350 A Week Is How Much A Year

The seemingly simple question, "350 a week is how much a year?" often arises in budgeting, financial planning, and employment discussions. Understanding the annual equivalent of a weekly income is crucial for individuals and businesses alike to manage finances effectively and make informed decisions.

The calculation provides a quick snapshot of potential yearly earnings or expenses. This conversion helps in comparing salaries, assessing the feasibility of loans, or simply understanding long-term financial implications. This article explores the straightforward mathematics behind this calculation and its relevance in various practical scenarios.

The Basic Calculation

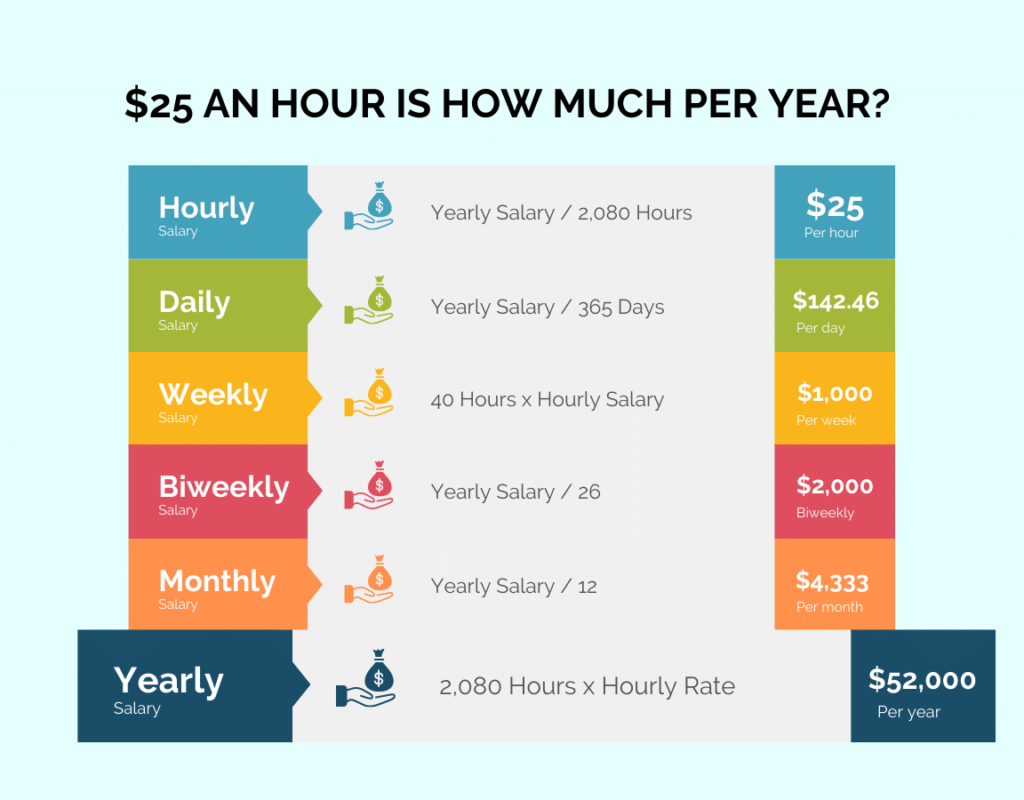

The core of the calculation is based on the number of weeks in a year. There are 52 weeks in a year, making the calculation relatively simple: 350 (weekly amount) multiplied by 52 (weeks).

The result, 18,200, represents the gross annual income or expense when 350 is earned or spent weekly. This figure doesn't account for deductions like taxes or contributions to retirement funds.

