450 Credit Score Personal Loan Direct Lender

Imagine a life where every financial door seems bolted shut. Bills pile up, opportunities slip away, and the dream of a stable future feels like a distant star. For millions of Americans, this isn't a hypothetical – it's the daily reality dictated by a credit score lingering in the low 400s.

The good news? Hope isn't lost. While traditional lenders often slam the door on individuals with credit scores hovering around 450, a new wave of direct lenders are emerging, offering personal loans tailored to this underserved segment of the population.

This article delves into the world of 450 credit score personal loans from direct lenders, exploring their significance, the pros and cons, and how to navigate this often-challenging landscape.

The Credit Score Conundrum

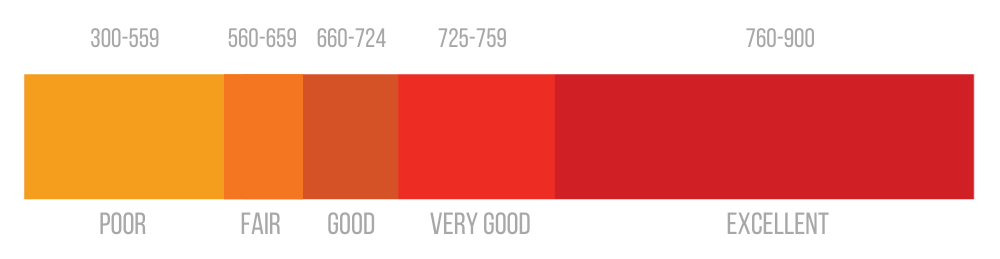

A credit score of 450 falls squarely into the "poor" or "very poor" credit range. Experian, one of the major credit bureaus, defines scores in this range as indicating a high risk of default.

This label can impact various aspects of life, from securing a mortgage to renting an apartment, and even getting approved for a cell phone plan.

Credit scores are primarily determined by factors such as payment history, amounts owed, length of credit history, credit mix, and new credit. Late payments, high credit card balances, and past bankruptcies can all contribute to a low score.

The Rise of Direct Lenders

Traditionally, individuals with low credit scores have been limited to predatory payday loans or pawn shops, options often characterized by exorbitant interest rates and fees. Direct lenders offering personal loans for those with 450 credit scores provide a much-needed alternative.

These lenders operate primarily online, cutting out the middleman and potentially offering more competitive terms. Many specialize in working with borrowers who have been turned down by traditional banks and credit unions.

Direct lenders offering loans to borrowers with poor credit often assess factors beyond the credit score, such as employment history, income stability, and overall ability to repay the loan.

What to Expect: Terms and Conditions

It's crucial to understand that personal loans for individuals with 450 credit scores come with specific terms and conditions. Interest rates will inevitably be higher than those offered to borrowers with good or excellent credit.

According to data from LendingTree, the average interest rate for a personal loan for borrowers with poor credit can range from 25% to 36% or even higher. This is significantly higher than the average interest rate for borrowers with excellent credit, which can be below 10%.

Loan amounts may also be limited, with many lenders offering smaller loans to start. Repayment terms may be shorter as well, requiring borrowers to make larger monthly payments.

Typical Loan Amounts and Terms

Generally, loan amounts for borrowers with very low credit scores range from a few hundred dollars to a few thousand dollars. The repayment terms can range from six months to three years. Shorter loan terms result in higher monthly payments but lower overall interest paid, while longer terms lower monthly payments but increase the total interest paid over the life of the loan.

Fees can also be a factor. Some lenders charge origination fees, which are typically a percentage of the loan amount. Late payment fees are also common.

It's imperative to carefully read the loan agreement and understand all the terms and conditions before signing anything.

Benefits and Risks

Securing a personal loan with a 450 credit score can offer several benefits. It can provide access to funds for emergencies, debt consolidation, or other pressing needs.

Successfully repaying the loan on time can also help rebuild credit. Each on-time payment is reported to the credit bureaus, demonstrating responsible credit behavior.

However, the risks are significant. High interest rates can make the loan difficult to repay, potentially leading to a cycle of debt.

Failure to repay the loan can further damage your credit score and lead to collection efforts. It's essential to borrow only what you can afford to repay.

Warning Signs of Predatory Lending

Be wary of lenders who guarantee approval regardless of credit score. This is a common tactic used by predatory lenders. Also, avoid lenders who pressure you to borrow more than you need or who are not transparent about their fees and interest rates.

Always check the lender's reputation with the Better Business Bureau (BBB) and read online reviews. A legitimate lender will be licensed and registered to operate in your state.

If a lender asks for upfront fees before disbursing the loan, that's a major red flag.

Navigating the Landscape: Tips for Success

If you're considering a personal loan with a 450 credit score, take these steps. First, check your credit report. Obtain a free copy of your credit report from each of the three major credit bureaus (Experian, Equifax, and TransUnion) at AnnualCreditReport.com. Review the reports for errors and dispute any inaccuracies.

Second, improve your credit score if possible. Even small improvements can make a difference. Pay down existing debt, make all payments on time, and avoid opening new credit accounts.

Third, shop around and compare offers from multiple direct lenders. Don't settle for the first offer you receive. Compare interest rates, fees, repayment terms, and loan amounts.

Fourth, be realistic about your ability to repay the loan. Create a budget and make sure you can comfortably afford the monthly payments. Remember, taking on more debt than you can handle will only worsen your financial situation.

Fifth, consider alternative options. If possible, explore alternatives such as borrowing from family or friends, seeking help from a credit counseling agency, or exploring government assistance programs.

Always remember that no loan is worth sacrificing your long-term financial stability.

The Future of Lending for Low Credit Scores

The market for personal loans for individuals with low credit scores is evolving. Fintech companies are leveraging technology to develop more sophisticated underwriting models that assess risk more accurately.

This could lead to more accessible and affordable loans for this underserved population. As competition increases, interest rates may also become more competitive.

However, it's crucial for borrowers to remain vigilant and informed, avoiding predatory lenders and making responsible borrowing decisions.

Conclusion

Obtaining a personal loan with a 450 credit score is undoubtedly a challenging endeavor. While it can provide a lifeline in times of need, it's essential to approach this option with caution and careful consideration.

The key is to understand the risks involved, shop around for the best possible terms, and prioritize responsible borrowing and repayment practices. Ultimately, the goal should be to use the loan as a stepping stone towards rebuilding credit and achieving long-term financial stability.

For individuals striving to improve their financial standing, accessing safe and responsible lending options can pave the way for a brighter financial future. The road may be long, but it is not impassable.