21 Million Divided By 8 Billion

Imagine standing on a vast, windswept plain under a starlit sky. The air is crisp, and the sheer scale of the universe presses in, both humbling and exhilarating. Now, picture scattered amongst those stars, a finite number of golden coins, each representing a single Bitcoin. As you gaze upwards, think about how many people on Earth might hope to claim just one of those glittering pieces.

This article explores the simple but profound equation: 21 million divided by 8 billion. It delves into what this calculation represents in the context of Bitcoin's limited supply and the growing global population, and examines the implications for wealth distribution and the future of digital scarcity.

The Foundation: Bitcoin's Fixed Supply

Bitcoin, unlike traditional fiat currencies, has a hard-coded supply limit of 21 million coins. This was a deliberate design choice by its pseudonymous creator, Satoshi Nakamoto, to ensure scarcity and prevent inflation.

This fixed supply is a fundamental aspect of Bitcoin's value proposition.

It sets it apart from currencies controlled by central banks, which can, in theory, print money indefinitely, potentially devaluing existing holdings.

Understanding Scarcity in a Digital Age

In a world of digital abundance, the concept of scarcity is often challenged. Information can be replicated infinitely, and digital assets can be easily copied.

Bitcoin, however, achieves scarcity through cryptographic mechanisms.

The blockchain technology underpinning Bitcoin ensures that each coin is unique and cannot be duplicated or counterfeited. This is a key element for the store of value narrative.

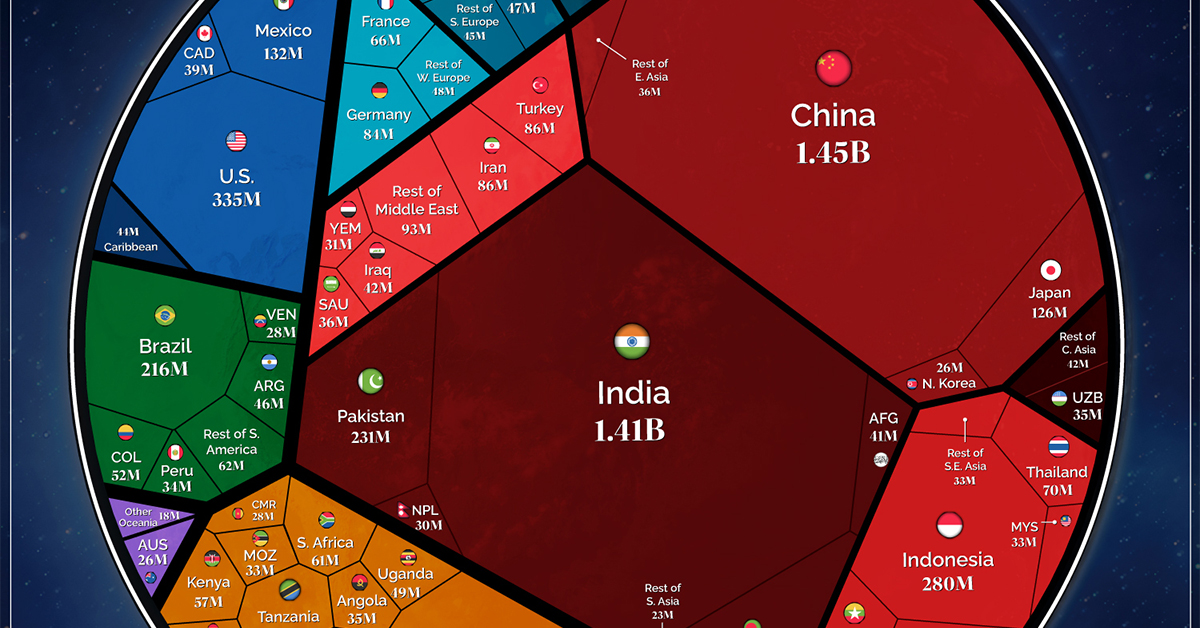

The Global Population: Eight Billion and Growing

According to the United Nations, the global population surpassed 8 billion in late 2022.

This number continues to grow, albeit at a slowing rate, placing increasing demands on resources and highlighting the importance of efficient allocation.

The sheer scale of humanity underscores the limited nature of resources, be they arable land, freshwater, or, in this case, Bitcoin.