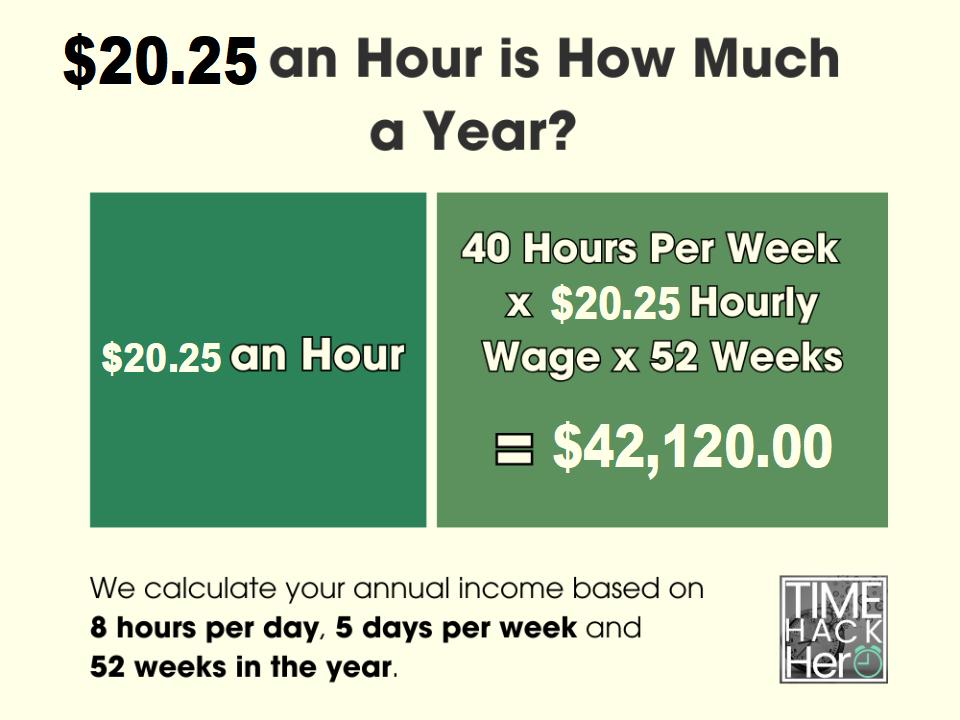

Mathematical Breakdown

The formula is: Weekly Amount × Weeks in a Year = Annual Amount. Using our example, this translates to: £350 × 52 = £18,200.

This basic calculation is applicable regardless of currency. It's a universal mathematical truth that translates across different monetary systems.

Significance in Employment and Finance

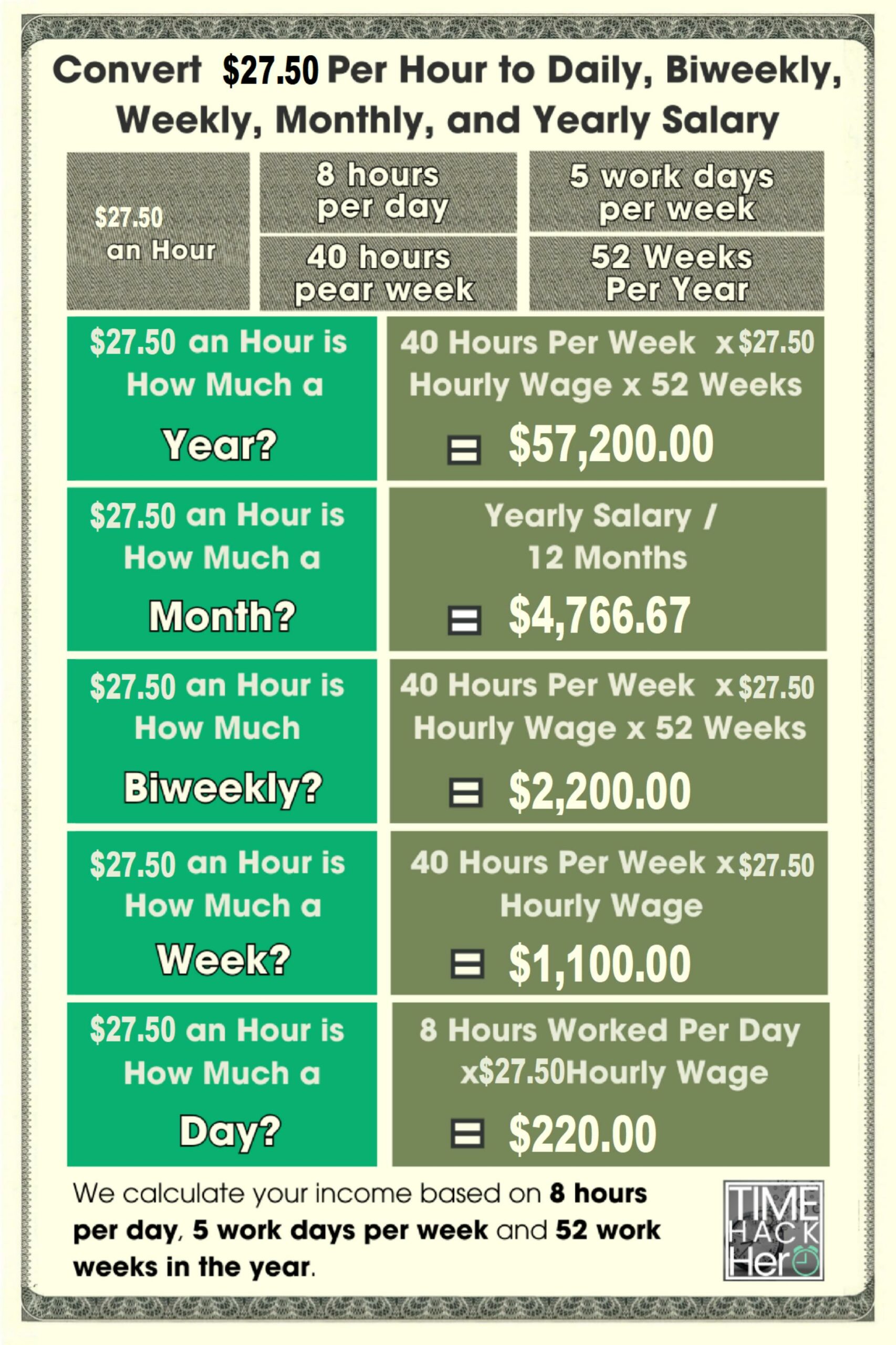

For employees, understanding the annual equivalent of their weekly wage is crucial for budgeting and long-term financial planning. Comparing job offers often involves analyzing annual salaries rather than weekly rates.

