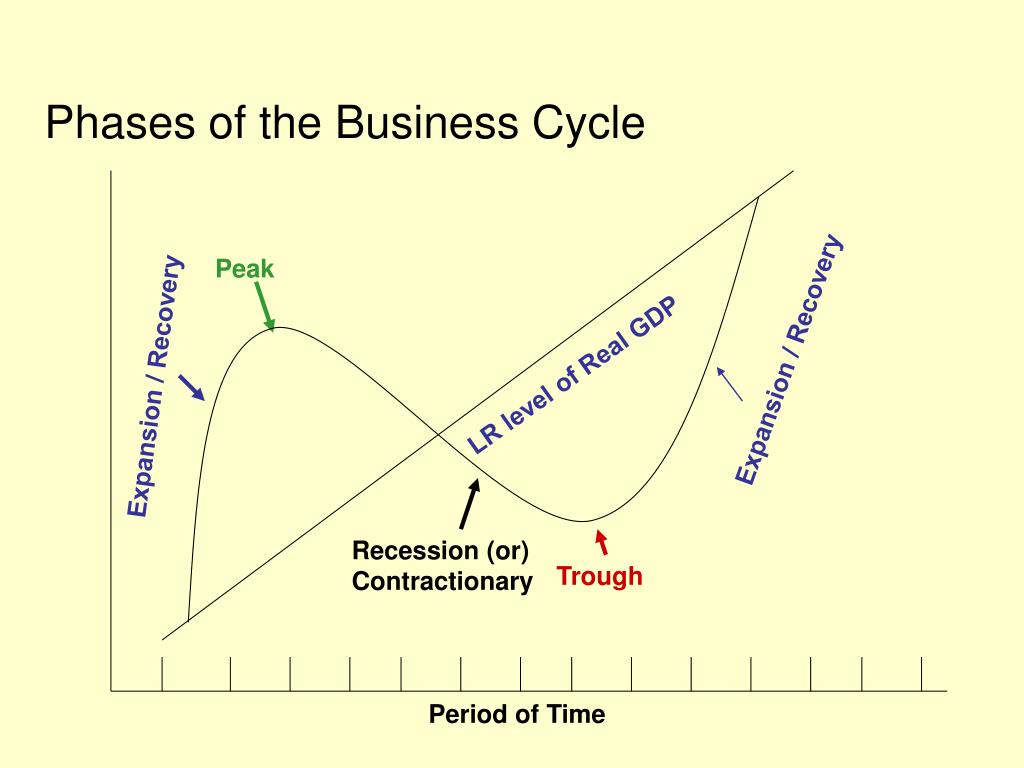

In The Expansion Phase Of The Business Cycle

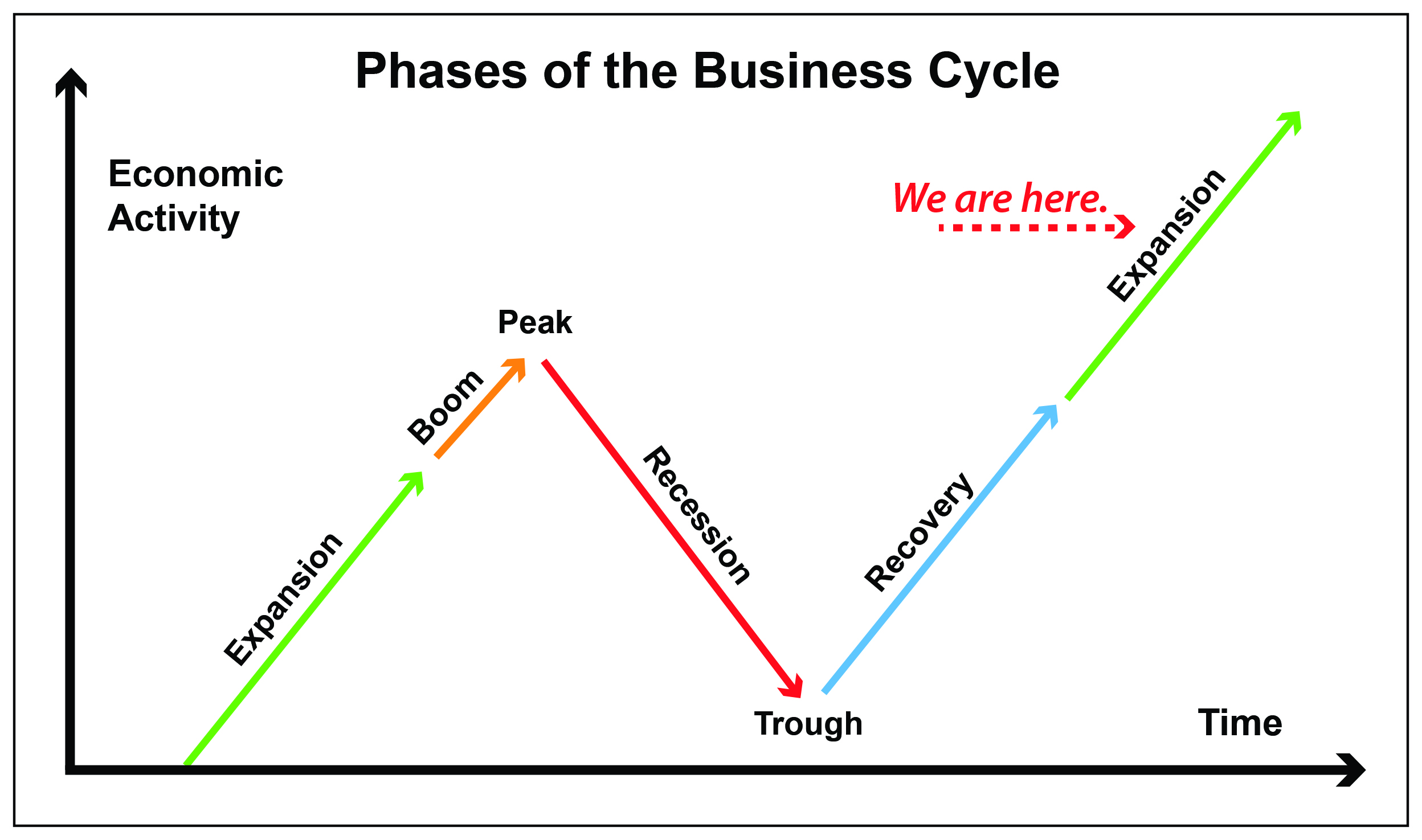

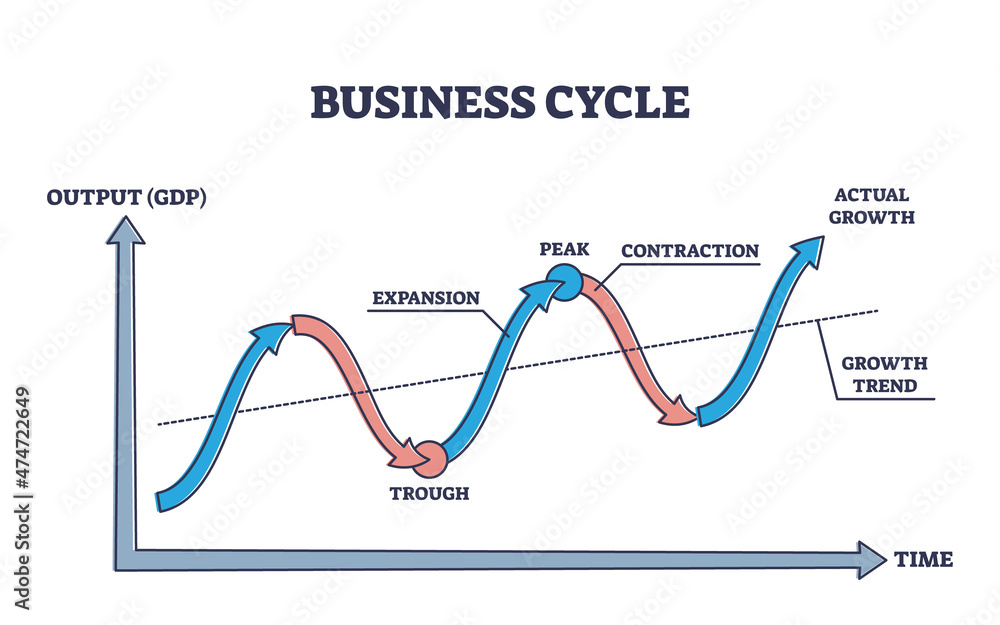

The United States economy continues to show signs of expansion, with recent data indicating sustained growth across various sectors. This period of economic expansion, while welcomed by many, also presents challenges and raises questions about its longevity and potential impact on inflation and employment.

