A Policy Of Adhesion Can Only Be Modified By

The legal landscape surrounding contracts of adhesion is undergoing a subtle but significant shift, raising concerns and sparking debate among legal scholars, consumer advocates, and business stakeholders. At the heart of this evolving landscape lies a critical question: Under what circumstances can a policy of adhesion, characterized by its “take-it-or-leave-it” nature, be modified?

The answer to this question dictates the balance of power between the drafting party, often a large corporation, and the adhering party, typically an individual consumer or small business. Understanding the permissible avenues for modification is crucial for ensuring fairness, promoting transparency, and preventing potential abuse within these ubiquitous contractual agreements.

Understanding Policies of Adhesion

A contract of adhesion, also known as a standard form contract, is drafted by one party (the offeror) and presented to the other party (the offeree) on a non-negotiable basis. The offeree must either accept the contract as is, or reject it entirely.

Common examples include end-user license agreements (EULAs), insurance policies, and credit card agreements. The inherent imbalance of power in these relationships has long been a source of legal scrutiny and consumer protection efforts.

Traditional View: Unilateral Modification Prohibition

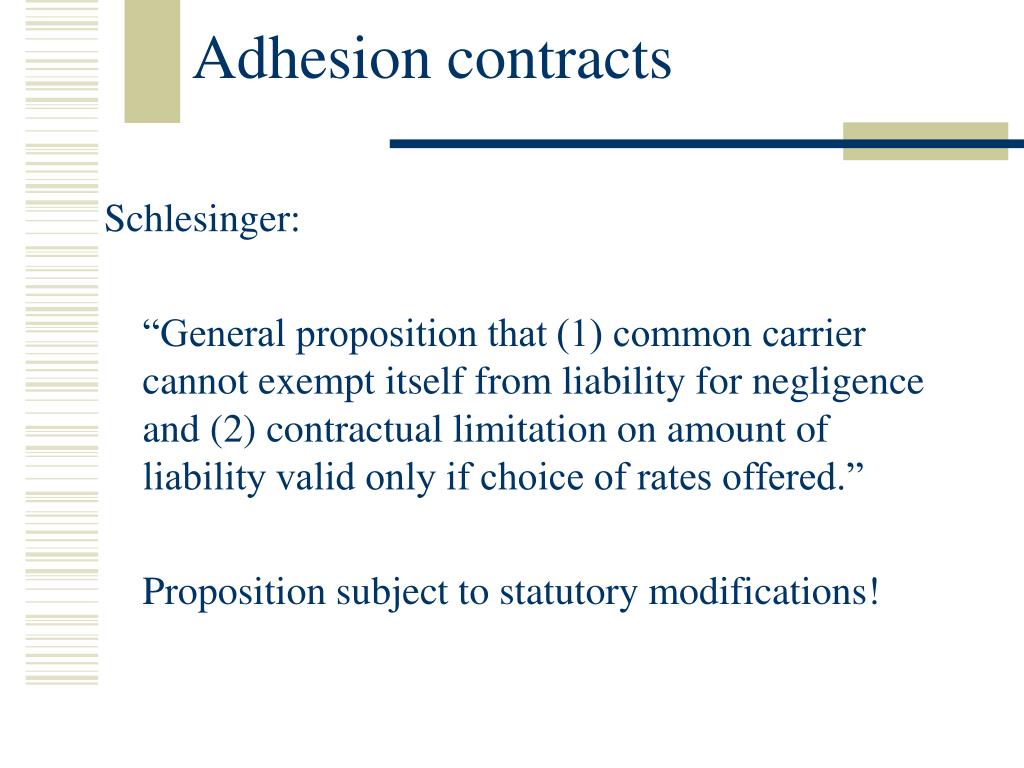

Historically, the prevailing legal view held that a policy of adhesion, once accepted, could only be modified through mutual agreement. This meant that both the offeror and the offeree had to consent to any changes in the terms of the contract.

This protection safeguarded the adhering party from arbitrary or unilateral changes that could significantly alter their rights and obligations. Court decisions often emphasized the need for clear and conspicuous notice of any proposed modifications, ensuring that the adhering party had a genuine opportunity to assess the impact of the changes.