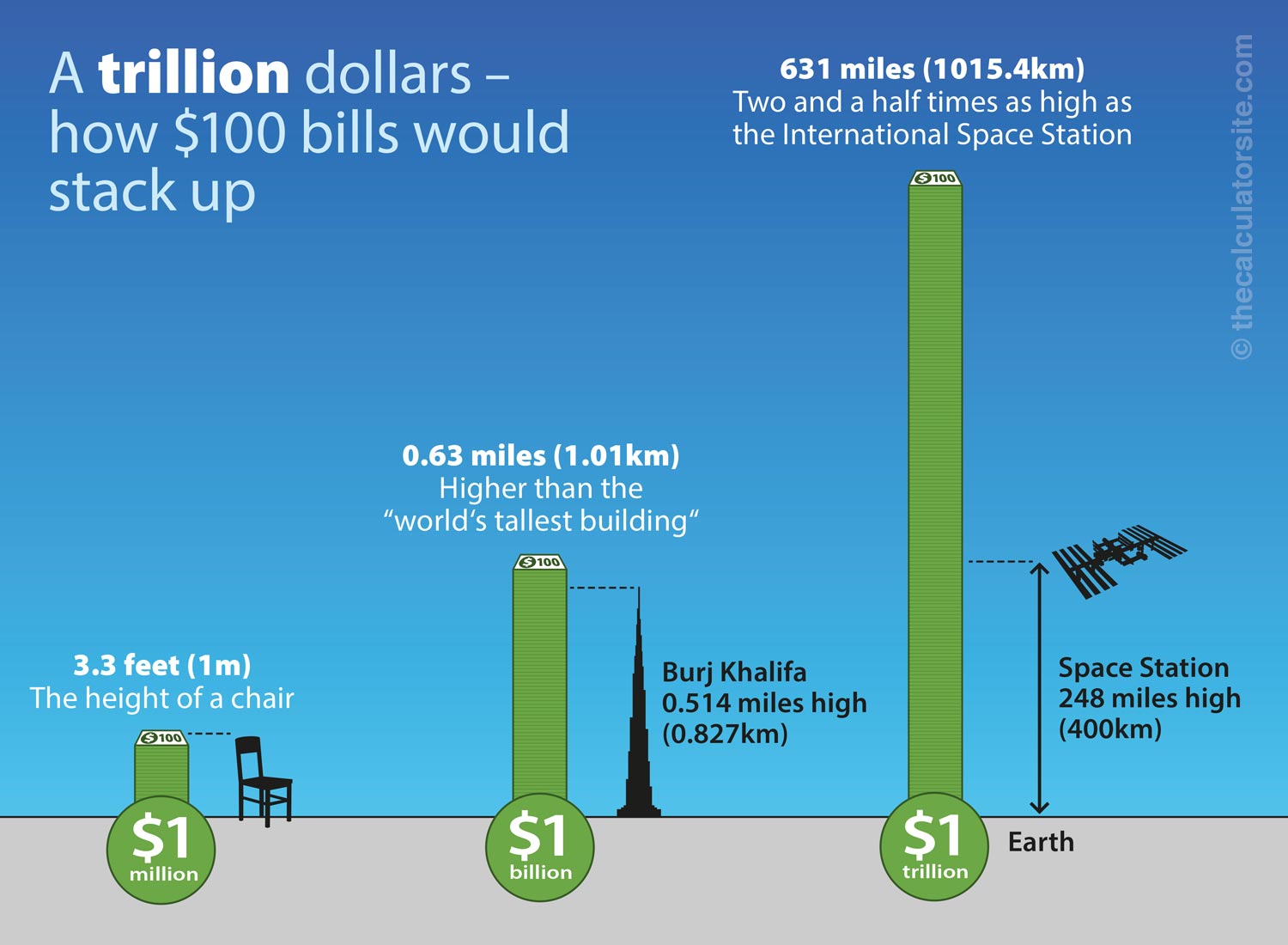

The Calculation: 21 Million Divided by 8 Billion

Dividing 21 million by 8 billion yields approximately 0.002625 Bitcoin per person. This is a tiny fraction, a decimal point followed by a string of zeros.

It means that if Bitcoin were to be distributed equally among the global population, each person would only receive a fraction of a single coin.

To put it another way, it highlights the extreme scarcity of Bitcoin on a global scale.

Implications for Wealth Distribution

The scarcity of Bitcoin naturally leads to discussions about wealth distribution. If only a small percentage of the population can realistically own a whole Bitcoin, what does that mean for the future?

Early adopters of Bitcoin have already benefited significantly from its price appreciation.

However, the potential for future gains raises questions about fairness and access to this scarce digital asset.

The Potential for Fractional Ownership

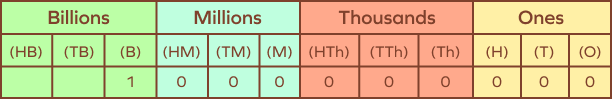

Fortunately, Bitcoin is divisible to eight decimal places, with each unit called a Satoshi.

This divisibility allows individuals to own even small fractions of a Bitcoin, making it accessible to those with limited capital.

Exchanges and investment platforms facilitate the purchase of fractional Bitcoin, democratizing access to this asset class.

Bitcoin as a Store of Value

Many proponents of Bitcoin view it primarily as a store of value, akin to gold.

The fixed supply and decentralized nature make it an attractive alternative to traditional stores of value, particularly in times of economic uncertainty or monetary debasement.

Its potential as a hedge against inflation has driven significant investment and adoption.

Bitcoin's Role in Emerging Economies

In countries with unstable currencies or limited access to traditional financial services, Bitcoin can offer a lifeline.

It provides a means to store value, conduct transactions, and bypass traditional banking systems.

While volatility remains a concern, the potential benefits for financial inclusion are significant.

Challenges and Considerations

Despite its potential, Bitcoin faces several challenges. Regulatory uncertainty, scalability issues, and environmental concerns related to its energy consumption are all valid concerns.

These issues need to be addressed to ensure the long-term viability and widespread adoption of Bitcoin.

Continued innovation and responsible development are crucial to realizing its full potential.

The Future of Bitcoin and Digital Scarcity

The future of Bitcoin is uncertain, but the concept of digital scarcity it embodies is likely to endure.

As the world becomes increasingly digital, the demand for scarce digital assets may continue to grow.

Bitcoin has paved the way for other cryptocurrencies and digital assets, each with its own unique characteristics and applications.

A Final Reflection

21 million divided by 8 billion is more than just a mathematical equation. It's a stark reminder of the limited nature of resources and the importance of equitable distribution.

While owning a whole Bitcoin may be out of reach for most, the ability to participate in this digital economy through fractional ownership offers a glimpse into a future where financial access is more democratized and inclusive.

As we continue to navigate the digital age, the lessons learned from Bitcoin's experiment in scarcity will undoubtedly shape the future of finance and technology.