A Flexible Budget May Be Prepared

Businesses grappling with the ever-shifting economic landscape may soon have a more adaptable tool at their disposal: the potential wider adoption of flexible budgeting practices. The concept, long discussed in academic circles, is gaining traction as organizations seek to navigate uncertainties in demand, costs, and overall market conditions.

This shift towards flexible budgeting represents a move away from the rigid structures of traditional fixed budgets. It promises greater responsiveness to real-world changes and more informed decision-making, according to industry analysts.

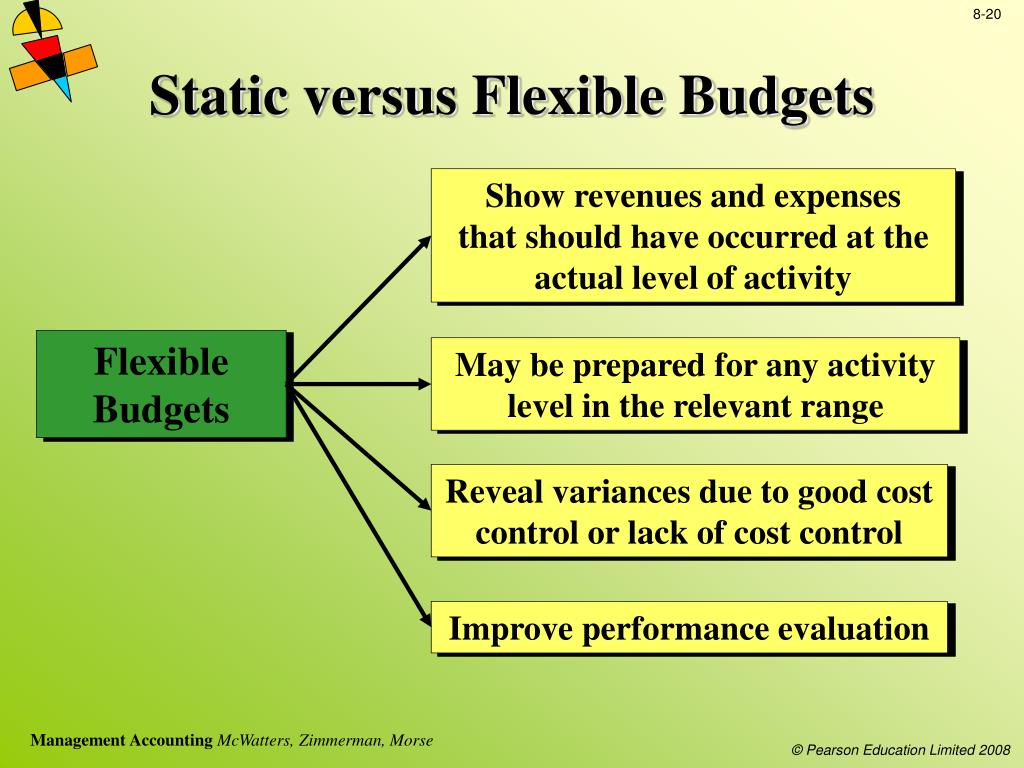

What is Flexible Budgeting?

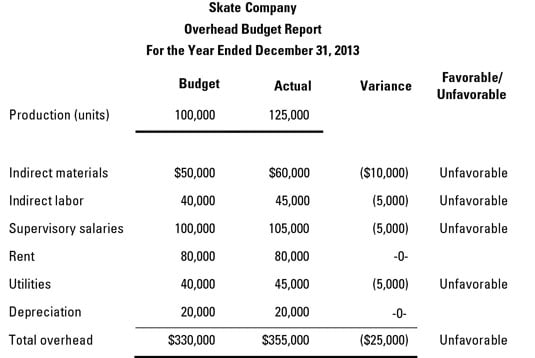

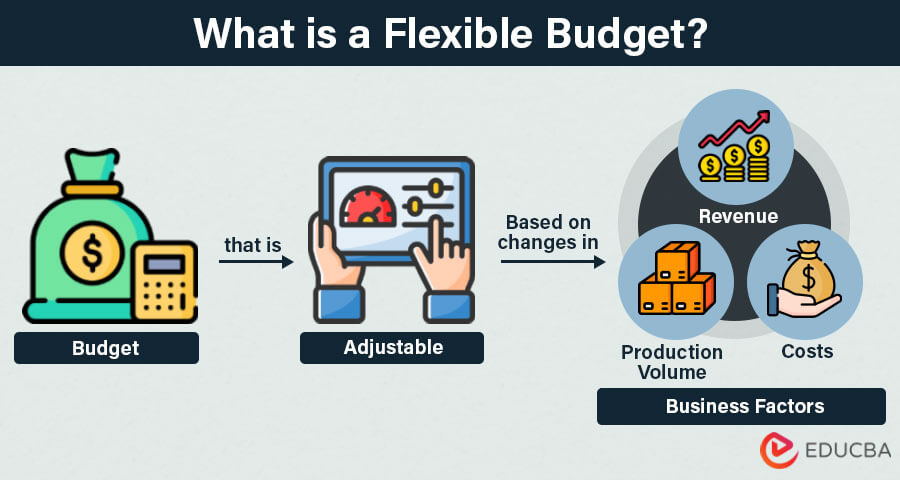

At its core, a flexible budget adjusts based on actual activity levels, such as sales volume or production output. Unlike a static budget, which remains constant regardless of these fluctuations, a flexible budget recalculates revenue and expenses based on the achieved level of activity.