This article examines the current state of the economic expansion, exploring the key indicators, contributing factors, and potential consequences for individuals and businesses.

Economic Indicators Point to Continued Growth

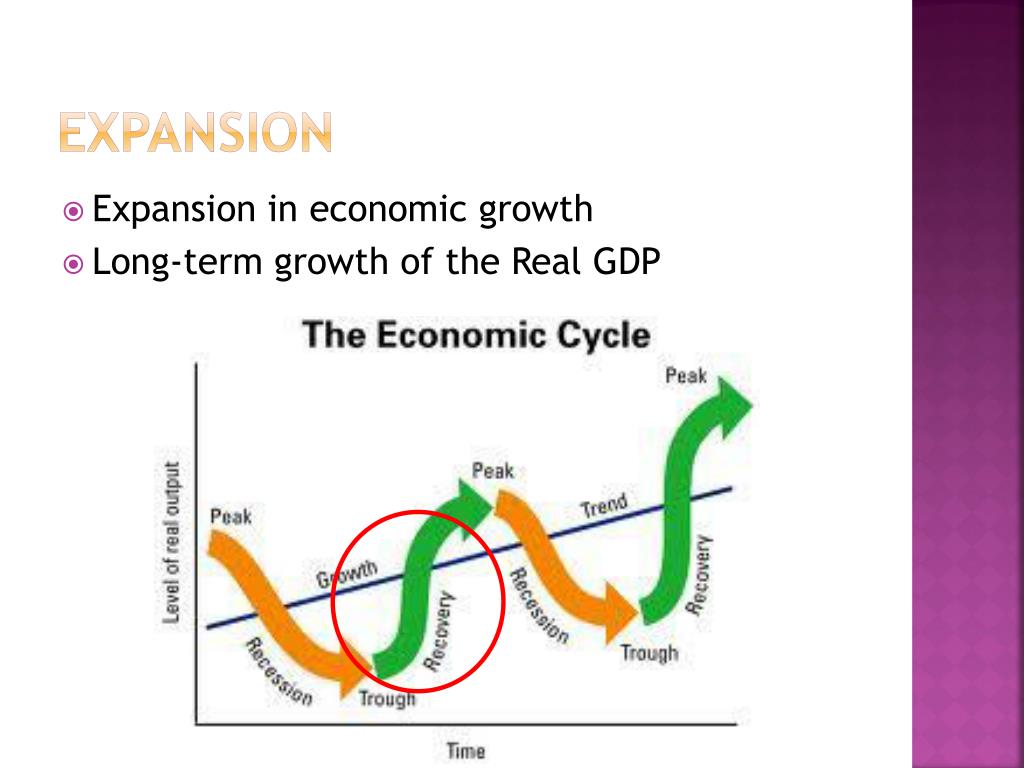

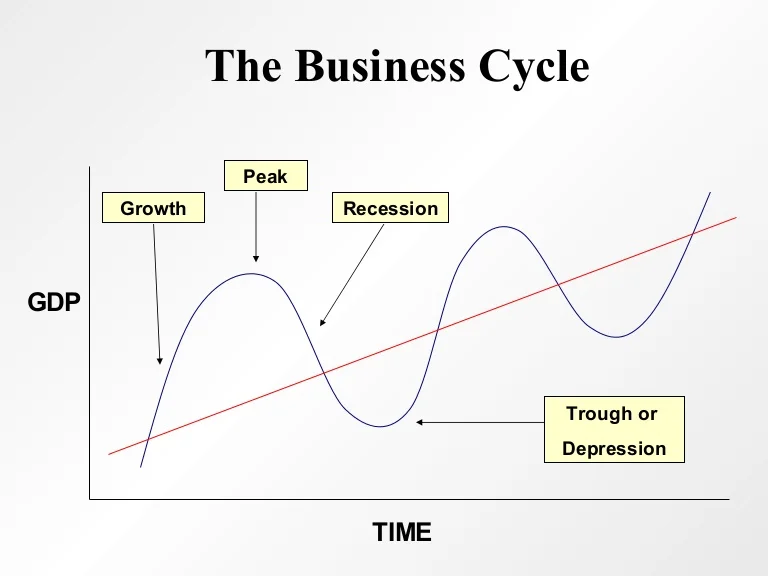

Multiple economic indicators suggest the U.S. economy is still in an expansion phase. The Gross Domestic Product (GDP), a key measure of economic output, has shown consistent growth in recent quarters, according to the Bureau of Economic Analysis (BEA). Consumer spending remains robust, driven by a strong labor market and rising wages.

“The ongoing expansion reflects the resilience of the American economy,” stated Dr. Anya Sharma, a senior economist at the Economic Policy Institute, in a recent interview. She added, “However, it’s crucial to monitor potential risks such as rising interest rates and global economic uncertainty.”

Labor Market Strength Fuels Expansion

A significant driver of the current expansion is the strength of the labor market. The unemployment rate remains low, hovering around historical lows, as reported by the Bureau of Labor Statistics (BLS). This tight labor market has led to increased wage growth, providing consumers with more disposable income and fueling spending.

However, the tight labor market also poses challenges. Businesses are struggling to find qualified workers, leading to increased labor costs and potentially impacting productivity.

Inflation a Key Concern

While economic expansion is generally positive, rising inflation remains a key concern. The Consumer Price Index (CPI), a measure of inflation, has shown a persistent upward trend. The Federal Reserve has been actively raising interest rates to combat inflation, but the effects of these rate hikes are still being felt throughout the economy.

"The Fed is walking a tightrope," explained Professor David Lee, an economics professor at Columbia University. "They need to cool down the economy to control inflation without triggering a recession."

Impact on Businesses and Individuals

The economic expansion has had a mixed impact on businesses. Many companies have benefited from increased consumer demand and rising profits. However, businesses are also facing challenges such as higher input costs, labor shortages, and rising interest rates.

For individuals, the expansion has led to increased job opportunities and higher wages. However, inflation has eroded some of these gains, as the cost of goods and services has risen significantly.

"I'm grateful for the raise I got this year," said Maria Rodriguez, a retail worker. "But everything is so expensive now, it feels like I'm not really making any more money."

Sustainability of the Expansion

The long-term sustainability of the current economic expansion is uncertain. Several factors could potentially derail the expansion, including rising interest rates, global economic slowdown, and geopolitical risks.

Economists are closely monitoring these risks and assessing their potential impact on the U.S. economy. The Federal Reserve's future actions will be crucial in determining the trajectory of the expansion.

