33 Whitehall Street New York Ny

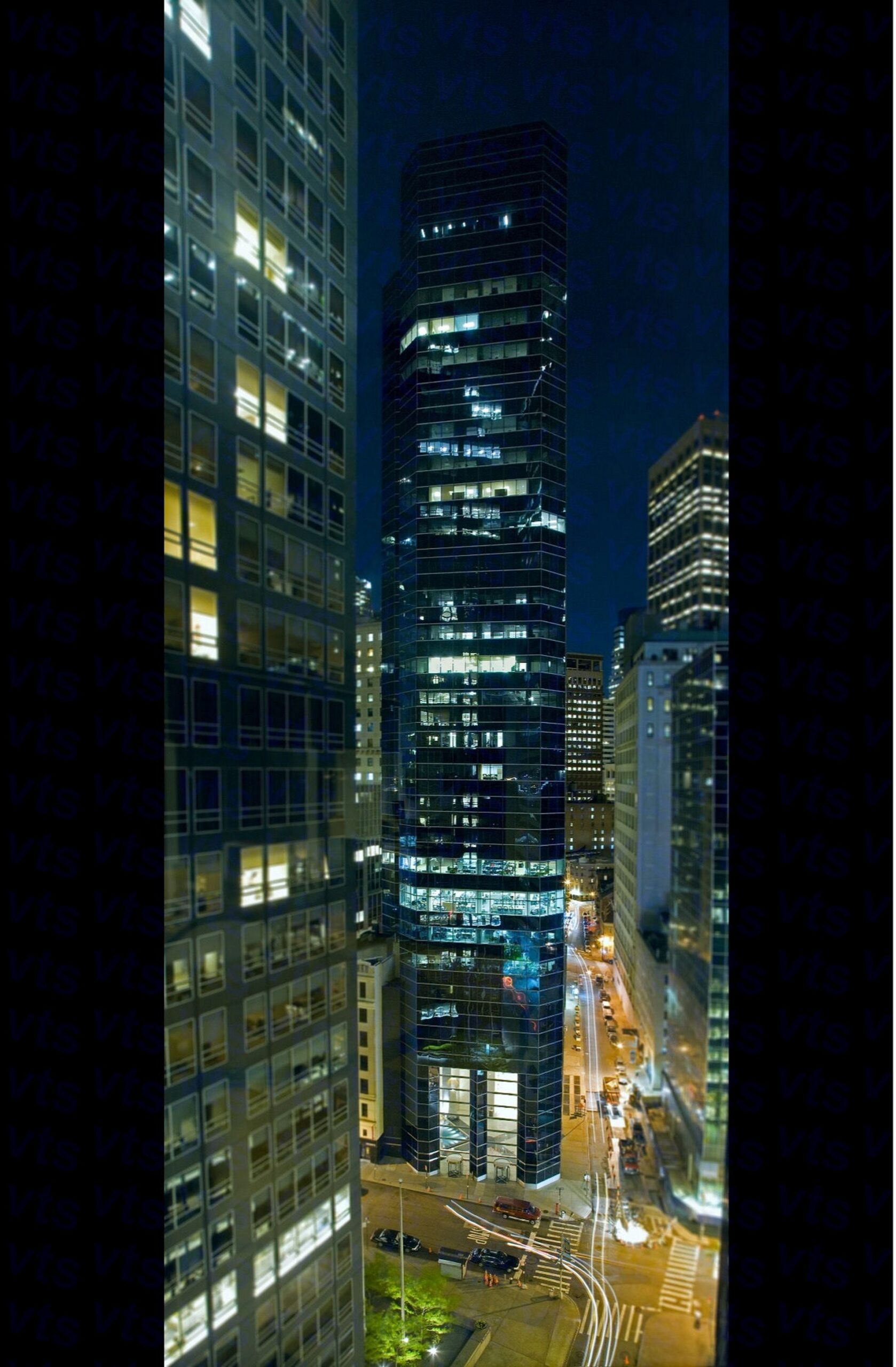

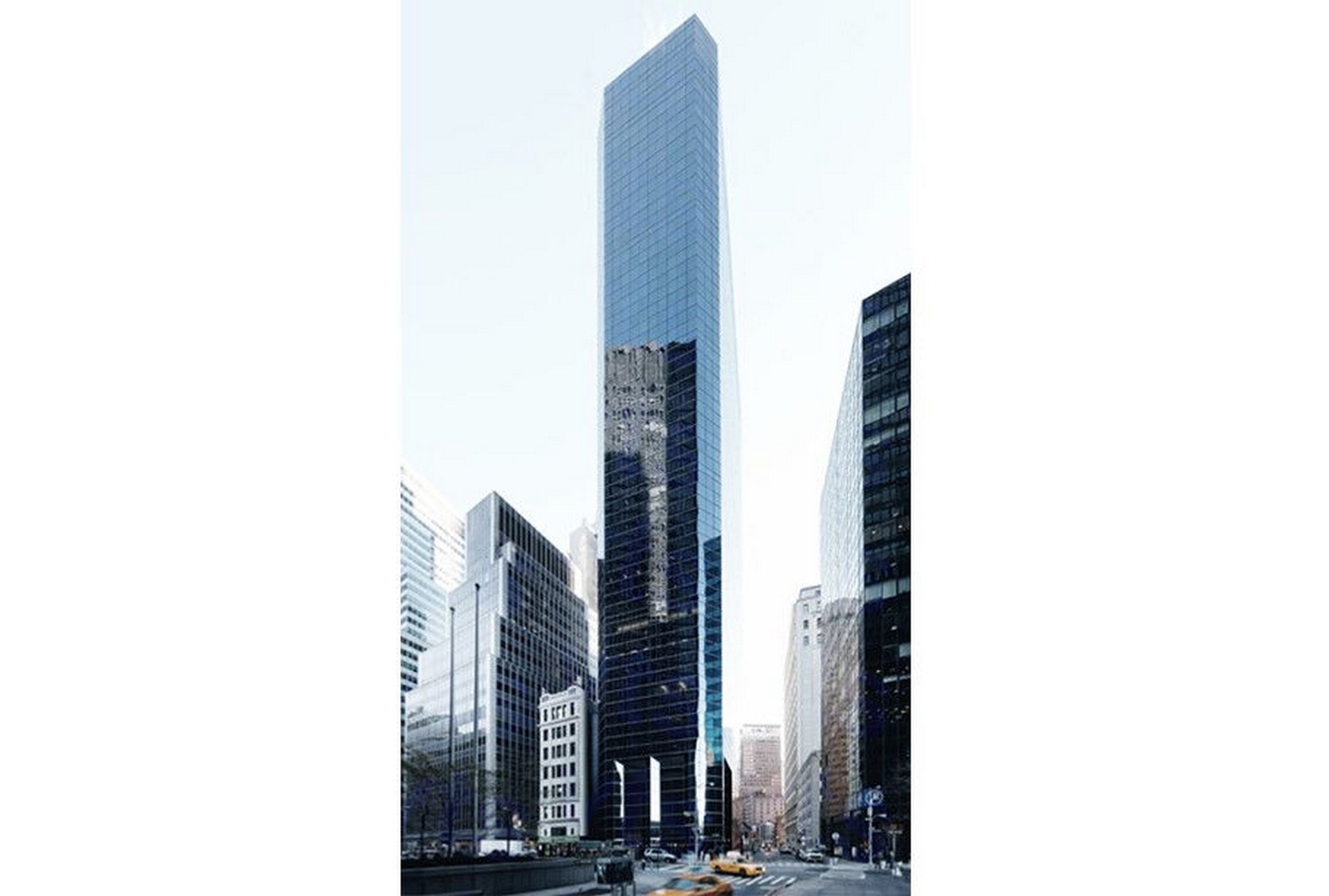

At the foot of Manhattan, where the canyons of Wall Street meet the open waters of New York Harbor, stands 33 Whitehall Street, a seemingly unremarkable office building steeped in history and now embroiled in a complex legal and financial drama. Once a symbol of maritime commerce, the building is now a focal point of a foreclosure battle that underscores the challenges facing commercial real estate in a post-pandemic world. The future of this iconic address hangs in the balance, raising concerns about the broader implications for the city's economic recovery.

The fate of 33 Whitehall Street hinges on a significant unpaid mortgage, a shift in tenant occupancy, and a growing debate over the valuation of commercial properties in a rapidly changing urban landscape. This article delves into the intricacies of the foreclosure proceedings, exploring the building's historical significance, the factors that led to its financial distress, and the potential consequences for its tenants, the surrounding community, and the New York City real estate market as a whole. It aims to provide a balanced perspective, incorporating official statements, financial data, and expert opinions to paint a comprehensive picture of the situation.