This allows for a more accurate comparison between budgeted and actual performance. It effectively eliminates the distortion caused by comparing results at a different activity level than originally planned.

The Nuts and Bolts

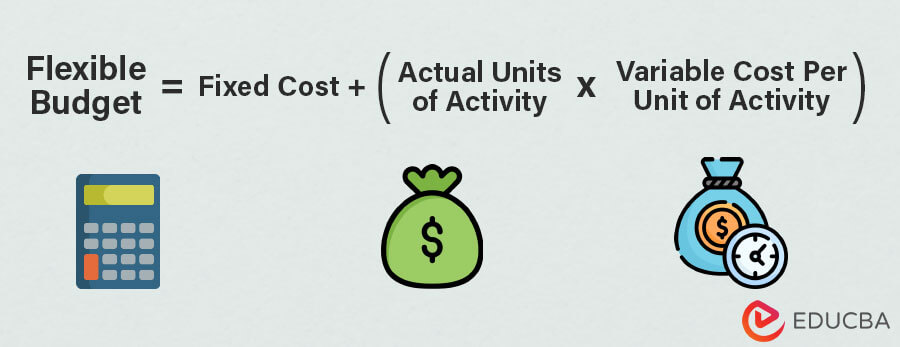

The process begins with identifying the cost behavior of various expenses. These are typically categorized as fixed, variable, or mixed.

Fixed costs remain constant regardless of activity level, while variable costs change in direct proportion to activity. Mixed costs contain both fixed and variable components.

Once cost behavior is understood, the budget can be adjusted to reflect the actual activity level. For example, if a company budgeted for 10,000 units but only produced 8,000, a flexible budget would recalculate variable costs based on the 8,000-unit output.

The Significance of the Shift

The potential shift toward flexible budgeting stems from several factors. Increased volatility in global markets, advancements in accounting software, and a growing emphasis on performance management are all contributing to this trend.

The ability to quickly adapt to changing circumstances is crucial for survival in today's business environment. Organizations that can accurately assess their financial performance under different scenarios are better positioned to make strategic decisions and allocate resources effectively, according to a recent report by the Chartered Institute of Management Accountants (CIMA).

"In a world of constant change, static budgets are becoming increasingly obsolete," said Dr. Emily Carter, a professor of accounting at the University of California, Berkeley. "Flexible budgeting provides a more realistic and insightful view of financial performance."

Who Benefits?

The benefits of flexible budgeting extend to various stakeholders. Management gains access to more accurate performance metrics, enabling better control over costs and improved decision-making.

Investors benefit from increased transparency and a more realistic assessment of a company's financial health. Employees can be more fairly evaluated based on performance against adjusted targets.

Smaller businesses, often more vulnerable to economic fluctuations, can leverage flexible budgeting to manage cash flow and adapt to changing customer demand.

How is it Implemented?

Implementing a flexible budget requires a robust accounting system and a thorough understanding of cost behavior. Companies must invest in the necessary technology and training to ensure accurate data collection and analysis.

According to a survey by the American Management Association, many organizations are already using some form of flexible budgeting, although the level of sophistication varies widely.

Some companies use simple spreadsheet models to adjust key variables, while others employ sophisticated enterprise resource planning (ERP) systems that automate the entire process.

Challenges and Considerations

Despite its advantages, flexible budgeting is not without its challenges. Accurately determining cost behavior can be complex, particularly for businesses with a wide range of products or services.

Maintaining data integrity and ensuring consistent application of budgeting principles are also critical. Management buy-in and employee training are essential for successful implementation.

The Human Angle

The move towards flexible budgeting can also have a direct impact on employees. By setting more realistic performance targets, companies can reduce stress and improve employee morale.

Employees who feel that they are being fairly evaluated are more likely to be engaged and productive. Flexible budgets can also help to identify areas where additional training or resources are needed.

John Miller, a financial analyst at a manufacturing firm that recently implemented a flexible budgeting system, noted the positive impact on his team. "We're now able to focus on what we can control, rather than being penalized for factors outside of our influence," he said.

Looking Ahead

As businesses continue to face increasing uncertainty, the adoption of flexible budgeting practices is likely to accelerate. The technology and tools are readily available, and the benefits are increasingly clear.

While it requires commitment and investment, the ability to adapt quickly and make informed decisions based on real-world data is a critical advantage in today's competitive landscape. The era of the static budget may be coming to an end.

Ultimately, a flexible budget may be prepared to empower organizations to navigate the future with greater confidence and agility, ensuring long-term sustainability and success.