Likewise, employers use this calculation to determine payroll costs and project annual expenses. Accurate financial projections are essential for business sustainability and growth.

Comparing Salaries

When considering a new job, focusing solely on the weekly pay can be misleading. An offer of £350 per week sounds appealing, but its annual equivalent (£18,200) should be compared to other opportunities presented as annual salaries.

This comparison allows for a more accurate assessment of the overall compensation package, including benefits and potential for career advancement. It provides a clear picture of the long-term financial prospects.

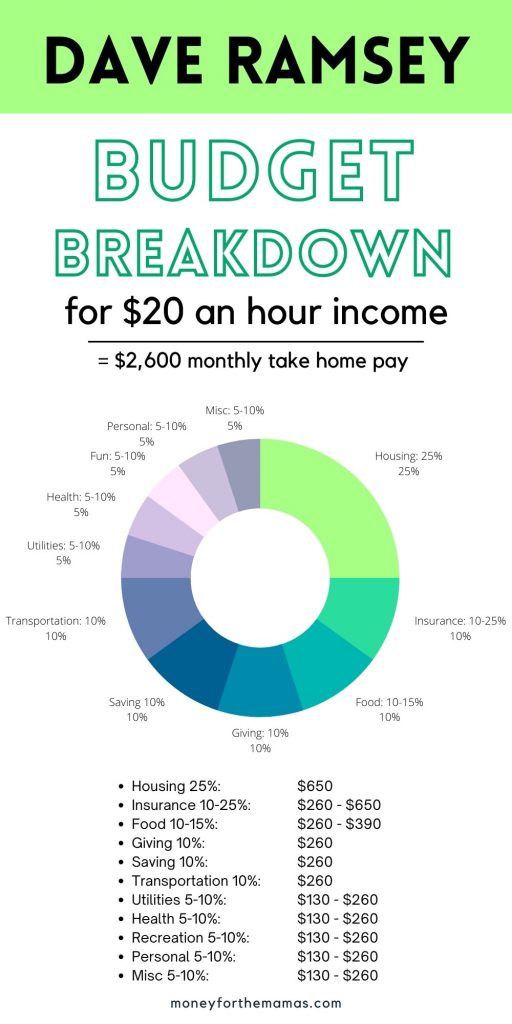

Budgeting and Financial Planning

Converting weekly income to an annual figure helps individuals create a realistic budget. A yearly view allows for the allocation of funds for essential expenses, savings, and discretionary spending.

Furthermore, it facilitates the setting of long-term financial goals, such as purchasing a home or planning for retirement. It helps to see the bigger financial picture.

Real-World Applications

This calculation is not limited to salary assessments; it extends to various financial situations. For example, it can be used to calculate the annual cost of weekly subscriptions or the potential savings from reducing weekly expenses.

Moreover, it is helpful in understanding the financial implications of recurring payments, such as loans or mortgages. A clear understanding of annual financial commitments is essential for financial stability.

Subscription Services

Many subscription services, such as streaming platforms or gym memberships, are billed weekly or monthly. Converting these costs to an annual figure can highlight the total expense over a year.

For instance, a £350 weekly expense could represent multiple subscriptions or a significant lifestyle cost. Analyzing this figure annually can lead to a reevaluation of spending habits.

Loan Repayments

For loan repayments, knowing the annual cost helps borrowers understand the long-term financial burden. A weekly payment of £350 translates to an annual commitment of £18,200.

This knowledge enables individuals to assess the affordability of the loan and plan accordingly. It's an important factor in responsible borrowing.

Potential Impact on Society

Widespread understanding of such simple calculations empowers individuals to make informed financial decisions. This can lead to improved financial literacy and reduced financial stress across society.

A more financially literate population is better equipped to handle economic challenges and contribute to economic growth. It fosters responsible financial behavior.

Promoting Financial Literacy

Financial literacy initiatives often emphasize the importance of understanding basic financial concepts like this. Promoting awareness of these calculations can contribute to a more informed and financially responsible citizenry.

It encourages individuals to take control of their finances and make informed decisions about spending, saving, and investing. It's an essential life skill.

Reducing Financial Stress

Financial stress is a significant contributor to mental health issues. By understanding their income and expenses on an annual basis, individuals can better manage their finances and reduce stress.

This can lead to improved overall well-being and a more productive workforce. It underscores the importance of financial planning.

Conclusion

In summary, multiplying a weekly amount of £350 by 52 weeks results in an annual figure of £18,200. This simple calculation has far-reaching implications for personal and business finance.

Understanding and utilizing this calculation is essential for effective budgeting, financial planning, and making informed financial decisions. It is a fundamental building block for financial stability and success.