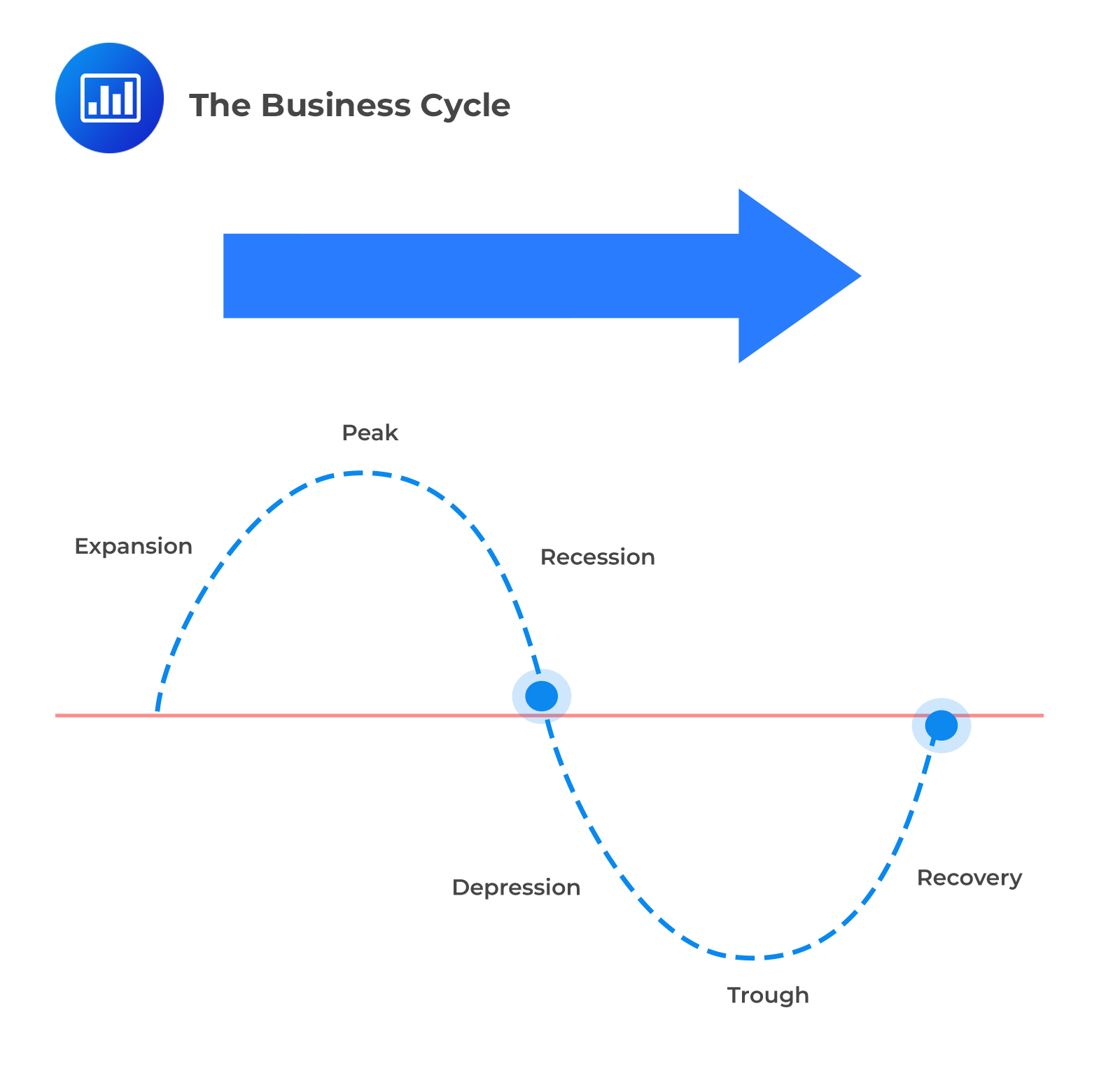

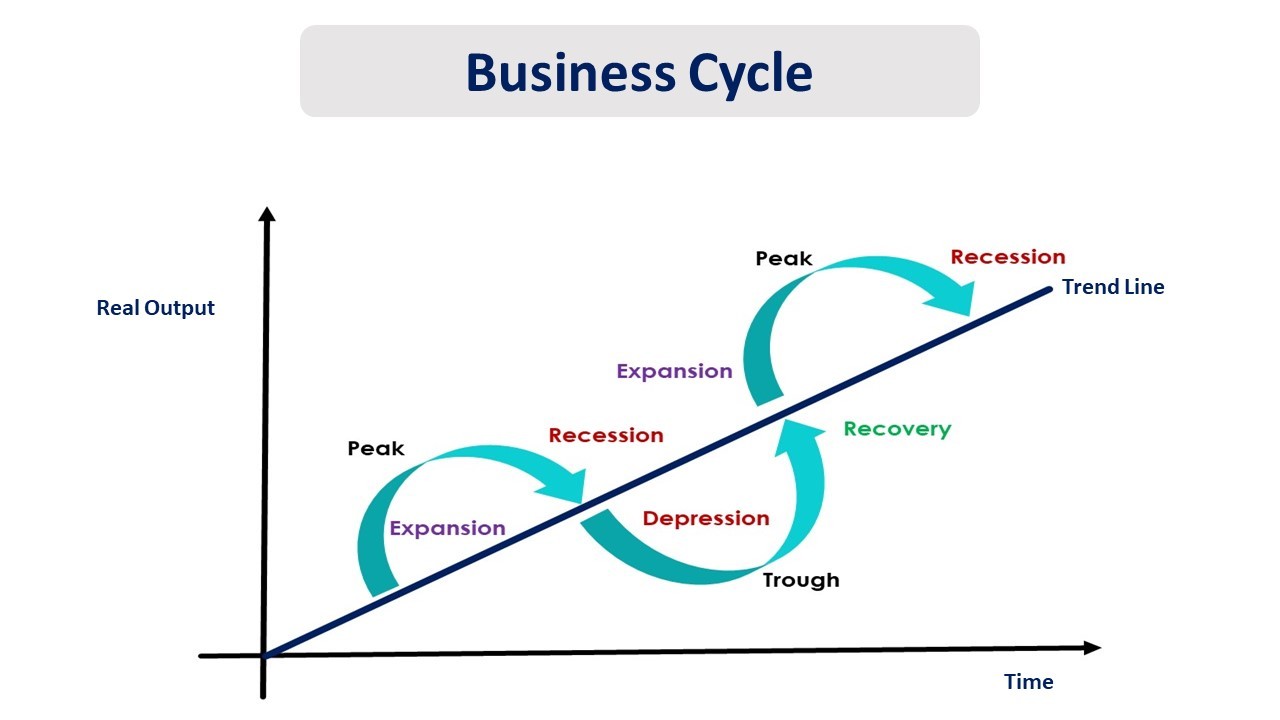

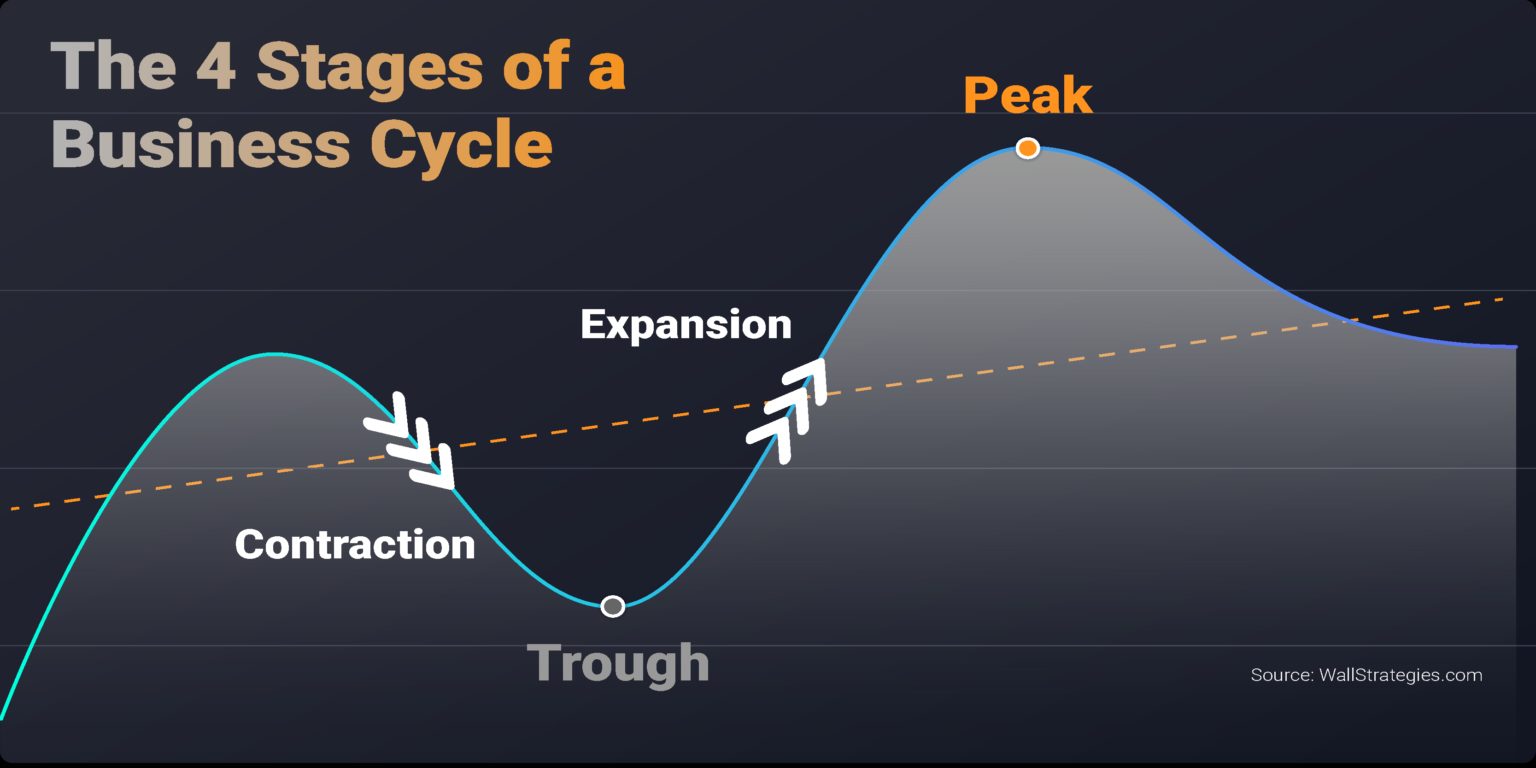

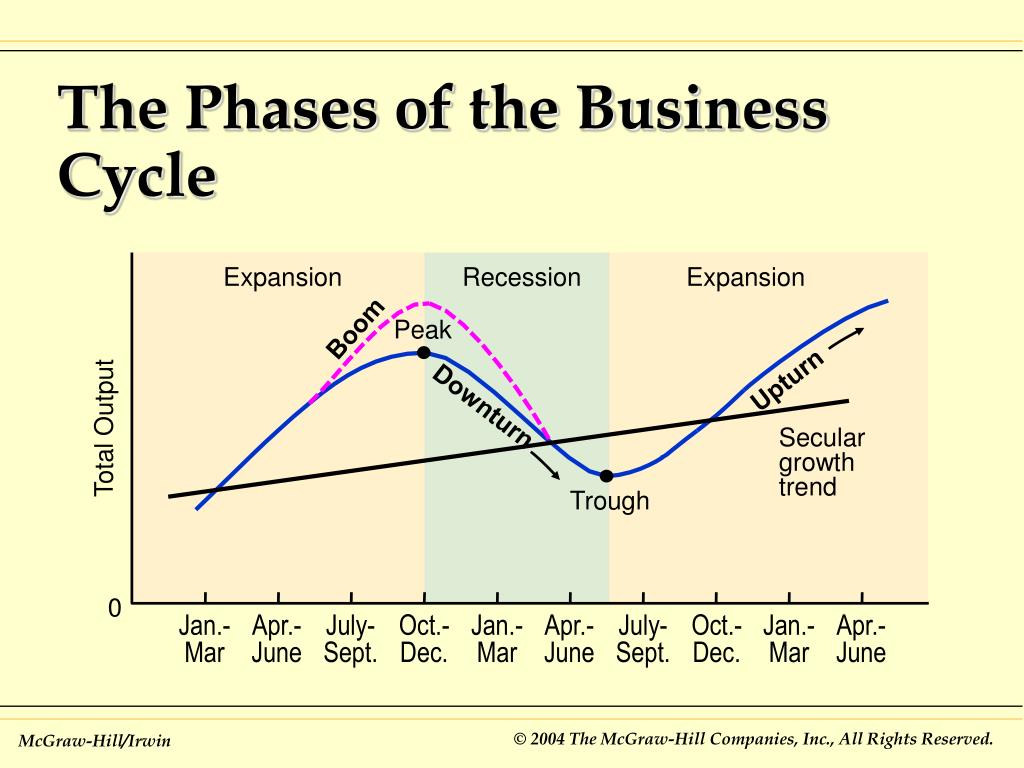

The current expansion highlights the inherent cyclical nature of economies, requiring constant vigilance and proactive policies to mitigate potential downturns.

/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)

:max_bytes(150000):strip_icc()/phasesofthebusinesscycle-c7cb7a3ce6894e86a3e44d5b0fe4d5e2.jpg)

:max_bytes(150000):strip_icc()/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)