A Storied Past: From Maritime Hub to Modern Office Space

33 Whitehall Street boasts a rich history, originally serving as a nexus for shipping and trade. In its early years, the building played a vital role in facilitating the city's maritime activities.

Over time, it evolved into a modern office building, housing a diverse range of tenants, from government agencies to private sector businesses.

Its location near the Staten Island Ferry terminal and the Financial District made it a prime piece of real estate.

The Foreclosure Crisis: A Perfect Storm of Factors

The current foreclosure crisis at 33 Whitehall Street is the result of a confluence of factors, primarily the lingering effects of the COVID-19 pandemic on commercial real estate. With many companies adopting remote work policies, office occupancy rates plummeted, leading to a decline in rental income for landlords.

This decline, coupled with rising interest rates, created a perfect storm for properties like 33 Whitehall Street, which were already carrying significant debt.

Furthermore, some argue that over-optimistic valuations in the pre-pandemic era contributed to the current financial strain.

The Debt Burden: A Closer Look at the Numbers

According to publicly available records, the outstanding mortgage on 33 Whitehall Street is substantial. Trepp, a leading provider of commercial mortgage-backed securities (CMBS) data, reports significant delinquency rates in similar properties across the city.

The lender, seeking to recoup its investment, initiated foreclosure proceedings after the building's owner, reportedly defaulted on loan payments.

The specifics of the loan agreement and the current financial status of the building are subject to ongoing legal scrutiny.

Tenant Impact: Uncertainty and Displacement Concerns

The foreclosure proceedings have created uncertainty for the tenants of 33 Whitehall Street. Many businesses are concerned about potential disruptions to their operations and the possibility of having to relocate.

Some tenants, including government agencies, have long-term leases, which may provide some protection, but the future remains unclear.

The New York City Department of Small Business Services is reportedly monitoring the situation and offering assistance to affected businesses.

Legal Battles and Potential Outcomes

The foreclosure case is currently being heard in the New York State Supreme Court. The legal proceedings are complex, involving multiple parties and intricate financial arrangements.

Several potential outcomes are possible, including a negotiated settlement, a sale of the property, or a court-ordered foreclosure sale.

Each scenario would have different implications for the building's tenants and the overall value of the property.

"The situation at 33 Whitehall Street is a microcosm of the challenges facing the commercial real estate market in New York City," said Michael Berman, a real estate attorney specializing in foreclosure cases. "The outcome will likely set a precedent for similar properties in the future."

Competing Perspectives: Owner vs. Lender

The owner of 33 Whitehall Street is likely arguing that they have been unfairly impacted by the pandemic and that they are actively seeking solutions to address the financial challenges. They may be exploring options such as refinancing or attracting new tenants.

The lender, on the other hand, is primarily focused on protecting its investment and recouping the outstanding debt. They may argue that the owner has failed to meet its obligations and that foreclosure is the only viable option.

The court will ultimately have to weigh these competing perspectives and make a decision based on the applicable laws and the specific facts of the case.

Broader Implications for the NYC Real Estate Market

The foreclosure at 33 Whitehall Street is not an isolated incident. It is part of a broader trend of financial distress in the commercial real estate market, particularly in office buildings.

Experts warn that if more properties face foreclosure, it could lead to a decline in property values and a slowdown in economic growth.

The city government is actively working to address these challenges, including exploring incentives for businesses to return to office spaces and investing in infrastructure improvements.

Some analysts believe that the situation could also create opportunities for new investment and redevelopment. Abandoned or distressed properties could be repurposed for other uses, such as residential housing or mixed-use developments.

The long-term impact on the city's economy will depend on how effectively these challenges are addressed and how quickly the commercial real estate market can adapt to the changing needs of businesses and residents.

Mayor Adams has repeatedly stressed the importance of a resilient and adaptable economy for New York City's future.

Looking Ahead: The Future of 33 Whitehall Street

The future of 33 Whitehall Street remains uncertain, but the outcome of the foreclosure proceedings will undoubtedly have a significant impact on the building's tenants, the surrounding community, and the broader New York City real estate market.

Whether it is revitalized under new ownership, repurposed for a different use, or remains a subject of legal contention, 33 Whitehall Street serves as a powerful reminder of the challenges and opportunities facing the city in the post-pandemic era. The resolution of this case will be closely watched by investors, developers, and policymakers alike.

Ultimately, the story of 33 Whitehall Street is a testament to the enduring dynamism and resilience of New York City, a place where history and commerce continue to collide and evolve.