"The fundamental principle of contract law is mutual assent," stated Professor Amelia Stone of the American Law Institute in a recent seminar, echoing this long-standing legal principle.

The Emergence of Unilateral Modification Clauses

However, a concerning trend has emerged: the inclusion of unilateral modification clauses within adhesion contracts themselves. These clauses ostensibly grant the drafting party the power to modify the terms of the agreement at any time, with or without the explicit consent of the adhering party.

The validity and enforceability of these clauses have become a major point of contention. Consumer advocacy groups argue that such clauses effectively nullify the concept of mutual agreement and undermine the very purpose of contract law.

The Consumer Federation of America has released several reports detailing instances where companies have exploited unilateral modification clauses to the detriment of consumers, including raising fees, altering service terms, and limiting liability.

The Legal Debate: Enforceability vs. Unconscionability

Courts are grappling with the delicate balance between upholding the principle of freedom of contract and protecting vulnerable parties from unfair or oppressive terms. Some jurisdictions have adopted a more lenient approach, upholding unilateral modification clauses as long as certain conditions are met.

These conditions often include requiring reasonable notice of the changes, providing an opportunity for the adhering party to terminate the contract without penalty, and ensuring that the modifications are not unconscionable or fundamentally alter the nature of the agreement.

Other jurisdictions, however, have taken a stricter stance, viewing unilateral modification clauses with skepticism and subjecting them to rigorous scrutiny. These courts often apply the doctrine of unconscionability, which allows them to invalidate contract terms that are so unfair or one-sided as to shock the conscience.

Factors Influencing Modification Enforceability

Several factors influence whether a modification to a policy of adhesion will be deemed enforceable.

These include the clarity and conspicuousness of the notice provided to the adhering party, the nature and extent of the modification, the availability of a meaningful opportunity to reject the changes, and the relative bargaining power of the parties.

The courts also consider whether the modification is commercially reasonable and consistent with the reasonable expectations of the adhering party.

The Role of State and Federal Legislation

The legal landscape surrounding adhesion contracts is also shaped by state and federal legislation. Some states have enacted laws that specifically regulate certain types of adhesion contracts, such as insurance policies or consumer credit agreements.

These laws may impose stricter requirements regarding notice, disclosure, and modification. The federal government has also taken steps to address concerns about unfair contract terms through legislation such as the Dodd-Frank Wall Street Reform and Consumer Protection Act, which established the Consumer Financial Protection Bureau (CFPB) with the authority to regulate certain financial products and services.

The CFPB has been actively involved in investigating and prosecuting companies that engage in deceptive or unfair practices related to adhesion contracts.

Future Implications and Recommendations

The evolving legal landscape surrounding the modification of adhesion contracts has significant implications for both businesses and consumers. Businesses must be mindful of the legal and ethical considerations when drafting and modifying adhesion contracts, ensuring that their terms are clear, conspicuous, and fair.

They should avoid using overly broad unilateral modification clauses that could be deemed unconscionable or unenforceable. Consumers, on the other hand, should carefully review the terms of adhesion contracts before accepting them, paying particular attention to any clauses that allow for unilateral modification.

If they are concerned about the fairness or enforceability of certain terms, they should seek legal advice or contact consumer protection agencies.

Ultimately, a balanced approach is needed that protects the legitimate interests of both businesses and consumers. This requires clear and consistent legal standards, effective enforcement mechanisms, and ongoing education and awareness-raising efforts. Only through such efforts can we ensure that policies of adhesion are used fairly and transparently, promoting a level playing field for all parties.

![A Policy Of Adhesion Can Only Be Modified By [Pockrass] Appeals panel now can only modify a penalty — if a points](https://external-preview.redd.it/pockrass-appeals-panel-now-can-only-modify-a-penalty-if-a-v0-FqwBKTvhxDqRsg5fuewZHgDtkquhEhLTpZwTkTpub-0.jpg?auto=webp&s=40100a4e309fdac4a20468cd38f39d6b46f895ef)